Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please include step by step solutions and explanation. thank you! help me with all those 4 questions please thank you Question #1 Blossom Corporation is

please include step by step solutions and explanation. thank you! help me with all those 4 questions please thank you

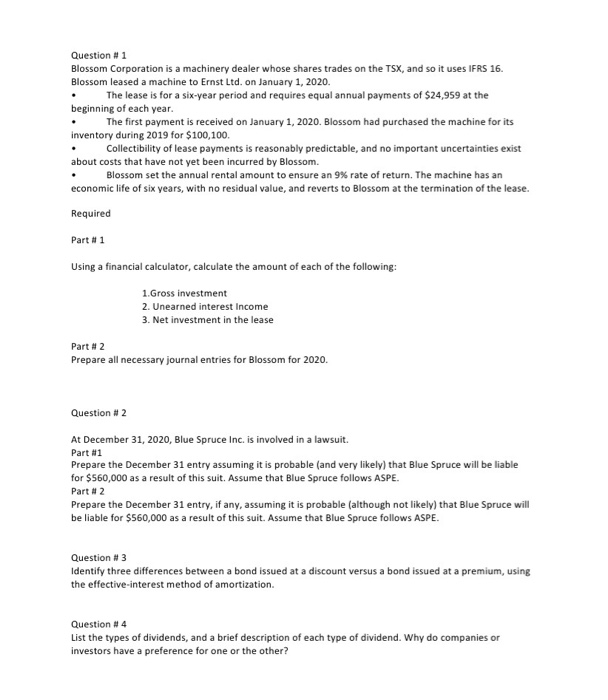

Question #1 Blossom Corporation is a machinery dealer whose shares trades on the TSX, and so it uses IFRS 16. Blossom leased a machine to Ernst Ltd. on January 1, 2020. The lease is for a six-year period and requires equal annual payments of $24,959 at the beginning of each year. The first payment is received on January 1, 2020. Blossom had purchased the machine for its inventory during 2019 for $100,100. Collectibility of lease payments is reasonably predictable, and no important uncertainties exist about costs that have not yet been incurred by Blossom. Blossom set the annual rental amount to ensure an 9% rate of return. The machine has an economic life of six years, with no residual value, and reverts to Blossom at the termination of the lease. Required Part #1 Using a financial calculator, calculate the amount of each of the following: 1. Gross investment 2. Unearned interest Income 3. Net investment in the lease Part #2 Prepare all necessary journal entries for Blossom for 2020. Question #2 At December 31, 2020, Blue Spruce Inc. is involved in a lawsuit. Part #1 Prepare the December 31 entry assuming it is probable (and very likely) that Blue Spruce will be liable for $560,000 as a result of this suit. Assume that Blue Spruce follows ASPE. Part # 2 Prepare the December 31 entry, if any, assuming it is probable (although not likely) that Blue Spruce will be liable for $560,000 as a result of this suit. Assume that Blue Spruce follows ASPE. Question # 3 Identify three differences between a bond issued at a discount versus a bond issued at a premium, using the effective-interest method of amortization. Question #4 List the types of dividends, and a brief description of each type of dividend. Why do companies or investors have a preference for one or the other? Question #1 Blossom Corporation is a machinery dealer whose shares trades on the TSX, and so it uses IFRS 16. Blossom leased a machine to Ernst Ltd. on January 1, 2020. The lease is for a six-year period and requires equal annual payments of $24,959 at the beginning of each year. The first payment is received on January 1, 2020. Blossom had purchased the machine for its inventory during 2019 for $100,100. Collectibility of lease payments is reasonably predictable, and no important uncertainties exist about costs that have not yet been incurred by Blossom. Blossom set the annual rental amount to ensure an 9% rate of return. The machine has an economic life of six years, with no residual value, and reverts to Blossom at the termination of the lease. Required Part #1 Using a financial calculator, calculate the amount of each of the following: 1. Gross investment 2. Unearned interest Income 3. Net investment in the lease Part #2 Prepare all necessary journal entries for Blossom for 2020. Question #2 At December 31, 2020, Blue Spruce Inc. is involved in a lawsuit. Part #1 Prepare the December 31 entry assuming it is probable (and very likely) that Blue Spruce will be liable for $560,000 as a result of this suit. Assume that Blue Spruce follows ASPE. Part # 2 Prepare the December 31 entry, if any, assuming it is probable (although not likely) that Blue Spruce will be liable for $560,000 as a result of this suit. Assume that Blue Spruce follows ASPE. Question # 3 Identify three differences between a bond issued at a discount versus a bond issued at a premium, using the effective-interest method of amortization. Question #4 List the types of dividends, and a brief description of each type of dividend. Why do companies or investors have a preference for one or the other Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started