please make anwser easy to read and understand, and show work. thank you!

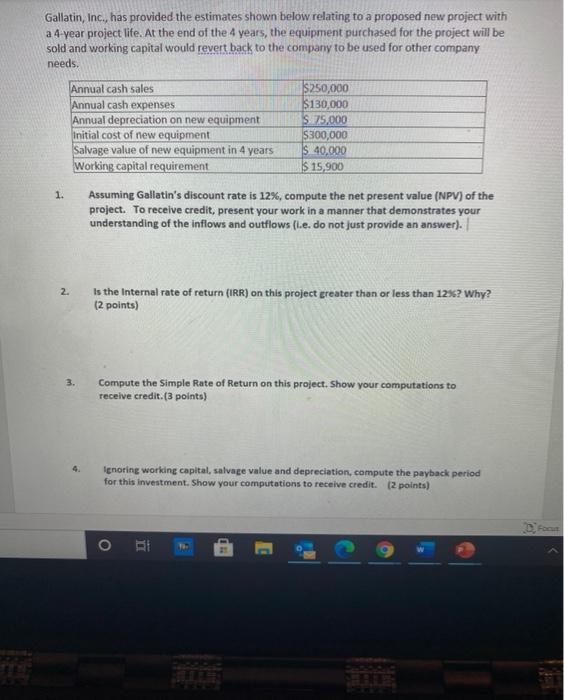

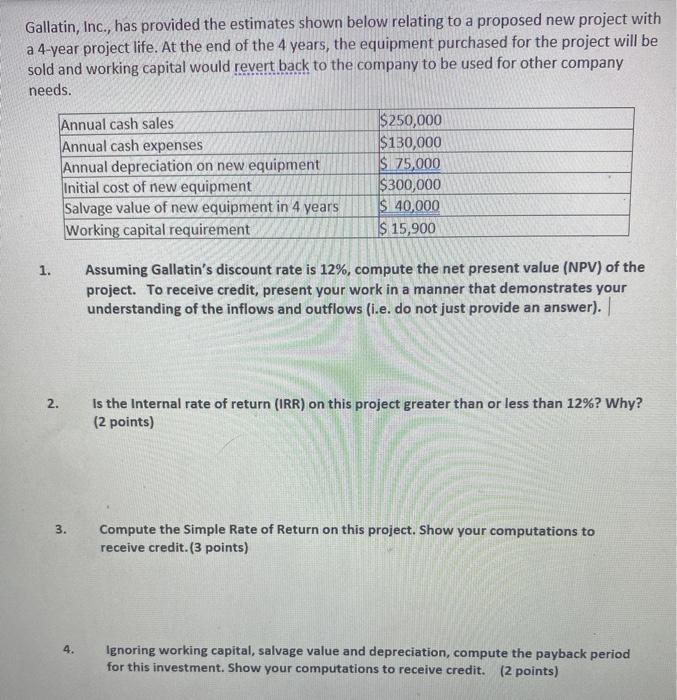

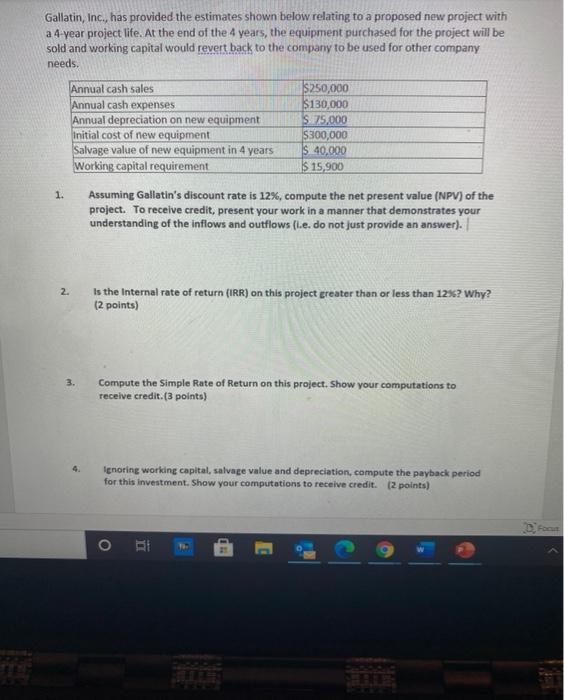

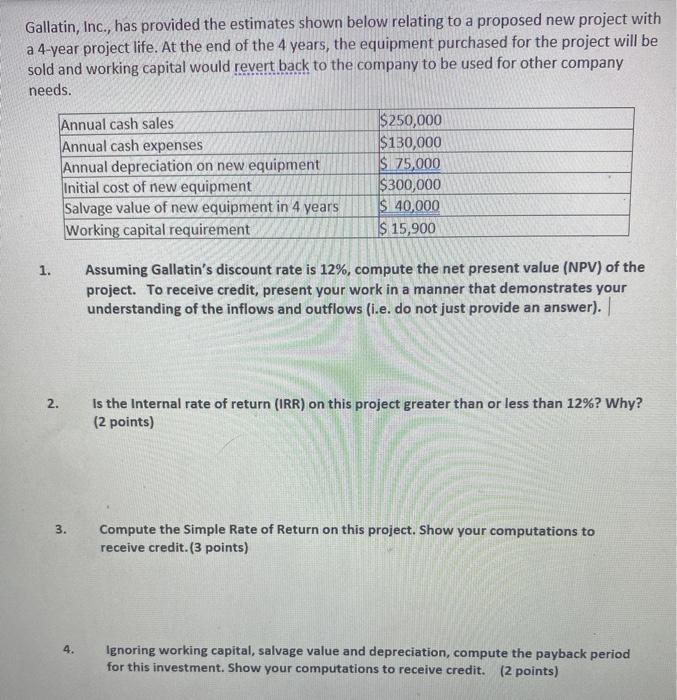

Gallatin, Inc., has provided the estimates shown below relating to a proposed new project with a 4-year project life. At the end of the 4 years, the equipment purchased for the project will be sold and working capital would revert back to the company to be used for other company needs. Annual cash sales Annual cash expenses Annual depreciation on new equipment Initial cost of new equipment Salvage value of new equipment in 4 years Working capital requirement $250,000 $130,000 $ 75,000 $300,000 $ 40,000 $ 15,900 1. Assuming Gallatin's discount rate is 12%, compute the net present value (NPV) of the project. To receive credit, present your work in a manner that demonstrates your understanding of the inflows and outflows (l.e. do not just provide an answer). 2. Is the Internal rate of return (IRR) on this project greater than or less than 12%? Why? (2 points) Compute the Simple Rate of Return on this project. Show your computations to receive credit. (3 points) Ignoring working capital, salvage value and depreciation, compute the payback period for this investment. Show your computations to receive credit. (2 points) Gallatin, Inc., has provided the estimates shown below relating to a proposed new project with a 4-year project life. At the end of the 4 years, the equipment purchased for the project will be sold and working capital would revert back to the company to be used for other company needs. Annual cash sales Annual cash expenses Annual depreciation on new equipment Initial cost of new equipment Salvage value of new equipment in 4 years Working capital requirement $250,000 $130,000 $ 75,000 $300,000 $ 40,000 $ 15,900 1. Assuming Gallatin's discount rate is 12%, compute the net present value (NPV) of the project. To receive credit, present your work in a manner that demonstrates your understanding of the inflows and outflows (i.e. do not just provide an answer). 2. Is the Internal rate of return (IRR) on this project greater than or less than 12%? Why? (2 points) 3 . Compute the Simple Rate of Return on this project. Show your computations to receive credit. (3 points) 4. Ignoring working capital, salvage value and depreciation, compute the payback period for this investment. Show your computations to receive credit. (2 points)