Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please make General Journal Entries prepare Multistep and Comprehensive Income Statement, Retained Earnings Statement, Statement of Stockholders Equity, Balance Sheet and Statement of Cash Flows

Please make General Journal Entries

prepare Multistep and Comprehensive Income Statement, Retained Earnings Statement, Statement of Stockholders Equity, Balance Sheet and Statement of Cash Flows for the following

-Please Journalize transactions 1-15 on General Journal

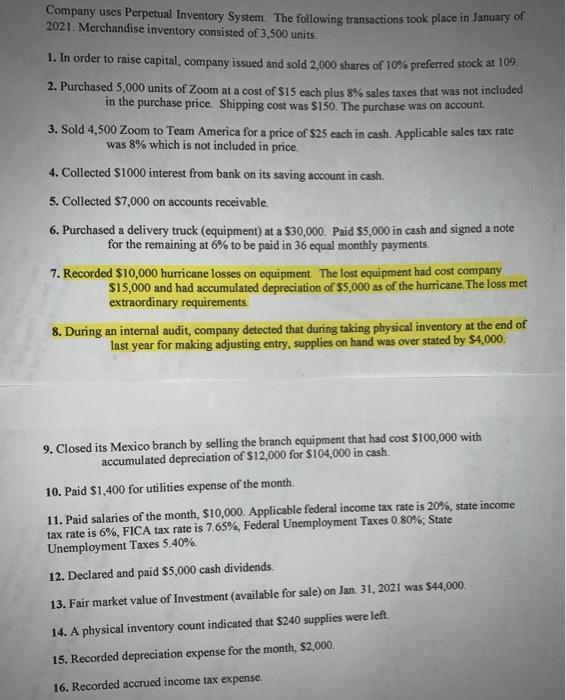

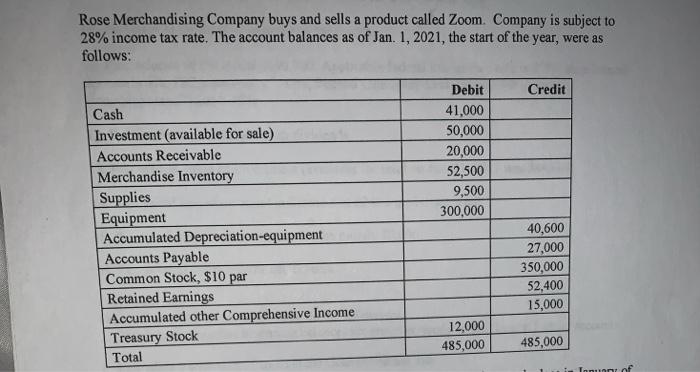

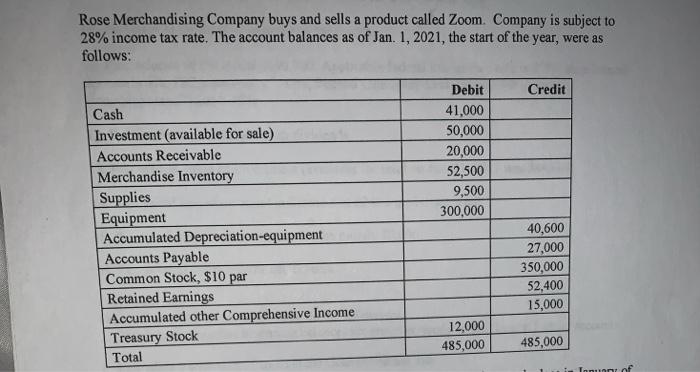

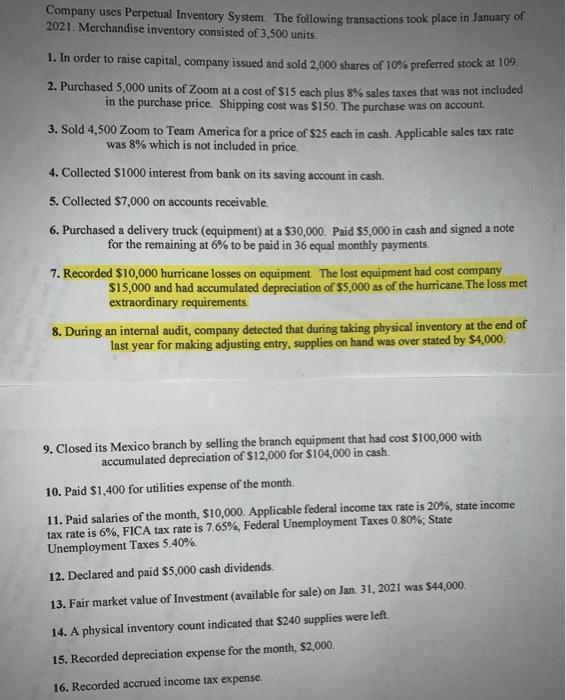

Rose Merchandising Company buys and sells a product called Zoom Company is subject to 28% income tax rate. The account balances as of Jan. 1, 2021, the start of the year, were as follows: Credit Debit 41,000 50,000 20,000 52,500 9,500 300,000 Cash Investment (available for sale) Accounts Receivable Merchandise Inventory Supplies Equipment Accumulated Depreciation equipment Accounts Payable Common Stock, $10 par Retained Earnings Accumulated other Comprehensive Income Treasury Stock Total 40,600 27,000 350,000 52,400 15,000 12,000 485,000 485,000 Innunt of Company uses Perpetual Inventory System. The following transactions took place in January of 2021. Merchandise inventory consisted of 3,500 units. 1. In order to raise capital company issued and sold 2,000 shares of 10% preferred stock at 109. 2. Purchased 5,000 units of Zoom at a cost of $15 each plus 8% sales taxes that was not included in the purchase price. Shipping cost was $150. The purchase was on account 3. Sold 4,500 Zoom to Team America for a price of $25 each in cash. Applicable sales tax rate was 8% which is not included in price. 4. Collected $1000 interest from bank on its saving account in cash. 5. Collected $7,000 on accounts receivable. 6. Purchased a delivery truck (equipment) at a $30,000. Paid $5,000 in cash and signed a note for the remaining at 6% to be paid in 36 cqual monthly payments. 7. Recorded $10,000 hurricane losses on equipment. The lost equipment had cost company $15,000 and had accumulated depreciation of $5,000 as of the hurricane. The loss met extraordinary requirements. 8. During an internal audit, company detected that during taking physical inventory at the end of last year for making adjusting entry, supplies on hand was over stated by 4,000. 9. Closed its Mexico branch by selling the branch equipment that had cost $100,000 with accumulated depreciation of $12,000 for $104,000 in cash. 10. Paid $1,400 for utilities expense of the month. 11. Paid salaries of the month, $10,000. Applicable federal income tax rate is 20%, state income tax rate is 6%, FICA tax rate is 7.65%, Federal Unemployment Taxes 0.80%; State Unemployment Taxes 5.40%. 12. Declared and paid $5,000 cash dividends. 13. Fair market value of Investment (available for sale) on Jan. 31, 2021 was $44,000 14. A physical inventory count indicated that $240 supplies were left 15. Recorded depreciation expense for the month, $2,000. 16. Recorded accrued income tax expense. Rose Merchandising Company buys and sells a product called Zoom Company is subject to 28% income tax rate. The account balances as of Jan. 1, 2021, the start of the year, were as follows: Credit Debit 41,000 50,000 20,000 52,500 9,500 300,000 Cash Investment (available for sale) Accounts Receivable Merchandise Inventory Supplies Equipment Accumulated Depreciation equipment Accounts Payable Common Stock, $10 par Retained Earnings Accumulated other Comprehensive Income Treasury Stock Total 40,600 27,000 350,000 52,400 15,000 12,000 485,000 485,000 Innunt of Company uses Perpetual Inventory System. The following transactions took place in January of 2021. Merchandise inventory consisted of 3,500 units. 1. In order to raise capital company issued and sold 2,000 shares of 10% preferred stock at 109. 2. Purchased 5,000 units of Zoom at a cost of $15 each plus 8% sales taxes that was not included in the purchase price. Shipping cost was $150. The purchase was on account 3. Sold 4,500 Zoom to Team America for a price of $25 each in cash. Applicable sales tax rate was 8% which is not included in price. 4. Collected $1000 interest from bank on its saving account in cash. 5. Collected $7,000 on accounts receivable. 6. Purchased a delivery truck (equipment) at a $30,000. Paid $5,000 in cash and signed a note for the remaining at 6% to be paid in 36 cqual monthly payments. 7. Recorded $10,000 hurricane losses on equipment. The lost equipment had cost company $15,000 and had accumulated depreciation of $5,000 as of the hurricane. The loss met extraordinary requirements. 8. During an internal audit, company detected that during taking physical inventory at the end of last year for making adjusting entry, supplies on hand was over stated by 4,000. 9. Closed its Mexico branch by selling the branch equipment that had cost $100,000 with accumulated depreciation of $12,000 for $104,000 in cash. 10. Paid $1,400 for utilities expense of the month. 11. Paid salaries of the month, $10,000. Applicable federal income tax rate is 20%, state income tax rate is 6%, FICA tax rate is 7.65%, Federal Unemployment Taxes 0.80%; State Unemployment Taxes 5.40%. 12. Declared and paid $5,000 cash dividends. 13. Fair market value of Investment (available for sale) on Jan. 31, 2021 was $44,000 14. A physical inventory count indicated that $240 supplies were left 15. Recorded depreciation expense for the month, $2,000. 16. Recorded accrued income tax expense -With the Beginning Balances given and the Journals please provide

Trial Balance

Multiple Step and Comprehensive Income Statemenf

Statement of Retained Earnings

Statement of Stockholders Equity

Balance Sheet

Statement of Cash Flows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started