Answered step by step

Verified Expert Solution

Question

1 Approved Answer

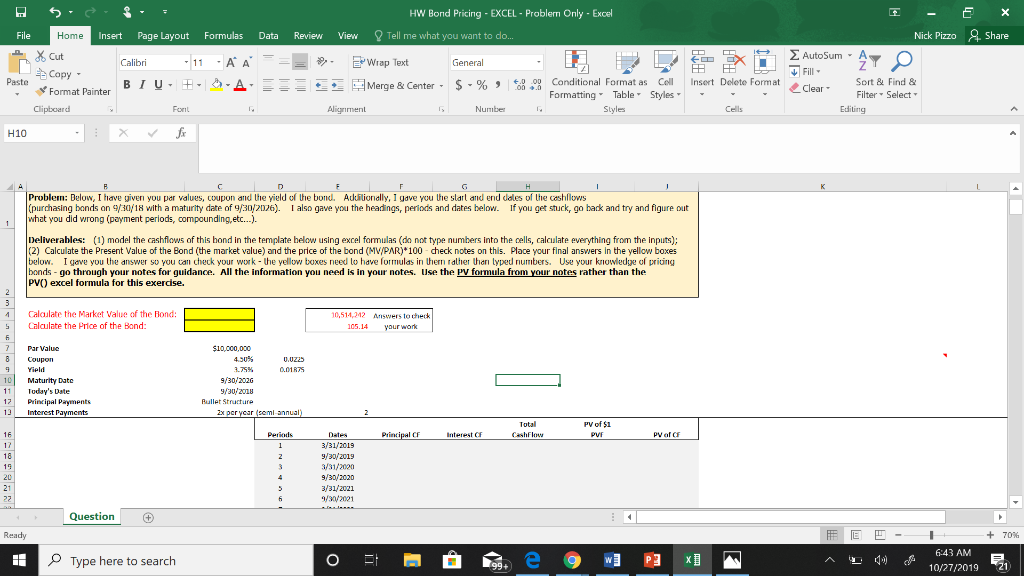

Please include what is within the cell references of all the columns. There are 16 periods in total. HW Bond Pricing - EXCEL - Problem

Please include what is within the cell references of all the columns.

Please include what is within the cell references of all the columns.

There are 16 periods in total.

HW Bond Pricing - EXCEL - Problem Only - Excel Tell me what you want to do... Data Review View & Share == > 5 = File Home Insert Page Layout Formulas Cut Calibri 11 AA Paste Copy - Format Painter B IU - A Clipboard Font H10X fix Wrap Text Merge & Center - General $ -% Nick Pizzo AutoSum" A O Fill Sort & Find & Clear Filter - Select Editing % Conditional Format as Cell Formatting - Table Styles Styles Insert Delete Format - - - Cells Alignment Number Problem: Below, I have given you par values, coupon and the yield of the bond. Additionally, 1 gave you the start and end deles of the cashllows (purchasing bonds on 9/30/18 with a maturity date of 9/30/2026). I also gave you the headings, periods and dates below. If you get stuck, go back and try and figure out what you did wrong (payment periods, compounding, etc...). Deliverables: (1) model the cashflows of this hond in the template below using excel formulas (do not type numbers into the cells, calculate everything from the inputs); (2) Calculate the Present Value of the Bond (the market value) and the price of the bond (MV/PAR)*100-check notes on this. Place your final answers in the yellow boxes below. I ove you the answer so you can check your work - the yellow boxes need lo have formulas in the rather than lvped numbers. Use your knowleduol pricing bonds - go through your notes for guidance. All the information you need is in your notes. Use the Pv formula from your notes rather than the PVC) excel formula for this exercise. Calculate the Market Value of the Hond: Calculate the price of the Bond: 10,514,22 Answers to check 105.14 your work $10,000,000 0.0125 Par Value Coupon Yield Maturity Date Today's Date Principal Payments Interest Payments 3.75% 9/30/2026 9/30/2018 12 12 2x per year (remiannual) Total PV of $1 PE Periods Principal interest Cashflow pyar CF Date 3/31/2019 9/30/2019 3/31/2000 9/30/2020 3/31/2021 9/9/2021 Question Ready E - + 70% 11 Type here to search o 3 - 0 e 9 w ] P2 E 6:43 AM 1027/2019 x] A 44 of 21Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started