Answered step by step

Verified Expert Solution

Question

1 Approved Answer

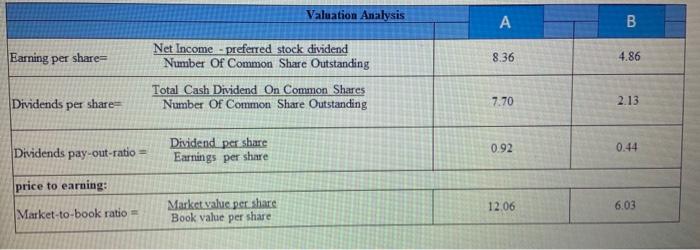

Please interpret and compare between the principal company A and its competitor B by using each ratio under the valuation, and solvency analysis. (Please do

Please interpret and compare between the principal company A and its competitor B by using each ratio under the valuation, and solvency analysis.

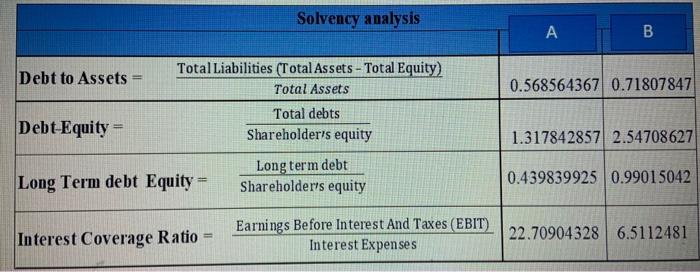

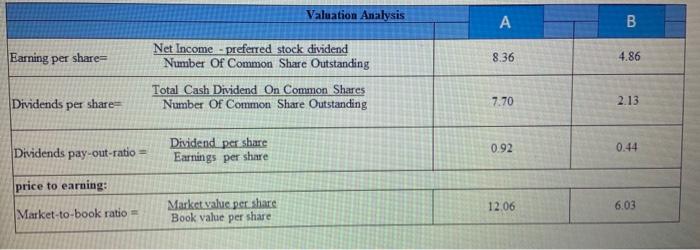

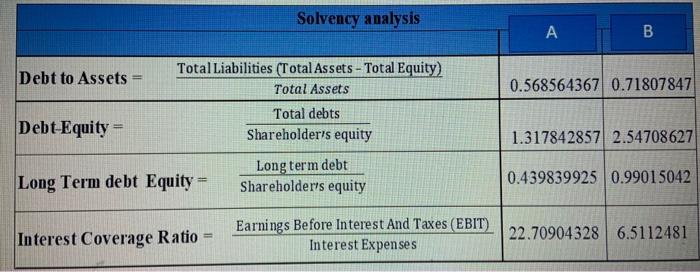

Solvency analysis A B Debt to Assets 0.568564367 0.71807847 Total Liabilities (Total Assets - Total Equity) Total Assets Total debts Shareholderis equity Debt-Equity = 1.317842857 2.54708627 Long Term debt Equity = Long term debt Shareholders equity 0.439839925 0.99015042 Interest Coverage Ratio Earnings Before Interest And Taxes (EBIT) Interest Expenses 22.70904328 6.5112481 Valuation Analysis B Earning per share Net Income - preferred stock dividend Number of Common Share Outstanding 8.36 4.86 Dividends per share Total Cash Dividend On Common Shares Number of Common Share Outstanding 7.70 2.13 Dividend per share Earnings per share 0.92 0.44 Dividends pay-out-ratio = price to earning: 12.06 6.03 Market value per share Book value per share Market-to-book ratio (Please do not give the overall Interpretation/comparison i want a specified comparison using each one of the ratios that are calculated)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started