please just c , d and e

will leave a good review

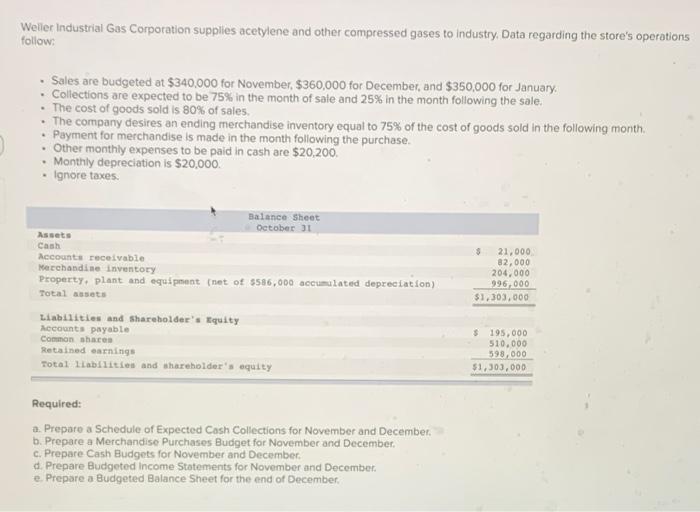

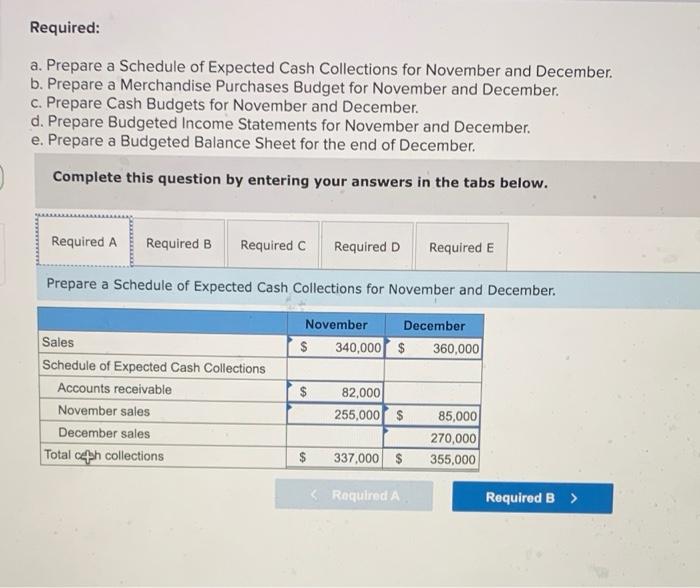

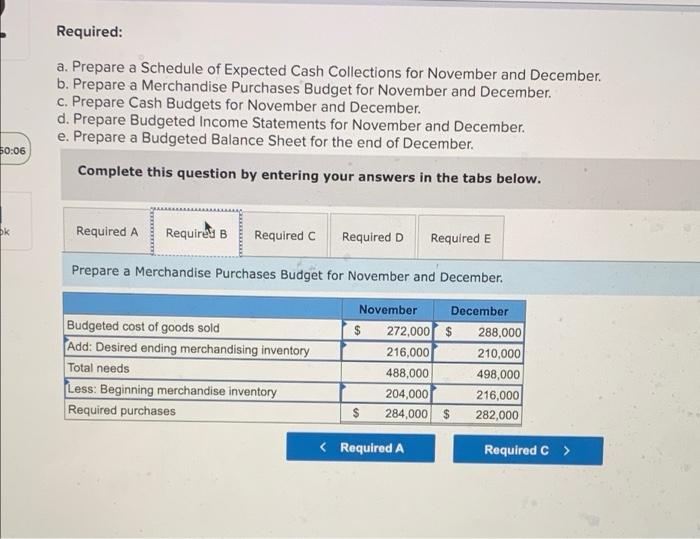

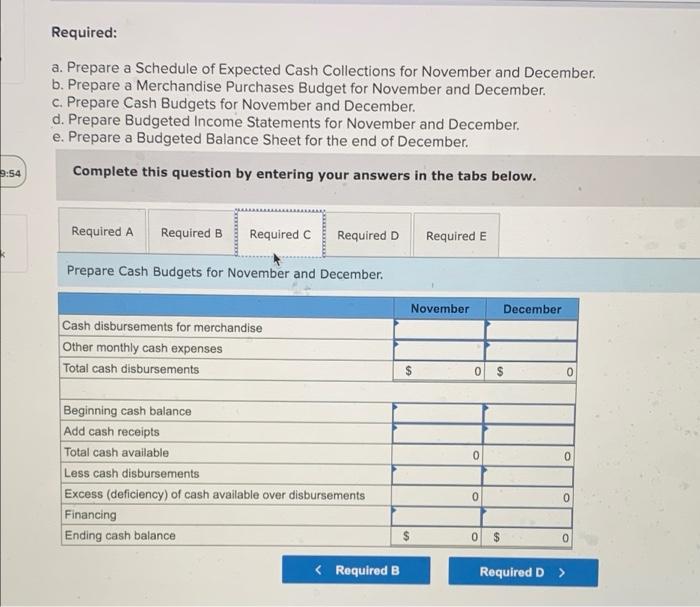

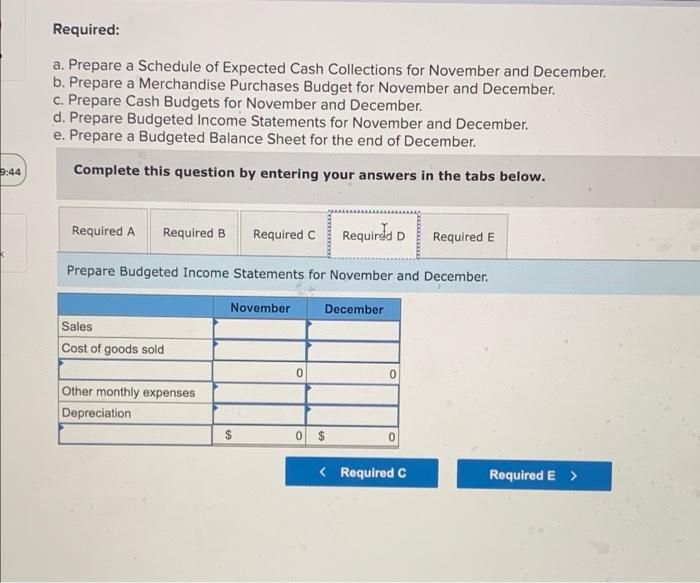

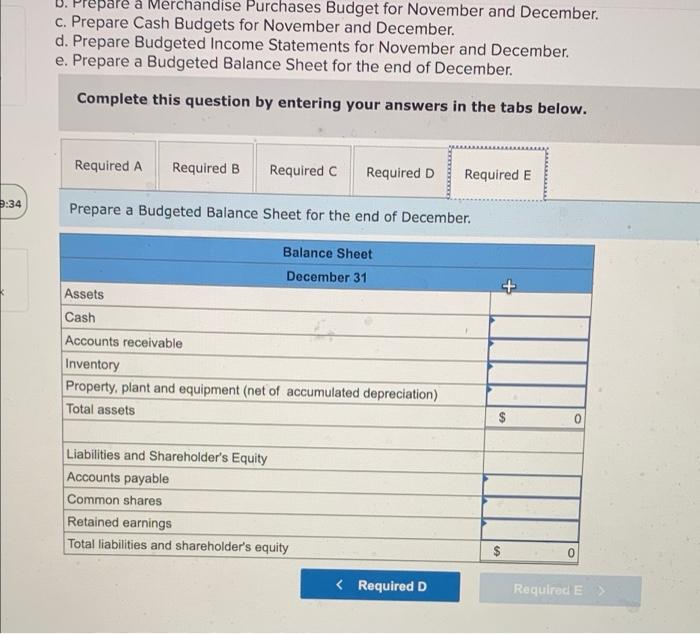

Weller Industrial Gas Corporation supplies acetylene and other compressed gases to Industry. Data regarding the store's operations follow Sales are budgeted at $340,000 for November, $360,000 for December, and $350,000 for January Collections are expected to be 75% in the month of sale and 25% in the month following the sale. The cost of goods sold is 80% of sales. The company desires an ending merchandise inventory equal to 75% of the cost of goods sold in the following month. Payment for merchandise is made in the month following the purchase. Other monthly expenses to be paid in cash are $20,200 Monthly depreciation is $20,000. . Ignore taxes Balance Sheet October 31 Assets Cash Accounts receivable Merchandise inventory Property, plant and equipment (net of $586,000 accumulated depreciation) Total assets Liabilities and shareholder' Equity Accounts payable Common shacen Retained earnings Total liabilities and shareholder's equity $ 21,000 82,000 204.000 996,000 $1,303,000 $ 195,000 510.000 598,000 $1,303,000 Required: 2. Prepare a Schedule of Expected Cash Collections for November and December b. Prepare a Merchandise Purchases Budget for November and December c. Prepare Cash Budgets for November and December d. Prepare Budgeted Income Statements for November and December e. Prepare a Budgeted Balance Sheet for the end of December Required: a. Prepare a Schedule of Expected Cash Collections for November and December b. Prepare a Merchandise Purchases Budget for November and December c. Prepare Cash Budgets for November and December d. Prepare Budgeted Income Statements for November and December e. Prepare a Budgeted Balance Sheet for the end of December Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Prepare a Schedule of Expected Cash Collections for November and December November December $ 340,000 $ 360,000 $ Sales Schedule of Expected Cash Collections Accounts receivable November sales December sales Total c4h collections 82,000 255,000 $ 85,000 270,000 355,000 $ 337,000 $ Required: a. Prepare a Schedule of Expected Cash Collections for November and December. b. Prepare a Merchandise Purchases Budget for November and December c. Prepare Cash Budgets for November and December d. Prepare Budgeted Income Statements for November and December. e. Prepare a Budgeted Balance Sheet for the end of December. Complete this question by entering your answers in the tabs below. 50:06 ok Required A Requires B Required C Required D Required E Prepare a Merchandise Purchases Budget for November and December. Budgeted cost of goods sold Add: Desired ending merchandising inventory Total needs Less: Beginning merchandise inventory Required purchases November December 272,000 $ 288,000 216,000 210,000 488,000 498,000 204,000 216,000 $ 284,000 $ 282,000 Required: a. Prepare a Schedule of Expected Cash Collections for November and December b. Prepare a Merchandise Purchases Budget for November and December. c. Prepare Cash Budgets for November and December. d. Prepare Budgeted Income Statements for November and December. e. Prepare a Budgeted Balance Sheet for the end of December Complete this question by entering your answers in the tabs below. 9:54 Required A Required B Required Required D Required E Prepare Cash Budgets for November and December November December Cash disbursements for merchandise Other monthly cash expenses Total cash disbursements $ 0 $ 0 0 0 Beginning cash balance Add cash receipts Total cash available Less cash disbursements Excess (deficiency) of cash available over disbursements Financing Ending cash balance 0 0 0 $ 0 Required: a. Prepare a Schedule of Expected Cash Collections for November and December. b. Prepare a Merchandise Purchases Budget for November and December c. Prepare Cash Budgets for November and December. d. Prepare Budgeted Income Statements for November and December. e. Prepare a Budgeted Balance Sheet for the end of December Complete this question by entering your answers in the tabs below. 3:44 Required A Required B Required C Required Required E Prepare Budgeted Income Statements for November and December November December Sales Cost of goods sold 0 0 Other monthly expenses Depreciation 0 $ 0 repare a Merchandise Purchases Budget for November and December. c. Prepare Cash Budgets for November and December d. Prepare Budgeted Income Statements for November and December. e. Prepare a Budgeted Balance Sheet for the end of December Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E 5:34 Prepare a Budgeted Balance Sheet for the end of December. Balance Sheet December 31 Assets Cash Accounts receivable Inventory Property, plant and equipment (net of accumulated depreciation) Total assets $ 0 Liabilities and Shareholder's Equity Accounts payable Common shares Retained earnings Total liabilities and shareholder's equity