Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please inform what you need to answer the question Macroeconomic Items: The CEO of the company is convinced that financial analysis should hinge only on

Please inform what you need to answer the question

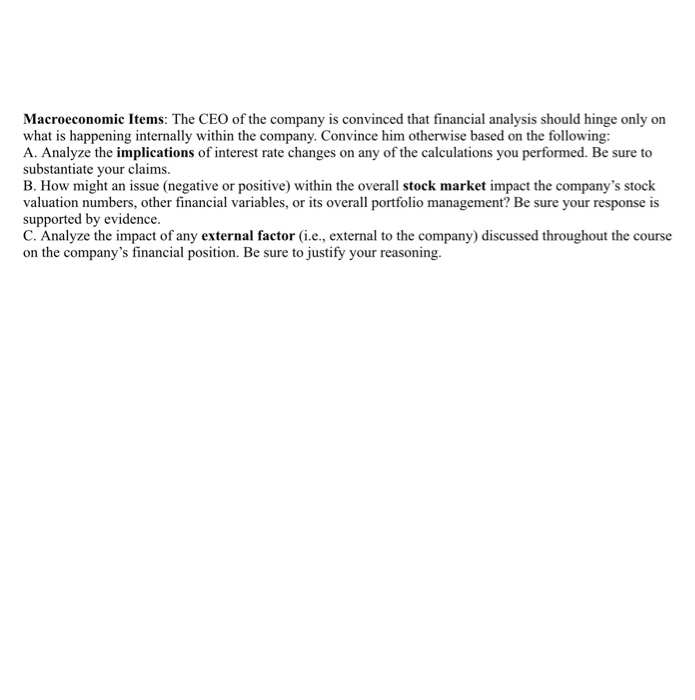

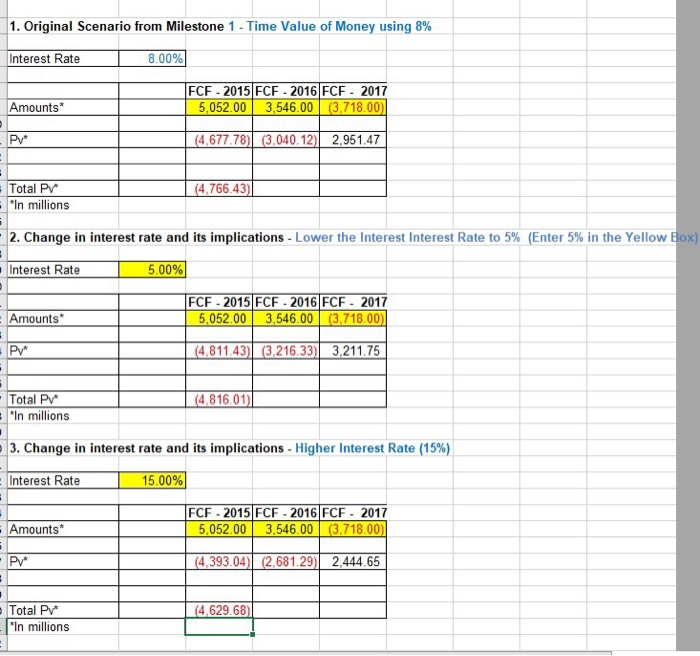

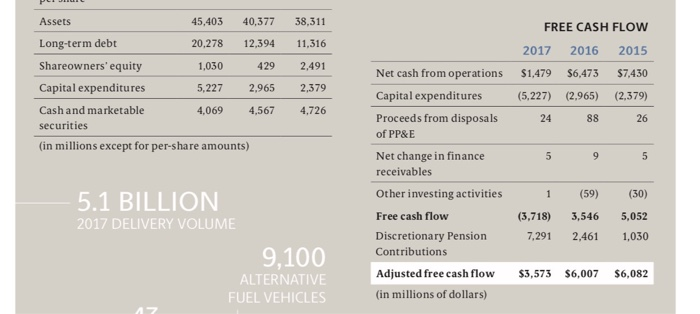

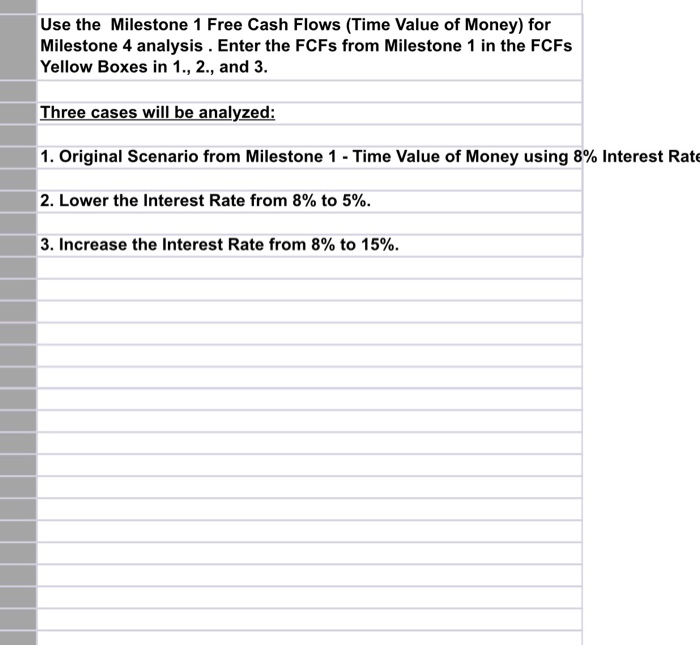

Macroeconomic Items: The CEO of the company is convinced that financial analysis should hinge only on what is happening internally within the company. Convince him otherwise based on the following: A. Analyze the implications of interest rate changes on any of the calculations you performed. Be sure to substantiate your claims. B. How might an issue (negative or positive) within the overall stock market impact the company's stock valuation numbers, other financial variables, or its overall portfolio management? Be sure your response is supported by evidence. C. Analyze the impact of any external factor (i.e., external to the company) discussed throughout the course on the company's financial position. Be sure to justify your reasoning. 1. Original Scenario from Milestone 1 - Time Value of Money using 8% Interest Rate 8.00% FCF - 2015 FCF - 2016 FCF - 2017 5.052.00 3.546.00 (3,718.00) Amounts PV (4.677.78) 3.040.12) 2.951.47 (4.766.43) Total PV *In millions 2. Change in interest rate and its implications - Lower the Interest Interest Rate to 5% (Enter 5% in the Yellow Box) Interest Rate 5.00% FCF - 2015 FCF - 2016 FCF - 2017 5,052.00 3,546.00 (3.718.00) Amounts PV" (4,811,43) (3.216.33 3.211.75 (4.816.01) - Total PV "In millions 3. Change in interest rate and its implications - Higher Interest Rate (15%) Interest Rate 15.00% FCF. 2015 FCF - 2016 FCF 2017 5.052.00 3.546.00 (3.718.00) Amounts* - PV (4,393.04) 2.681.29 2,444.65 (4.629.687|| Total PV "In millions Assets 45,403 40,377 Long-term debt 20,278 12,394 Shareowners' equity 1,030 4 29 Capital expenditures 5,227 2,965 Cash and marketable 4,069 4,567 securities (in millions except for per-share amounts) 38,311 11,316 2,491 2,379 4,726 Net cash from operations Capital expenditures Proceeds from disposals of PP&E FREE CASH FLOW 2017 2016 2015 $1,479 $6,473 $7,430 (5,227) (2,965) (2,379) 24 88 26 5 95 Net change in finance receivables Other investing activities 1 (3,718) 7,291 (59) 3,546 2,461 (30) 5,052 1,030 5.1 BILLION 2017 DELIVERY VOLUME 9.100 ALTERNATIVE FUEL VEHICLES Free cash flow Discretionary Pension Contributions Adjusted free cash flow (in millions of dollars) $3,573 $6,007 $6,082 Use the Milestone 1 Free Cash Flows (Time Value of Money) for Milestone 4 analysis. Enter the FCFs from Milestone 1 in the FCFs Yellow Boxes in 1., 2., and 3. Three cases will be analyzed: 1. Original Scenario from Milestone 1 - Time Value of Money using 8% Interest Rate 2. Lower the Interest Rate from 8% to 5%. 3. Increase the Interest Rate from 8% to 15% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started