Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please journalize entries The note payable to Royce Computers (transactions 04 and 08) is a five-year note, with interest at the rate of 12 percent

please journalize entries

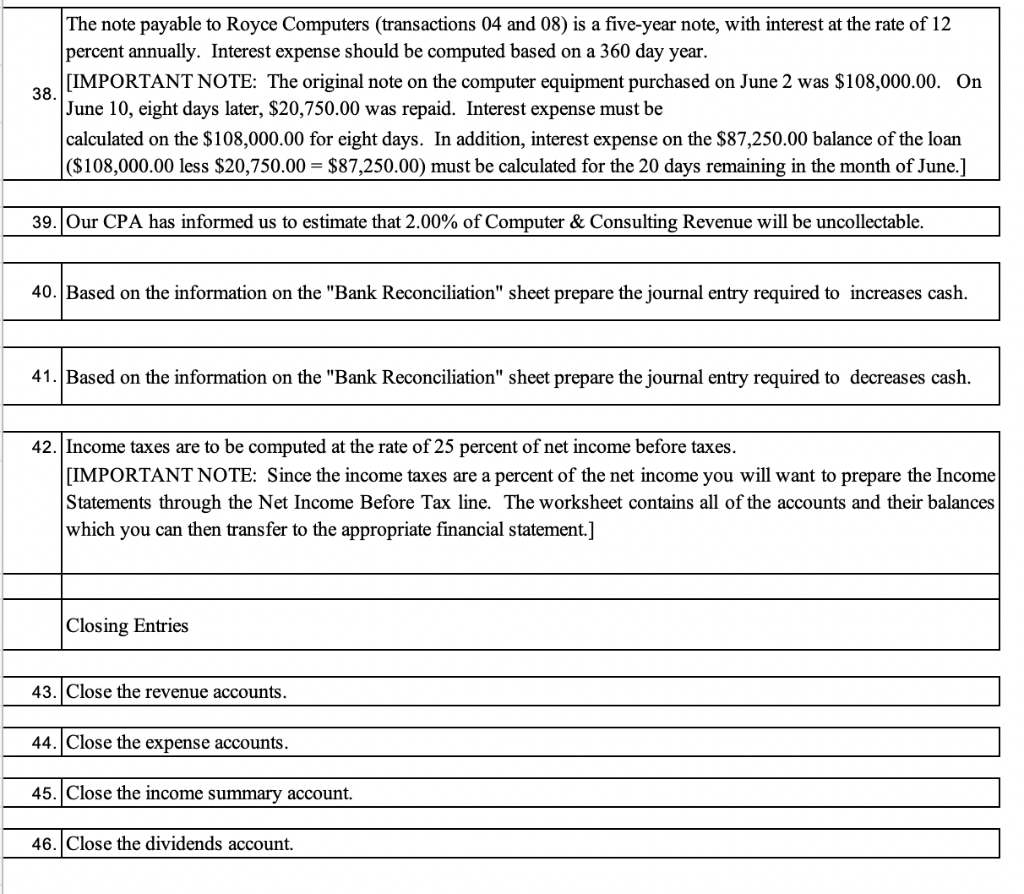

The note payable to Royce Computers (transactions 04 and 08) is a five-year note, with interest at the rate of 12 percent annually. Interest expense should be computed based on a 360 day year. [IMPORTANT NOTE: The original note on the computer equipment purchased on June 2 was $108,000.00. On 38. June 10, eight days later, $20,750.00 was repaid. Interest expense must be calculated on the $108,000.00 for eight days. In addition, interest expense on the $87,250.00 balance of the loan ($108,000.00 less $20,750.00 = $87,250.00) must be calculated for the 20 days remaining in the month of June.] 39. Our CPA has informed us to estimate that 2.00% of Computer & Consulting Revenue will be uncollectable. 40. Based on the information on the "Bank Reconciliation" sheet prepare the journal entry required to increases cash. 41. Based on the information on the "Bank Reconciliation" sheet prepare the journal entry required to decreases cash. 42. Income taxes are to be computed at the rate of 25 percent of net income before taxes. [IMPORTANT NOTE: Since the income taxes are a percent of the net income you will want to prepare the Income Statements through the Net Income Before Tax line. The worksheet contains all of the accounts and their balances which you can then transfer to the appropriate financial statement.] |Closing Entries 43. Close the revenue accounts. 44. Close the expense accounts. 45. Close the income summary account. 46. Close the dividends account. The note payable to Royce Computers (transactions 04 and 08) is a five-year note, with interest at the rate of 12 percent annually. Interest expense should be computed based on a 360 day year. [IMPORTANT NOTE: The original note on the computer equipment purchased on June 2 was $108,000.00. On 38. June 10, eight days later, $20,750.00 was repaid. Interest expense must be calculated on the $108,000.00 for eight days. In addition, interest expense on the $87,250.00 balance of the loan ($108,000.00 less $20,750.00 = $87,250.00) must be calculated for the 20 days remaining in the month of June.] 39. Our CPA has informed us to estimate that 2.00% of Computer & Consulting Revenue will be uncollectable. 40. Based on the information on the "Bank Reconciliation" sheet prepare the journal entry required to increases cash. 41. Based on the information on the "Bank Reconciliation" sheet prepare the journal entry required to decreases cash. 42. Income taxes are to be computed at the rate of 25 percent of net income before taxes. [IMPORTANT NOTE: Since the income taxes are a percent of the net income you will want to prepare the Income Statements through the Net Income Before Tax line. The worksheet contains all of the accounts and their balances which you can then transfer to the appropriate financial statement.] |Closing Entries 43. Close the revenue accounts. 44. Close the expense accounts. 45. Close the income summary account. 46. Close the dividends accountStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started