please look at every picture to answer the question. thank you

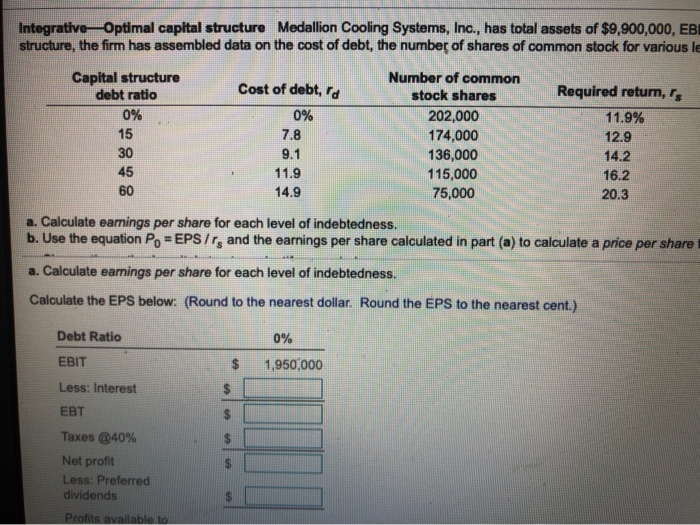

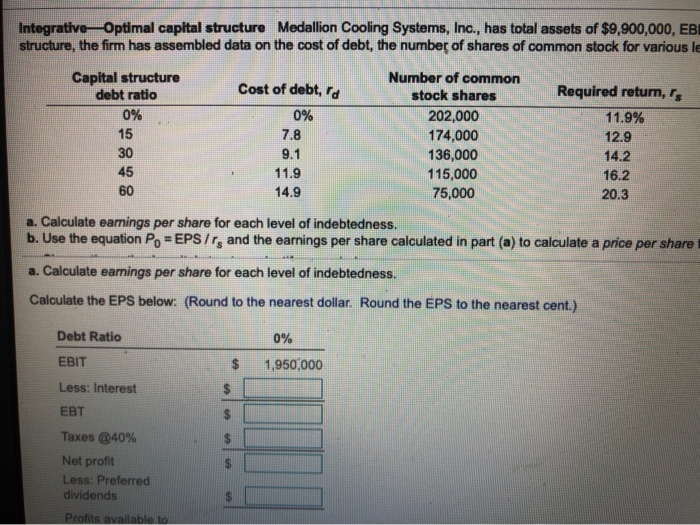

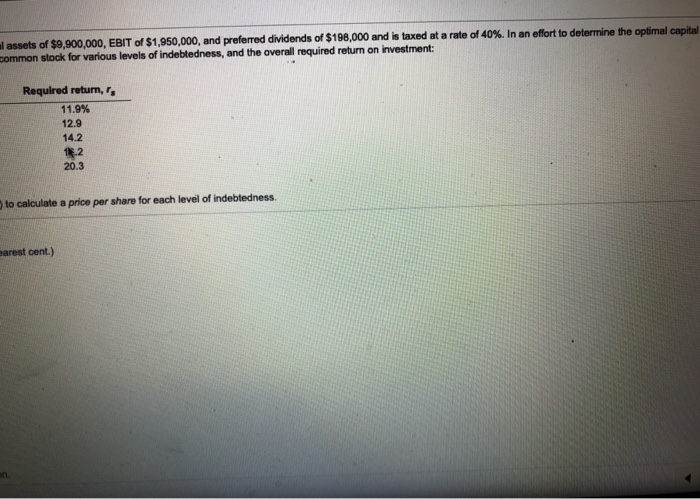

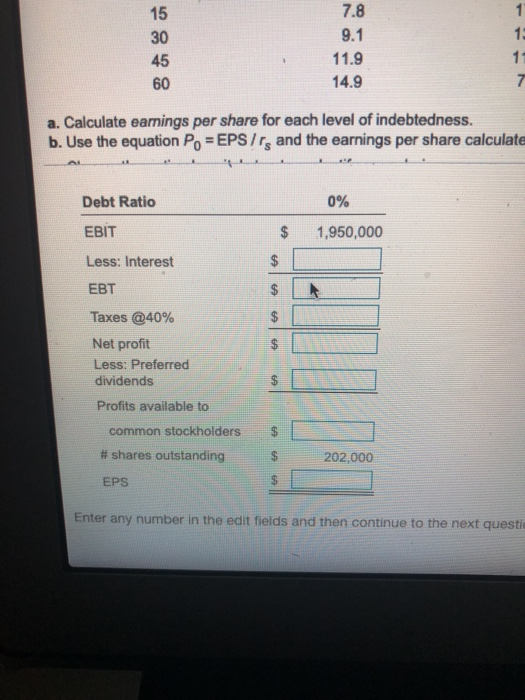

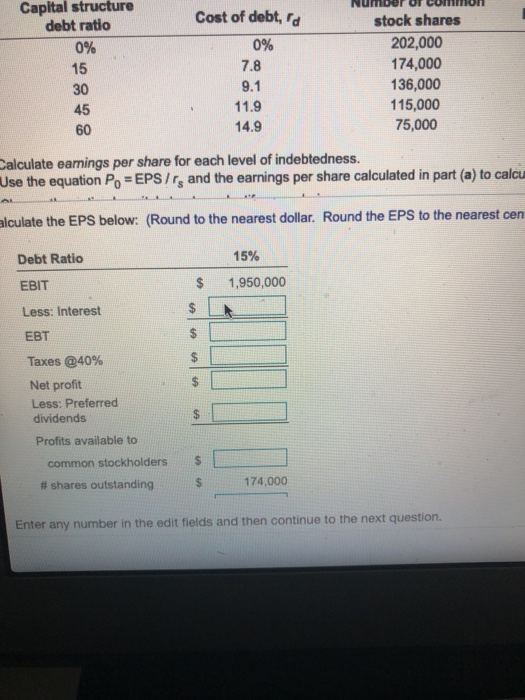

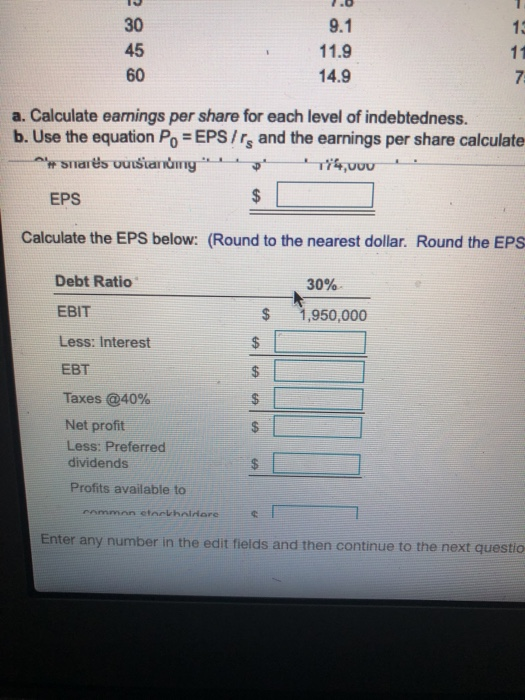

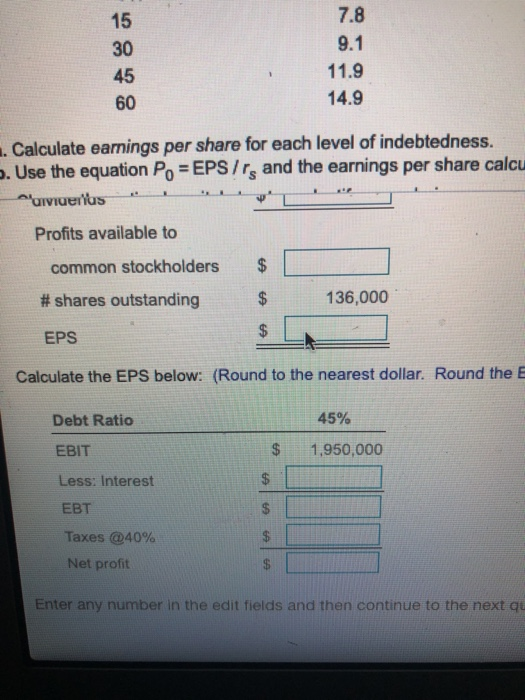

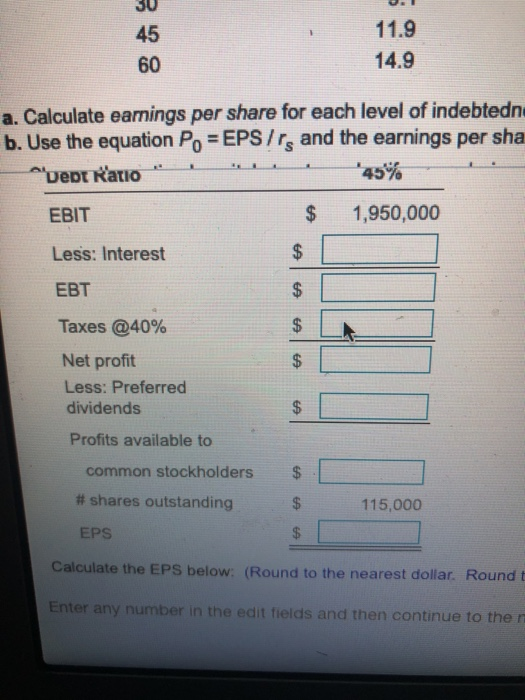

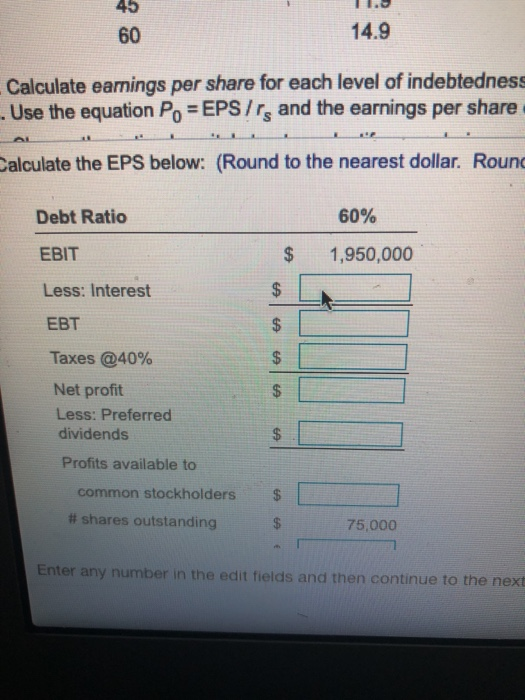

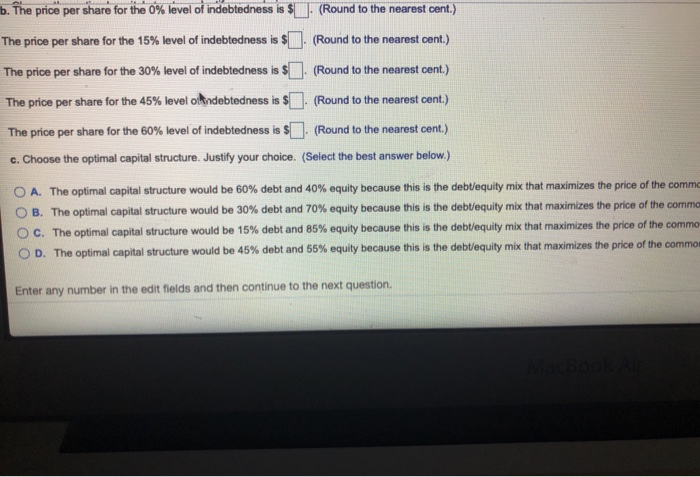

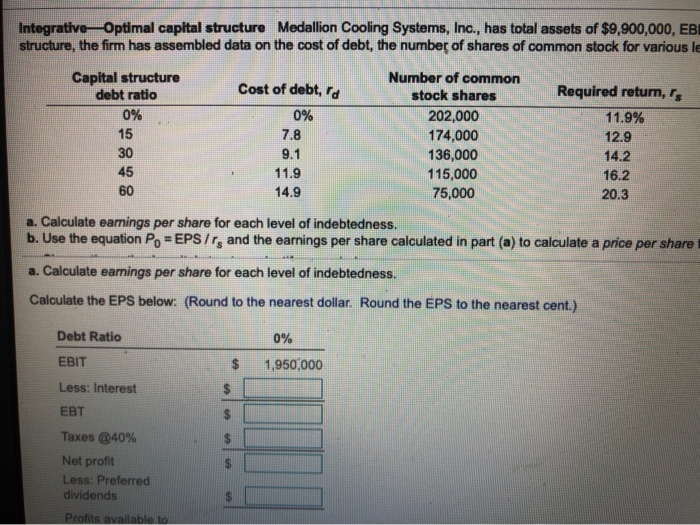

Integrative Optimal capital structure Medallion Cooling Systems, Inc., has total assets of $9,900,000, EB structure, the firm has assembled data on the cost of debt, the number of shares of common stock for various le Capital structure debt ratio 0% 15 30 45 60 Cost of debt, ' 0% 7.8 9.1 11.9 14.9 Number of common stock shares 202,000 174,000 136,000 115,000 75,000 Required retum,rs 11.9% 12.9 14.2 16.2 20.3 a. Calculate earnings per share for each level of indebtedness. b. Use the equation Po = EPS/rs and the earnings per share calculated in part (a) to calculate a price per share a. Calculate earnings per share for each level of indebtedness. Calculate the EPS below: (Round to the nearest dollar. Round the EPS to the nearest cent.) Debt Ratio 0% EBIT $ 1,950,000 Less: Interest $ EBT Taxes @40% Net profit Less: Preferred dividends Profits available to l assets of $9,900,000, EBIT of $1,950,000, and preferred dividends of $196,000 and is taxed at a rate of 40%. In an effort to determine the optimal capital common stock for various levels of indebtedness, and the overall required return on investment: Required return, 11.9% 12.9 14.2 12 20.3 to calculate a price per share for each level of indebtedness earest cent.) un 15 30 45 60 7.8 9.1 11.9 14.9 1 1 11 7 a. Calculate earnings per share for each level of indebtedness. b. Use the equation Po = EPS/rs and the earnings per share calculate Debt Ratio 0% EBIT $ 1,950,000 Less: Interest $ EBT $ $ Taxes @40% Net profit Less: Preferred dividends $ $ Profits available to common stockholders # shares outstanding 202.000 EPS Enter any number in the edit fields and then continue to the next questi Capital structure debt ratio 0% 15 30 45 60 Cost of debt, d 0% 7.8 9.1 11.9 14.9 stock shares 202,000 174,000 136,000 115,000 75,000 Calculate earnings per share for each level of indebtedness. Use the equation Po=EPS/rs and the earnings per share calculated in part (a) to calcu alculate the EPS below: (Round to the nearest dollar. Round the EPS to the nearest cen Debt Ratio 15% EBIT $ 1,950,000 Less: Interest EBT $ $ va Taxes @40% Net profit Less: Preferred dividends Profits available to common stockholders $ # shares outstanding $ 174,000 Enter any number in the edit fields and then continue to the next question. 13 30 45 60 9.1 11.9 14.9 7 a. Calculate earnings per share for each level of indebtedness. b. Use the equation Po = EPS /rs and the earnings per share calculate smars vuistanumg T74,000 EPS Calculate the EPS below: (Round to the nearest dollar. Round the EPS Debt Ratio 30% EBIT $ 1,950,000 Less: Interest $ EBT $ CA Taxes @40% Net profit Less: Preferred dividends $ Profits available to Amman etarletrare Enter any number in the edit fields and then continue to the next questio 15 30 45 60 7.8 9.1 11.9 14.9 .. Calculate earnings per share for each level of indebtedness. - Use the equation Po = EPS/rs and the earnings per share calcu Alaviuerlus Profits available to common stockholders # shares outstanding $ 136,000 EPS $ Calculate the EPS below: (Round to the nearest dollar. Round the E Debt Ratio 45% EBIT $ 1,950,000 Less: Interest $ EBT $ Taxes @40% Net profit Enter any number in the edit fields and then continue to the next qu SU 45 60 11.9 14.9 a. Calculate earnings per share for each level of indebtedna b. Use the equation Po = EPS/rs and the earnings per sha vept Ratio 45% EBIT $ 1,950,000 Less: Interest $ EBT $ $ Taxes @40% Net profit Less: Preferred dividends $ $ Profits available to $ common stockholders # shares outstanding 115,000 EPS $ Calculate the EPS below: (Round to the nearest dollar. Roundt Enter any number in the edit fields and then continue to the 45 60 14.9 Calculate earnings per share for each level of indebtedness . Use the equation Po = EPS/rs and the earnings per share Calculate the EPS below: (Round to the nearest dollar. Round Debt Ratio 60% EBIT $ 1,950,000 Less: Interest $ EBT $ $ Taxes @40% Net profit Less: Preferred dividends $ $ Profits available to - common stockholders # shares outstanding $ 75,000 Enter any number in the edit fields and then continue to the next