please let it be in laptop not hand writing!!

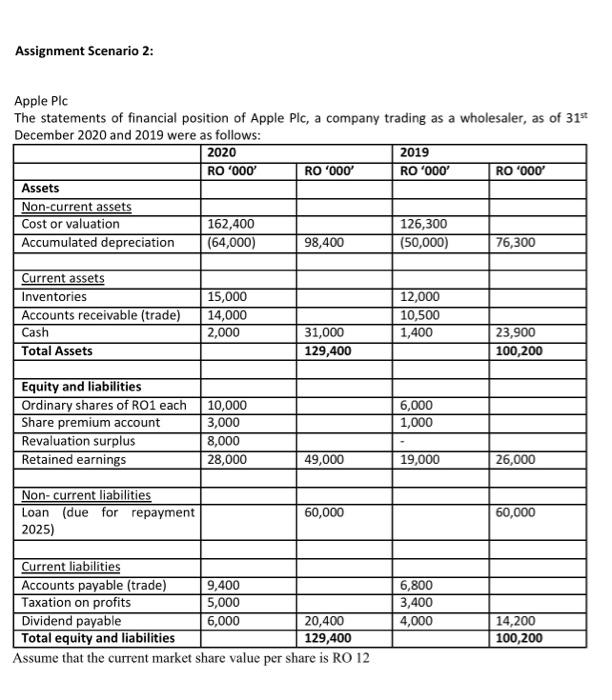

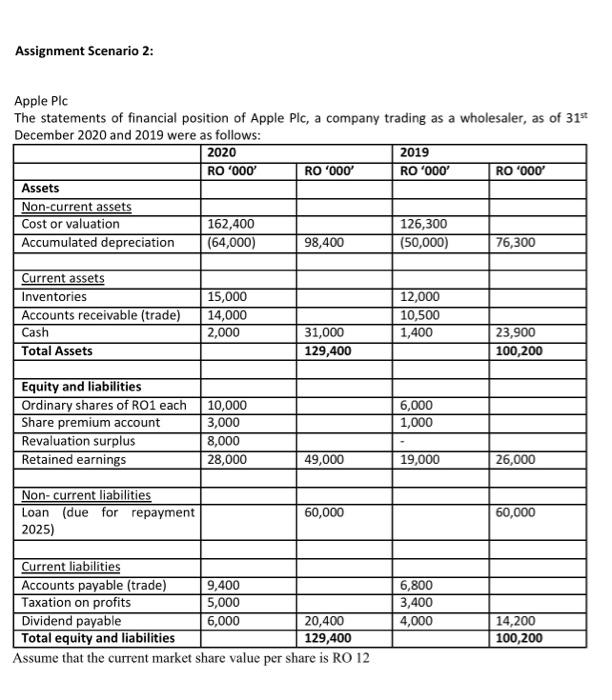

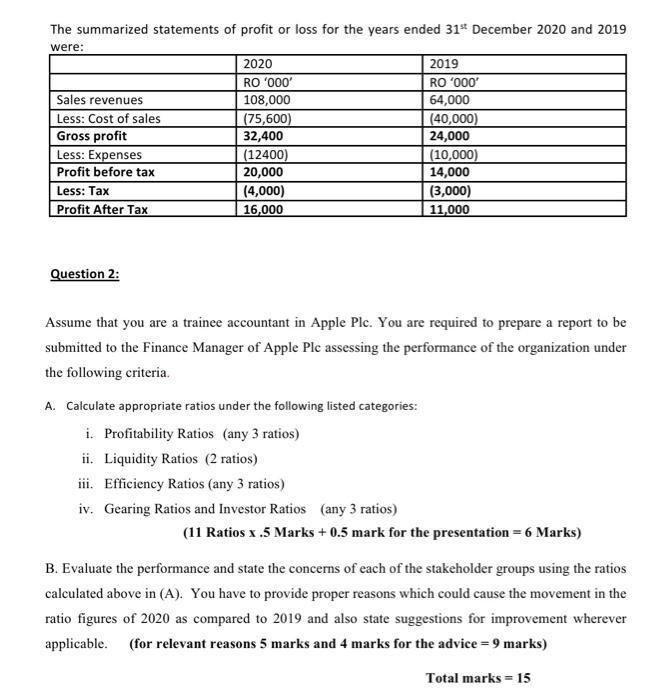

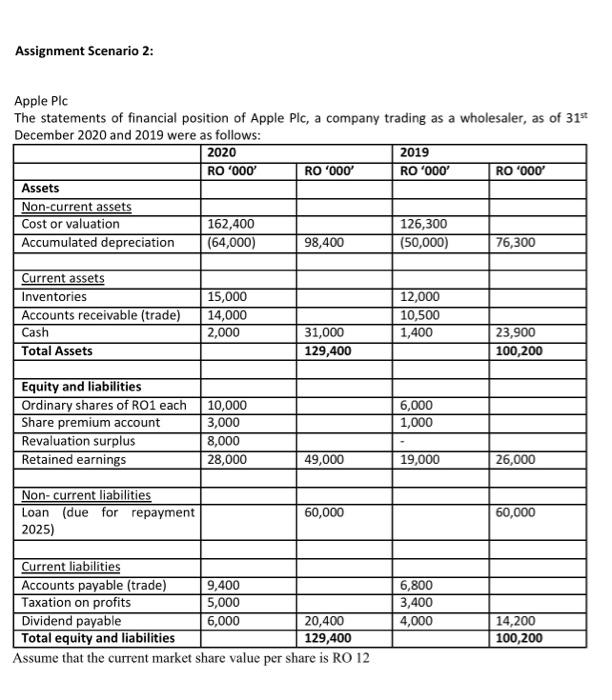

Assignment Scenario 2: Apple Pic The statements of financial position of Apple Pic, a company trading as a wholesaler, as of 31* December 2020 and 2019 were as follows: 2020 2019 RO 000 RO 000 RO 000 RO 000 Assets Non-current assets Cost or valuation 162,400 126,300 Accumulated depreciation (64,000) 98,400 (50,000) 76,300 Current assets Inventories Accounts receivable (trade) Cash Total Assets 15,000 14,000 2,000 12,000 10,500 1,400 31,000 129,400 23,900 100,200 Equity and liabilities Ordinary shares of RO1 each Share premium account Revaluation surplus Retained earnings 6,000 1,000 10,000 3,000 8,000 28,000 49,000 19,000 26,000 Non-current liabilities Loan (due for repayment 2025) 60,000 60,000 Current liabilities Accounts payable (trade) 9,400 Taxation on profits 5,000 Dividend payable 6,000 20,400 Total equity and liabilities 129,400 Assume that the current market share value per share is RO 12 6,800 3,400 4,000 14,200 100,200 The summarized statements of profit or loss for the years ended 31 December 2020 and 2019 were: 2020 2019 R0 000 RO 4000 Sales revenues 108,000 64,000 Less: Cost of sales (75,600) (40,000) Gross profit 32,400 24,000 Less: Expenses (12400) (10,000) Profit before tax 20,000 14,000 Less: Tax (4,000) (3,000) Profit After Tax 16,000 11,000 Question 2: Assume that you are a trainee accountant in Apple Plc. You are required to prepare a report to be submitted to the Finance Manager of Apple Plc assessing the performance of the organization under the following criteria. A. Calculate appropriate ratios under the following listed categories: i. Profitability Ratios (any 3 ratios) ii. Liquidity Ratios (2 ratios) iii. Efficiency Ratios (any 3 ratios) iv. Gearing Ratios and Investor Ratios (any 3 ratios) (11 Ratios 2.5 Marks +0.5 mark for the presentation = 6 Marks) B. Evaluate the performance and state the concerns of each of the stakeholder groups using the ratios calculated above in (A). You have to provide proper reasons which could cause the movement in the ratio figures of 2020 as compared to 2019 and also state suggestions for improvement wherever applicable. (for relevant reasons 5 marks and 4 marks for the advice = 9 marks) Total marks = 15