Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE just put answer i dont understand it at all so an explanation will NOT help, just lines with answers please Mercedes, Co. has the

PLEASE just put answer i dont understand it at all so an explanation will NOT help, just lines with answers please

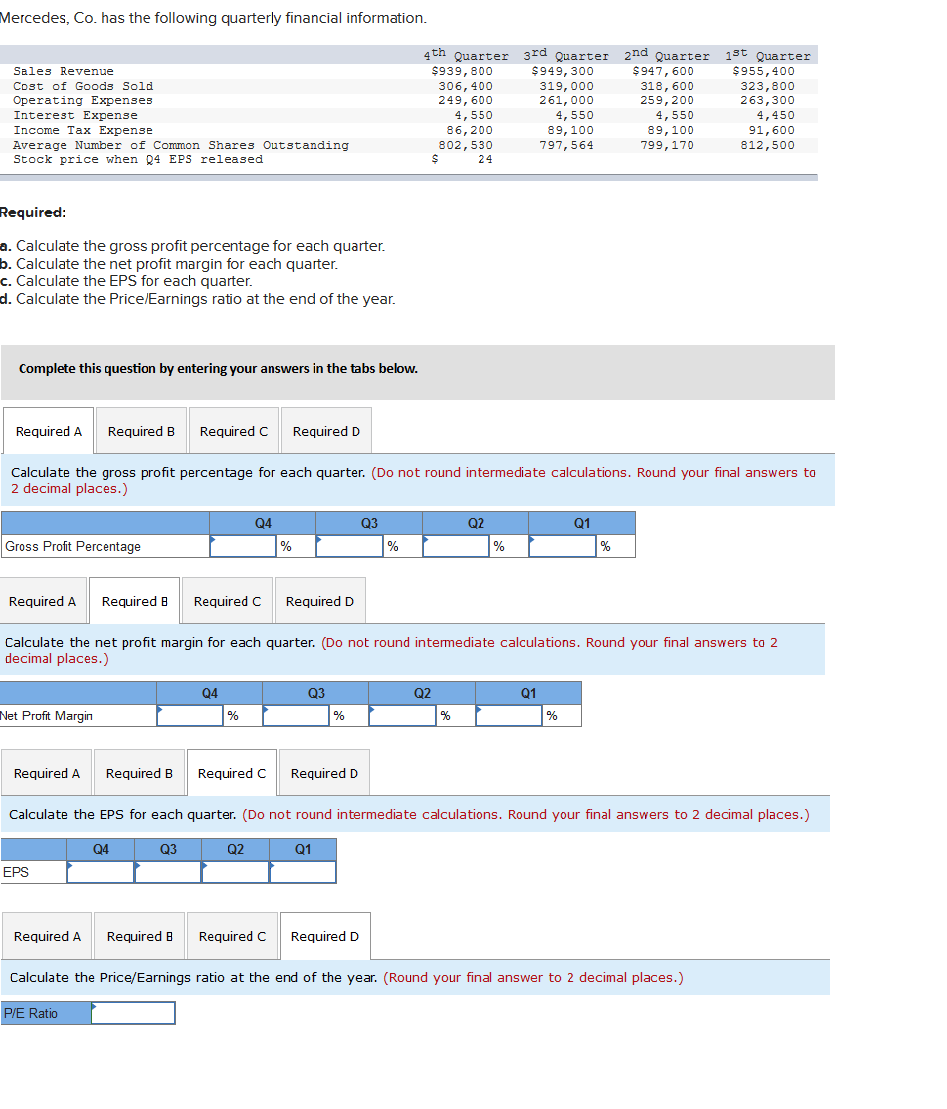

Mercedes, Co. has the following quarterly financial information. Sales Revenue Cost of Goods Sold Operating Expenses Interest Expense Income Tax Expense Average Number of Common Shares Outstanding Stock price when Q4 EPS released 4th Quarter 3rd Quarter 2nd Quarter $939,800 $949, 300 $947, 600 306,400 319,000 318,600 249,600 261,000 259, 200 4,550 4,550 4,550 86,200 89,100 89, 100 802,530 797,564 799,170 $ 24 1st Quarter $955,400 323,800 263,300 4,450 91,600 812,500 Required: a. Calculate the gross profit percentage for each quarter. b. Calculate the net profit margin for each quarter. c. Calculate the EPS for each quarter. d. Calculate the Price/Earnings ratio at the end of the year. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Calculate the gross profit percentage for each quarter. (Do not round intermediate calculations. Round your final answers to 2 decimal places.) Q4 Q3 Q2 Q1 Gross Profit Percentage % % % % Required A Required B Required C Required D Calculate the net profit margin for each quarter. (Do not round intermediate calculations. Round your final answers to 2 decimal places.) Q4 Q3 Q2 Q1 Net Profit Margin % % % Required A Required B Required C Required D Calculate the EPS for each quarter. (Do not round intermediate calculations. Round your final answers to 2 decimal places.) Q4 Q3 Q2 Q1 EPS Required A Required B Required C Required D Calculate the Price/Earnings ratio at the end of the year. (Round your final answer to 2 decimal places.) P/E RatioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started