Answered step by step

Verified Expert Solution

Question

1 Approved Answer

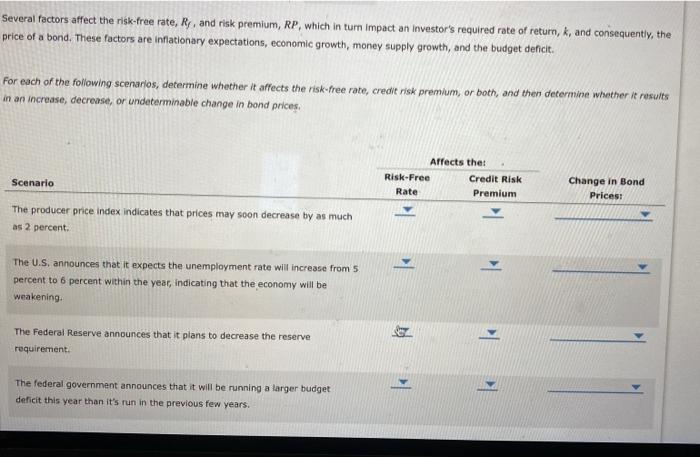

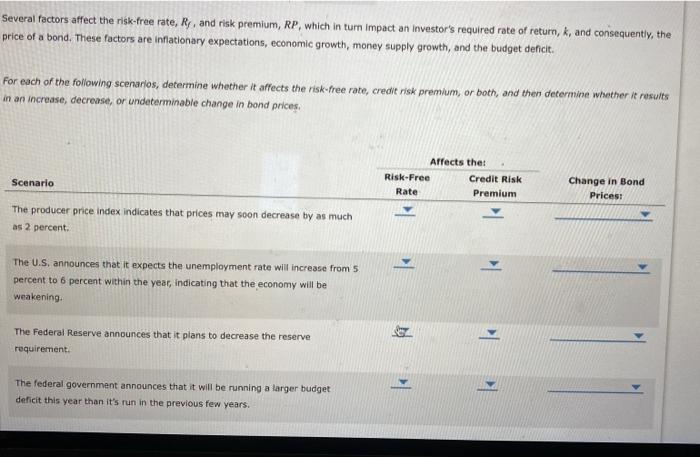

Please make answers clear, I have a hard time understand the information. Thank You;) feveral factors affect the risk-free rate, Rf, and risk premium, RP,

Please make answers clear, I have a hard time understand the information. Thank You;)

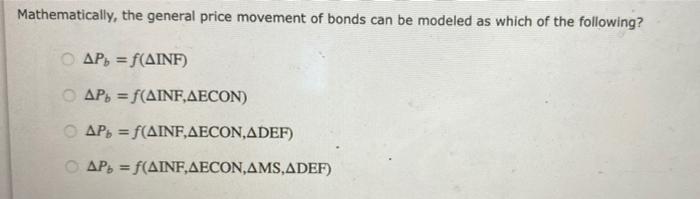

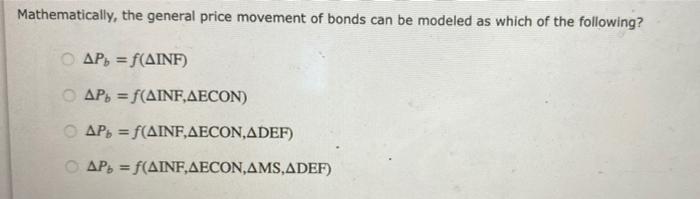

feveral factors affect the risk-free rate, Rf, and risk premium, RP, which in tum impact an investor's required rate of return, k, and consequently, the rice of a bond. These factors are inflationary expectations, economic growth, money supply growth, and the budget deficit. For each of the foliowing scenarios, determine whether it affects the risk-free rate, credit risk premium, or both, and then determine whether it results 7 an increase, decrease, or undeterminable change in bond prices, Mathematically, the general price movement of bonds can be modeled as which of the following? Pb=f(INF)Pb=f(INF,ECON)Pb=f(INF,ECON,DEF)Pb=f(INF,ECON,MS,DEF) feveral factors affect the risk-free rate, Rf, and risk premium, RP, which in tum impact an investor's required rate of return, k, and consequently, the rice of a bond. These factors are inflationary expectations, economic growth, money supply growth, and the budget deficit. For each of the foliowing scenarios, determine whether it affects the risk-free rate, credit risk premium, or both, and then determine whether it results 7 an increase, decrease, or undeterminable change in bond prices, Mathematically, the general price movement of bonds can be modeled as which of the following? Pb=f(INF)Pb=f(INF,ECON)Pb=f(INF,ECON,DEF)Pb=f(INF,ECON,MS,DEF)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started