Answered step by step

Verified Expert Solution

Question

1 Approved Answer

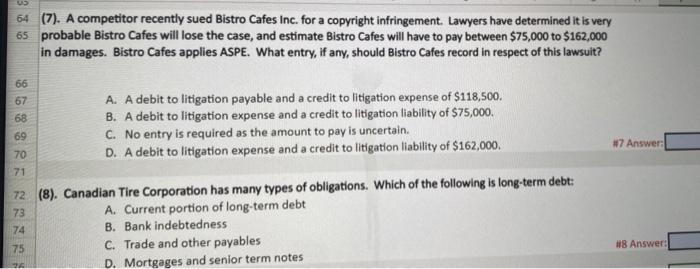

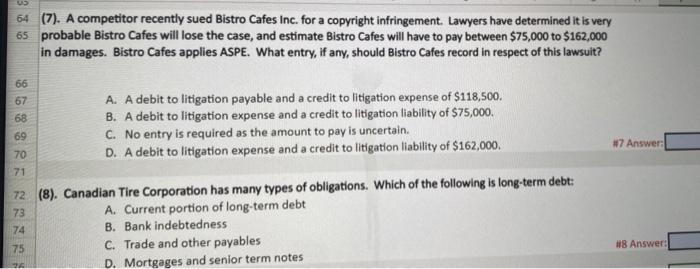

please its urgent Us 64 (7). A competitor recently sued Bistro Cafes Inc. for a copyright infringement. Lawyers have determined it is very 65 probable

please its urgent

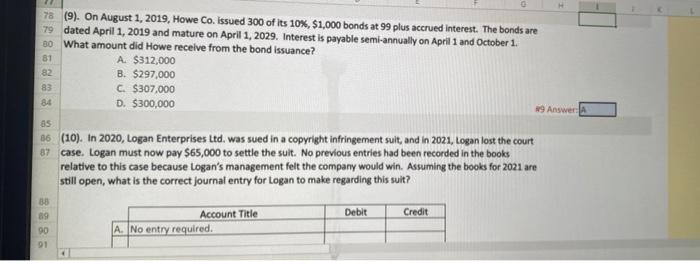

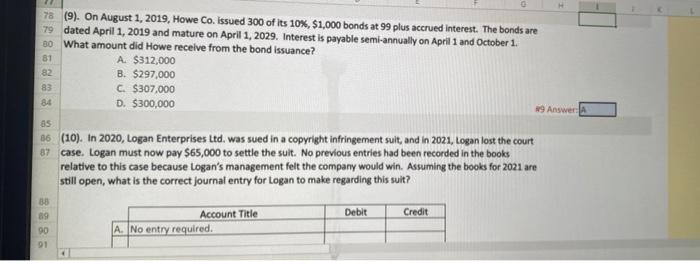

Us 64 (7). A competitor recently sued Bistro Cafes Inc. for a copyright infringement. Lawyers have determined it is very 65 probable Bistro Cafes will lose the case, and estimate Bistro Cafes will have to pay between $75,000 to $162,000 in damages. Bistro Cafes applies ASPE. What entry, if any, should Bistro Cafes record in respect of this lawsuit? A. A debit to litigation payable and a credit to litigation expense of $118,500. B. A debit to litigation expense and a credit to litigation liability of $75,000 C. No entry is required as the amount to pay is uncertain. D. A debit to litigation expense and a credit to litigation liability of $162,000. #7 Answer: 73 74 75 72 (8). Canadian Tire Corporation has many types of obligations. Which of the following is long-term debt: A. Current portion of long-term debt B. Bank indebtedness C. Trade and other payables D. Mortgages and senior term notes 8 Answer: 78 (9). On August 1, 2019, Howe Co. Issued 300 of its 10%, $1,000 bonds at 99 plus accrued interest. The bonds are 79 dated April 1, 2019 and mature on April 1, 2029. Interest is payable semi-annually on April 1 and October 1. 80 What amount did Howe receive from the bond issuance? 81 A $312,000 B. $297,000 C. $307,000 84 D. $300,000 9 Answer 82 83 85 36 (10). In 2020, Logan Enterprises Ltd. was sued in a copyright infringement suit, and in 2021, Logan lost the court 87 case. Logan must now pay $65,000 to settle the suit. No previous entries had been recorded in the books relative to this case because Logan's management felt the company would win. Assuming the books for 2021 are still open, what is the correct journal entry for Logan to make regarding this suit? Debit Credit 88 89 90 01 Account Title A. No entry required

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started