Please label everything

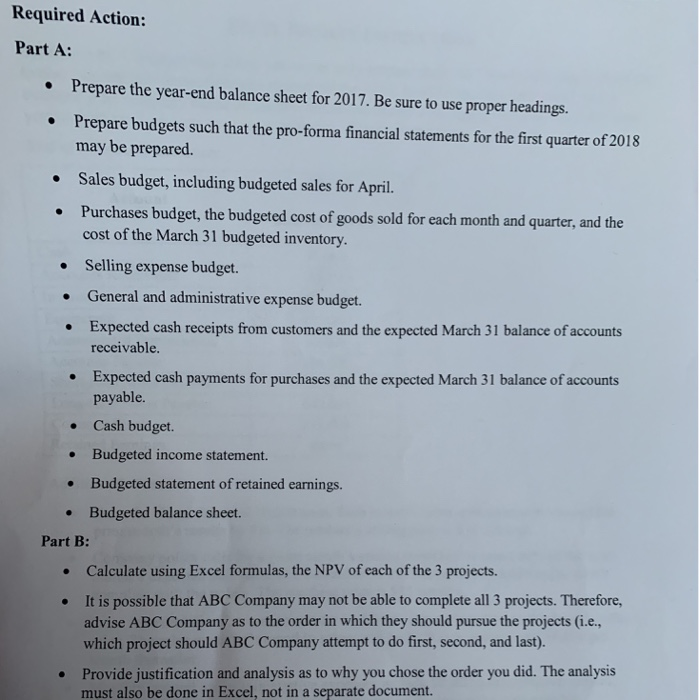

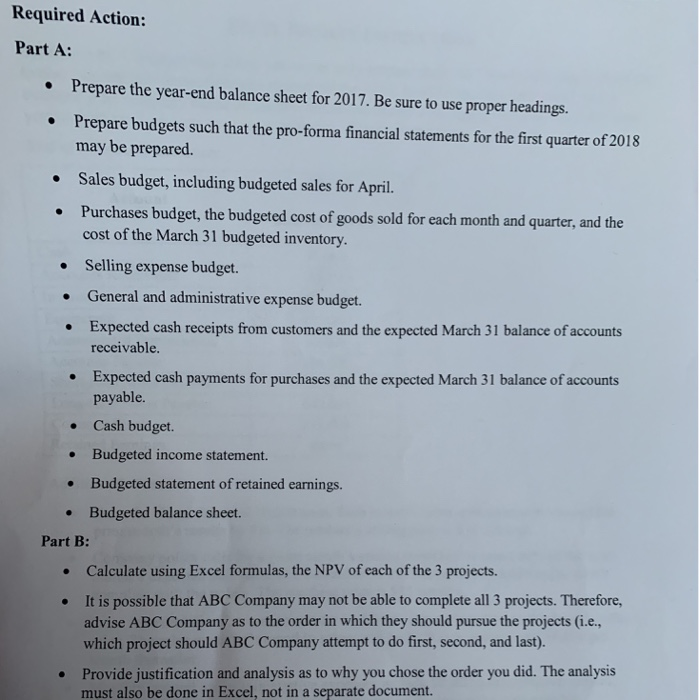

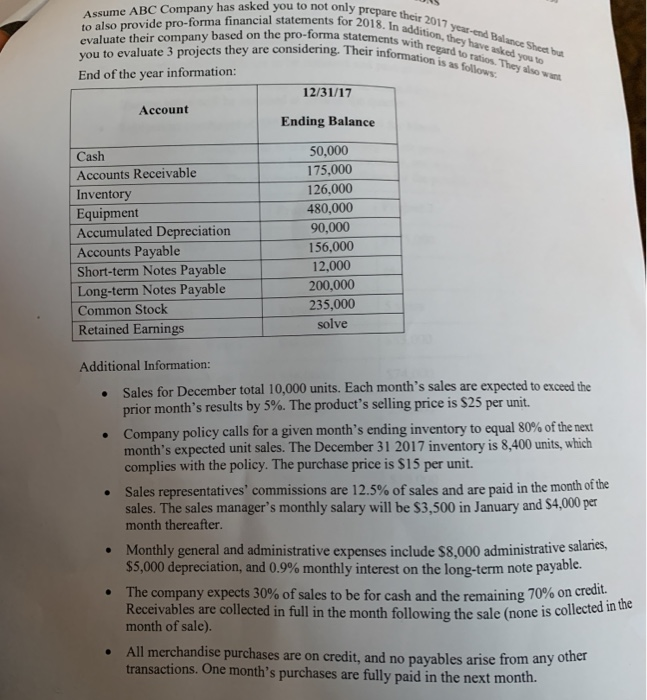

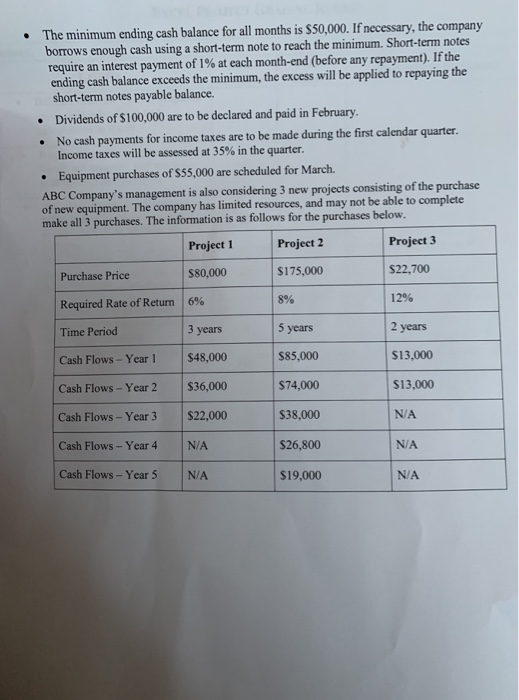

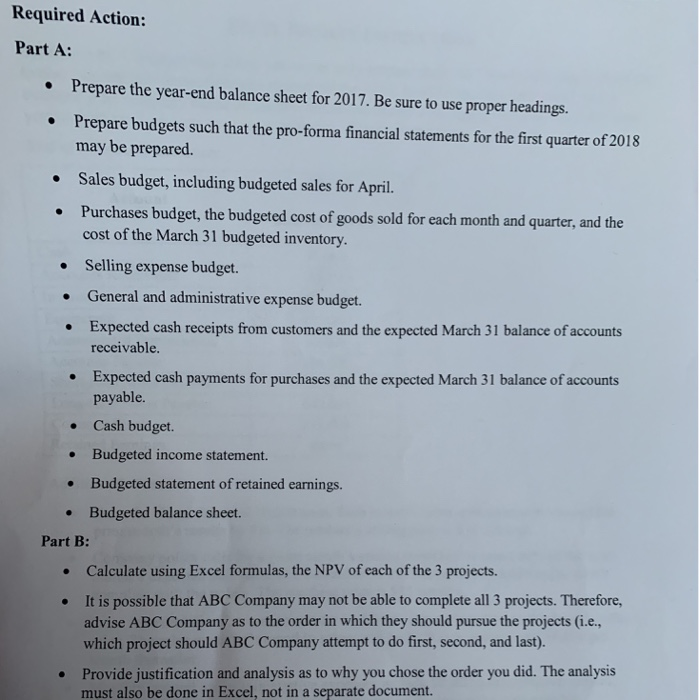

Required Action: Part A: Prepare the year-end balance sheet for 2017. Be sure to use proper headings Prepare budgets such that the pro-forma financial statements for the first quarter of 2018 may be prepared. Sales budget, including budgeted sales for April. Purchases budget, the budgeted cost of goods sold for each month and quarter, and the cost of the March 31 budgeted inventory. Selling expense budget. . General and administrative expense budget. Expected cash receipts from customers and the expected March 31 balance of accounts receivable Expected cash payments for purchases and the expected March 31 balance of accounts payable. Cash budget. Budgeted income statement. Budgeted statement of retained earnings. Budgeted balance sheet. Part B: Calculate using Excel formulas, the NPV of each of the 3 projects. It is possible that ABC Company may not be able to complete all 3 projects. Therefore, as to the order in which they should pursue the projects (i.e., advise ABC Company which project should ABC Company attempt to do first, second, and last). Provide justification and analysis must also be done in Excel, not in a separate document. to why you chose the order you did. The analysis as Assume ABC Company has asked you to not only prepare their 2017 year-end Balance Sheet but to also provide pro-forma financial statements for 2018. In addition, they have asked you to evaluate their company based on the pro-forma statements with regard to ratios. They also want you to evaluate 3 projects they are considering. Their information is as follows: End of the year information: 12/31/17 Account Ending Balance 50,000 Cash 175,000 Accounts Receivable 126,000 Inventory Equipment Accumulated Depreciation Accounts Payable Short-term Notes Payable 480,000 90,000 156,000 12,000 200,000 Long-term Notes Payable 235,000 solve Common Stock Retained Earnings Additional Information: Sales for December total 10,000 units. Each month's sales are expected to exceed the prior month's results by 5%. The product's selling price is $25 per unit. Company policy calls for a given month's ending inventory to equal 80% of the next month's expected unit sales. The December 31 2017 inventory is 8,400 units, which complies with the policy. The purchase price is $15 per unit. Sales representatives' commissions are 12.5% of sales and are paid in the month of the sales. The sales manager's monthly salary will be $3,500 in January and $4,000 per month thereafter. Monthly general and administrative expenses include $8,000 administrative salaries, $5,000 depreciation, and 0.9% monthly interest on the long-term note payable. The company expects 30% of sales to be for cash and the remaining 70% on credi. Receivables are collected in full in the month following the sale (none is collected in the month of sale). All merchandise purchases are on credit, and no payables arise from any other transactions. One month's purchases are fully paid in the next month. The minimum ending cash balance for all months is $50,000. If necessary, the company borrows enough cash using a short-term note to reach the minimum. Short-term notes require an interest payment of 1% at each month-end (before any repayment). If the ending cash balance exceeds the minimum, the excess will be applied to repaying the short-term notes payable balance Dividends of $100,000 are to be declared and paid in February No cash payments for income taxes are to be made during the first calendar quarter Income taxes will be assessed at 35% in the quarter. Equipment purchases of $55,000 are scheduled for March. ABC Company's management is also considering 3 new projects consisting of the purchase of new equipment. The company has limited resources, and may not be able to complete make all 3 purchases. The information is as follows for the purchases below. Project 3 Project 2 Project 1 $22,700 $175,000 $80,000 Purchase Price 12% 8% 6% Required Rate of Return 2 years 5 years 3 years Time Period $13,000 $85,000 $48,000 Cash Flows- Year 1 $74,000 $13,000 $36,000 Cash Flows-Year 2 N/A $38,000 Cash Flows-Year 3 $22,000 $26,800 N/A Cash Flows -Year 4 N/A Cash Flows- Year 5 $19,000 N/A N/A