Answered step by step

Verified Expert Solution

Question

1 Approved Answer

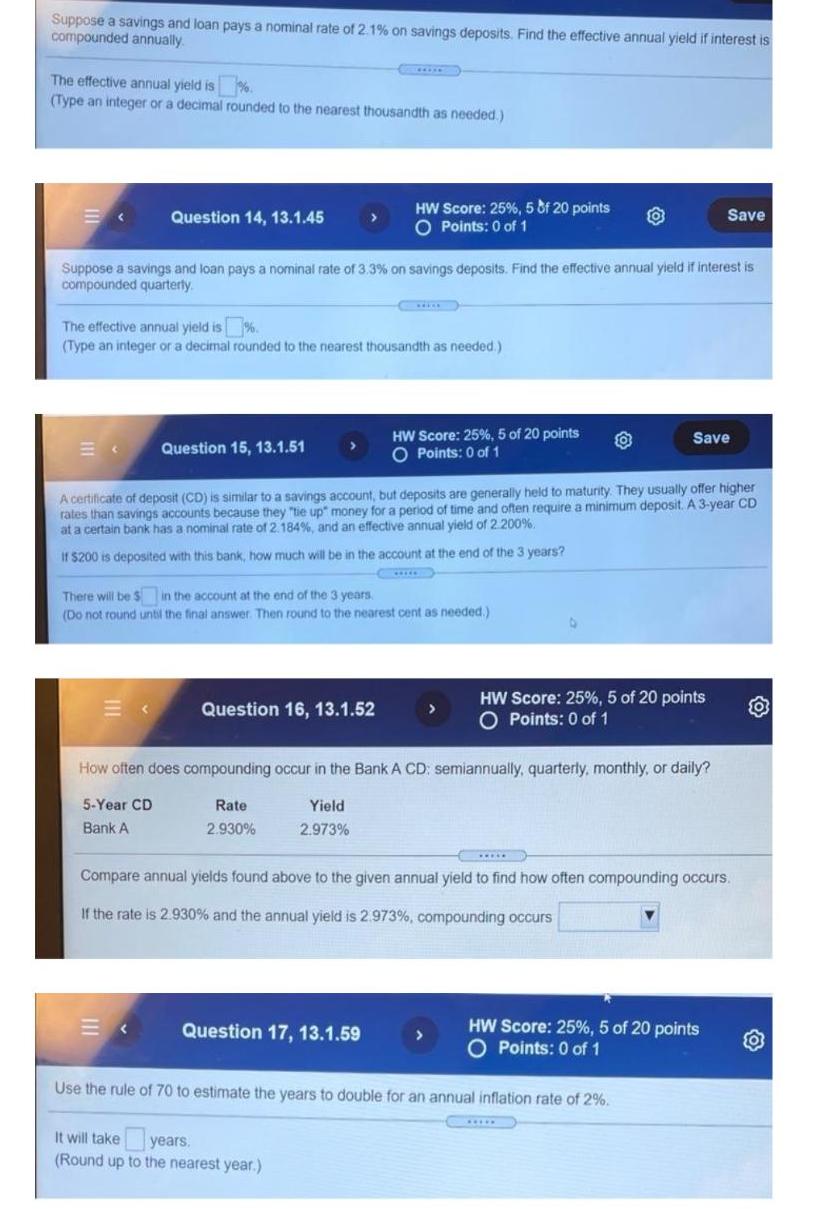

Suppose a savings and loan pays a nominal rate of 2.1% on savings deposits. Find the effective annual yield if interest is compounded annually.

Suppose a savings and loan pays a nominal rate of 2.1% on savings deposits. Find the effective annual yield if interest is compounded annually. The effective annual yield is. (Type an integer or a decimal rounded to the nearest thousandth as needed.) Question 14, 13.1.45 Suppose a savings and loan pays a nominal rate of 3.3% on savings deposits. Find the effective annual yield if interest is compounded quarterly. The effective annual yield is %. (Type an integer or a decimal rounded to the nearest thousandth as needed.) Question 15, 13.1.51 HW Score: 25%, 5 of 20 points O Points: 0 of 1 Question 16, 13.1.52 There will be $ in the account at the end of the 3 years. (Do not round until the final answer. Then round to the nearest cent as needed.) HW Score: 25%, 5 of 20 points O Points: 0 of 1 A certificate of deposit (CD) is similar to a savings account, but deposits are generally held to maturity. They usually offer higher rates than savings accounts because they "tie up" money for a period of time and often require a minimum deposit. A 3-year CD at a certain bank has a nominal rate of 2.184%, and an effective annual yield of 2.200%. If $200 is deposited with this bank, how much will be in the account at the end of the 3 years? Question 17, 13.1.59 How often does compounding occur in the Bank A CD: semiannually, quarterly, monthly, or daily? Rate Yield 5-Year CD Bank A 2.930% 2.973% It will take years. (Round up to the nearest year.) HW Score: 25%, 5 of 20 points O Points: 0 of 1 Save Compare annual yields found above to the given annual yield to find how often compounding occurs. If the rate is 2.930% and the annual yield is 2.973%, compounding occurs Save Use the rule of 70 to estimate the years to double for an annual inflation rate of 2%. HW Score: 25%, 5 of 20 points O Points: 0 of 1 *****

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Question 14 Nominal rate 33 Number of compounding periods per year quarterly compounding 4 Effective ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started