Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please lable answers, show formulas, and briefly explain answers. i will thumbs up. 4. Using the dividend discount model: collect your own data: You become

please lable answers, show formulas, and briefly explain answers. i will thumbs up.

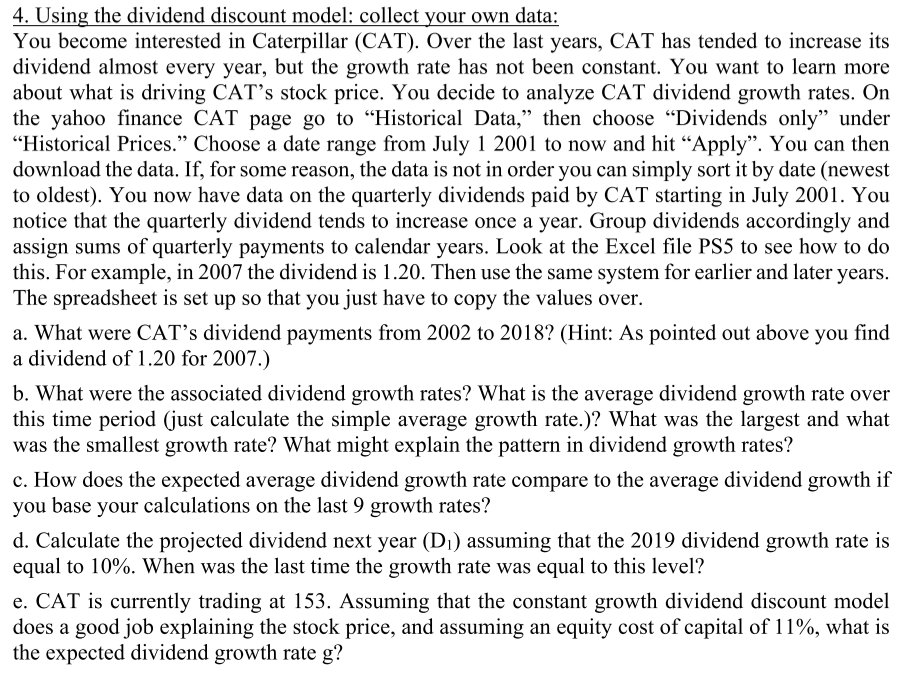

4. Using the dividend discount model: collect your own data: You become interested in Caterpillar (CAT). Over the last years, CAT has tended to increase its dividend almost every year, but the growth rate has not been constant. You want to learn more about what is driving CAT's stock price. You decide to analyze CAT dividend growth rates. On the yahoo finance CAT page go to Historical Data,'' then choose "Dividends only" under Historical Prices." Choose a date range from July 1 2001 to now and hit "Apply". You can then download the data. If, for some reason, the data is not in order you can simply sort it by date (newest to oldest). You now have data on the quarterly dividends paid by CAT starting in July 2001. You notice that the quarterly dividend tends to increase once a year. Group dividends accordingly and assign sums of quarterly payments to calendar years. Look at the Excel file PS5 to see how to do this. For example, in 2007 the dividend is 1.20. Then use the same system for earlier and later years The spreadsheet is set up so that you just have to copy the values over. a. What were CAT's dividend payments from 2002 to 2018 (Hint: As pointed out above you find a dividend of 1.20 for 2007.) b. What were the associated dividend growth rates? What is the average dividend growth rate over this time period (just calculate the simple average growth rate.)? What was the largest and what was the smallest growth rate? What might explain the pattern in dividend growth rates? c. How does the expected average dividend growth rate compare to the average dividend growth if you base your calculations on the last 9 growth rates? d. Calculate the projected dividend next year (D) assuming that the 2019 dividend growth rate is equal to 10%. When was the last time the growth rate was equal to this level? e. CAT is currently trading at 153. Assuming that the constant growth dividend discount model does a good job explaining the stock price, and assuming an equity cost of capital of 1%, what is the expected dividend growth rate gStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started