Answered step by step

Verified Expert Solution

Question

1 Approved Answer

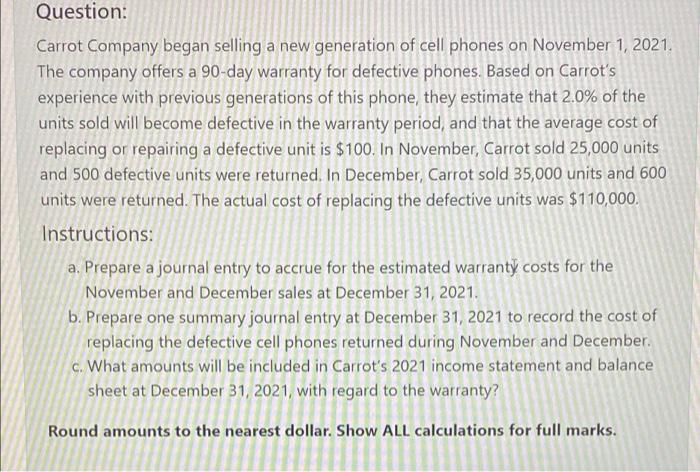

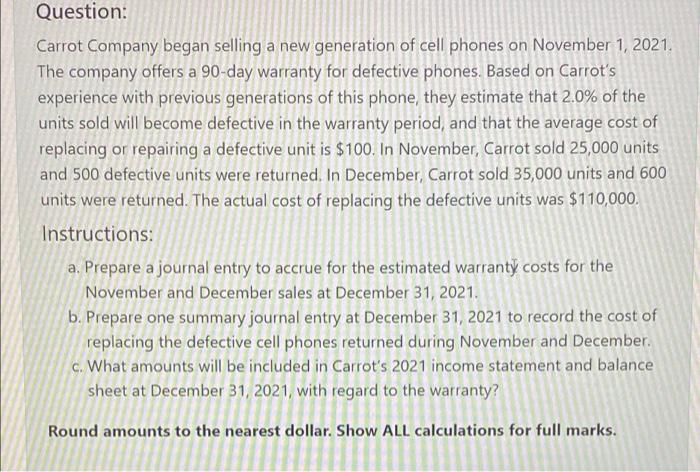

please it is urgent Question: Carrot Company began selling a new generation of cell phones on November 1, 2021. The company offers a 90-day warranty

please it is urgent

Question: Carrot Company began selling a new generation of cell phones on November 1, 2021. The company offers a 90-day warranty for defective phones. Based on Carrot's experience with previous generations of this phone, they estimate that 2.0% of the units sold will become defective in the warranty period, and that the average cost of replacing or repairing a defective unit is $100. In November, Carrot sold 25,000 units and 500 defective units were returned. In December, Carrot sold 35,000 units and 600 units were returned. The actual cost of replacing the defective units was $110,000. Instructions: a. Prepare a journal entry to accrue for the estimated warranty costs for the November and December sales at December 31, 2021. b. Prepare one summary journal entry at December 31, 2021 to record the cost of replacing the defective cell phones returned during November and December c. What amounts will be included in Carrot's 2021 income statement and balance sheet at December 31, 2021, with regard to the warranty? Round amounts to the nearest dollar. Show ALL calculations for full marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started