Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please list Income Statement Balance Sheet Statement of Cash flows for the year ending 31 December 2022, 2023, 2024, 2025 Gulgong is a 19th-century gold

Please list

Income Statement

Balance Sheet

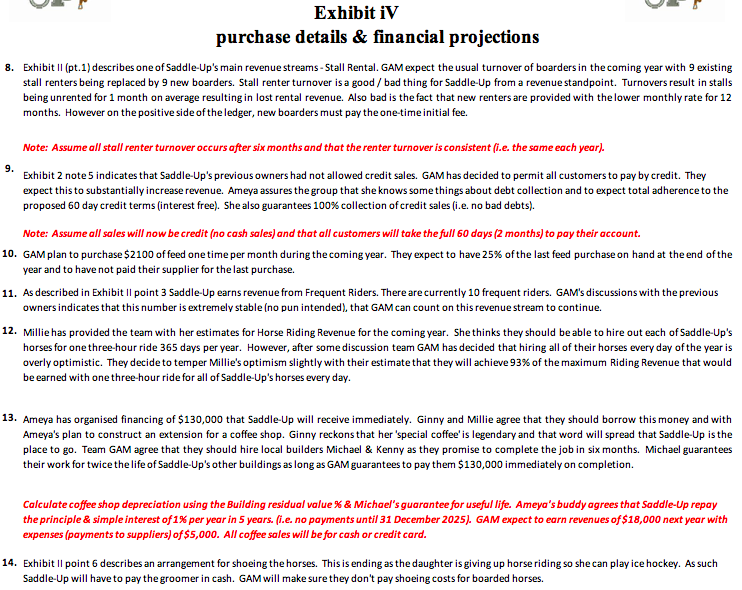

Statement of Cash flows

for the year ending 31 December 2022, 2023, 2024, 2025

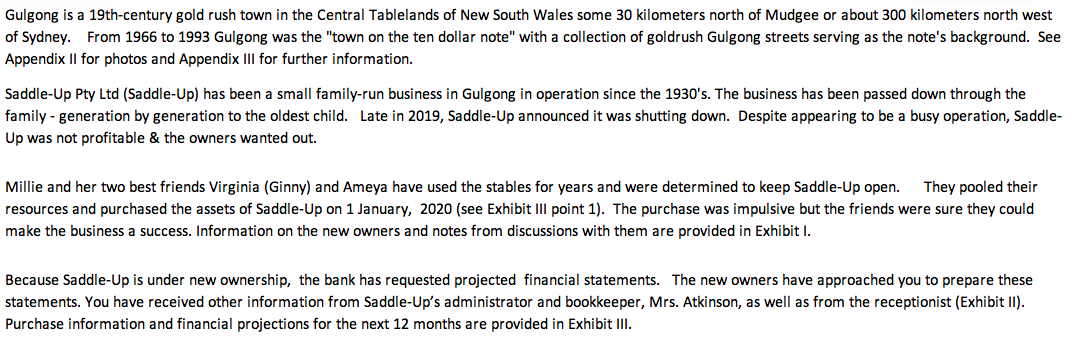

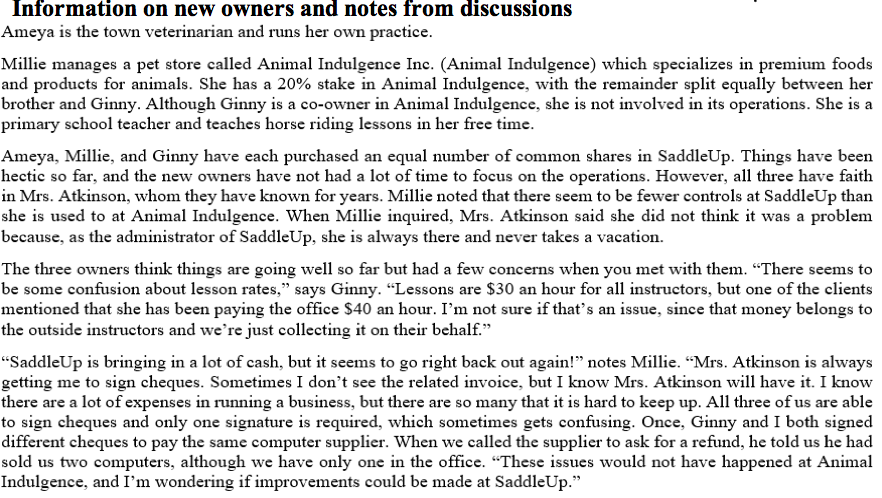

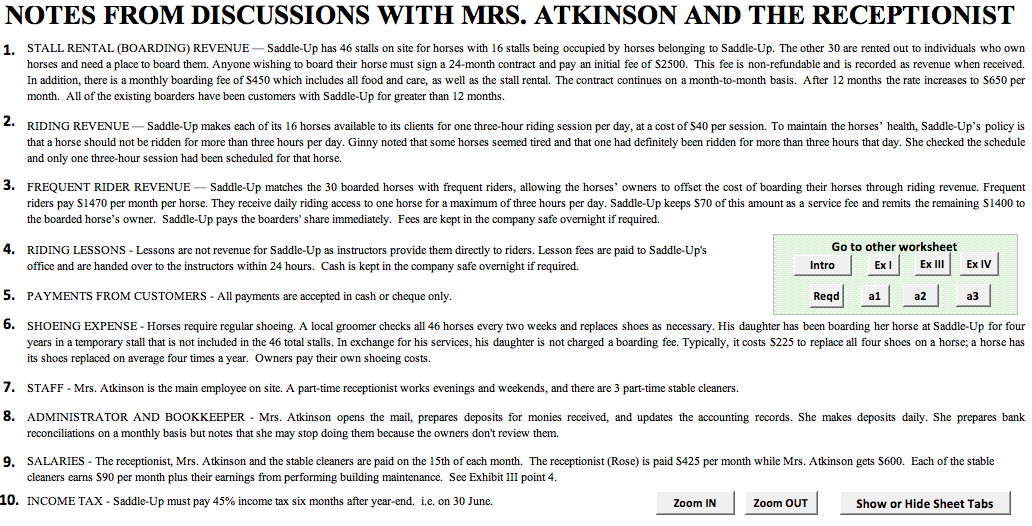

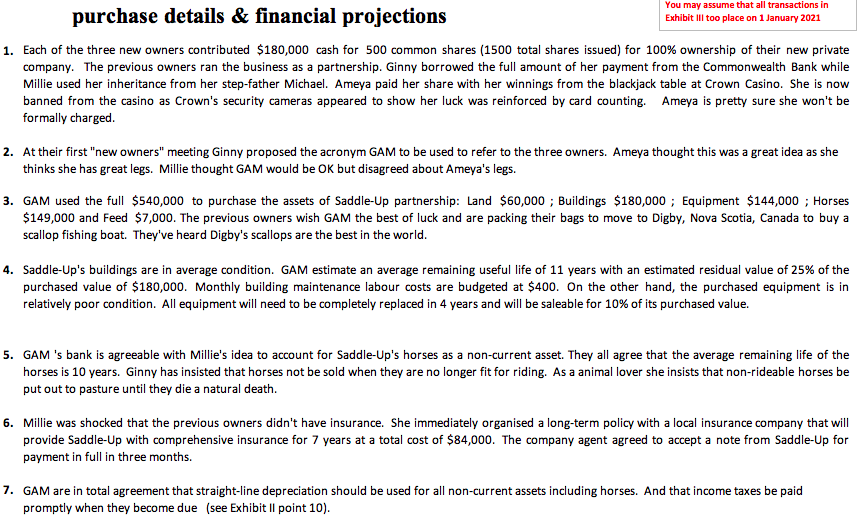

Gulgong is a 19th-century gold rush town in the Central Tablelands of New South Wales some 30 kilometers north of Mudgee or about 300 kilometers north west of Sydney. From 1966 to 1993 Gulgong was the "town on the ten dollar note" with a collection of goldrush Gulgong streets serving as the note's background. See Appendix Il for photos and Appendix III for further information. Saddle-Up Pty Ltd (Saddle-Up) has been a small family-run business in Gulgong in operation since the 1930's. The business has been passed down through the family - generation by generation to the oldest child. Late in 2019, Saddle-Up announced it was shutting down. Despite appearing to be a busy operation, Saddle- Up was not profitable & the owners wanted out. Millie and her two best friends Virginia (Ginny) and Ameya have used the stables for years and were determined to keep Saddle-Up open. They pooled their resources and purchased the assets of Saddle-Up on 1 January, 2020 (see Exhibit III point 1). The purchase was impulsive but the friends were sure they could make the business a success. Information on the new owners and notes from discussions with them are provided in Exhibit I. Because Saddle-Up is under new ownership, the bank has requested projected financial statements. The new owners have approached you to prepare these statements. You have received other information from Saddle-Up's administrator and bookkeeper, Mrs. Atkinson, as well as from the receptionist (Exhibit II). Purchase information and financial projections for the next 12 months are provided in Exhibit III. Information on new owners and notes from discussions Ameya is the town veterinarian and runs her own practice. Millie manages a pet store called Animal Indulgence Inc. (Animal Indulgence) which specializes in premium foods and products for animals. She has a 20% stake in Animal Indulgence, with the remainder split equally between her brother and Ginny. Although Ginny is a co-owner in Animal Indulgence, she is not involved in its operations. She is a primary school teacher and teaches horse riding lessons in her free time. Ameya, Millie, and Ginny have each purchased an equal number of common shares in SaddleUp. Things have been hectic so far, and the new owners have not had a lot of time to focus on the operations. However, all three have faith in Mrs. Atkinson, whom they have known for years. Millie noted that there seem to be fewer controls at SaddleUp than she is used to at Animal Indulgence. When Millie inquired, Mrs. Atkinson said she did not think it was a problem because, as the administrator of SaddleUp, she is always there and never takes a vacation. The three owners think things are going well so far but had a few concerns when you met with them. There seems to be some confusion about lesson rates," says Ginny. Lessons are $30 an hour for all instructors, but one of the clients mentioned that she has been paying the office $40 an hour. I'm not sure if that's an issue, since that money belongs to the outside instructors and we're just collecting it on their behalf. SaddleUp is bringing in a lot of cash, but it seems to go right back out again!" notes Millie. Mrs. Atkinson is always getting me to sign cheques. Sometimes I don't see the related invoice, but I know Mrs. Atkinson will have it. I know there are a lot of expenses in running a business, but there are so many that it is hard to keep up. All three of us are able to sign cheques and only one signature is required, which sometimes gets confusing. Once, Ginny and I both signed different cheques to pay the same computer supplier. When we called the supplier to ask for a refund, he told us he had sold us two computers, although we have only one in the office. These issues would not have happened at Animal Indulgence, and I'm wondering if improvements could be made at SaddleUp." NOTES FROM DISCUSSIONS WITH MRS. ATKINSON AND THE RECEPTIONIST 1. STALL RENTAL (BOARDING) REVENUE -Saddle-Up has 46 stalls on site for horses with 16 stalls being occupied by horses belonging to Saddle-Up. The other 30 are rented out to individuals who own horses and need a place to board them. Anyone wishing to board their horse must sign a 24-month contract and pay an initial fee of $2500. This fee is non-refundable and is recorded as revenue when received. In addition, there is a monthly boarding fee of S450 which includes 1 food and care, as well as the stall rental. The contract continues on a month-to-month basis. After 12 months the rate increases to S650 per month. All of existing boarders have been customers with Saddle-Up for greater than 12 months. 2. RIDING REVENUE - Saddle-Up makes each of its 16 horses available to its clients for one three-hour riding session per day, at a cost of S40 per session. To maintain the horses' health, Saddle-Up's policy is that a horse should not be ridden for more than three hours per day. Ginny noted that some horses seemed tired and that one had definitely been ridden for more than three hours that day. She checked the schedule and only one three-hour session had been scheduled for that horse. 3. FREQUENT RIDER REVENUE Saddle-Up matches the 30 boarded horses with frequent riders, allowing the horses' owners to offset the cost of boarding their horses through riding revenue. Frequent riders pay S1470 per month per horse. They receive daily riding access to one horse for a maximum of three hours per day. Saddle-Up keeps S70 of this amount as a service fee and remits the remaining S1400 to the boarded horse's owner. Saddle-Up pays the boarders' share immediately. Fees are kept in the company safe overnight if required. 4. RIDING LESSONS - Lessons are not revenue for Saddle-Up as instructors provide them directly to riders. Lesson fees are paid to Saddle-Up's office and are handed over to the instructors within 24 hours. Cash is kept in the company safe overnight if required. Go to other worksheet Intro Ex Ex III Ex IV 5. PAYMENTS FROM CUSTOMERS - All payments are accepted in cash or cheque only. Reqd al a2 a3 6. SHOEING EXPENSE - Horses require regular shoeing. A local groomer checks all 46 horses every two weeks and replaces shoes as necessary. His daughter has been boarding her horse at Saddle-Up for four years in a temporary stall that is not included in the 46 total stalls. In exchange for his services, his daughter is not charged a boarding fee. Typically, it costs $225 to replace all four shoes on a horse; a horse has its shoes replaced on average four times a year. Owners pay their own shoeing costs. 7. STAFF - Mrs. Atkinson is the main employee on site. A part-time receptionist works evenings and weekends, and there are 3 part-time stable cleaners. 8. ADMINISTRATOR AND BOOKKEEPER Mrs. Atkinson opens the mail, prepares deposits for monies received, and updates the accounting records. She makes deposits daily. She prepares bank reconciliations on a monthly basis but notes that she may stop doing them because the owners don't review them. 9. SALARIES - The receptionist, Mrs. Atkinson and the stable cleaners are paid on the 15th of each month. The receptionist (Rose) is paid $425 month while Mrs. Atkinson gets S600. Each of the stable cleaners earns $90 per month plus their earnings from performing building maintenance. See Exhibit III point 4. 10. INCOME TAX - Saddle-Up must pay 45% income tax six months after year-end. i.e. on 30 June. Zoom IN Zoom OUT Show or Hide Sheet Tabs You may assume that all transactions in purchase details & financial projections Exhibit III too place on 1 January 2021 1. Each of the three new owners contributed $180,000 cash for 500 common shares (1500 total shares issued) for 100% ownership of their new private company. The previous owners ran the business as a partnership. Ginny borrowed the full amount of her payment from the Commonwealth Bank while Millie used her inheritance from her step-father Michael. Ameya paid her share with her winnings from the blackjack table at Crown Casino. She is now banned from the casino as Crown's security cameras appeared to show her luck was reinforced by card counting. Ameya is pretty sure she won't be formally charged 2. At their first "new owners" meeting Ginny proposed the acronym GAM to be used to refer to the three owners. Ameya thought this was a great idea as she thinks she has great legs. Millie thought GAM would be OK but disagreed about Ameya's legs. 3. GAM used the full $540,000 to purchase the assets of Saddle-Up partnership: Land $60,000 ; Buildings $180,000 ; Equipment $144,000 ; Horses $149,000 and Feed $7,000. The previous owners wish GAM the best of luck and are packing their bags to move to Digby, Nova Scotia, Canada to buy a scallop fishing boat. They've heard Digby's scallops are the best in the world. 4. Saddle-Up's buildings are in average condition. GAM estimate an average remaining useful life of 11 years with an estimated residual value of 25% of the purchased value of $180,000. Monthly building maintenance labour costs are budgeted at $400. On the other hand, the purchased equipment is in relatively poor condition. All equipment will need to be completely replaced in 4 years and will be saleable for 10% of its purchased value. 5. GAM 's bank is agreeable with Millie's idea to account for Saddle-Up's horses as a non-current asset. They all agree that the average remaining life of the horses is 10 years. Ginny has insisted that horses not be sold when they are no longer fit for riding. As a animal lover she insists that non-rideable horses be put out to pasture until they die a natural death. 6. Millie was shocked that the previous owners didn't have insurance. She immediately organised a long-term policy with a local insurance company that will provide Saddle-Up with comprehensive insurance for 7 years at a total cost of $84,000. The company agent agreed to accept a note from Saddle-Up for payment in full in three months. 7. GAM are in total agreement that straight-line depreciation should be used for all non-current assets including horses. And that income taxes be paid promptly when they become due (see Exhibit II point 10). Exhibit iV purchase details & financial projections 8. Exhibit 11 (pt.1) describes one of Saddle-Up's main revenue streams - Stall Rental. GAM expect the usual turnover of boarders in the coming year with 9 existing stall renters being replaced by 9 new boarders. Stall renter turnover is a good / bad thing for Saddle-Up from a revenue standpoint. Turnovers result in stalls being unrented for 1 month on average resulting in lost rental revenue. Also bad is the fact that new renters are provided with the lower monthly rate for 12 months. However on the positive side of the ledger, new boarders must pay the one-time initial fee. 9. Note: Assume all stall renter turnover occurs after six months and that the renter turnover is consistent (i.e. the same each year). Exhibit 2 note 5 indicates that Saddle-Up's previous owners had not allowed credit sales. GAM has decided to permit all customers to pay by credit. They expect this to substantially increase revenue. Ameya assures the group that she knows some things about debt collection and to expect total adherence to the proposed 60 day credit terms (interest free). She also guarantees 100% collection of credit sales (i.e. no bad debts). Note: Assume all sales will now be credit (no cash sales) and that all customers will take the full 60 days (2 months) to pay their account. 10. GAM plan to purchase $2100 of feed one time per month during the coming year. They expect to have 25% of the last feed purchase on hand at the end of the year and to have not paid their supplier for the last purchase. 11. As described in Exhibit Il point 3 Saddle-Up earns revenue from Frequent Riders. There are currently 10 frequent riders. GAM's discussions with the previous owners indicates that this number is extremely stable (no pun intended), that GAM can count on this revenue stream to continue. 12. Millie has provided the team with her estimates for Horse Riding Revenue for the coming year. She thinks they should be able to hire out each of Saddle-Up's horses for one three-hour ride 365 days per year. However, after some discussion team GAM has decided that hiring all of their horses every day of the year is overly optimistic. They decide to temper Millie's optimism slightly with their estimate that they will achieve 93% of the maximum Riding Revenue that would be earned with one three-hour ride for all of Saddle-Up's horses every day. 13. Ameya has organised financing of $130,000 that Saddle-Up will receive immediately. Ginny and Millie agree that they should borrow this money and with Ameya's plan to construct an extension for a coffee shop. Ginny reckons that her 'special coffee'is legendary and that word will spread that Saddle-Up is the place to go. Team GAM agree that they should hire local builders Michael & Kenny as they promise to complete the job in six months. Michael guarantees their work for twice the life of Saddle-Up's other buildings as long as GAM guarantees to pay them $130,000 immediately on completion. Calculate coffee shop depreciation using the Building residual value % & Michael's guarantee for useful life. Ameya's buddy agrees that Saddle-Up repay the principle & simple interest of 1% per year in 5 years. (i.e. no payments until 31 December 2025). GAM expect to earn revenues of $18,000 next year with expenses (payments to suppliers) of $5,000. All coffee sales will be for cash or credit card. 14. Exhibit II point 6 describes an arrangement for shoeing the horses. This is ending as the daughter is giving up horse riding so she can play ice hockey. As such Saddle-Up will have to pay the groomer in cash. GAM will make sure they don't pay shoeing costs for boarded horses. INTERMEDIATE option requirements plus the three Financial Statements for the year 2023. Assume a 5% increase in both revenues & expenses in 2023 as compared to 2021/2022. See NOTE * NOTE* Insurance, interest & depreciation do not increase in years 3-5 with other expenses and revenues. Info #1 Assume that all revenue streams occur evenly throughout each year. i.e. No seasonal fluctuation. Info #2 Salary payments occur on the 15th of each month. See Exhibit II point 9. Of the total for the month, 50% has been earned by the 15th. Info #3 All expenses are paid for by credit card unless stated otherwise. Or is an accrued expense such as expiry of a prepaid amount. The empty entry (directly below NONE) on the a/c listbox can be used to restore a F/S row that has been mistakenly removed. Hint #2 With the a/c selection lisbox displayed, typing a single letter will "jump" to that section of the listbox alternatives. Hint #1 Gulgong is a 19th-century gold rush town in the Central Tablelands of New South Wales some 30 kilometers north of Mudgee or about 300 kilometers north west of Sydney. From 1966 to 1993 Gulgong was the "town on the ten dollar note" with a collection of goldrush Gulgong streets serving as the note's background. See Appendix Il for photos and Appendix III for further information. Saddle-Up Pty Ltd (Saddle-Up) has been a small family-run business in Gulgong in operation since the 1930's. The business has been passed down through the family - generation by generation to the oldest child. Late in 2019, Saddle-Up announced it was shutting down. Despite appearing to be a busy operation, Saddle- Up was not profitable & the owners wanted out. Millie and her two best friends Virginia (Ginny) and Ameya have used the stables for years and were determined to keep Saddle-Up open. They pooled their resources and purchased the assets of Saddle-Up on 1 January, 2020 (see Exhibit III point 1). The purchase was impulsive but the friends were sure they could make the business a success. Information on the new owners and notes from discussions with them are provided in Exhibit I. Because Saddle-Up is under new ownership, the bank has requested projected financial statements. The new owners have approached you to prepare these statements. You have received other information from Saddle-Up's administrator and bookkeeper, Mrs. Atkinson, as well as from the receptionist (Exhibit II). Purchase information and financial projections for the next 12 months are provided in Exhibit III. Information on new owners and notes from discussions Ameya is the town veterinarian and runs her own practice. Millie manages a pet store called Animal Indulgence Inc. (Animal Indulgence) which specializes in premium foods and products for animals. She has a 20% stake in Animal Indulgence, with the remainder split equally between her brother and Ginny. Although Ginny is a co-owner in Animal Indulgence, she is not involved in its operations. She is a primary school teacher and teaches horse riding lessons in her free time. Ameya, Millie, and Ginny have each purchased an equal number of common shares in SaddleUp. Things have been hectic so far, and the new owners have not had a lot of time to focus on the operations. However, all three have faith in Mrs. Atkinson, whom they have known for years. Millie noted that there seem to be fewer controls at SaddleUp than she is used to at Animal Indulgence. When Millie inquired, Mrs. Atkinson said she did not think it was a problem because, as the administrator of SaddleUp, she is always there and never takes a vacation. The three owners think things are going well so far but had a few concerns when you met with them. There seems to be some confusion about lesson rates," says Ginny. Lessons are $30 an hour for all instructors, but one of the clients mentioned that she has been paying the office $40 an hour. I'm not sure if that's an issue, since that money belongs to the outside instructors and we're just collecting it on their behalf. SaddleUp is bringing in a lot of cash, but it seems to go right back out again!" notes Millie. Mrs. Atkinson is always getting me to sign cheques. Sometimes I don't see the related invoice, but I know Mrs. Atkinson will have it. I know there are a lot of expenses in running a business, but there are so many that it is hard to keep up. All three of us are able to sign cheques and only one signature is required, which sometimes gets confusing. Once, Ginny and I both signed different cheques to pay the same computer supplier. When we called the supplier to ask for a refund, he told us he had sold us two computers, although we have only one in the office. These issues would not have happened at Animal Indulgence, and I'm wondering if improvements could be made at SaddleUp." NOTES FROM DISCUSSIONS WITH MRS. ATKINSON AND THE RECEPTIONIST 1. STALL RENTAL (BOARDING) REVENUE -Saddle-Up has 46 stalls on site for horses with 16 stalls being occupied by horses belonging to Saddle-Up. The other 30 are rented out to individuals who own horses and need a place to board them. Anyone wishing to board their horse must sign a 24-month contract and pay an initial fee of $2500. This fee is non-refundable and is recorded as revenue when received. In addition, there is a monthly boarding fee of S450 which includes 1 food and care, as well as the stall rental. The contract continues on a month-to-month basis. After 12 months the rate increases to S650 per month. All of existing boarders have been customers with Saddle-Up for greater than 12 months. 2. RIDING REVENUE - Saddle-Up makes each of its 16 horses available to its clients for one three-hour riding session per day, at a cost of S40 per session. To maintain the horses' health, Saddle-Up's policy is that a horse should not be ridden for more than three hours per day. Ginny noted that some horses seemed tired and that one had definitely been ridden for more than three hours that day. She checked the schedule and only one three-hour session had been scheduled for that horse. 3. FREQUENT RIDER REVENUE Saddle-Up matches the 30 boarded horses with frequent riders, allowing the horses' owners to offset the cost of boarding their horses through riding revenue. Frequent riders pay S1470 per month per horse. They receive daily riding access to one horse for a maximum of three hours per day. Saddle-Up keeps S70 of this amount as a service fee and remits the remaining S1400 to the boarded horse's owner. Saddle-Up pays the boarders' share immediately. Fees are kept in the company safe overnight if required. 4. RIDING LESSONS - Lessons are not revenue for Saddle-Up as instructors provide them directly to riders. Lesson fees are paid to Saddle-Up's office and are handed over to the instructors within 24 hours. Cash is kept in the company safe overnight if required. Go to other worksheet Intro Ex Ex III Ex IV 5. PAYMENTS FROM CUSTOMERS - All payments are accepted in cash or cheque only. Reqd al a2 a3 6. SHOEING EXPENSE - Horses require regular shoeing. A local groomer checks all 46 horses every two weeks and replaces shoes as necessary. His daughter has been boarding her horse at Saddle-Up for four years in a temporary stall that is not included in the 46 total stalls. In exchange for his services, his daughter is not charged a boarding fee. Typically, it costs $225 to replace all four shoes on a horse; a horse has its shoes replaced on average four times a year. Owners pay their own shoeing costs. 7. STAFF - Mrs. Atkinson is the main employee on site. A part-time receptionist works evenings and weekends, and there are 3 part-time stable cleaners. 8. ADMINISTRATOR AND BOOKKEEPER Mrs. Atkinson opens the mail, prepares deposits for monies received, and updates the accounting records. She makes deposits daily. She prepares bank reconciliations on a monthly basis but notes that she may stop doing them because the owners don't review them. 9. SALARIES - The receptionist, Mrs. Atkinson and the stable cleaners are paid on the 15th of each month. The receptionist (Rose) is paid $425 month while Mrs. Atkinson gets S600. Each of the stable cleaners earns $90 per month plus their earnings from performing building maintenance. See Exhibit III point 4. 10. INCOME TAX - Saddle-Up must pay 45% income tax six months after year-end. i.e. on 30 June. Zoom IN Zoom OUT Show or Hide Sheet Tabs You may assume that all transactions in purchase details & financial projections Exhibit III too place on 1 January 2021 1. Each of the three new owners contributed $180,000 cash for 500 common shares (1500 total shares issued) for 100% ownership of their new private company. The previous owners ran the business as a partnership. Ginny borrowed the full amount of her payment from the Commonwealth Bank while Millie used her inheritance from her step-father Michael. Ameya paid her share with her winnings from the blackjack table at Crown Casino. She is now banned from the casino as Crown's security cameras appeared to show her luck was reinforced by card counting. Ameya is pretty sure she won't be formally charged 2. At their first "new owners" meeting Ginny proposed the acronym GAM to be used to refer to the three owners. Ameya thought this was a great idea as she thinks she has great legs. Millie thought GAM would be OK but disagreed about Ameya's legs. 3. GAM used the full $540,000 to purchase the assets of Saddle-Up partnership: Land $60,000 ; Buildings $180,000 ; Equipment $144,000 ; Horses $149,000 and Feed $7,000. The previous owners wish GAM the best of luck and are packing their bags to move to Digby, Nova Scotia, Canada to buy a scallop fishing boat. They've heard Digby's scallops are the best in the world. 4. Saddle-Up's buildings are in average condition. GAM estimate an average remaining useful life of 11 years with an estimated residual value of 25% of the purchased value of $180,000. Monthly building maintenance labour costs are budgeted at $400. On the other hand, the purchased equipment is in relatively poor condition. All equipment will need to be completely replaced in 4 years and will be saleable for 10% of its purchased value. 5. GAM 's bank is agreeable with Millie's idea to account for Saddle-Up's horses as a non-current asset. They all agree that the average remaining life of the horses is 10 years. Ginny has insisted that horses not be sold when they are no longer fit for riding. As a animal lover she insists that non-rideable horses be put out to pasture until they die a natural death. 6. Millie was shocked that the previous owners didn't have insurance. She immediately organised a long-term policy with a local insurance company that will provide Saddle-Up with comprehensive insurance for 7 years at a total cost of $84,000. The company agent agreed to accept a note from Saddle-Up for payment in full in three months. 7. GAM are in total agreement that straight-line depreciation should be used for all non-current assets including horses. And that income taxes be paid promptly when they become due (see Exhibit II point 10). Exhibit iV purchase details & financial projections 8. Exhibit 11 (pt.1) describes one of Saddle-Up's main revenue streams - Stall Rental. GAM expect the usual turnover of boarders in the coming year with 9 existing stall renters being replaced by 9 new boarders. Stall renter turnover is a good / bad thing for Saddle-Up from a revenue standpoint. Turnovers result in stalls being unrented for 1 month on average resulting in lost rental revenue. Also bad is the fact that new renters are provided with the lower monthly rate for 12 months. However on the positive side of the ledger, new boarders must pay the one-time initial fee. 9. Note: Assume all stall renter turnover occurs after six months and that the renter turnover is consistent (i.e. the same each year). Exhibit 2 note 5 indicates that Saddle-Up's previous owners had not allowed credit sales. GAM has decided to permit all customers to pay by credit. They expect this to substantially increase revenue. Ameya assures the group that she knows some things about debt collection and to expect total adherence to the proposed 60 day credit terms (interest free). She also guarantees 100% collection of credit sales (i.e. no bad debts). Note: Assume all sales will now be credit (no cash sales) and that all customers will take the full 60 days (2 months) to pay their account. 10. GAM plan to purchase $2100 of feed one time per month during the coming year. They expect to have 25% of the last feed purchase on hand at the end of the year and to have not paid their supplier for the last purchase. 11. As described in Exhibit Il point 3 Saddle-Up earns revenue from Frequent Riders. There are currently 10 frequent riders. GAM's discussions with the previous owners indicates that this number is extremely stable (no pun intended), that GAM can count on this revenue stream to continue. 12. Millie has provided the team with her estimates for Horse Riding Revenue for the coming year. She thinks they should be able to hire out each of Saddle-Up's horses for one three-hour ride 365 days per year. However, after some discussion team GAM has decided that hiring all of their horses every day of the year is overly optimistic. They decide to temper Millie's optimism slightly with their estimate that they will achieve 93% of the maximum Riding Revenue that would be earned with one three-hour ride for all of Saddle-Up's horses every day. 13. Ameya has organised financing of $130,000 that Saddle-Up will receive immediately. Ginny and Millie agree that they should borrow this money and with Ameya's plan to construct an extension for a coffee shop. Ginny reckons that her 'special coffee'is legendary and that word will spread that Saddle-Up is the place to go. Team GAM agree that they should hire local builders Michael & Kenny as they promise to complete the job in six months. Michael guarantees their work for twice the life of Saddle-Up's other buildings as long as GAM guarantees to pay them $130,000 immediately on completion. Calculate coffee shop depreciation using the Building residual value % & Michael's guarantee for useful life. Ameya's buddy agrees that Saddle-Up repay the principle & simple interest of 1% per year in 5 years. (i.e. no payments until 31 December 2025). GAM expect to earn revenues of $18,000 next year with expenses (payments to suppliers) of $5,000. All coffee sales will be for cash or credit card. 14. Exhibit II point 6 describes an arrangement for shoeing the horses. This is ending as the daughter is giving up horse riding so she can play ice hockey. As such Saddle-Up will have to pay the groomer in cash. GAM will make sure they don't pay shoeing costs for boarded horses. INTERMEDIATE option requirements plus the three Financial Statements for the year 2023. Assume a 5% increase in both revenues & expenses in 2023 as compared to 2021/2022. See NOTE * NOTE* Insurance, interest & depreciation do not increase in years 3-5 with other expenses and revenues. Info #1 Assume that all revenue streams occur evenly throughout each year. i.e. No seasonal fluctuation. Info #2 Salary payments occur on the 15th of each month. See Exhibit II point 9. Of the total for the month, 50% has been earned by the 15th. Info #3 All expenses are paid for by credit card unless stated otherwise. Or is an accrued expense such as expiry of a prepaid amount. The empty entry (directly below NONE) on the a/c listbox can be used to restore a F/S row that has been mistakenly removed. Hint #2 With the a/c selection lisbox displayed, typing a single letter will "jump" to that section of the listbox alternatives. Hint #1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started