Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please make an excel spreadsheet Step-by-Step: 1. Open a new Excel spreadsheet. 2. In column A, create a bold-faced heading that contains the following: Row

Please make an excel spreadsheet

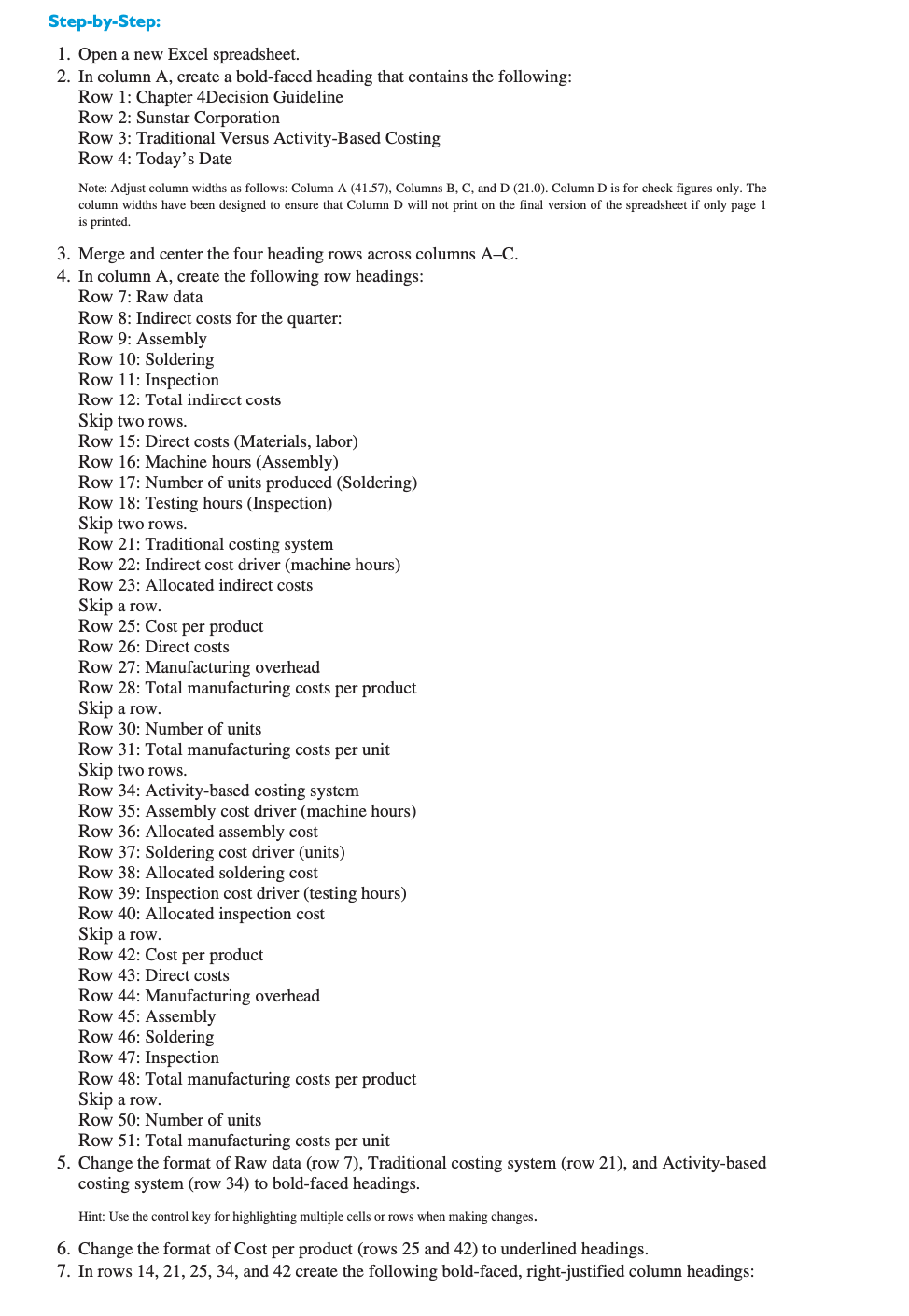

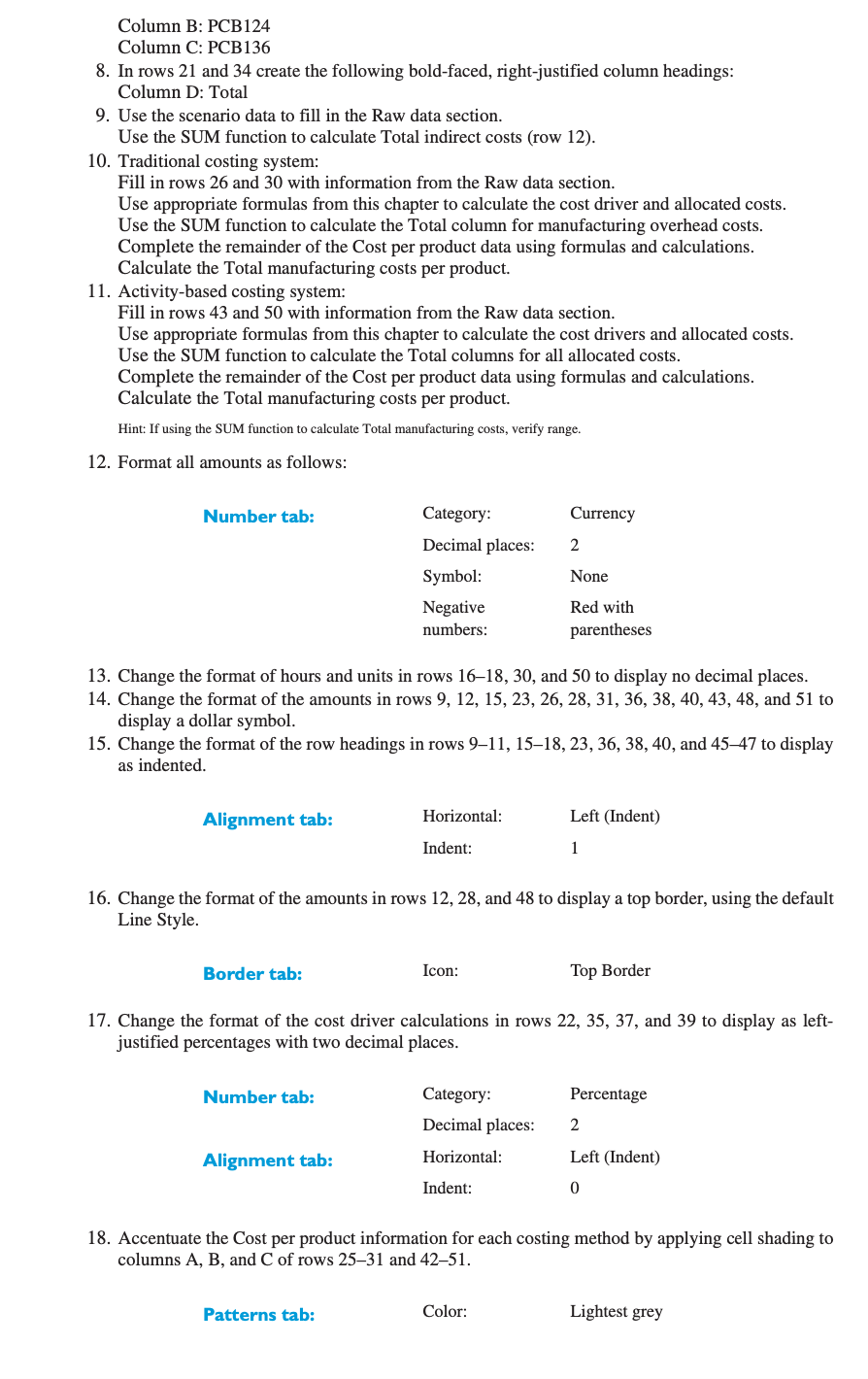

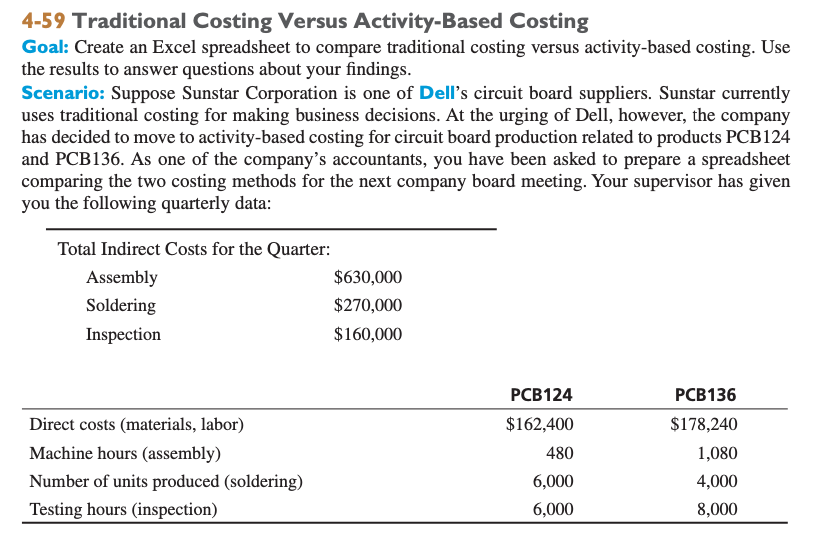

Step-by-Step: 1. Open a new Excel spreadsheet. 2. In column A, create a bold-faced heading that contains the following: Row 1: Chapter 4Decision Guideline Row 2: Sunstar Corporation Row 3: Traditional Versus Activity-Based Costing Row 4: Today's Date Note: Adjust column widths as follows: Column A (41.57), Columns B, C, and D (21.0). Column D is for check figures only. The column widths have been designed to ensure that Column D will not print on the final version of the spreadsheet if only page 1 is printed. 3. Merge and center the four heading rows across columns A-C. 4. In column A, create the following row headings: Row 7: Raw data Row 8: Indirect costs for the quarter: Row 9: Assembly Row 10: Soldering Row 11: Inspection Row 12: Total indirect costs Skip two rows. Row 15: Direct costs (Materials, labor) Row 16: Machine hours (Assembly) Row 17: Number of units produced (Soldering) Row 18: Testing hours (Inspection) Skip two rows. Row 21: Traditional costing system Row 22: Indirect cost driver (machine hours) Row 23: Allocated indirect costs Skip a row. Row 25: Cost per product Row 26: Direct costs Row 27: Manufacturing overhead Row 28: Total manufacturing costs per product Skip a row. Row 30: Number of units Row 31: Total manufacturing costs per unit Skip two rows. Row 34: Activity-based costing system Row 35: Assembly cost driver (machine hours) Row 36: Allocated assembly cost Row 37: Soldering cost driver (units) Row 38: Allocated soldering cost Row 39: Inspection cost driver (testing hours) Row 40: Allocated inspection cost Skip a row. Row 42: Cost per product Row 43: Direct costs Row 44: Manufacturing overhead Row 45: Assembly Row 46: Soldering Row 47: Inspection Row 48: Total manufacturing costs per product Skip a row. Row 50: Number of units Row 51: Total manufacturing costs per unit 5. Change the format of Raw data (row 7), Traditional costing system (row 21), and Activity-based costing system (row 34) to bold-faced headings. Hint: Use the control key for highlighting multiple cells or rows when making changes. 6. Change the format of Cost per product (rows 25 and 42) to underlined headings. 7. In rows 14, 21, 25, 34, and 42 create the following bold-faced, right-justified column headings: Column B: PCB124 Column C: PCB136 8. In rows 21 and 34 create the following bold-faced, right-justified column headings: Column D: Total 9. Use the scenario data to fill in the Raw data section. Use the SUM function to calculate Total indirect costs (row 12). 10. Traditional costing system: Fill in rows 26 and 30 with information from the Raw data section. Use appropriate formulas from this chapter to calculate the cost driver and allocated costs. Use the SUM function to calculate the Total column for manufacturing overhead costs. Complete the remainder of the Cost per product data using formulas and calculations. Calculate the Total manufacturing costs per product. 11. Activity-based costing system: Fill in rows 43 and 50 with information from the Raw data section. Use appropriate formulas from this chapter to calculate the cost drivers and allocated costs. Use the SUM function to calculate the Total columns for all allocated costs. Complete the remainder of the Cost per product data using formulas and calculations. Calculate the Total manufacturing costs per product. Hint: If using the SUM function to calculate Total manufacturing costs, verify range. 12. Format all amounts as follows: Number tab: Currency 2 Category: Decimal places: Symbol: Negative numbers: None Red with parentheses 13. Change the format of hours and units in rows 16-18, 30, and 50 to display no decimal places. 14. Change the format of the amounts in rows 9, 12, 15, 23, 26, 28, 31, 36, 38, 40, 43, 48, and 51 to display a dollar symbol. 15. Change the format of the row headings in rows 911, 1518, 23, 36, 38, 40, and 45-47 to display as indented. Alignment tab: Horizontal: Left (Indent) Indent: 1 16. Change the format of the amounts in rows 12, 28, and 48 to display a top border, using the default Line Style. Border tab: Icon: Top Border 17. Change the format of the cost driver calculations in rows 22, 35, 37, and 39 to display as left- justified percentages with two decimal places. Number tab: Percentage Category: Decimal places: 2 Alignment tab: Horizontal: Left (Indent) Indent: 0 18. Accentuate the Cost per product information for each costing method by applying cell shading to columns A, B, and C of rows 2531 and 4251. Patterns tab: Color: Lightest grey 4-59 Traditional Costing Versus Activity-Based Costing Goal: Create an Excel spreadsheet to compare traditional costing versus activity-based costing. Use the results to answer questions about your findings. Scenario: Suppose Sunstar Corporation is one of Dell's circuit board suppliers. Sunstar currently uses traditional costing for making business decisions. At the urging of Dell, however, the company has decided to move to activity-based costing for circuit board production related to products PCB124 and PCB136. As one of the company's accountants, you have been asked to prepare a spreadsheet comparing the two costing methods for the next company board meeting. Your supervisor has given you the following quarterly data: Total Indirect Costs for the Quarter: Assembly $630,000 Soldering $270,000 Inspection $160,000 Direct costs (materials, labor) Machine hours (assembly) Number of units produced (soldering) Testing hours (inspection) PCB124 $162,400 480 6,000 6,000 PCB136 $178,240 1,080 4,000 8,000 Step-by-Step: 1. Open a new Excel spreadsheet. 2. In column A, create a bold-faced heading that contains the following: Row 1: Chapter 4Decision Guideline Row 2: Sunstar Corporation Row 3: Traditional Versus Activity-Based Costing Row 4: Today's Date Note: Adjust column widths as follows: Column A (41.57), Columns B, C, and D (21.0). Column D is for check figures only. The column widths have been designed to ensure that Column D will not print on the final version of the spreadsheet if only page 1 is printed. 3. Merge and center the four heading rows across columns A-C. 4. In column A, create the following row headings: Row 7: Raw data Row 8: Indirect costs for the quarter: Row 9: Assembly Row 10: Soldering Row 11: Inspection Row 12: Total indirect costs Skip two rows. Row 15: Direct costs (Materials, labor) Row 16: Machine hours (Assembly) Row 17: Number of units produced (Soldering) Row 18: Testing hours (Inspection) Skip two rows. Row 21: Traditional costing system Row 22: Indirect cost driver (machine hours) Row 23: Allocated indirect costs Skip a row. Row 25: Cost per product Row 26: Direct costs Row 27: Manufacturing overhead Row 28: Total manufacturing costs per product Skip a row. Row 30: Number of units Row 31: Total manufacturing costs per unit Skip two rows. Row 34: Activity-based costing system Row 35: Assembly cost driver (machine hours) Row 36: Allocated assembly cost Row 37: Soldering cost driver (units) Row 38: Allocated soldering cost Row 39: Inspection cost driver (testing hours) Row 40: Allocated inspection cost Skip a row. Row 42: Cost per product Row 43: Direct costs Row 44: Manufacturing overhead Row 45: Assembly Row 46: Soldering Row 47: Inspection Row 48: Total manufacturing costs per product Skip a row. Row 50: Number of units Row 51: Total manufacturing costs per unit 5. Change the format of Raw data (row 7), Traditional costing system (row 21), and Activity-based costing system (row 34) to bold-faced headings. Hint: Use the control key for highlighting multiple cells or rows when making changes. 6. Change the format of Cost per product (rows 25 and 42) to underlined headings. 7. In rows 14, 21, 25, 34, and 42 create the following bold-faced, right-justified column headings: Column B: PCB124 Column C: PCB136 8. In rows 21 and 34 create the following bold-faced, right-justified column headings: Column D: Total 9. Use the scenario data to fill in the Raw data section. Use the SUM function to calculate Total indirect costs (row 12). 10. Traditional costing system: Fill in rows 26 and 30 with information from the Raw data section. Use appropriate formulas from this chapter to calculate the cost driver and allocated costs. Use the SUM function to calculate the Total column for manufacturing overhead costs. Complete the remainder of the Cost per product data using formulas and calculations. Calculate the Total manufacturing costs per product. 11. Activity-based costing system: Fill in rows 43 and 50 with information from the Raw data section. Use appropriate formulas from this chapter to calculate the cost drivers and allocated costs. Use the SUM function to calculate the Total columns for all allocated costs. Complete the remainder of the Cost per product data using formulas and calculations. Calculate the Total manufacturing costs per product. Hint: If using the SUM function to calculate Total manufacturing costs, verify range. 12. Format all amounts as follows: Number tab: Currency 2 Category: Decimal places: Symbol: Negative numbers: None Red with parentheses 13. Change the format of hours and units in rows 16-18, 30, and 50 to display no decimal places. 14. Change the format of the amounts in rows 9, 12, 15, 23, 26, 28, 31, 36, 38, 40, 43, 48, and 51 to display a dollar symbol. 15. Change the format of the row headings in rows 911, 1518, 23, 36, 38, 40, and 45-47 to display as indented. Alignment tab: Horizontal: Left (Indent) Indent: 1 16. Change the format of the amounts in rows 12, 28, and 48 to display a top border, using the default Line Style. Border tab: Icon: Top Border 17. Change the format of the cost driver calculations in rows 22, 35, 37, and 39 to display as left- justified percentages with two decimal places. Number tab: Percentage Category: Decimal places: 2 Alignment tab: Horizontal: Left (Indent) Indent: 0 18. Accentuate the Cost per product information for each costing method by applying cell shading to columns A, B, and C of rows 2531 and 4251. Patterns tab: Color: Lightest grey 4-59 Traditional Costing Versus Activity-Based Costing Goal: Create an Excel spreadsheet to compare traditional costing versus activity-based costing. Use the results to answer questions about your findings. Scenario: Suppose Sunstar Corporation is one of Dell's circuit board suppliers. Sunstar currently uses traditional costing for making business decisions. At the urging of Dell, however, the company has decided to move to activity-based costing for circuit board production related to products PCB124 and PCB136. As one of the company's accountants, you have been asked to prepare a spreadsheet comparing the two costing methods for the next company board meeting. Your supervisor has given you the following quarterly data: Total Indirect Costs for the Quarter: Assembly $630,000 Soldering $270,000 Inspection $160,000 Direct costs (materials, labor) Machine hours (assembly) Number of units produced (soldering) Testing hours (inspection) PCB124 $162,400 480 6,000 6,000 PCB136 $178,240 1,080 4,000 8,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started