Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please just answer for all of them 10. Suppose that Britain pegs the pound to gold at four pounds per ounce, whereas the exchange rate

please just answer for all of them

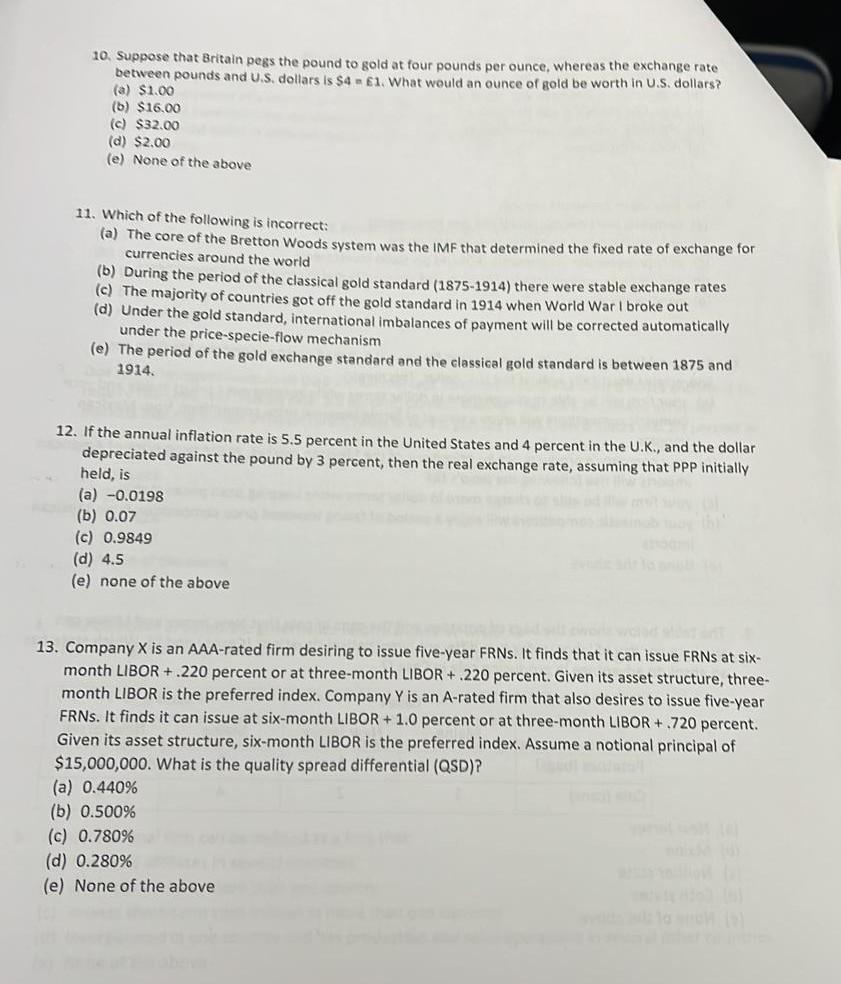

10. Suppose that Britain pegs the pound to gold at four pounds per ounce, whereas the exchange rate between pounds and U.S. dollars is $4 a 61 . What would an ounce of gold be worth in U.S. dollars? (a) $1.00 (b) $16.00 (c) $32.00 (d) $2.00 (e) None of the above 11. Which of the following is incorrect: (a) The core of the Bretton Woods system was the IMF that determined the fixed rate of exchange for currencies around the world (b) During the period of the classical gold standard (18751914) there were stable exchange rates (c) The majority of countries got off the gold standard in 1914 when World War I broke out (d) Under the gold standard, international imbalances of payment will be corrected automatically under the price-specie-flow mechanism (e) The period of the gold exchange standard and the classical gold standard is between 1875 and 1914. 12. If the annual inflation rate is 5.5 percent in the United States and 4 percent in the U.K., and the dollar depreciated against the pound by 3 percent, then the real exchange rate, assuming that PPP initially held, is (a) 0.0198 (b) 0.07 (c) 0.9849 (d) 4.5 (e) none of the above 13. Company X is an AAA-rated firm desiring to issue five-year FRNs. It finds that it can issue FRNs at sixmonth LIBOR + . 220 percent or at three-month LIBOR + .220 percent. Given its asset structure, threemonth LIBOR is the preferred index. Company Y is an A-rated firm that also desires to issue five-year FRNs. It finds it can issue at six-month LIBOR +1.0 percent or at three-month LIBOR +.720 percent. Given its asset structure, six-month LIBOR is the preferred index. Assume a notional principal of $15,000,000. What is the quality spread differential (QSD)? (a) 0.440% (b) 0.500% (c) 0.780% (d) 0.280% (e) None of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started