Answered step by step

Verified Expert Solution

Question

1 Approved Answer

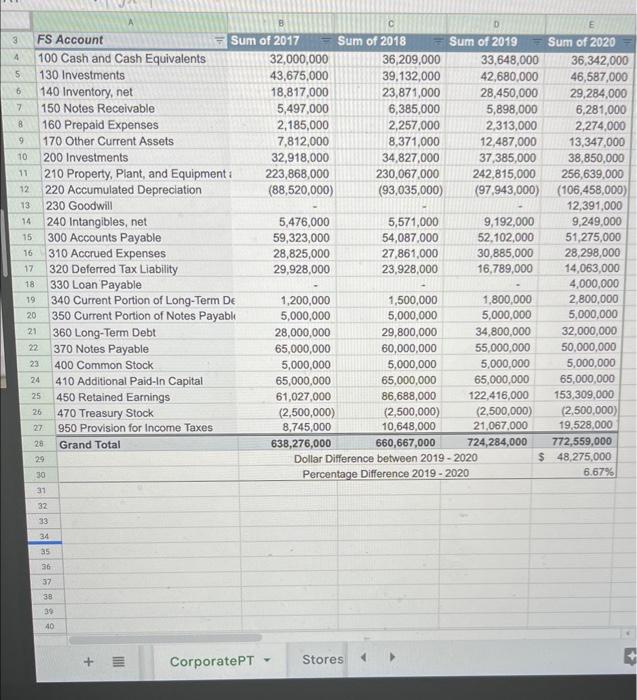

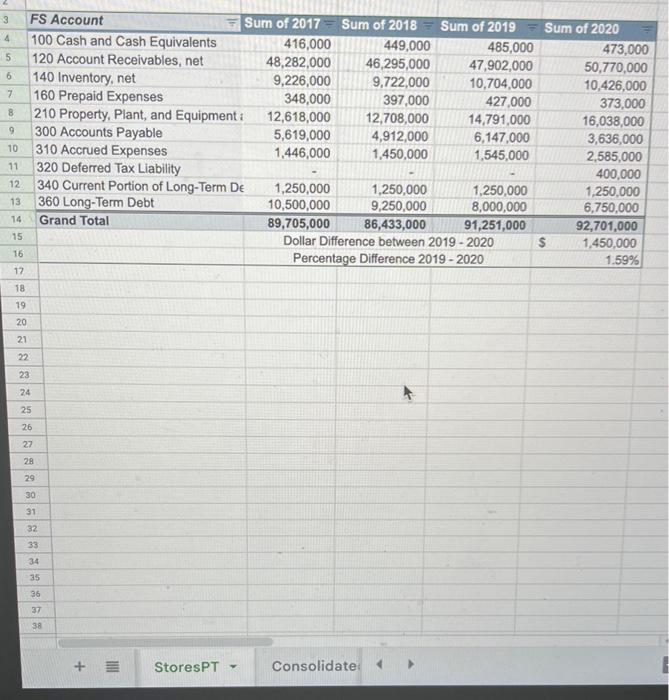

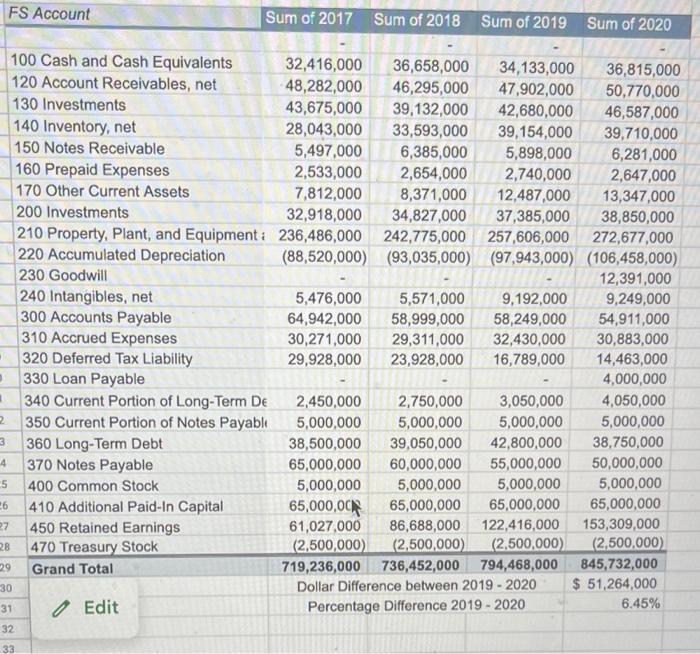

please list all steps & work for answer #4 use the PT for important information in order to answer best four distinct FS accounts FS

please list all steps & work for answer #4

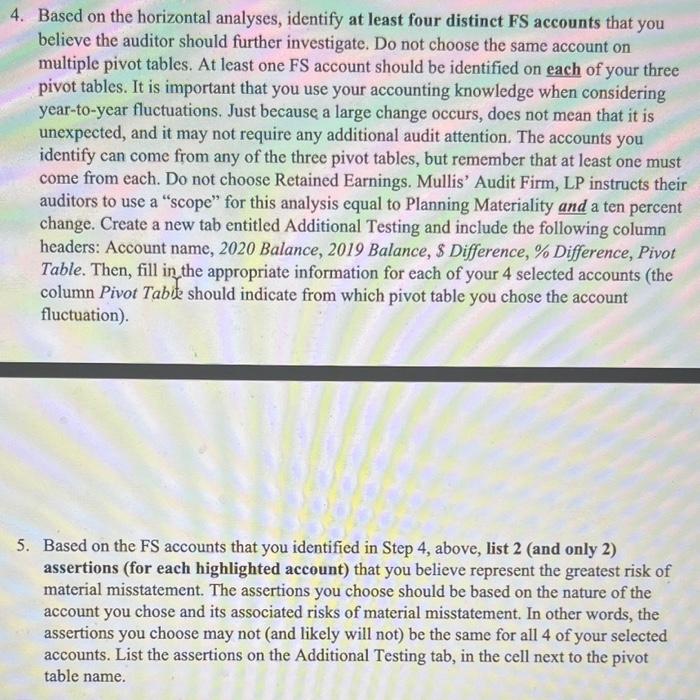

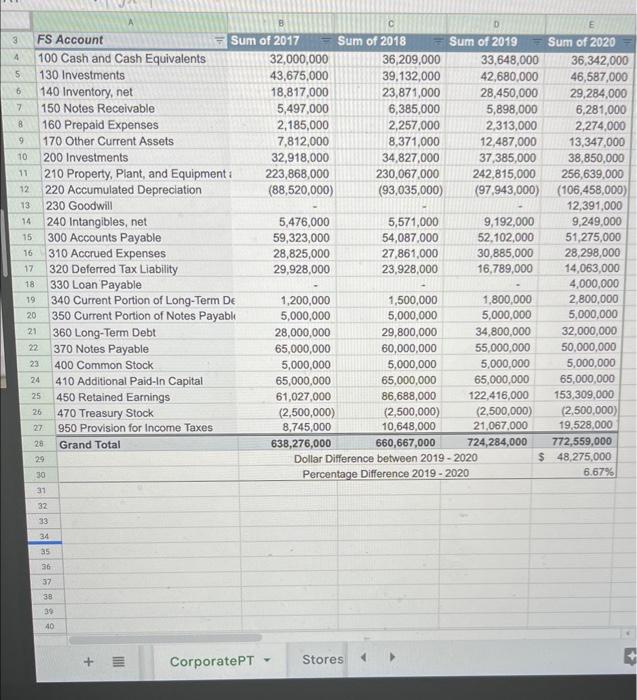

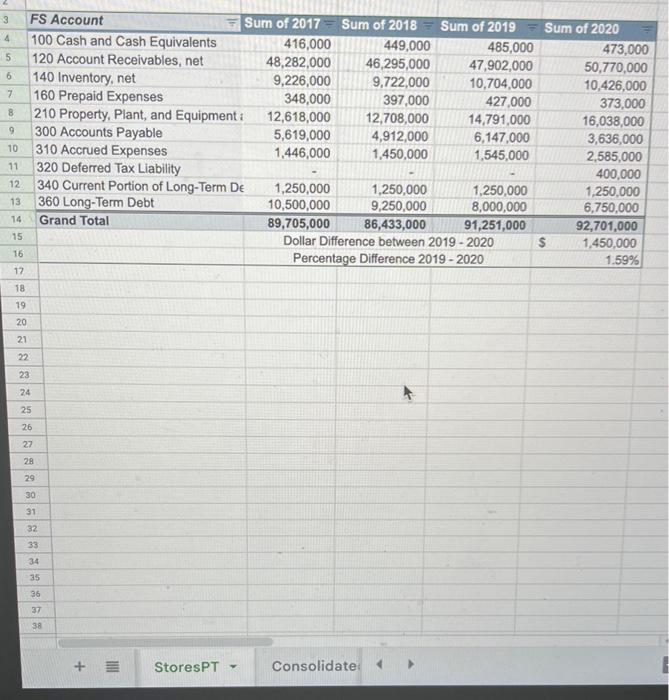

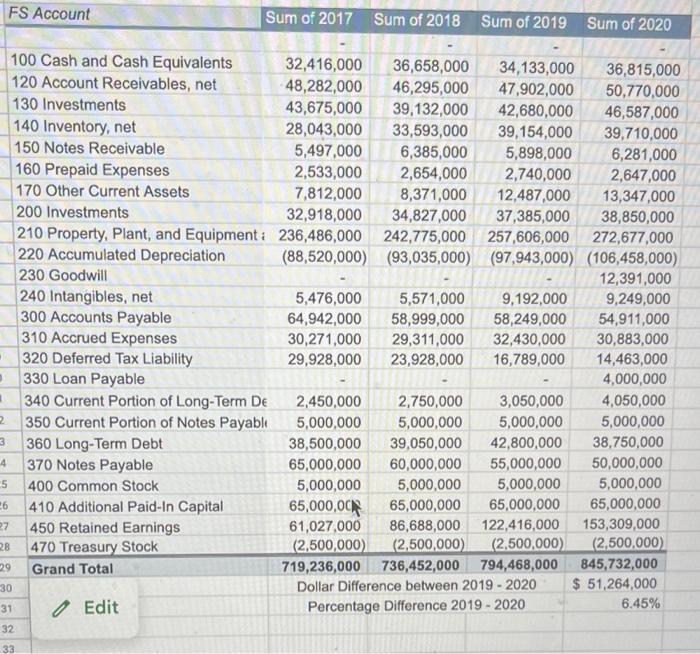

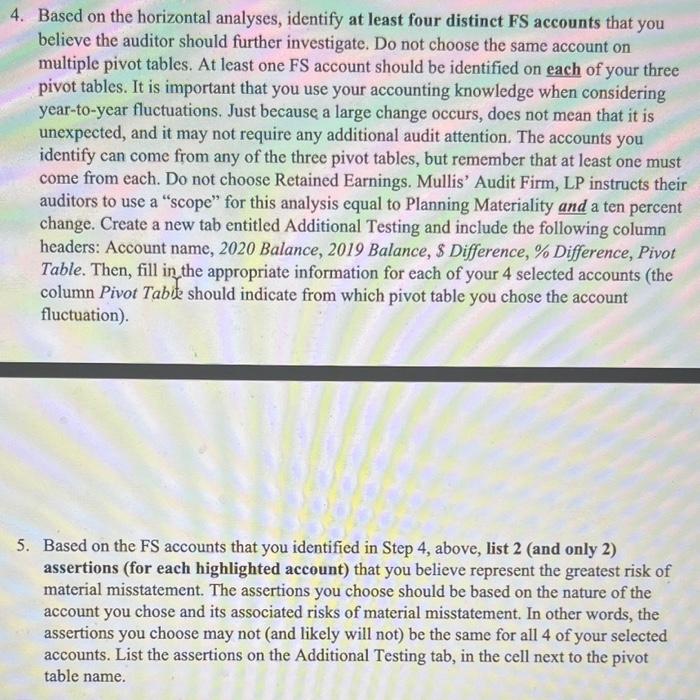

FS Account \begin{tabular}{|llll} Sum of 2017 Sum of 2018 & Sum of 2019 Sum of 2020 \\ \hline & & \end{tabular} 4. Based on the horizontal analyses, identify at least four distinct FS accounts that you believe the auditor should further investigate. Do not choose the same account on multiple pivot tables. At least one FS account should be identified on each of your three pivot tables. It is important that you use your accounting knowledge when considering year-to-year fluctuations. Just because a large change occurs, does not mean that it is unexpected, and it may not require any additional audit attention. The accounts you identify can come from any of the three pivot tables, but remember that at least one must come from each. Do not choose Retained Earnings. Mullis' Audit Firm, LP instructs their auditors to use a "scope" for this analysis equal to Planning Materiality and a ten percent change. Create a new tab entitled Additional Testing and include the following column headers: Account name, 2020 Balance, 2019 Balance, \$Difference, \% Difference, Pivot Table. Then, fill in the appropriate information for each of your 4 selected accounts (the column Pivot Tabit should indicate from which pivot table you chose the account fluctuation). 5. Based on the FS accounts that you identified in Step 4, above, list 2 (and only 2) assertions (for each highlighted account) that you believe represent the greatest risk of material misstatement. The assertions you choose should be based on the nature of the account you chose and its associated risks of material misstatement. In other words, the assertions you choose may not (and likely will not) be the same for all 4 of your selected accounts. List the assertions on the Additional Testing tab, in the cell next to the pivot table name. FS Account \begin{tabular}{|llll} Sum of 2017 Sum of 2018 & Sum of 2019 Sum of 2020 \\ \hline & & \end{tabular} 4. Based on the horizontal analyses, identify at least four distinct FS accounts that you believe the auditor should further investigate. Do not choose the same account on multiple pivot tables. At least one FS account should be identified on each of your three pivot tables. It is important that you use your accounting knowledge when considering year-to-year fluctuations. Just because a large change occurs, does not mean that it is unexpected, and it may not require any additional audit attention. The accounts you identify can come from any of the three pivot tables, but remember that at least one must come from each. Do not choose Retained Earnings. Mullis' Audit Firm, LP instructs their auditors to use a "scope" for this analysis equal to Planning Materiality and a ten percent change. Create a new tab entitled Additional Testing and include the following column headers: Account name, 2020 Balance, 2019 Balance, \$Difference, \% Difference, Pivot Table. Then, fill in the appropriate information for each of your 4 selected accounts (the column Pivot Tabit should indicate from which pivot table you chose the account fluctuation). 5. Based on the FS accounts that you identified in Step 4, above, list 2 (and only 2) assertions (for each highlighted account) that you believe represent the greatest risk of material misstatement. The assertions you choose should be based on the nature of the account you chose and its associated risks of material misstatement. In other words, the assertions you choose may not (and likely will not) be the same for all 4 of your selected accounts. List the assertions on the Additional Testing tab, in the cell next to the pivot table name use the PT for important information in order to answer best four distinct FS accounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started