Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please let me know what additional information is needed. Thanks QUESTION 11 4 points Save Answer Filing status (Single, Head of Household, Qualifying Widow with

Please let me know what additional information is needed. Thanks

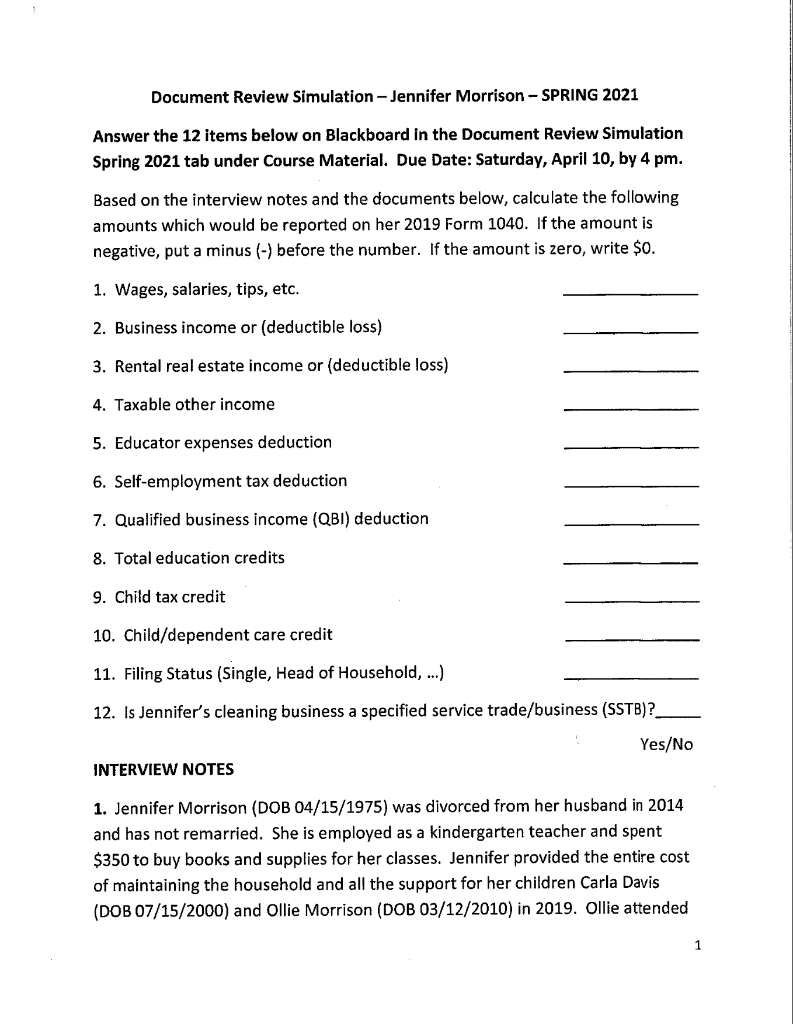

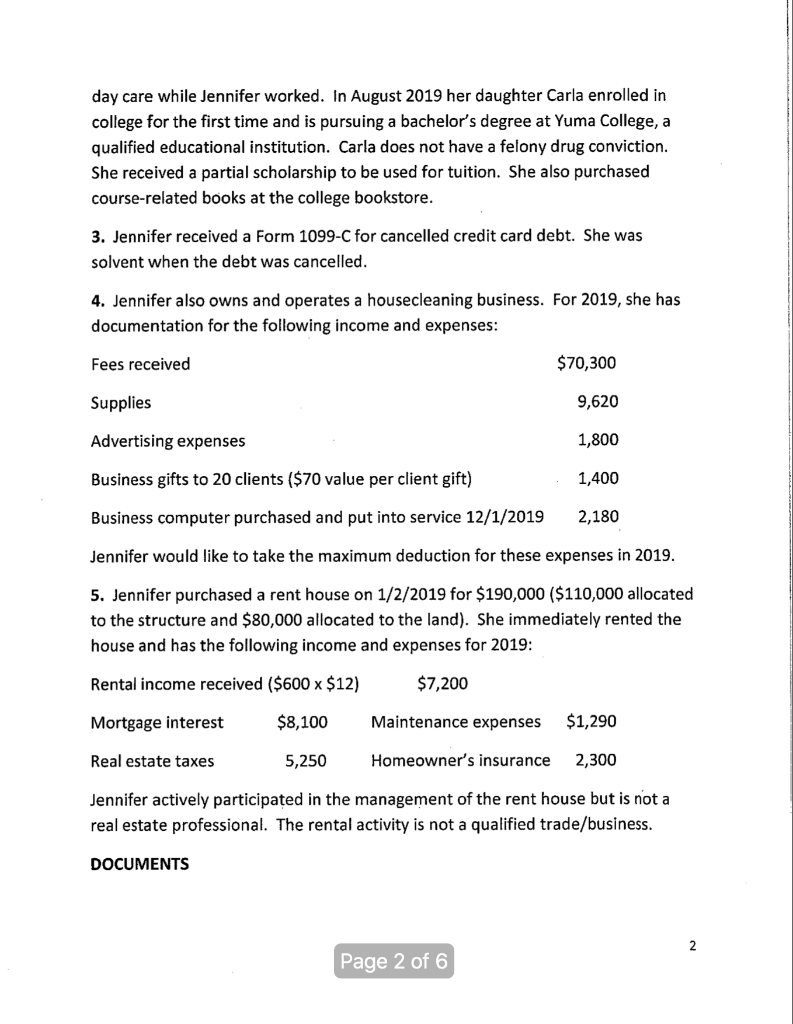

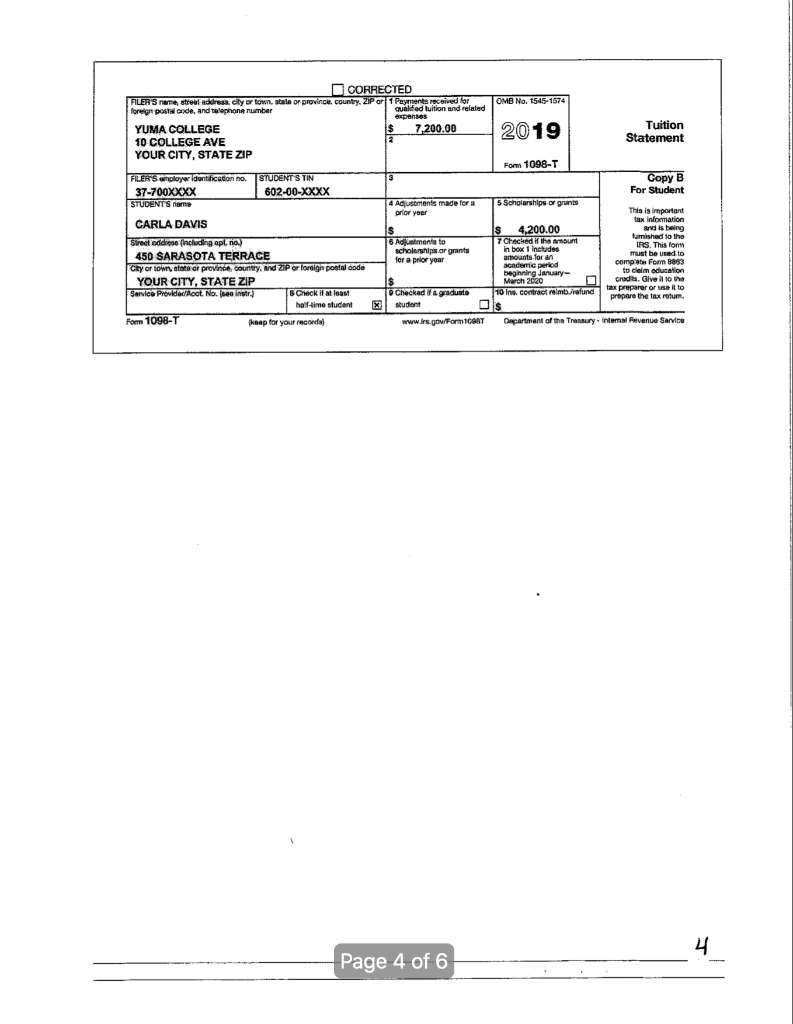

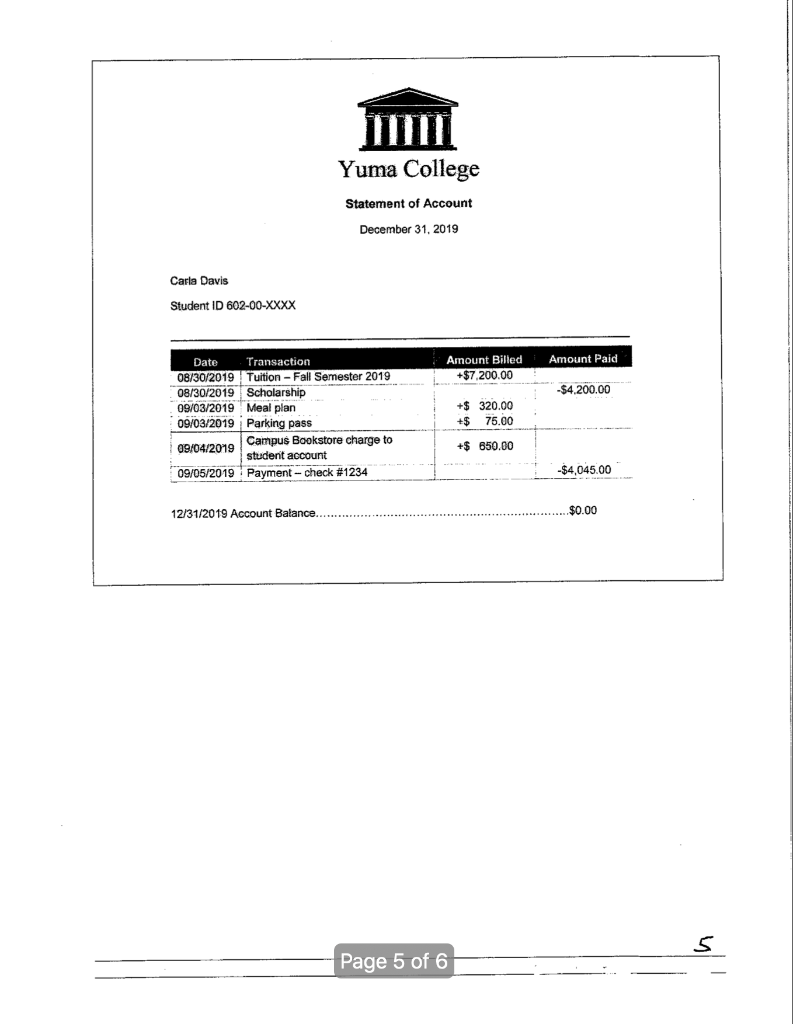

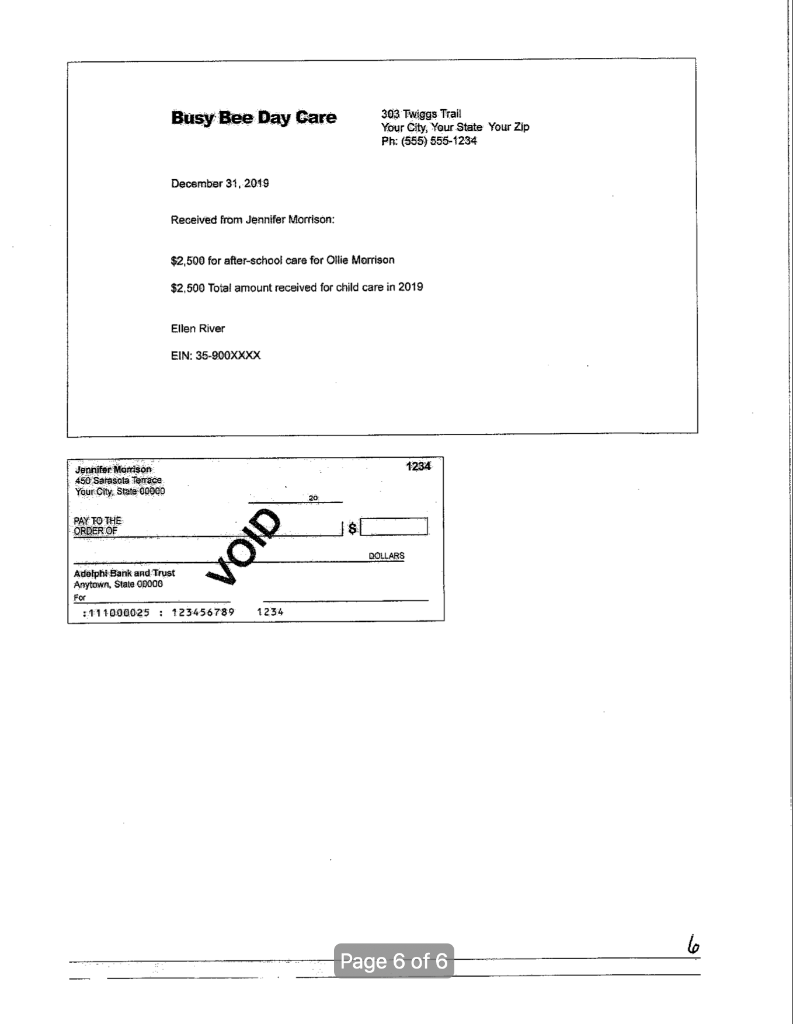

QUESTION 11 4 points Save Answer Filing status (Single, Head of Household, Qualifying Widow with Dependent Child, Married Filing Jointly, Married Filing Separately) QUESTION 12 4 points Save Answer Is Jennifer's cleaning business a specified service trade or business (SSTB)? YES or NO Document Review Simulation - Jennifer Morrison - SPRING 2021 Answer the 12 items below on Blackboard in the Document Review Simulation Spring 2021 tab under Course Material. Due Date: Saturday, April 10, by 4 pm. Based on the interview notes and the documents below, calculate the following amounts which would be reported on her 2019 Form 1040. If the amount is negative, put a minus (-) before the number. If the amount is zero, write $0. 1. Wages, salaries, tips, etc. 2. Business income or (deductible loss) 3. Rental real estate income or (deductible loss) 4. Taxable other income 5. Educator expenses deduction 6. Self-employment tax deduction 7. Qualified business income (QBI) deduction 8. Total education credits 9. Child tax credit 10. Child/dependent care credit 11. Filing Status (Single, Head of Household, ...) 12. Is Jennifer's cleaning business a specified service trade/business (SSTB)? Yes/No INTERVIEW NOTES 1. Jennifer Morrison (DOB 04/15/1975) was divorced from her husband in 2014 and has not remarried. She is employed as a kindergarten teacher and spent $350 to buy books and supplies for her classes. Jennifer provided the entire cost of maintaining the household and all the support for her children Carla Davis (DOB 07/15/2000) and Ollie Morrison (DOB 03/12/2010) in 2019. Ollie attended day care while Jennifer worked. In August 2019 her daughter Carla enrolled in college for the first time and is pursuing a bachelor's degree at Yuma College, a qualified educational institution. Carla does not have a felony drug conviction. She received a partial scholarship to be used for tuition. She also purchased course-related books at the college bookstore. 3. Jennifer received a Form 1099-C for cancelled credit card debt. She was solvent when the debt was cancelled. 4. Jennifer also owns and operates a housecleaning business. For 2019, she has documentation for the following income and expenses: Fees received $70,300 Supplies 9,620 Advertising expenses 1,800 Business gifts to 20 clients ($70 value per client gift) 1,400 Business computer purchased and put into service 12/1/2019 2,180 Jennifer would like to take the maximum deduction for these expenses in 2019. 5. Jennifer purchased a rent house on 1/2/2019 for $190,000 ($110,000 allocated to the structure and $80,000 allocated to the land). She immediately rented the house and has the following income and expenses for 2019: Rental income received ($600 x $12) $7,200 Mortgage interest $8,100 Maintenance expenses $1,290 Real estate taxes 5,250 Homeowner's insurance 2,300 Jennifer actively participated in the management of the rent house but is not a real estate professional. The rental activity is not a qualified trade/business. DOCUMENTS 2 Page 2 of 6 Employees social securky number 601-00-XXXX t Employer identification number EN 34-600XXXX c Employer's name, address, and ZIP code Safe, accurato Visit the website at OMB No 1545-0009 FASTU re-file www.is gowlalle 1 Wagas, eps, other comparation 2 Federal income tax wind 41,000.00 2,200.00 Seen security was 4 Secil security tax withhold 43,000.00 2,666.00 5 Medicare wages and pe Medicare tax withheld 43,000.00 624.00 7 Social security tips & Allocated tipe GILMER ELEMENTARY SCHOOL 2250 DELTA AVENUE YOUR CITY, STATE ZIP d Control number 10 Dependent care benefits . Employer's first name and initial Last name Suff. 11 Noriqualified plana 12a See Instructions for box 12 E 2,000.00 12b rolyte pl werpe JENNIFER MORRISON 450 SARASOTA TERRACE YOUR CITY, STATE ZIP 14 Other 126 124 f Employee's address and ZIP code 16 State Employer's state ID number YS 34-600XXXX 10 Local wages, tips, etc. 10 Local incornie tax 20 Lacrily name 18 State Wages, tips, sto. V State income tax 41,000.00 1,800.00 W-2 Wage and Tax 2019 Department of the Treasury-Internal Revenue Service Farm Statement Copy B-To Be Filed With Employee's FEDERAL Tax Return This information is being furnished to the Internal Revenue Service 2019 CORRECTED (if checked) CREDITOR'S nama, straat address, city or town, state or province, country. 1 Date of identifiable event OMB No. 1546-1424 ZIP or foreign postal code, and telephone no 06/15/19 PRAIRIE BANK 2 Amount of debt discharged Cancellation 1727 OSAGE WAY $ 1,100.00 of Debt YOUR CITY, STATE ZIP 3 Inverest it included in box $ Form 1099-C CREDITOR'S TIN DEBTOR'S TIN 4 Debt description Copy B B 30-600XXXX 601-00-XXXX CREDIT CARD For Debtor DESTOR'S This is important tax JENNIFER MORRISON information and being fumished to the RS. you are required to file Street address including pt. no.) it checked, the debtor was personally liable for retum, a neglence 450 SARASOTA TERRACE repayment of the debt . . . . . . penalty or other sanction may be Clty or town, state or province, country, and ZP or foreign postal code mposed on you 11 taxable income run YOUR CITY, STATE ZIP from the transaction and the IRS determines Account number (seeingtruction) 8 centifiable event code 7 For market value of property that it has not been G $ reported Form 1099-0 (keep for your records) www.in.gow Form 10900 Department of the Treasury - Internal Revenue Service 3 Page 3 of 6 2019 CORRECTED FILER'S nerestreladdress, city or town, state or province, country. ZiP or 1 Payments received OMB No. 1545-1574 foreign postal code, and telephone number quelifed tuition and related sponses YUMA COLLEGE $ 7,200.00 Tuition 10 COLLEGE AVE 12 Statement YOUR CITY, STATE ZIP Fom 1098-T FILERS player identication no. STUDENT S TIN Copy B 37-700XXXX 602-00-XXXX For Student STUDENTS iomo Austments made for a 5 Scholarships or grants prior voer This is important CARLA DAVIS tax information $ IS 4,200.00 and is being Sireet edes (including opl. na turnished to the 6 Adjustments to 7 Checked if the runt in box 1 includes scholarships ar grants IRS. This for 450 SARASOTA TERRACE for a prior year amounts for an must be used to Cry or towy, or province, country and ZIP or lordign postal code academic period combu Fom 8893 beginning January to claim education YOUR CITY, STATE ZIP $ March 2020 credits. Give it to a Service Provided/Acct. No. or.) Check it at least Checkad graduate 10 Ins, contractelmbrafund tax preparar ora il to prepare the tax motum half-time student X student Os Form 1098-T keep for your record www.lrs.gov/Form TCAT Department of the Treasury Internal Revenue Service 4 Page 4 of 6 Yuma College Statement of Account December 31, 2019 Carla Davis Student ID 602-00-XXXX Amount Paid Amount Billed +$7.200.00 -$4.200.00 Date Transaction 08/30/2019 Tuition - Fall Semester 2019 08/30/2019 Scholarship 09/03/2019 Meal plan 09/03/2019 Parking pass Campus Bookstore charge to 09/04/2019 student account 09/05/2019 Payment - check #1234 +$ 320.00 +$ 75.00 +$ 650.00 -$4,045.00 12/31/2019 Account Balance $0.00 Page 5 of 6 Busy Bee Day Care 303 Twiggs Trail Your City, Your State Your Zip Ph: (555) 555-1234 December 31, 2019 Received from Jennifer Morrison: $2,500 for after-school care for Ollie Morrison $2.500 Total amount received for child care in 2019 Ellen River EIN: 35-900XXXX 1234 Jennifer Morrison 450 Sarasota Terrace Your City State 00000 PAY TO THE ORDER OF $1 VOID DOLLARS Adelphi Bank and Trust Anytown, State OD000 For :111000025 : 123456789 1234 Page 6 of 6 QUESTION 11 4 points Save Answer Filing status (Single, Head of Household, Qualifying Widow with Dependent Child, Married Filing Jointly, Married Filing Separately) QUESTION 12 4 points Save Answer Is Jennifer's cleaning business a specified service trade or business (SSTB)? YES or NO Document Review Simulation - Jennifer Morrison - SPRING 2021 Answer the 12 items below on Blackboard in the Document Review Simulation Spring 2021 tab under Course Material. Due Date: Saturday, April 10, by 4 pm. Based on the interview notes and the documents below, calculate the following amounts which would be reported on her 2019 Form 1040. If the amount is negative, put a minus (-) before the number. If the amount is zero, write $0. 1. Wages, salaries, tips, etc. 2. Business income or (deductible loss) 3. Rental real estate income or (deductible loss) 4. Taxable other income 5. Educator expenses deduction 6. Self-employment tax deduction 7. Qualified business income (QBI) deduction 8. Total education credits 9. Child tax credit 10. Child/dependent care credit 11. Filing Status (Single, Head of Household, ...) 12. Is Jennifer's cleaning business a specified service trade/business (SSTB)? Yes/No INTERVIEW NOTES 1. Jennifer Morrison (DOB 04/15/1975) was divorced from her husband in 2014 and has not remarried. She is employed as a kindergarten teacher and spent $350 to buy books and supplies for her classes. Jennifer provided the entire cost of maintaining the household and all the support for her children Carla Davis (DOB 07/15/2000) and Ollie Morrison (DOB 03/12/2010) in 2019. Ollie attended day care while Jennifer worked. In August 2019 her daughter Carla enrolled in college for the first time and is pursuing a bachelor's degree at Yuma College, a qualified educational institution. Carla does not have a felony drug conviction. She received a partial scholarship to be used for tuition. She also purchased course-related books at the college bookstore. 3. Jennifer received a Form 1099-C for cancelled credit card debt. She was solvent when the debt was cancelled. 4. Jennifer also owns and operates a housecleaning business. For 2019, she has documentation for the following income and expenses: Fees received $70,300 Supplies 9,620 Advertising expenses 1,800 Business gifts to 20 clients ($70 value per client gift) 1,400 Business computer purchased and put into service 12/1/2019 2,180 Jennifer would like to take the maximum deduction for these expenses in 2019. 5. Jennifer purchased a rent house on 1/2/2019 for $190,000 ($110,000 allocated to the structure and $80,000 allocated to the land). She immediately rented the house and has the following income and expenses for 2019: Rental income received ($600 x $12) $7,200 Mortgage interest $8,100 Maintenance expenses $1,290 Real estate taxes 5,250 Homeowner's insurance 2,300 Jennifer actively participated in the management of the rent house but is not a real estate professional. The rental activity is not a qualified trade/business. DOCUMENTS 2 Page 2 of 6 Employees social securky number 601-00-XXXX t Employer identification number EN 34-600XXXX c Employer's name, address, and ZIP code Safe, accurato Visit the website at OMB No 1545-0009 FASTU re-file www.is gowlalle 1 Wagas, eps, other comparation 2 Federal income tax wind 41,000.00 2,200.00 Seen security was 4 Secil security tax withhold 43,000.00 2,666.00 5 Medicare wages and pe Medicare tax withheld 43,000.00 624.00 7 Social security tips & Allocated tipe GILMER ELEMENTARY SCHOOL 2250 DELTA AVENUE YOUR CITY, STATE ZIP d Control number 10 Dependent care benefits . Employer's first name and initial Last name Suff. 11 Noriqualified plana 12a See Instructions for box 12 E 2,000.00 12b rolyte pl werpe JENNIFER MORRISON 450 SARASOTA TERRACE YOUR CITY, STATE ZIP 14 Other 126 124 f Employee's address and ZIP code 16 State Employer's state ID number YS 34-600XXXX 10 Local wages, tips, etc. 10 Local incornie tax 20 Lacrily name 18 State Wages, tips, sto. V State income tax 41,000.00 1,800.00 W-2 Wage and Tax 2019 Department of the Treasury-Internal Revenue Service Farm Statement Copy B-To Be Filed With Employee's FEDERAL Tax Return This information is being furnished to the Internal Revenue Service 2019 CORRECTED (if checked) CREDITOR'S nama, straat address, city or town, state or province, country. 1 Date of identifiable event OMB No. 1546-1424 ZIP or foreign postal code, and telephone no 06/15/19 PRAIRIE BANK 2 Amount of debt discharged Cancellation 1727 OSAGE WAY $ 1,100.00 of Debt YOUR CITY, STATE ZIP 3 Inverest it included in box $ Form 1099-C CREDITOR'S TIN DEBTOR'S TIN 4 Debt description Copy B B 30-600XXXX 601-00-XXXX CREDIT CARD For Debtor DESTOR'S This is important tax JENNIFER MORRISON information and being fumished to the RS. you are required to file Street address including pt. no.) it checked, the debtor was personally liable for retum, a neglence 450 SARASOTA TERRACE repayment of the debt . . . . . . penalty or other sanction may be Clty or town, state or province, country, and ZP or foreign postal code mposed on you 11 taxable income run YOUR CITY, STATE ZIP from the transaction and the IRS determines Account number (seeingtruction) 8 centifiable event code 7 For market value of property that it has not been G $ reported Form 1099-0 (keep for your records) www.in.gow Form 10900 Department of the Treasury - Internal Revenue Service 3 Page 3 of 6 2019 CORRECTED FILER'S nerestreladdress, city or town, state or province, country. ZiP or 1 Payments received OMB No. 1545-1574 foreign postal code, and telephone number quelifed tuition and related sponses YUMA COLLEGE $ 7,200.00 Tuition 10 COLLEGE AVE 12 Statement YOUR CITY, STATE ZIP Fom 1098-T FILERS player identication no. STUDENT S TIN Copy B 37-700XXXX 602-00-XXXX For Student STUDENTS iomo Austments made for a 5 Scholarships or grants prior voer This is important CARLA DAVIS tax information $ IS 4,200.00 and is being Sireet edes (including opl. na turnished to the 6 Adjustments to 7 Checked if the runt in box 1 includes scholarships ar grants IRS. This for 450 SARASOTA TERRACE for a prior year amounts for an must be used to Cry or towy, or province, country and ZIP or lordign postal code academic period combu Fom 8893 beginning January to claim education YOUR CITY, STATE ZIP $ March 2020 credits. Give it to a Service Provided/Acct. No. or.) Check it at least Checkad graduate 10 Ins, contractelmbrafund tax preparar ora il to prepare the tax motum half-time student X student Os Form 1098-T keep for your record www.lrs.gov/Form TCAT Department of the Treasury Internal Revenue Service 4 Page 4 of 6 Yuma College Statement of Account December 31, 2019 Carla Davis Student ID 602-00-XXXX Amount Paid Amount Billed +$7.200.00 -$4.200.00 Date Transaction 08/30/2019 Tuition - Fall Semester 2019 08/30/2019 Scholarship 09/03/2019 Meal plan 09/03/2019 Parking pass Campus Bookstore charge to 09/04/2019 student account 09/05/2019 Payment - check #1234 +$ 320.00 +$ 75.00 +$ 650.00 -$4,045.00 12/31/2019 Account Balance $0.00 Page 5 of 6 Busy Bee Day Care 303 Twiggs Trail Your City, Your State Your Zip Ph: (555) 555-1234 December 31, 2019 Received from Jennifer Morrison: $2,500 for after-school care for Ollie Morrison $2.500 Total amount received for child care in 2019 Ellen River EIN: 35-900XXXX 1234 Jennifer Morrison 450 Sarasota Terrace Your City State 00000 PAY TO THE ORDER OF $1 VOID DOLLARS Adelphi Bank and Trust Anytown, State OD000 For :111000025 : 123456789 1234 Page 6 of 6Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started