please list the 5 forces from this case. (competitive rivalry, threat of new entrants, bargaining power of supplier, bargaining power of customer, and threat of substitutes.)

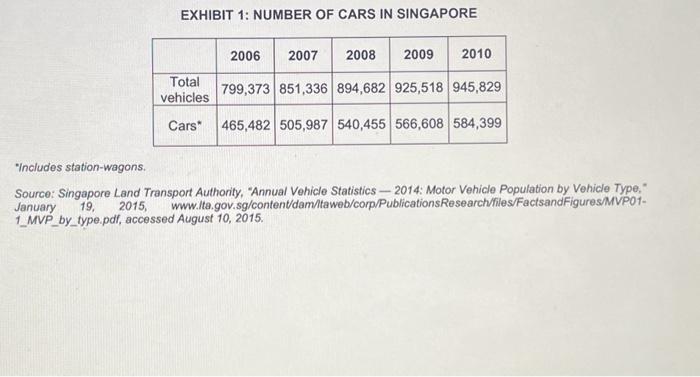

TESLA: INTERNATIONALIZATION FROM SINGAPORE TO CHINA 1 Umair Shafique, Agata Barczyk, Lukasz Gluszymski, Adnan Kayssi and Wanyi Zhao wrote this case under the supervision of Christopher Wiliams solely to provide material for class discussion. The authors do not intend to illustrate either effoctive or ineffective handling of a manogerial situation. The authors may have disguised certain names and other identifying information to protect confidentiality. This publication may not be transmitted, photocopied, digitized or otherwise reproduced in any form or by any means without the permission of the copynght holder. Reproduction of this material is nof covered under authorization by any reproduction righrs onganization. To ordor copios or roquest permission to reproduce materials, confact Ney Publishing, Ivey Business School, Western University, London, Ontario, Canada, N6G ON1; (0) 519.661,3208; (e) casesciney ca; whwiveycases com. Copynght 0 2015. Richard Ivey School of Business Foundation Vorsion: 20170928 In late December 2012, U.S.-headquartered Tesla Motors (Tesla) was faced with a challenge in terms of how to continue with its internationalization strategy. It had been more than a year since Tesla exited Singapore - six months after having entered that market. In considering China as a possible location for investment, several questions needed to be addressed. What could the company learn from its experiences in the United States and Singapore? Was it the right time to enter the Chinese market? How could Tesla prevent a repeat of the Singapore experience in China? ELON MUSK - A SERIAL ENTREPRENEUR Bom in South Africa, Elon Musk immigrated to Canada at the age of 15. He later relocated to the United States for further education. 2 In 1995, he co-founded Zip2, an Internet map and directory company, which he sold to Compaq Computer for more than US 300 million in 1999.3He went on to co-found PayPal an e-payments service - which was sold to eBay for $1.5 billion in 2002.4 Not content with revolutionizing the online payments market, Musk then founded SpaceX - a company that developed spacecraft and reusable rockets, and with which he hoped to revolutionize space travel. 5He joined the board of Tesla in 2004 and helped shape its vision. 6 He also had plans to develop a new high-speed transit system, called Hyperloop, which would transport commuters between Los Angeles and San Francisco in only 30 minutes at 1,287 kilometres per hour? Despite these apparent successes in entrepreneurship, Musk's most recent ventures had suffered setbacks, such as delays in the production of the all-electric Roadster sports car in 2007, and the failure of the first three rocket launches by SpaceX between 2006 and 2008. 8 It had been noted how Musk's calculated risktaking and persistence ensured that his companies were able to overcome hurdles. In fact, such was Musk's determination that he had even risked personal bankruptcy to ensure Tesla survived.? TESLA - COMPANY BACKGROUND Tesla was an automaker headquartered in Palo Alto, California. The company designed, manufactured and sold fully-electric vehicles (EVs) as well as EV powertrain components. 10 Tesla was formed in 2003 and went public Tesla's ability to adapt and innovate in uncertain times came under examination in 2008. Such uncertainty was characterized by a decline in automotive industry sales due to the credit crisis and a general lack of acceptance of the "electric car" concept by U.S. consumers. The appeal of electric cars suffered from a steep drop in fuel prices in the United States at the end of 2008.27 Tesla needed to be creative in order to develop a successful strategy to sell its vehicles to consumers. While a traditional dealership-based franchise model had been implemented by all other car manufacturers in the United States, Musk believed that such a model would not meet Tesla's needs. He felt that this model had two major disadvantages for the sale of EVs. First, dealers would encounter a fundamental conflict between the sale of gasoline-dependant cars and EVs. They would not be able to explain the benefits of an EV without undermining the advantages of their traditional business. 28 Second, Musk believed that when consumers visited a local dealership, the majority of potential buyers had already come to a tentative decision about which vehicle they would purchase. This could potentially reduce the dealer's opportunity to educate those consumers on the benefits of Tesla's EV. Tesla decided to pursue an alternative strategy to sell its vehicles by making them available through their own dealerships. 20 Tesla's strategy allowed the company to offer a compelling customer experience while operating efficiently. The company was also able to capture sales and service revenues that other automobile manufacturers would not be able to attain through the use of the traditional model. However there was one problem: U.S. law-makers in some states had prevented the direct sale of vehicles to customers by their manufacturers. This created a barrier for Tesla to overcome in its pursuit of companyowned dealerships. 31 In 48 of the 50 states, Tesla was required to sell and service its automobiles through a middleman franchise - a dealer. 32 Once dealers had invested in inventory and facilities, automotive companies could pressure dealers to accept shipments of cars. If the dealer did not comply they could face the possibility of the manufacturer finding another local dealer to use instead. In such a situation, the dealer would lose the money that had been invested in the dealership. To prevent such situations from occurring, the states had begun to enact laws to provide dealers with exclusive rights in local markets. Tesla overcame this obstacle with a revolutionary solution. On July 8,2010, Tesla announced the appointment of George Blankenship as the vice-president of design and store development for Tesla, 33 Blankenship, the former vice-president of real estate for Apple, was best known for his work on Apple's brand-building retail strategy one of the most successful retail growth strategies in history, "Blankenship, through the use of his knowledge acquired at Apple, was able to devise an innovative strategy to adapt to the laws that prohibited the sale of vehicles by a manufacturer. His strategy would also maximize the number of consumers that would be exposed to and educated about the product. Blankenship recommended that Tesla position its new stores, which they called "showrooms," in retail venues that had high foot-traffic and visibility. Places such as malls and shopping districts, where people were regularly in a relatively open and buying mood, were considered the ideal places for the "showrooms." He believed this would satisfy the company's need to educate consumers because Tesla would be able to interact with potential consumers before they had decided on which new vehicle they wanted to purchase. 35 Also, implementing these showrooms in high foot-traffic areas ensured maximum exposure for the company's brand. More importantly, Blankenship's showrooms enabled Tesla to sell its own vehicles in the United States without violating the dealership laws. Each showroom was used to display the vehicles and to educate consumers on the benefits of EVs and Tesla's other products. If the consumer did decide to purchase a Tesla vehicle, a company employee would direct the consumer to the company's website, where they would complete their order. By having the customer purchase the vehicle online, Tesla would not infringe on state laws and would be allowed to sell its own vehicles. Consumers had questioned the vehicles' potential to serve as a primary form of transportation. This was due to limitations on long-distance travel associated with EVs and their power sources. Without an improvement in the vehicle's range, the product would be considered impractical. This would prevent Tesla from producing vehicles on a mass scale. Similarly, questions were being asked about the practicality of a vehicle that required a long time to charge its battery. Tesla products had two feasible charging options: The wall charger and the universal mobile connector. The wall charger would be installed in the consumer's home, and could refuel a Model S at a 90-kilometre range per hour (approximately four hours). The universal mobile connector was designed to allow consumers to travel longer distances. It could charge the vehicle at a 52 -kilometre range per hour (six hours for a full charge). 36 With the high-end Model S able to travel only a 426 -kilometre range between charges, the time required to refuel would cause the vehicle to be considered impractical for everyday use. In response to this challenge, Tesla developed a solution that satisfied both the charging-needs of its vehicle and the requirement for the vehicle to be able to travel longer distances. These challenges were ameliorated with the introduction of Tesla's "supercharger stations." A charging station allowed a consumer to recharge a vehicle at a much higher speed then previously possible. Tesla vehicles could now replenish half of their battery power in as little as 20 minutes. The significant improvement in charging time eliminated a portion of consumer concems related to using a Tesla vehicle as a primary mode of transportation. The supercharger stations also addressed long-distance travel concems. As of December 2012, Tesla had implemented supercharger stations in two separate corridors in the United States that allowed for efficient long-distance travel. The first corridor used six charging stations to connect San Francisco, Lake Tahoe, Los Angeles and Las Vegas. The second corridor connected the District of Columbia, New York City and Boston. 38 Tesla announced further expansions in 2013 for its supercharger stations which included a network that featured a "supercharger highway" that would connect Los Angeles to New York. Battery Swap Tesla's implementation of Supercharger stations placated many critics that questioned the Model S's potential to serve as a primary vehicle. However, a few detractors remained. Some believed that without an option for instant charges, Tesla products would be too time consuming for many customers. If the cars could not refuel instantly like their gasoline-using counterparts, the issue would continue to be seen as a weakness. To address this issue, Tesla designed a system that would allow consumers to "swap" batteries in their vehicles, allowing for immediate refuelling. The swap option was implemented in 2013. TESLA IN SINGAPORE In the 2000s, Singapore was one of the wealthiest economies in the world. The real gross domestic product per capita was fourth and fifth in the world, in 2009 and 2010, respectively, exceeding US 560,000 (purchasing power parity). 39 Singapore's population amounted to around five million people, while the number of cars used in Singapore exceeded half a million (see Exhibit 1 ). 40 Alongside a high tax policy for conventional fuel-using cars, the Singaporean government pursued a policy of maintaining a green and clean city that included limiting air pollution. Singapore was technologically advanced and offered local expertise in electronics, power and precision engineering. These factors, together with its small size, compact urban environment and robust power grid, as well as an information and communications technology infrastructure, made Singapore an ideal location for testing EVs. Singapore generated around 80 per cent of its power from natural gas. It was estimated that a 30 per cent penetration of EVs in private car ownership would provide the benefit of a 7 per cent reduction in carbon emissions in the country. 4 Moreover, the size 42 of Singapore meant short average driving distances (55 kilometres per day). This put passenger vehicle distance requirements within the range of a fully charged EV ( 90 to 160 kilometres). )43 Another benefit of moving over to EVs was the potential reduction in the Singaporean preoccupation with cars as status symbols. This was hoped to be an added benefit if EVs could be seen only as functional vehicles with the single purpose of getting from point A to point B. The move over to EVs would potentially shift consumer focus from the fastest, most powerful cars to the most environmentally friendly ones. 4 In May 2009, the Singaporean government announced its decision to establish a two-year test-bed program for EVs. 45 The program was dubbed the Transport Technology Innovation and Development Scheme (TIDES). The program prompted the government to look for commercial partnerships with foreign companies. There were two different types of investments within the program. First, companies were needed that were able to provide EVs. Second, companies were needed that could help develop a charging-station infrastructure in the city. Singapore had already offered a 40 per cent discount for EVs on the Additional Registration Fee (ARF), but TIDES was a great opportunity for electric car manufacturers to build their presence in Singapore. 46 When TIDES was announced, the Renault-Nissan Alliance was already appointed as a partner, but applications from other players were still being accepted. Tesla's Response and Subsequent Outcome Tesla opened its first store and service centre in Singapore in 2010. In order to take advantage of the opportunities offered by the Singaporean government, Tesla applied for participation in the program. Tesla felt that it met the government's criteria. 47 Although it had already taken advantage of a 40 per cent rebate for the ARF, the company endeavoured to obtain additional tax breaks through TIDES; this would allow it to decrease the initial price of the cars offered in Singapore by 50 per cent. Meanwhile, a new player had joined the program: Mitsubishi i-MiEV. The i-MiEV had an open market value (i.e. dealership price) of about SGS85,000, which would increase to about SG 190,000 after payment of full ARF, Certificate of Entitlement 48 and road taxes 49 Under TIDES, each i-MiEV was priced at only SG $90,000, with exemption from the above duties and taxes for a maximum period of 10 years. 50 Tesla's price for the Roadster was much higher - SG $500,000 (more than SG $400,000 without any tax exemptions). By becoming part of TIDES, the price for the Roadster would come down to SGS250,000. Despite all of the favourable conditions, Tesla did not receive the aforementioned tax breaks. Only four companies managed to obtain the grant from the Singaporean government (Daimler, Mitsubishi, Nissan and Renault). 51 It was reported that Tesla did not meet the technical requirements for EVs. 52 Consequently, Tesla did not sell a single car in Singapore. 53 The company had garnered about a dozen orders, most on the condition that the tax break be granted. 54A few people were willing to buy the car without the tax break, because they perceived Tesla as the car manufacturer of the future, but the numbers were too small to justify Tesla's presence in Singapore. Tesla Motors' Asia-Pacific director Kevin Yu told The Straits Times: "Unfortunately, Singapore has not turned out to be the market we hoped it would be," He followed: "Given the Roadster's limited production run and the enthusiastic support from both customers and governments for the vehicle in other markets, Tesla has decided to focus our limited resources elsewhere., 55 Failing to Meet World Demand By the end of 2012, Tesla's automotive sales revenue had increased to $385.7 million from \$148.6 million due to a dramatic increase in demand. 562,650 units of the Model S were delivered in 2012, but the total number of reservations was 15,000. Those vehicles that were delivered were all in North America none were delivered in Europe or Asia. In addition, the supply of the Tesla Model S significantly lagged the demand. Tesla could not provide vehicles in any of the countries where it operated in 2012. Tesla explained that the delays were due to "difficulties in training new employees to use new equipment, and in part to delays from suppliers. .57 CONSIDERING CHINA The electric and hybrid automotive industry in China consisted of well-known car manufacturers such as Mercedes-Benz, Hyundai and Toyota, as well as other Asian brands, like Chery and BYD. Customers with high incomes, who wanted to have high social recognition, preferred well-known manufacturers, while customers with lower incomes, who were also concerned about environmental issues, tended to choose the Asian brands. The market was already competitive and Tesla had no reputation amongst such players. The electric and hybrid automotive industry in China consisted of well-known car manufacturers such as Mercedes-Benz, Hyundai and Toyota, as well as other Asian brands, like Chery and BYD. Customers with high incomes, who wanted to have high social recognition, preferred well-known manufacturers, while customers with lower incomes, who were also concerned about environmental issues, tended to choose the Asian brands. The market was already competitive and Tesla had no reputation amongst such players. China had been suffering from severe air pollution, and the Chinese government had taken a variety of approaches to reduce emissions. One of those approaches was to encourage EV purchases. At the end of 2012, the Chinese government planned to provide tax credits for those who purchased EVs and also implied that potential subsidies would be issued to some EV manufacturers in the future. If Tesla could apply for said subsidies it would be able to offer more competitive prices for its vehicles. However, nothing concrete had been confirmed. In addition, Tesla did not have much information on the demand conditions in the Chinese market. It was thought that Tesla would need to invest in measures to educate local customers on its business vision, design and manufacturing. Another important issue was the electric charging infrastructure. In China, most people lived in apartments with limited parking space, which they often shared with others. Chinese customers were going to experience difficulty charging EVs which DECISION POINT Given the outcome in Singapore, as well as the mixed performance in the United States and Europe, was the time right for Tesla to enter China? If Musk took Tesla into China, what could he leam from the experiences Tesla had had elsewhere in order to make China a success? How could he deal with some of the unknowns that confronted the company in China? What should the company's entry strategy consist of? EXHIBIT 1: NUMBER OF CARS IN SINGAPORE IIncludes station-wagons. Source: Singapore Land Transport Authority, "Annual Vehicle Statistics - 2014: Motor Vehicle Population by Vehicle Type," January 19, 2015, www.lta.gov.sg/content/dam/taweb/corp/PublicationsResearch/files/FactsandFigures/MVP011_MVP_by_type.pdf, accessed August 10, 2015