Please just explain why the correct answers are well correct if its just math please just show what math you used to get that answer that will suffice.

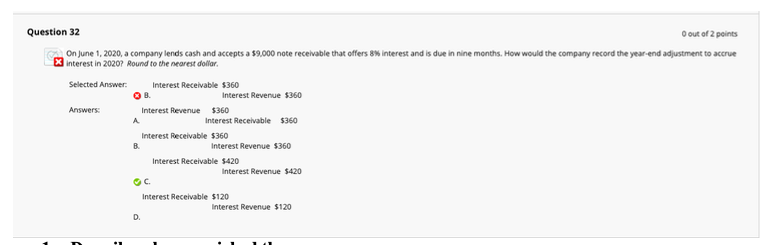

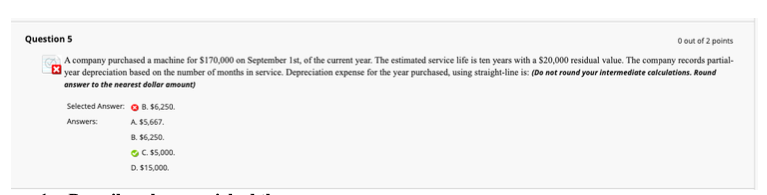

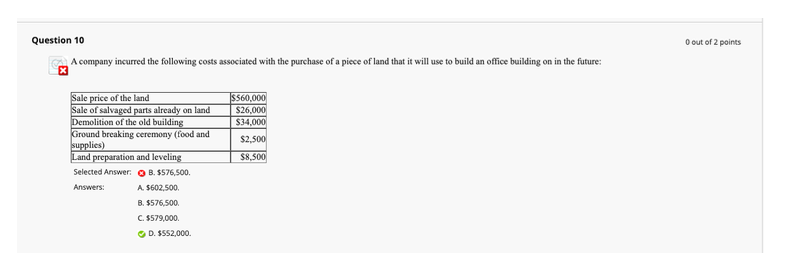

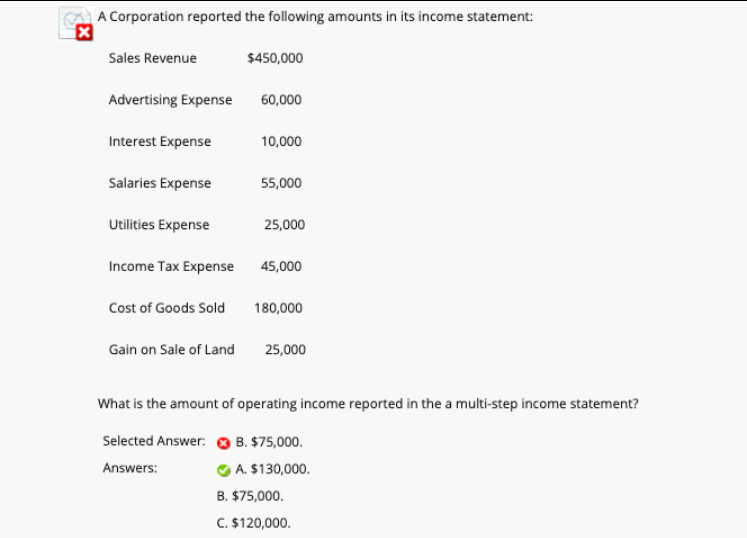

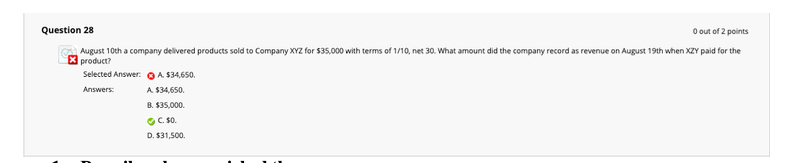

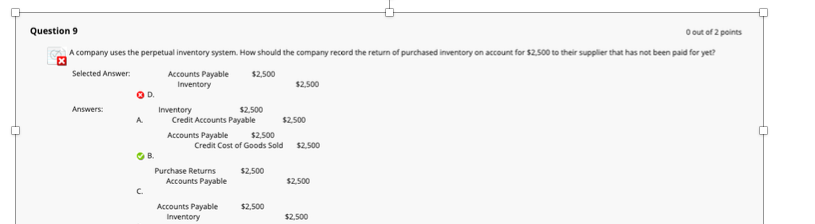

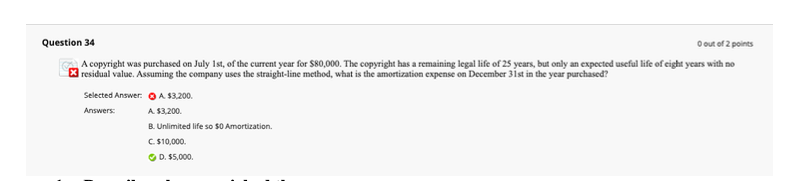

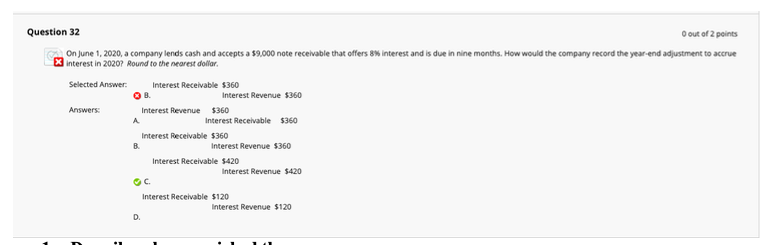

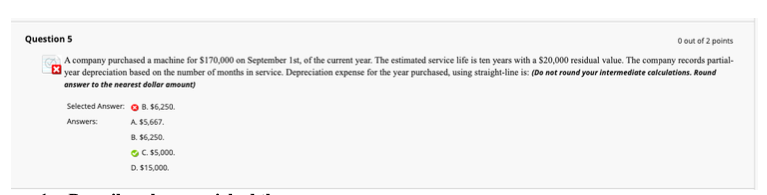

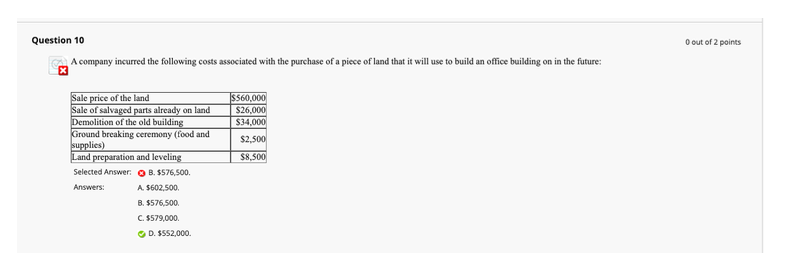

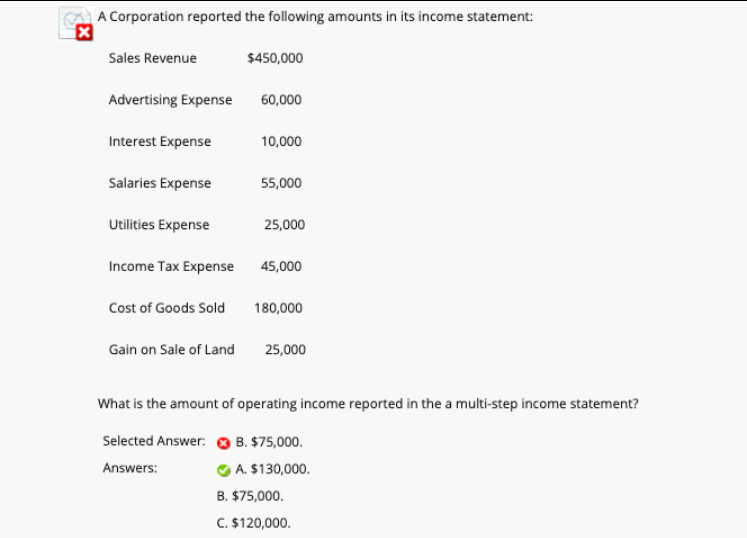

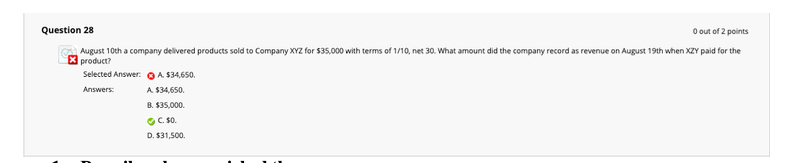

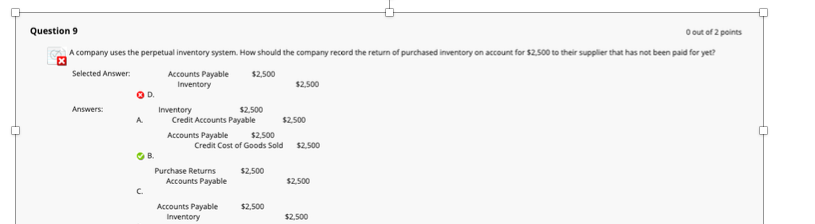

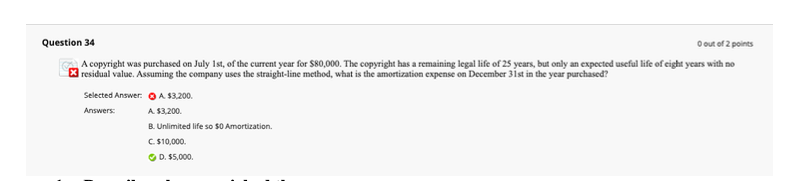

Question 32 O out of 2 points On June 1, 2020, a company lends cash and accepts a 59.000 note receivable that offers 8% interest and is due in nine months. How would the company record the year-end adjustment to accrue x interest in 2020? Round to the nearest dollar. Selected Answer: interest Receivable $360 Interest Revenue $360 Answers Interest Revenue $360 Interest Receivable $360 Interest Receivable $360 Interest Revenue $360 Interest Receivable $420 Interest Revenue 5420 Interest Receivable $120 Interest Revenue $120 Question 5 O out of 2 points A company purchased a machine for $170,000 on September Ist of the current year. The estimated service life is ten years with a $20,000 residual value. The company records partial w year depreciation based on the number of months in service. Depreciation expense for the year purchased, using straight-line is: (Do not round your intermediate calculations. Round answer to the nearest dollar amount) Selected Answer: B. $6.250. Answers: A $5.667. B. 56,250. C. 55.000 D. $15,000 O out of 2 points Question 10 CAA company incurred the following costs associated with the purchase of a piece of land that it will use to build an office building on in the future: S560.000 $26.000 $34,000 $2.500 $8.500 Sale price of the land Sale of salvaged parts already on land Demolition of the old building Ground breaking ceremony (food and supplies) Land preparation and leveling Selected Answer: B. $576,500. Answers: A. $602,500 B. $576,500 C. $579,000 D. 3552.000 A Corporation reported the following amounts in its income statement: Sales Revenue $450,000 Advertising Expense 60,000 Interest Expense 10,000 Salaries Expense 55,000 Utilities Expense 25,000 Income Tax Expense 45,000 Cost of Goods Sold 180,000 Gain on Sale of Land 25,000 What is the amount of operating income reported in the a multi-step income statement? Selected Answer: 3 B. $75,000. Answers: A. $130,000. B. $75,000. C. $120,000 Question 28 O out of 2 points August 10th a company delivered products sold to Company XYZ for $35,000 with terms of 1/10, net 30. What amount did the company record as revenue on August 19th when XZY paid for the x product? Selected Answer: Answers A $34,650. A $34,650. B. $35,000 C. 0. D. $31,500 Question 9 O out of 2 points A company uses the perpetual inventory system. How should the company record the return of purchased inventory on account for $2.500 to their supplier that has not been paid for yet? Selected Answer: Accounts Payable Inventory $2,500 $2.500 D Answers: Inventory $2.500 Credit Accounts Payable $2.500 Accounts Payable $2.500 Credit Cost of Goods Sold $2.500 $2.500 Purchase Returns Accounts Payable $2.500 Accounts Payable Inventory $2.500 $2.500 Question 34 O out of 2 points A copyright was purchased on July 1st, of the current year for $80,000. The copyright has a remaining legal life of 25 years, but only an expected useful life of eight years with no X residual value. Assuming the company uses the straight-line method, what is the amortization expense on December 31st in the year purchased? Selected Answer: Answers: A $3.200. A $3,200 B. Unlimited life so SO Amortization. C. $10,000 D. $5,000