Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please just answer question 6 and work it out, thank you! 5) Tangshan China's stock is currently selling for $100.00 per share and the firm's

please just answer question 6 and work it out, thank you!

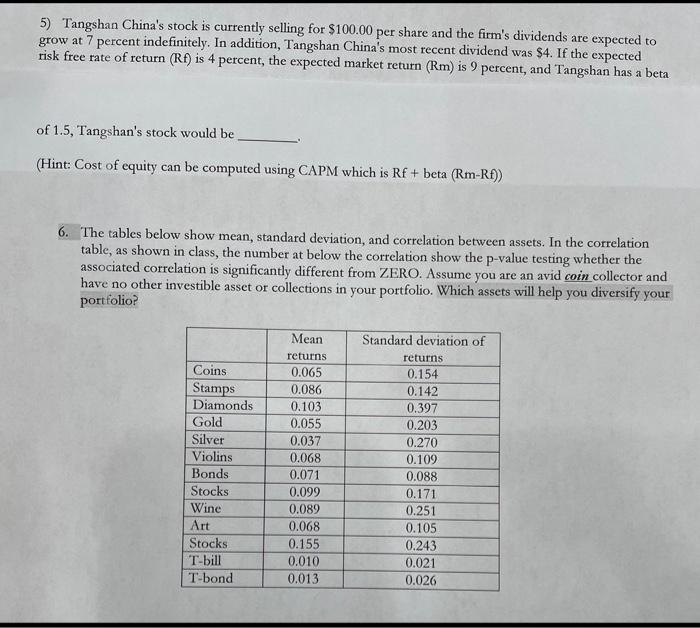

5) Tangshan China's stock is currently selling for $100.00 per share and the firm's dividends are expected to grow at 7 percent indefinitely. In addition, Tangshan China's most recent dividend was $4. If the expected risk free rate of return (Rt) is 4 percent, the expected market return (Rm) is 9 percent, and Tangshan has a beta of 1.5, Tangshan's stock would be (Hint: Cost of equity can be computed using CAPM which is Rf + beta (Rm-Rf)) 6. The tables below show mean, standard deviation, and correlation between assets. In the correlation table, as shown in class, the number at below the correlation show the p-value testing whether the associated correlation is significantly different from ZERO. Assume you are an avid coin collector and have no other investible asset or collections in your portfolio. Which assets will help you diversify your portfolio? Coins Stamps Diamonds Gold Silver Violins Bonds Stocks Wine Art Stocks T-bill T-bond Mean returns 0.065 0.086 0.103 0.055 0.037 0.068 0.071 0.099 0.089 0.068 0.155 0.010 0.013 Standard deviation of returns 0.154 0.142 0.397 0.203 0.270 0.109 0.088 0.171 0.251 0.105 0.243 0.021 0.026 5) Tangshan China's stock is currently selling for $100.00 per share and the firm's dividends are expected to grow at 7 percent indefinitely. In addition, Tangshan China's most recent dividend was $4. If the expected risk free rate of return (Rt) is 4 percent, the expected market return (Rm) is 9 percent, and Tangshan has a beta of 1.5, Tangshan's stock would be (Hint: Cost of equity can be computed using CAPM which is Rf + beta (Rm-Rf)) 6. The tables below show mean, standard deviation, and correlation between assets. In the correlation table, as shown in class, the number at below the correlation show the p-value testing whether the associated correlation is significantly different from ZERO. Assume you are an avid coin collector and have no other investible asset or collections in your portfolio. Which assets will help you diversify your portfolio? Coins Stamps Diamonds Gold Silver Violins Bonds Stocks Wine Art Stocks T-bill T-bond Mean returns 0.065 0.086 0.103 0.055 0.037 0.068 0.071 0.099 0.089 0.068 0.155 0.010 0.013 Standard deviation of returns 0.154 0.142 0.397 0.203 0.270 0.109 0.088 0.171 0.251 0.105 0.243 0.021 0.026 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started