Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please journal entry and make T-accounts The following are selected accounts and account balances of Sawyer Company on May 31 : Savyer entered into the

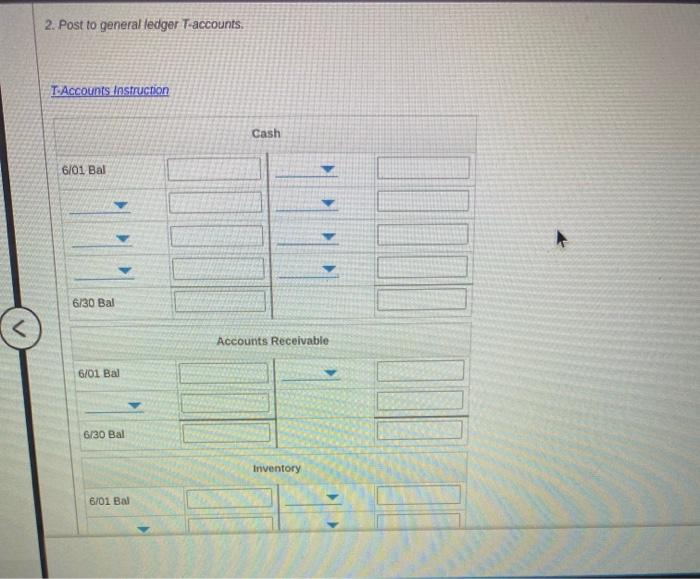

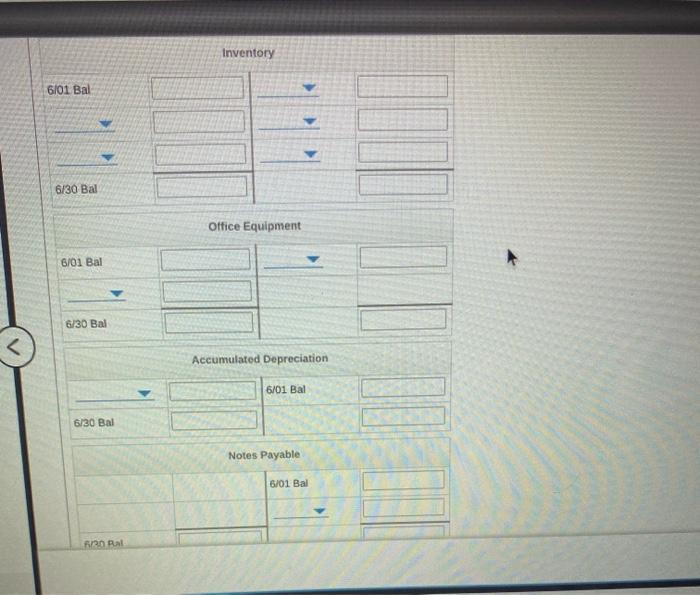

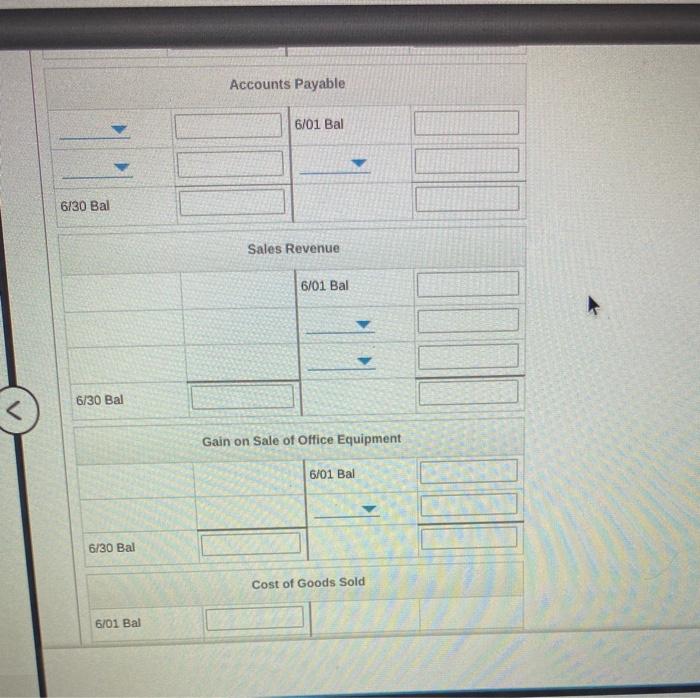

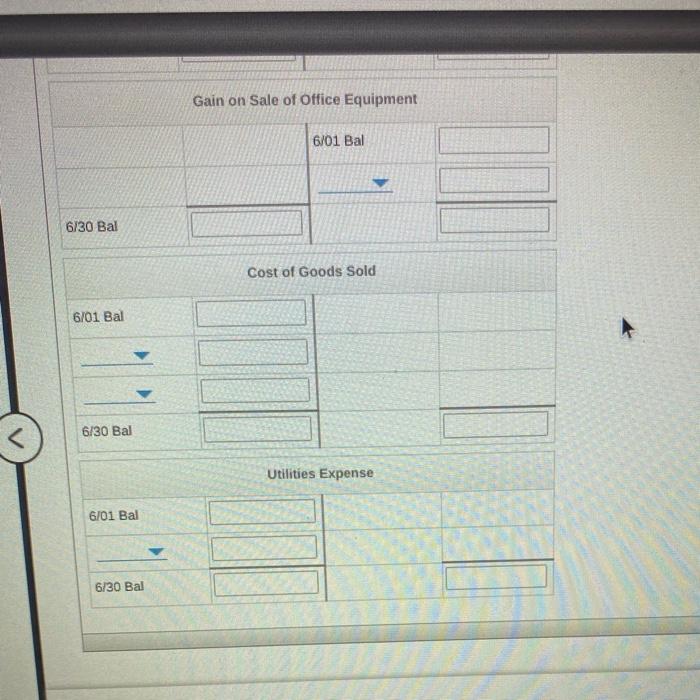

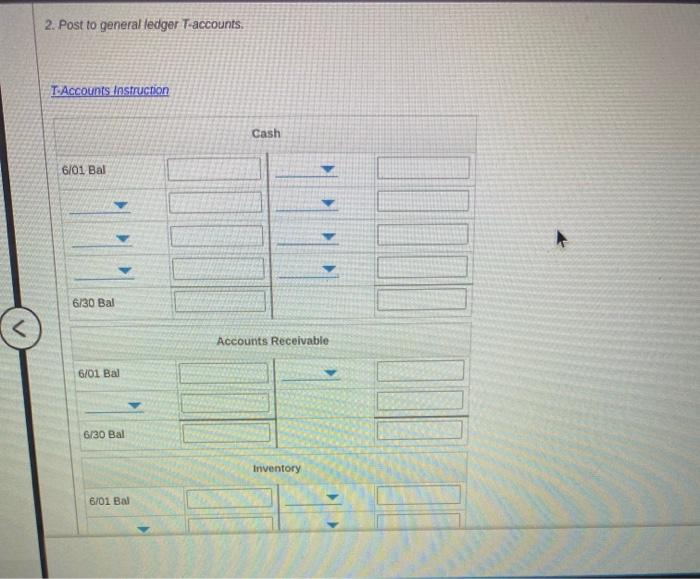

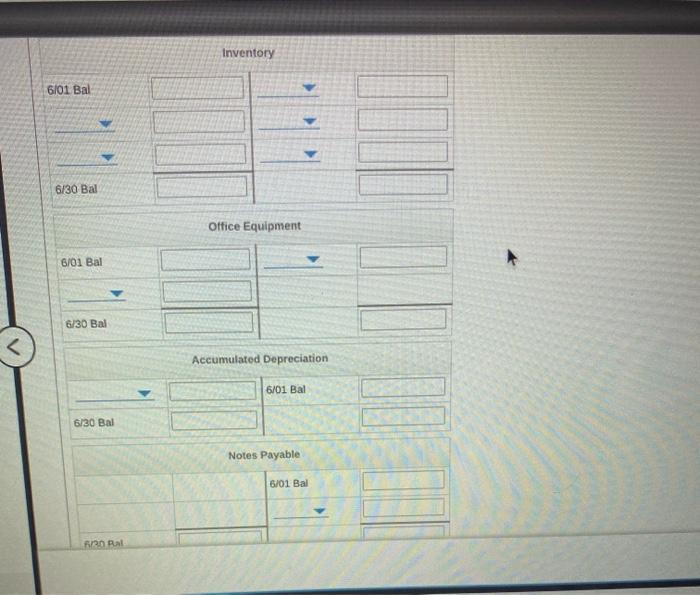

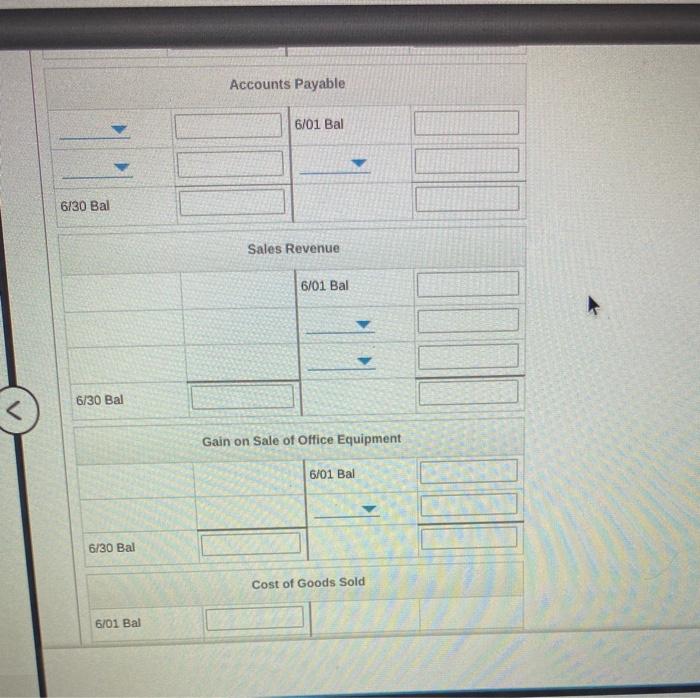

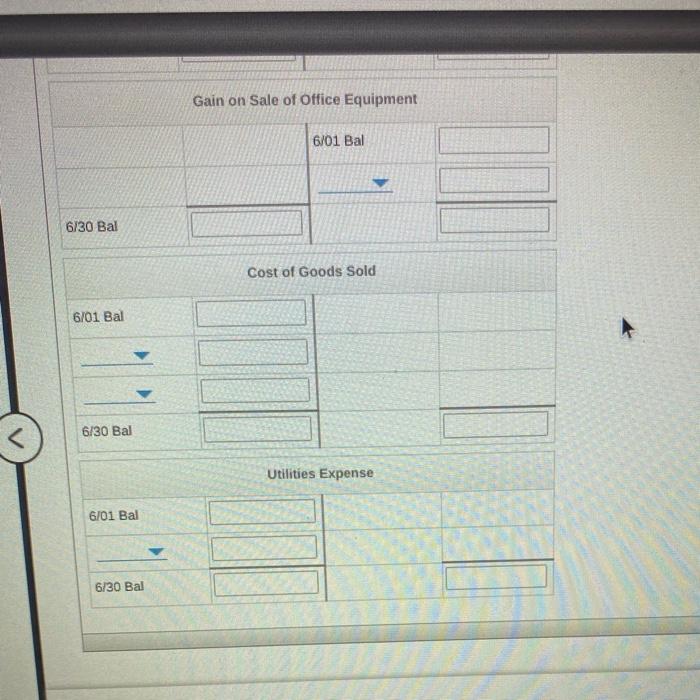

please journal entry and make T-accounts

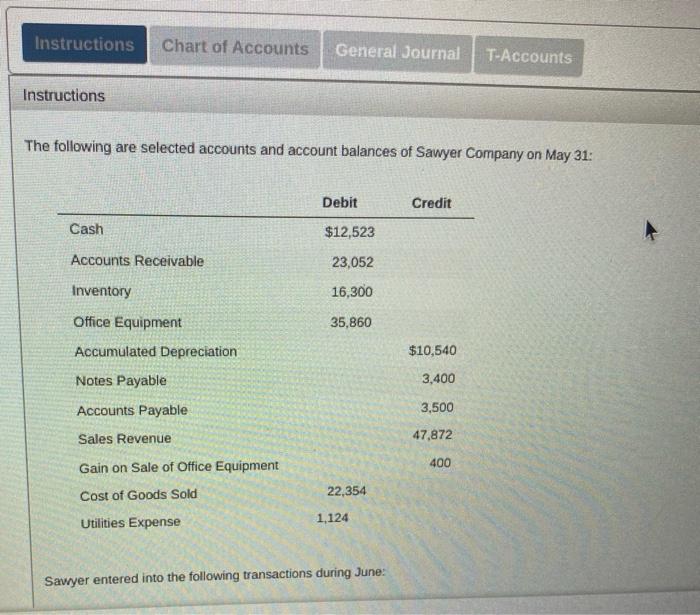

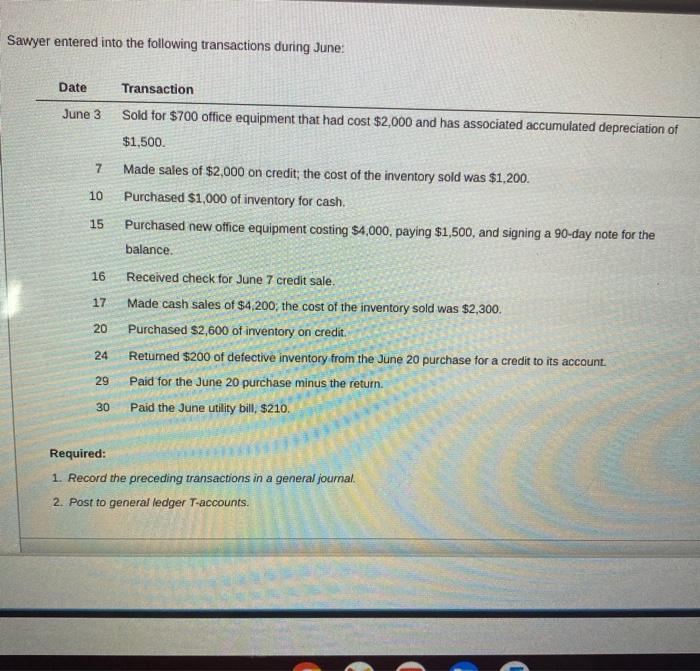

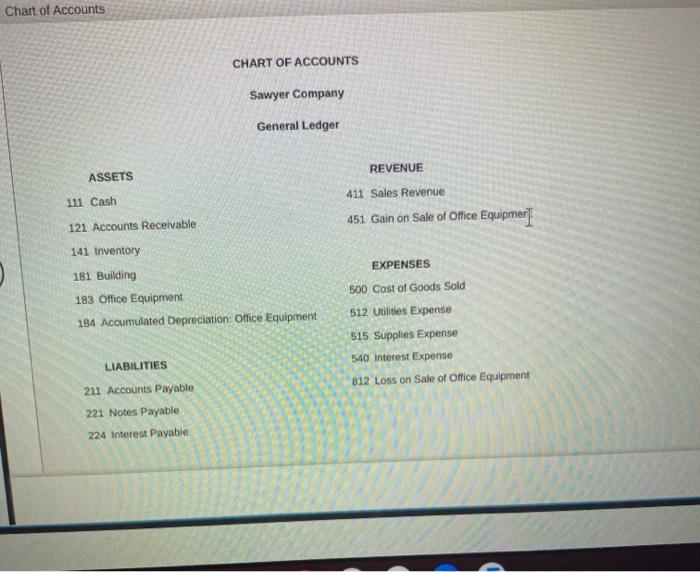

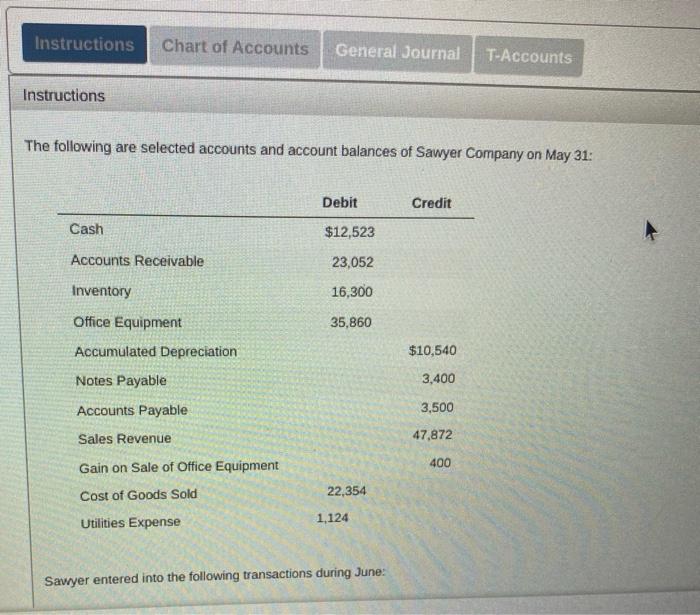

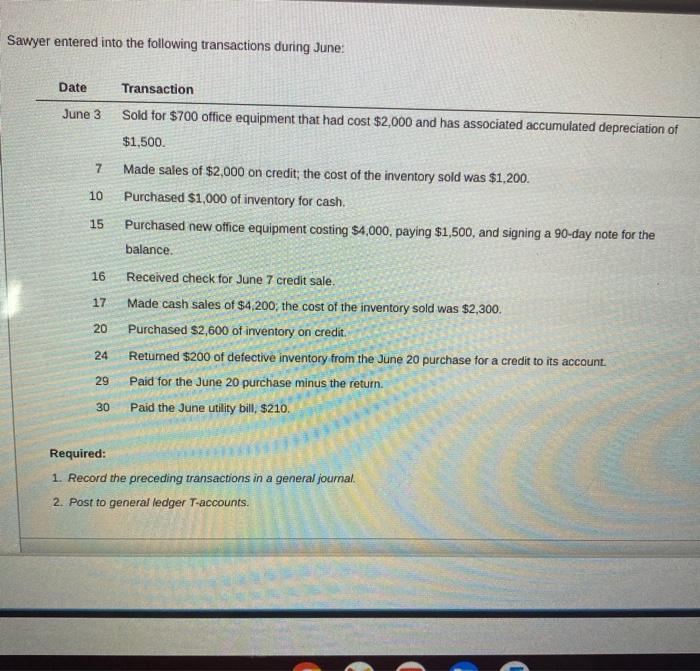

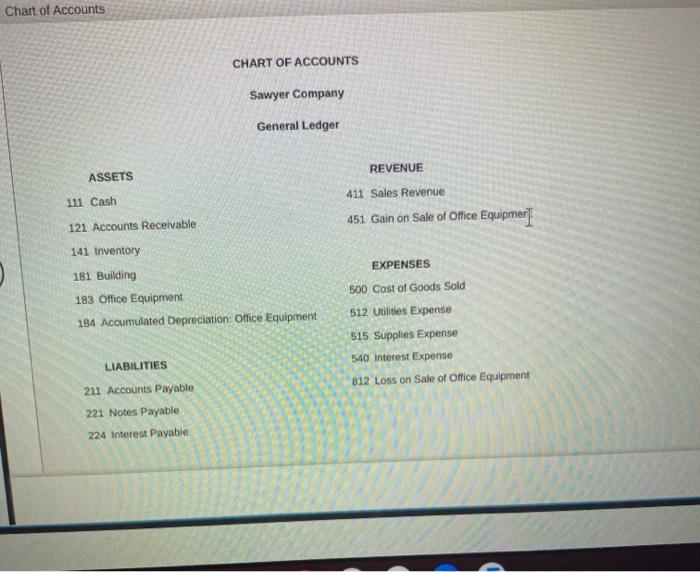

The following are selected accounts and account balances of Sawyer Company on May 31 : Savyer entered into the following transactions during June: Sawryer entered into the following transactions during June: Date Transaction June 3 Sold for $700 office equipment that had cost $2,000 and has associated accumulated depreciation of $1,500. 7 Made sales of $2,000 on credit; the cost of the inventory sold was $1,200. 10 Purchased $1,000 of inventory for cash. 15 Purchased new office equipment costing $4,000, paying $1,500, and signing a 90 -day note for the balance. 16 Received check for June 7 credit sale. 17 Made cash sales of $4,200; the cost of the inventory sold was $2,300. 20 Purchased $2,600 of inventory on credit. 24 Retumed $200 of defective inventory from the June 20 purchase for a credit to its account. 29 Paid for the June 20 purchase minus the return. 30 Paid the June utility bill, $210. Required: 1. Record the preceding transactions in a general joumal. 2. Post to general ledger T-accounts. Chart of Accounts CHART OF ACCOUNTS Sawyer Company General Ledger FELUED A I TAIIBMAI 2. Post to general ledger T-accounts. T.Accounts instruction Inventory Accounts Payable Gain on Sale of Office Equipment Utilities Expense 6/30Bal The following are selected accounts and account balances of Sawyer Company on May 31 : Savyer entered into the following transactions during June: Sawryer entered into the following transactions during June: Date Transaction June 3 Sold for $700 office equipment that had cost $2,000 and has associated accumulated depreciation of $1,500. 7 Made sales of $2,000 on credit; the cost of the inventory sold was $1,200. 10 Purchased $1,000 of inventory for cash. 15 Purchased new office equipment costing $4,000, paying $1,500, and signing a 90 -day note for the balance. 16 Received check for June 7 credit sale. 17 Made cash sales of $4,200; the cost of the inventory sold was $2,300. 20 Purchased $2,600 of inventory on credit. 24 Retumed $200 of defective inventory from the June 20 purchase for a credit to its account. 29 Paid for the June 20 purchase minus the return. 30 Paid the June utility bill, $210. Required: 1. Record the preceding transactions in a general joumal. 2. Post to general ledger T-accounts. Chart of Accounts CHART OF ACCOUNTS Sawyer Company General Ledger FELUED A I TAIIBMAI 2. Post to general ledger T-accounts. T.Accounts instruction Inventory Accounts Payable Gain on Sale of Office Equipment Utilities Expense 6/30Bal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started