Please Label Clearly & Answer all Parts. PLEASE

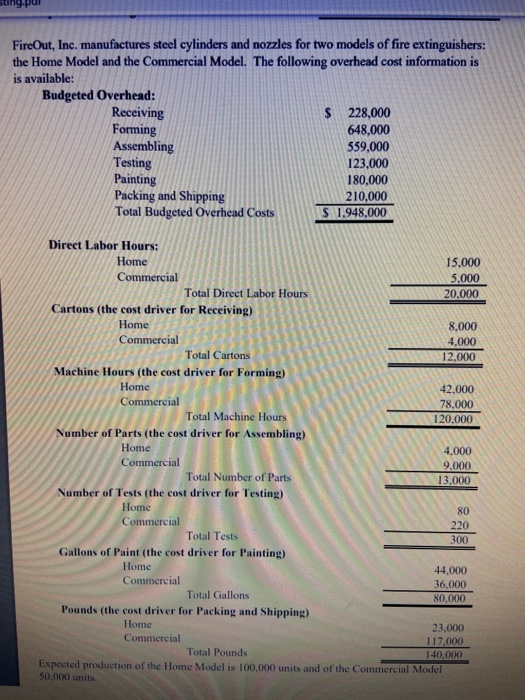

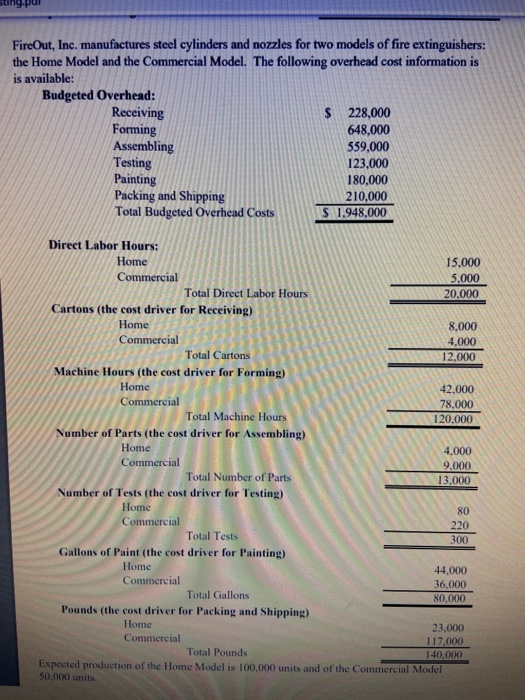

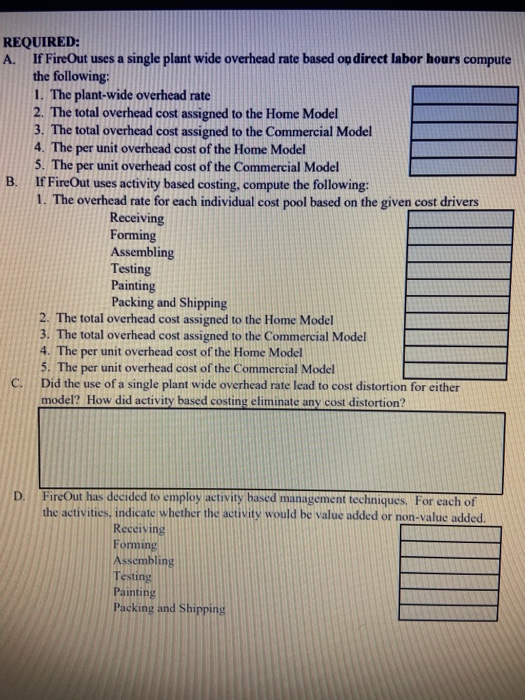

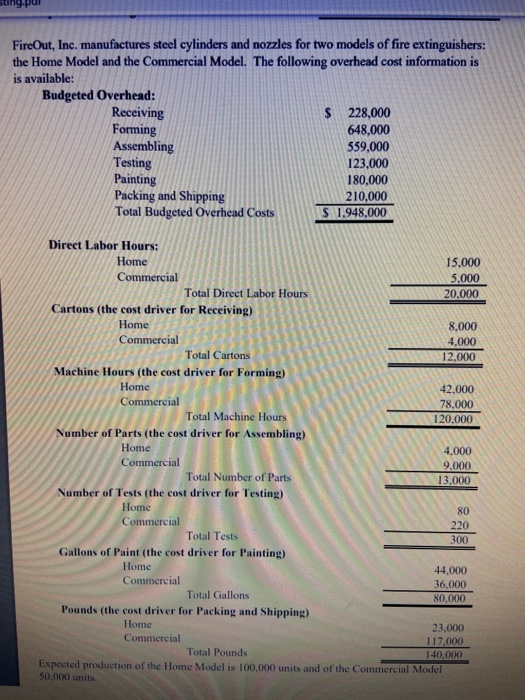

FireOut, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: the Home Model and the Commercial Model. The following overhead cost information is is available: Budgeted Overhead: Receiving $ 228,000 Forming 648,000 Assembling 559,000 Testing 123,000 Painting 180,000 Packing and Shipping 210,000 Total Budgeted Overhead Costs $ 1,948,000 Direct Labor Hours: Home 15.000 Commercial 5.000 Total Direct Labor Hours 20,000 Cartons (the cost driver for Receiving) Home 8.000 Commercial 4,000 Total Cartons 12.000 Machine Hours (the cost driver for Forming) Home 42.000 Commercial 78,000 Total Machine Hours 120.000 Number of Parts (the cost driver for Assembling) Home 4.000 Commercial 9.000 Total Number of Parts 13.000 Number of Tests (the cost driver for Testing) Home 80 Commercial 220 Total Tests 300 Gallons of Paint (the cost driver for Painting) Home 44,000 Commercial 36,000 Total Gallons 80,000 Pounds (the cost driver for Packing and Shipping) Home 23.000 Commercial 117,000 Total Pounds 140,000 Expected production of the Home Model is 100,000 units and of the Commercial Model 50.000 units REQUIRED: A. If FireOut uses a single plant wide overhead rate based op direct labor hours compute the following: 1. The plant-wide overhead rate 2. The total overhead cost assigned to the Home Model 3. The total overhead cost assigned to the Commercial Model 4. The per unit overhead cost of the Home Model 5. The per unit overhead cost of the Commercial Model . If FireOut uses activity based costing, compute the following: 1. The overhead rate for each individual cost pool based on the given cost drivers Receiving Forming Assembling Testing Painting Packing and Shipping 2. The total overhead cost assigned to the Home Model 3. The total overhead cost assigned to the Commercial Model 4. The per unit overhead cost of the Home Model 5. The per unit overhead cost of the Commercial Model C. Did the use of a single plant wide overhead rate lead to cost distortion for either model? How did activity based costing eliminate any cost distortion? D FireOut has decided to employ activity based management techniques. For each of the activities, indicate whether the activity would be value added or non-value added. Receiving Forming Assembling Testing Painting Packing and Shipping