Answered step by step

Verified Expert Solution

Question

1 Approved Answer

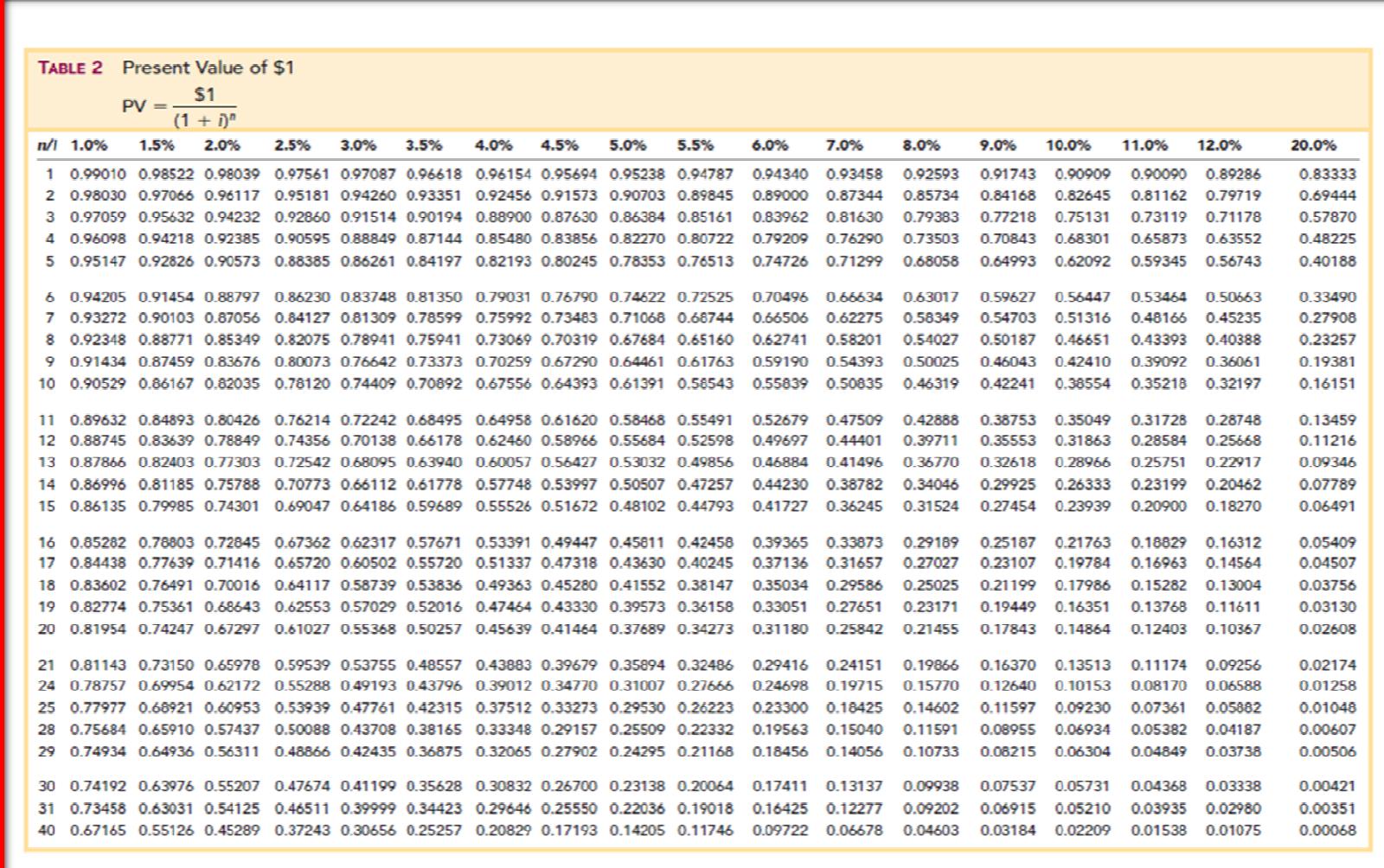

On January 1, a corporation issued a $1 million, five-year, 11 percent bond that pays interest semiannually. The market interest rate on January 1 was

On January 1, a corporation issued a $1 million, five-year, 11 percent bond that pays interest semiannually. The market interest rate on January 1 was 10 percent.

Record the proper journal entry for recording the issuance of the bond. Hint: You will need to refer to the Present Value Tables.pdf

TABLE 2 Present Value of $1 $1 PV => n/l 1.0% (1 + i)" 1.5% 2.0% 7.0% 9.0% 10.0% 11.0% 12.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% 8.0% 1 0.99010 0.98522 0.98039 0.97561 0.97087 0.96618 0.96154 0.95694 0.95238 0.94787 0.94340 0.93458 0.92593 0.91743 0.90909 0.90090 0.89286 2 0.98030 0.97066 0.96117 0.95181 0.94260 0.93351 0.92456 0.91573 0.90703 0.89845 0.89000 0.87344 0.85734 0.84168 0.82645 0.81162 0.79719 3 0.97059 0.95632 0.94232 0.92860 0.91514 0.90194 0.88900 0.87630 0.86384 0.85161 0.83962 0.81630 0.79383 0.77218 0.75131 0.73119 0.71178 4 0.96098 0.94218 0.92385 0.90595 0.88849 0.87144 0.85480 0.83856 0.82270 0.80722 0.79209 0.76290 0.73503 0.70843 0.68301 0.65873 0.63552 5 0.95147 0.92826 0.90573 0.88385 0.86261 0.84197 0.82193 0.80245 0.78353 0.76513 0.74726 0.71299 0.68058 0.64993 0.62092 0.59345 0.56743 20.0% 0.83333 0.69444 0.57870 0.48225 0.40188 6 0.94205 0.91454 0.88797 0.86230 0.83748 0.81350 7 0.93272 0.90103 0.87056 0.84127 0.81309 0.78599 8 0.92348 0.88771 0.85349 0.82075 0.78941 0.75941 9 0.91434 0.87459 0.83676 0.80073 0.76642 0.73373 10 0.90529 0.86167 0.82035 0.78120 0.74409 0.70892 0.79031 0.76790 0.74622 0.72525 0.75992 0.73483 0.71068 0.68744 0.73069 0.70319 0.67684 0.65160 0.70259 0.67290 0.64461 0.61763 0.67556 0.64393 0.61391 0.58543 0.70496 0.66634 0.63017 0.59627 0.56447 0.53464 0.50663 0.66506 0.62275 0.58349 0.54703 0.51316 0.48166 0.45235 0.62741 0.58201 0.54027 0.50187 0.46651 0.43393 0.40388 0.59190 0.54393 0.50025 0.46043 0.42410 0.39092 0.36061 0.55839 0.50835 0.46319 0.42241 0.38554 0.35218 0.32197 0.33490 0.27908 0.23257 0.19381 0.16151 11 0.89632 0.84893 0.80426 0.76214 0.72242 0.68495 0.64958 0.61620 0.58468 0.55491 0.52679 0.47509 0.42888 0.38753 0.35049 0.31728 0.28748 12 0.88745 0.83639 0.78849 0.74356 0.70138 0.66178 0.62460 0.58966 0.55684 0.52598 0.49697 0.44401 0.39711 0.35553 0.31863 0.28584 0.25668 13 0.87866 0.82403 0.77303 0.72542 0.68095 0.63940 0.60057 0.56427 0.53032 0.49856 0.46884 0.41496 0.36770 0.32618 0.28966 0.25751 0.22917 14 0.86996 0.81185 0.75788 0.70773 0.66112 0.61778 0.57748 0.53997 0.50507 0.47257 0.44230 0.38782 0.34046 0.29925 0.26333 0.23199 0.20462 15 0.86135 0.79985 0.74301 0.69047 0.64186 0.59689 0.55526 0.51672 0.48102 0.44793 0.41727 0.36245 0.31524 0.27454 0.23939 0.20900 0.18270 0.13459 0.11216 0.09346 0.07789 0.06491 16 0.85282 0.78803 0.72845 0.67362 0.62317 0.57671 0.53391 0.49447 0.45811 0.42458 0.39365 0.33873 0.29189 0.25187 0.21763 0.18829 0.16312 17 0.84438 0.77639 0.71416 0.65720 0.60502 0.55720 0.51337 0.47318 0.43630 0.40245 0.37136 0.31657 0.27027 0.23107 0.19784 0.16963 0.14564 18 0.83602 0.76491 0.70016 0.64117 0.58739 0.53836 0.49363 0.45280 0.41552 0.38147 0.35034 0.29586 0.25025 0.21199 0.17986 0.15282 0.13004 19 0.82774 0.75361 0.68643 0.62553 0.57029 0.52016 0.47464 0.43330 0.39573 0.36158 0.33051 0.27651 0.23171 0.19449 0.16351 0.13768 0.11611 20 0.81954 0.74247 0.67297 0.61027 0.55368 0.50257 0.45639 0.41464 0.37689 0.34273 0.31180 0.25842 0.21455 0.17843 0.14864 0.12403 0.10367 21 0.81143 0.73150 0.65978 0.59539 0.53755 0.48557 0.43883 0.39679 0.35894 0.32486 0.29416 0.24151 0.19866 0.16370 0.13513 24 0.78757 0.69954 0.62172 0.55288 0.49193 0.43796 0.39012 0.34770 0.31007 0.27666 0.24698 0.19715 0.15770 0.12640 0.10153 0.08170 0.06588 25 0.77977 0.68921 0.60953 0.53939 0.47761 0.42315 0.37512 0.33273 0.29530 0.26223 0.23300 0.18425 0.14602 0.11597 0.09230 0.07361 0.05882 28 0.75684 0.65910 0.57437 0.50088 0.43708 0.38165 0.33348 0.29157 0.25509 0.22332 0.19563 0.15040 0.11591 0.08955 0.06934 0.05382 0.04187 29 0.74934 0.64936 0.56311 0.48866 0.42435 0.36875 0.32065 0.27902 0.24295 0.21168 0.18456 0.14056 0.10733 0.08215 0.06304 0.04849 0.03738 30 0.74192 0.63976 0.55207 0.47674 0.41199 0.35628 0.30832 0.26700 0.23138 0.20064 0.17411 0.13137 0.09938 0.07537 0.05731 0.04368 0.03338 31 0.73458 0.63031 0.54125 0.46511 0.39999 0.34423 0.29646 0.25550 0.22036 0.19018 0.16425 0.12277 0.09202 0.06915 0.05210 0.03935 0.02980 40 0.67165 0.55126 0.45289 0.37243 0.30656 0.25257 0.20829 0.17193 0.14205 0.11746 0.09722 0.06678 0.04603 0.03184 0.02209 0.01538 0.01075 0.05409 0.04507 0.03756 0.03130 0.02608 0.11174 0.09256 0.02174 0.01258 0.01048 0.00607 0.00506 0.00421 0.00351 0.00068

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Scenario a On January 1 a corporation issued a 1 million fiveyear 10 percent bond that pays interest ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started