Please just match the right and left side, no need to explain anything

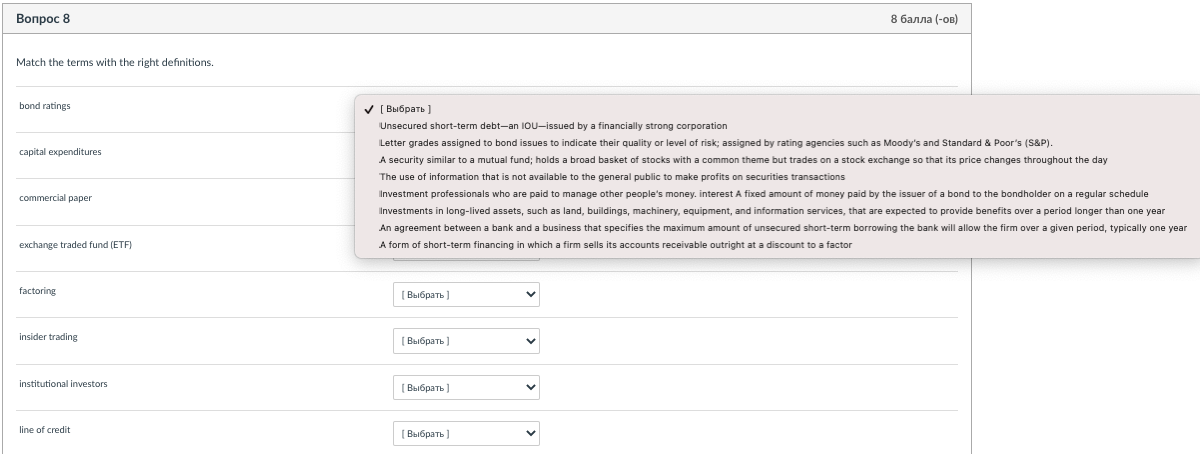

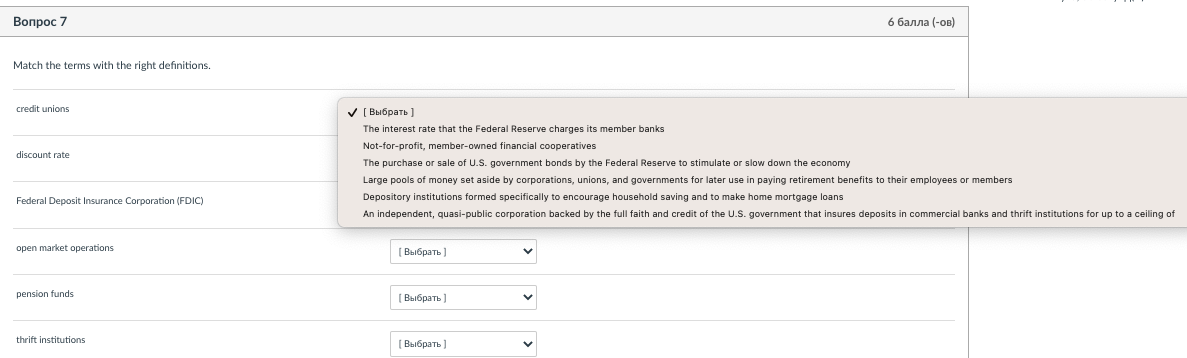

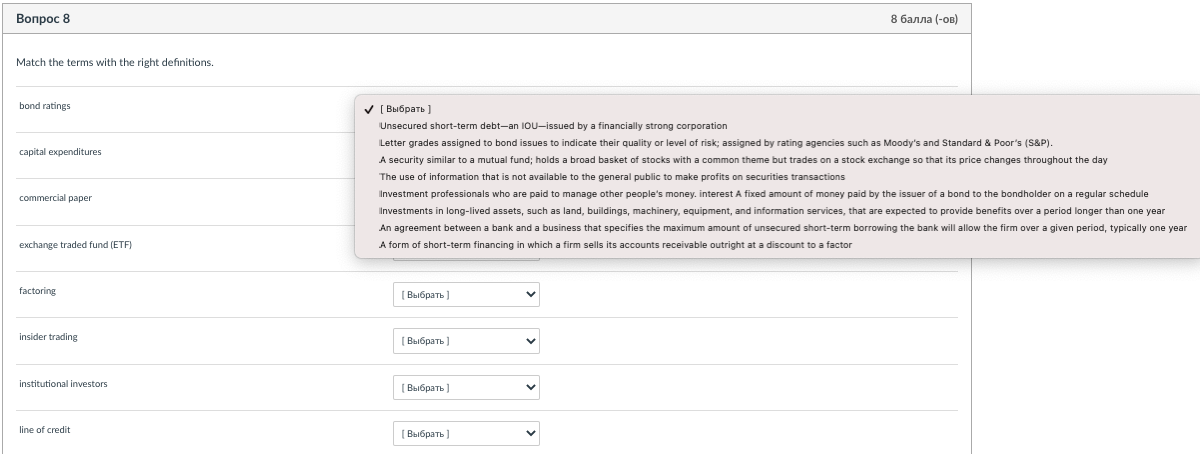

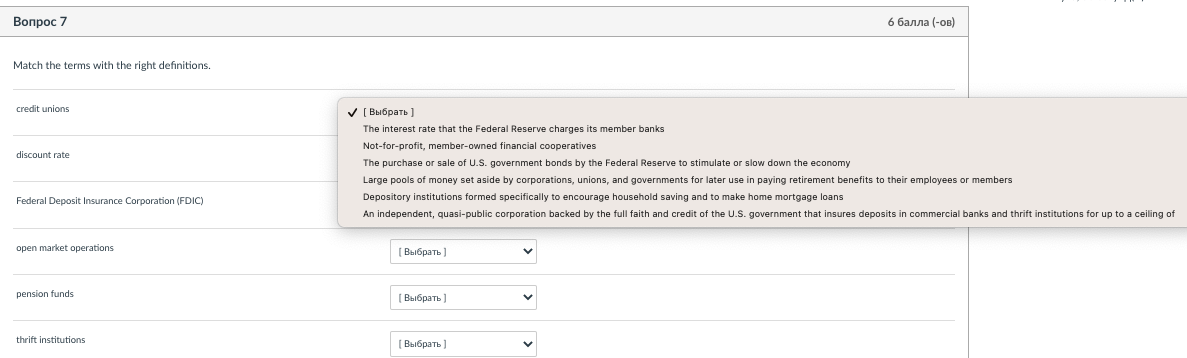

Bonpoc 8 8 (-) Match the terms with the right definitions. bond ratings capital expenditures [ ] Unsecured short-term debt-an lou-issued by a financially strong corporation Letter grades assigned to bond issues to indicate their quality or level of risk; assigned by rating agencies such as Moody's and Standard & Poor's (S&P). A security similar to a mutual fund; holds a broad basket of stocks with a common theme but trades on a stock exchange so that its price changes throughout the day The use of information that is not available to the general public make profits on securities transactions Investment professionals who are paid to manage other people's money. interest A fixed amount of money paid by the issuer of a bond to the bondholder on a regular schedule Investments in long-lived assets, such as land, buildings, machinery, equipment, and information services, that are expected to provide benefits over a period longer than one year An agreement between a bank and a business that specifies the maximum amount of unsecured short-term borrowing the bank will allow the firm over a given period, typically one year A form of short-term financing in which a firm sells its accounts receivable outright at a discount to a factor commercial paper exchange traded fund IETEX factoring [ ) insider trading [ ) institutional investors ( ) line of credit [ ) 7 6 (-) Match the terms with the right definitions. credit unions discount rate ( | The interest rate that the Federal Reserve charges its member banks Not-for-profit, member-owned financial cooperatives The purchase or sale of U.S. government bonds by the Federal Reserve to stimulate or slow down the economy Large pools of money set aside corporations, unions, and governments for later use in paying retirement benefits their employees or members Depository institutions formed specifically to encourage household saving and to make home mortgage loans An independent, quasi-public corporation backed by the full faith and credit of the U.S. government that insures deposits in commercial banks and thrift institutions for up to a ceiling of Federal Deposit Insurance Corporation (FDIC) open market operations ( ] pension funds ( ] thrift institutions ( )