PLEASE LOOK AT THE INSTRUCTIONS AND WORK ON ALL PARTS:

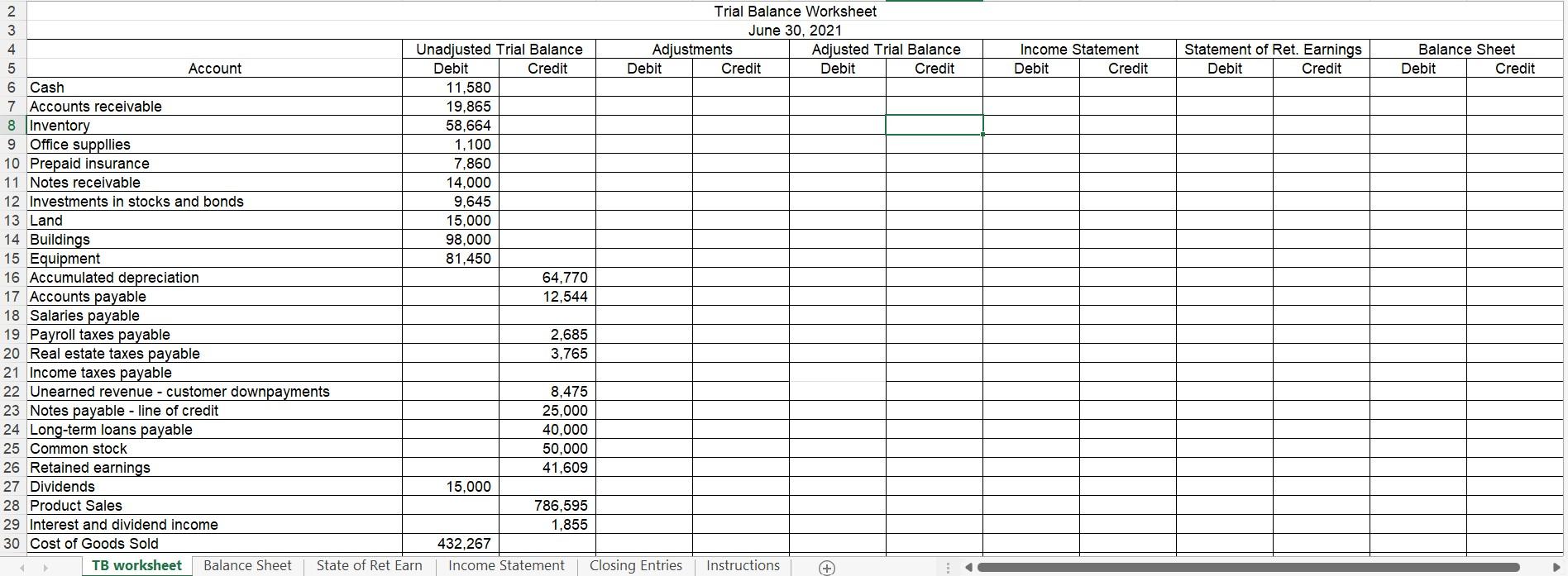

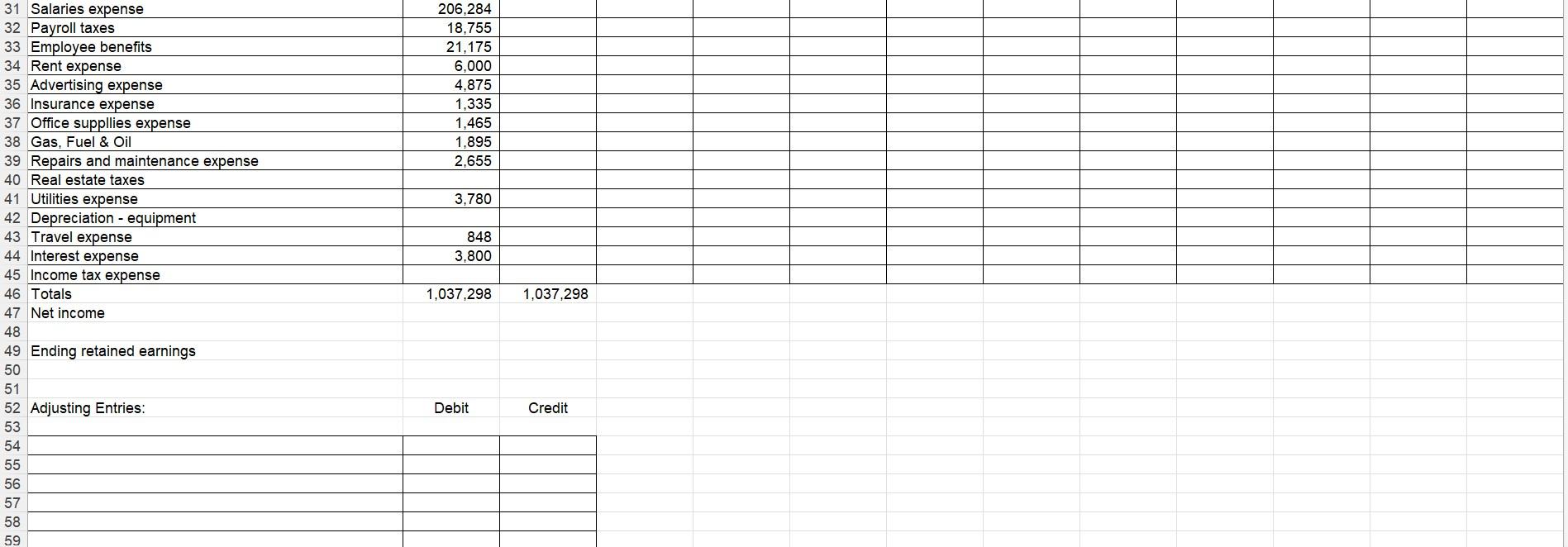

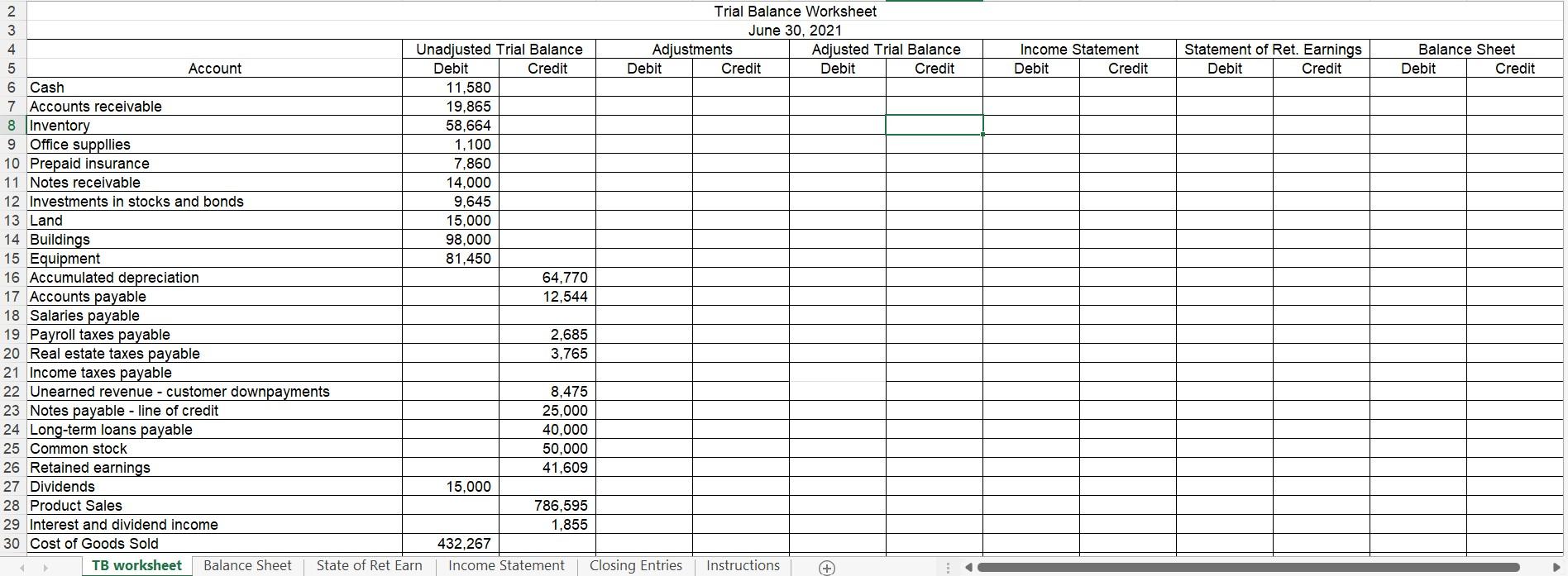

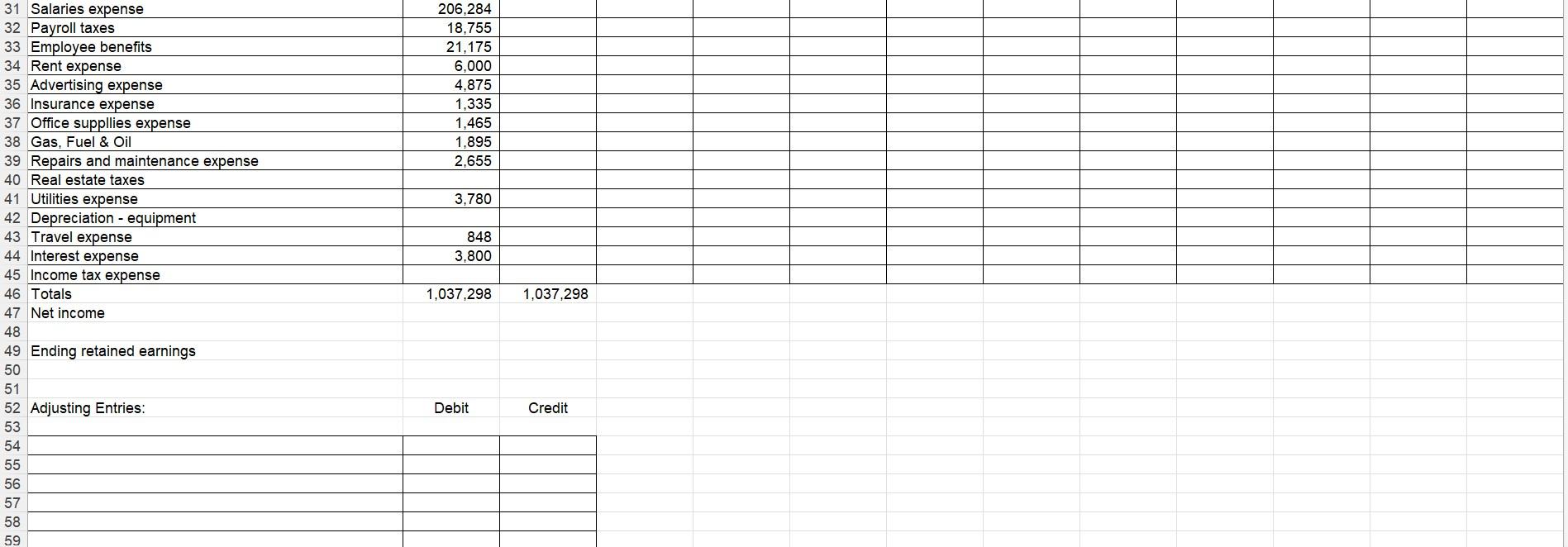

-Complete the adjusting entries and trial balance worksheet

the date column is not necessary on the adjusting entries as all are the last day of the year

remember to show a description for each of the entries

remember how the accounts should be entered to show debits and credits

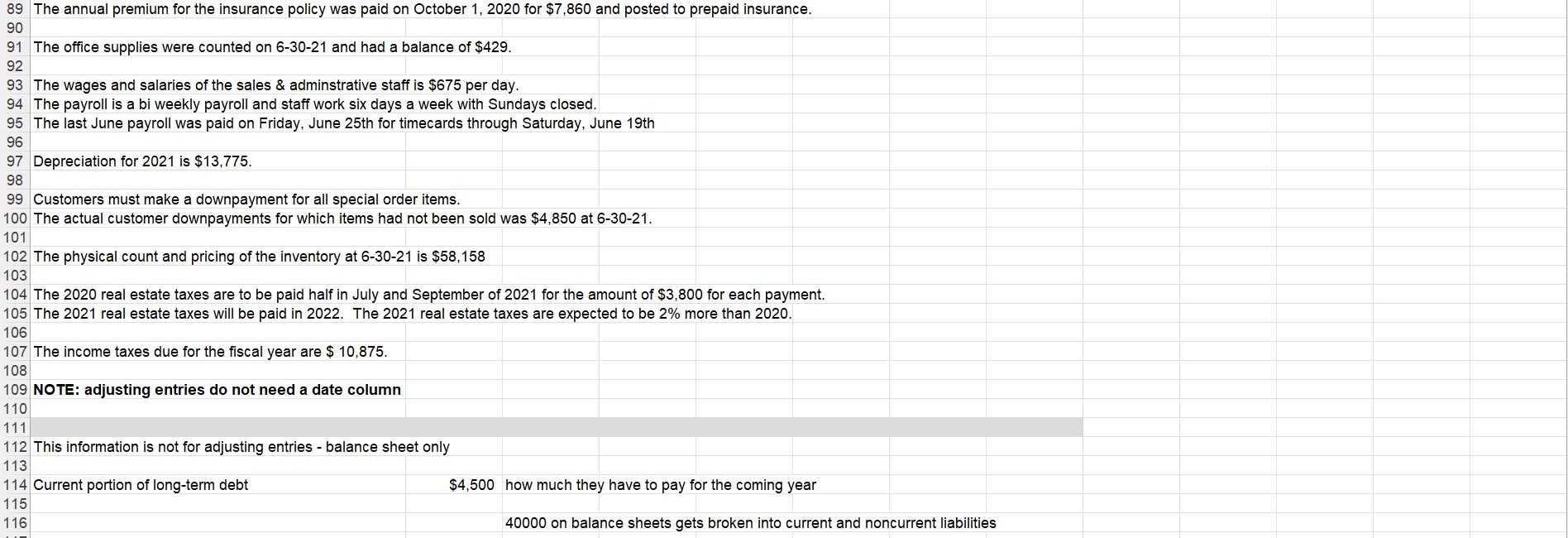

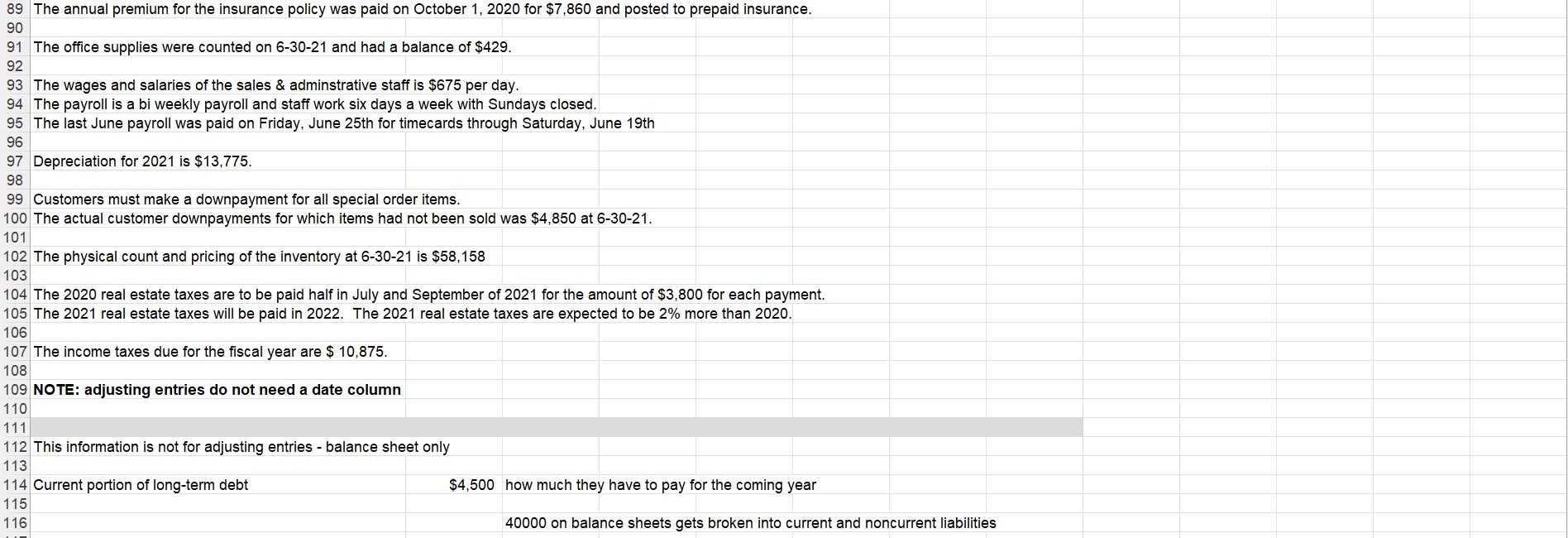

Ending retained earnings 89 The annual premium for the insurance policy was paid on October 1,2020 for $7,860 and posted to prepaid insurance. The office supplies were counted on 63021 and had a balance of $429. 3 The wages and salaries of the sales \& adminstrative staff is $675 per day. 94 The payroll is a bi weekly payroll and staff work six days a week with Sundays closed. 95 The last June payroll was paid on Friday, June 25 th for timecards through Saturday, June 19th 96 Depreciation for 2021 is $13,775. 98 Customers must make a downpayment for all special order items. 99 Customers must make a downpayment for all special order items. 100 The actual customer downpayments for which items had not been sold was $4,850 at 63021. 100 102 The physical count and pricing of the inventory at 63021 is $58,158 103 104 The 2020 real estate taxes are to be paid half in July and September of 2021 for the amount of $3,800 for each payment. 105 The 2021 real estate taxes will be paid in 2022 . The 2021 real estate taxes are expected to be 2% more than 2020 . 106 The income taxes due for the fiscal year are $10,875. 108 The income taxes due for the fiscal year are $10,875. 9 NOTE: adjusting entries do not need a date column This information is not for adjusting entries - balance sheet only Current portion of long-term debt $4,500 how much they have to pay for the coming year 40000 on balance sheets gets broken into current and noncurrent liabilities Ending retained earnings 89 The annual premium for the insurance policy was paid on October 1,2020 for $7,860 and posted to prepaid insurance. The office supplies were counted on 63021 and had a balance of $429. 3 The wages and salaries of the sales \& adminstrative staff is $675 per day. 94 The payroll is a bi weekly payroll and staff work six days a week with Sundays closed. 95 The last June payroll was paid on Friday, June 25 th for timecards through Saturday, June 19th 96 Depreciation for 2021 is $13,775. 98 Customers must make a downpayment for all special order items. 99 Customers must make a downpayment for all special order items. 100 The actual customer downpayments for which items had not been sold was $4,850 at 63021. 100 102 The physical count and pricing of the inventory at 63021 is $58,158 103 104 The 2020 real estate taxes are to be paid half in July and September of 2021 for the amount of $3,800 for each payment. 105 The 2021 real estate taxes will be paid in 2022 . The 2021 real estate taxes are expected to be 2% more than 2020 . 106 The income taxes due for the fiscal year are $10,875. 108 The income taxes due for the fiscal year are $10,875. 9 NOTE: adjusting entries do not need a date column This information is not for adjusting entries - balance sheet only Current portion of long-term debt $4,500 how much they have to pay for the coming year 40000 on balance sheets gets broken into current and noncurrent liabilities