Answered step by step

Verified Expert Solution

Question

1 Approved Answer

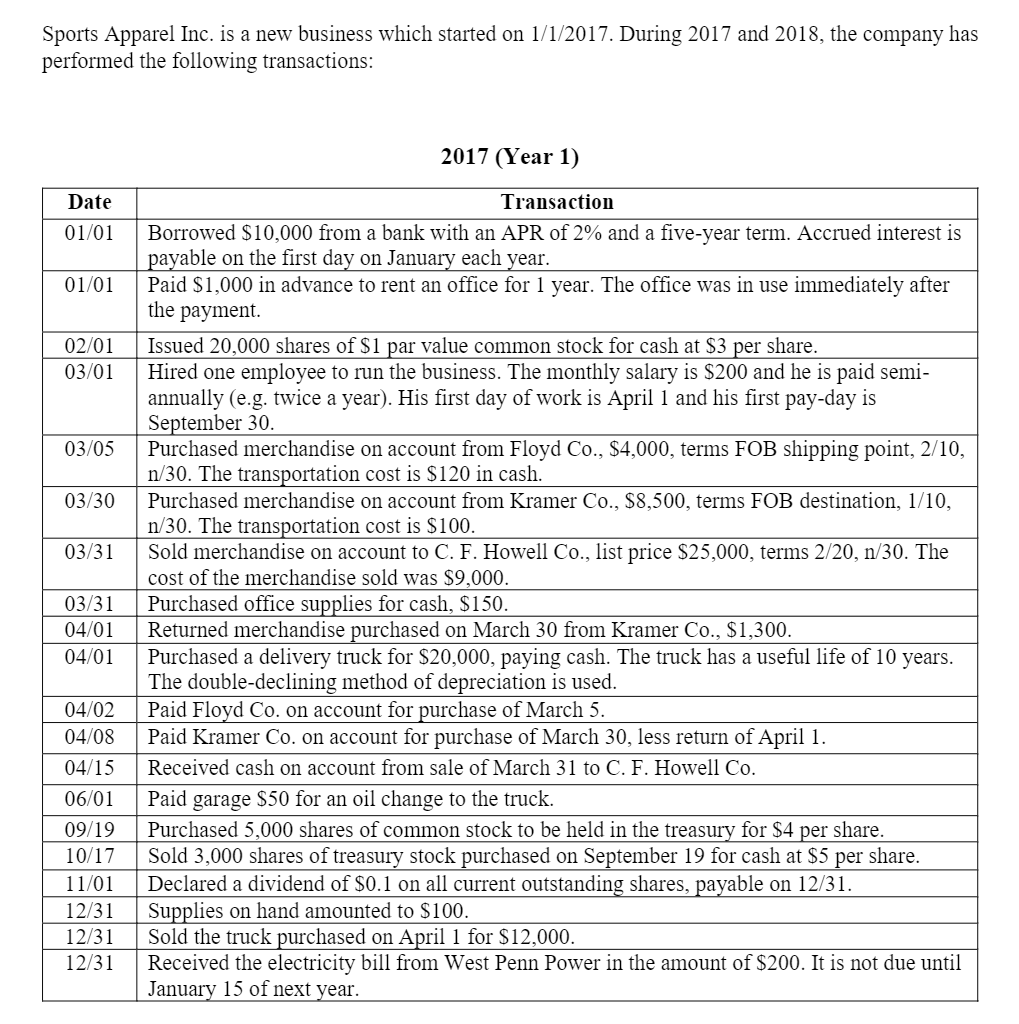

Please journalize all transactions (including adjusting and closing entries) for Sports Apparel Inc. in 2017. Prepare the income statement and balance sheet for the year

Please journalize all transactions (including adjusting and closing entries) for Sports Apparel Inc. in 2017. Prepare the income statement and balance sheet for the year ended 12/31/2017. You do not need to prepare the statement of changes in shareholders equity and the cash flow statement. All adjusting entries should only be made on 12/31 instead of monthly entries.

(I.E:

Journal entries that take place in 2017 along with thet-tables, balance sheet, and income statement for 2017.

Sports Apparel Inc. is a new business which started on 1/1/2017. During 2017 and 2018, the company has performed the following transactions: 2017 (Year 1) Date 01/01 01/01 02/01 03/01 03/05 03/30 03/31 03/31 04/01 04/01 Transaction Borrowed $10,000 from a bank with an APR of 2% and a five-year term. Accrued interest is payable on the first day on January each year. Paid $1,000 in advance to rent an office for 1 year. The office was in use immediately after the payment Issued 20,000 shares of $1 par value common stock for cash at $3 per share. Hired one employee to run the business. The monthly salary is $200 and he is paid semi- annually (e.g. twice a year). His first day of work is April 1 and his first pay-day is September 30. Purchased merchandise on account from Floyd Co., $4,000, terms FOB shipping point, 2/10, n/30. The transportation cost is $120 in cash. Purchased merchandise on account from Kramer Co., $8,500, terms FOB destination, 1/10, n/30. The transportation cost is $100. Sold merchandise on account to C. F. Howell Co., list price $25,000, terms 2/20, n/30. The cost of the merchandise sold was $9,000. Purchased office supplies for cash, $150. Returned merchandise purchased on March 30 from Kramer Co., $1,300. Purchased a delivery truck for $20,000, paying cash. The truck has a useful life of 10 years. The double-declining method of depreciation is used. Paid Floyd Co. on account for purchase of March 5. Paid Kramer Co. on account for purchase of March 30, less return of April 1. Received cash on account from sale of March 31 to C. F. Howell Co. Paid garage $50 for an oil change to the truck. Purchased 5,000 shares of common stock to be held in the treasury for $4 per share. Sold 3,000 shares of treasury stock purchased on September 19 for cash at $5 per share. Declared a dividend of $0.1 on all current outstanding shares, payable on 12/31. Supplies on hand amounted to $100. Sold the truck purchased on April 1 for $12,000. Received the electricity bill from West Penn Power in the amount of $200. It is not due until January 15 of next year. 04/02 04/08 04/15 06/01 09/19 10/17 11/01 12/31 12/31 12/31Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started