Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please make my subscription worth and answer this question. I posted this 4 days ago and still haven't answeard yet. Requirements on how to answer

Please make my subscription worth and answer this question. I posted this 4 days ago and still haven't answeard yet. Requirements on how to answer this problem question is included in the picture.

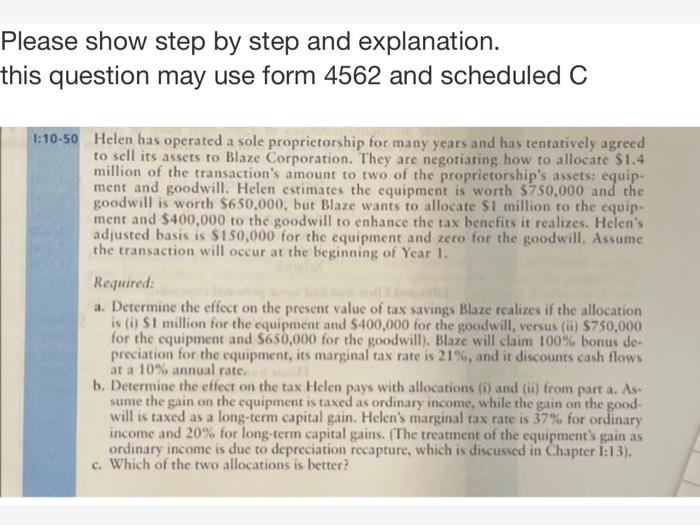

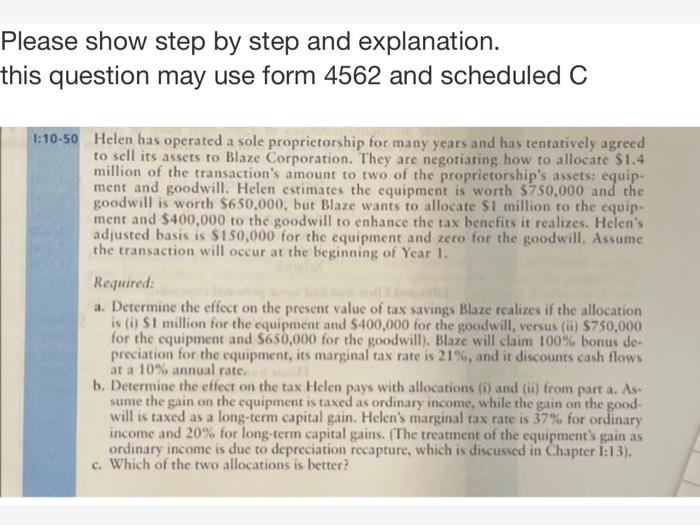

Please show step by step and explanation. this question may use form 4562 and scheduled C 1:10-50 Helen has operated a sole proprietorship for many years and has tentatively agreed to sell its assets to Blaze Corporation. They are negotiating how to allocate $1.4 million of the transaction's amount to two of the proprietorship's assets: equip ment and goodwill. Helen estimates the equipment is worth $750,000 and the goodwill is worth $650,000, but Blaze wants to allocate $1 million to the equip- ment and $400,000 to the goodwill to enhance the tax benefits it realizes. Helen's adjusted basis is $150,000 for the equipment and zero for the goodwill. Assume the transaction will occur at the beginning of Year 1. Required: a. Determine the effect on the present value of tax savings Blaze realizes if the allocation is (0) $1 million for the equipment and $400,000 for the goodwill, versus (i) $750,000 for the equipment and $650,000 for the goodwill). Blaze will claim 100% bonus de- preciation for the equipment, its marginal tax rate is 21%, and it discounts cash flows at a 10% annual rate. b. Determine the effect on the tax Helen pays with allocations (i) and (ii) from part a. As sume the gain on the equipment is taxed as ordinary income, while the gain on the good will is taxed as a long-term capital gain. Helen's marginal tax rate is 37% for ordinary income and 20% for long-term capital gains. (The treatment of the equipment's gain as ordinary income is due to depreciation recapture, which is discussed in Chapter 1:13). c. Which of the two allocations is better? Please show step by step and explanation. this question may use form 4562 and scheduled C 1:10-50 Helen has operated a sole proprietorship for many years and has tentatively agreed to sell its assets to Blaze Corporation. They are negotiating how to allocate $1.4 million of the transaction's amount to two of the proprietorship's assets: equip ment and goodwill. Helen estimates the equipment is worth $750,000 and the goodwill is worth $650,000, but Blaze wants to allocate $1 million to the equip- ment and $400,000 to the goodwill to enhance the tax benefits it realizes. Helen's adjusted basis is $150,000 for the equipment and zero for the goodwill. Assume the transaction will occur at the beginning of Year 1. Required: a. Determine the effect on the present value of tax savings Blaze realizes if the allocation is (0) $1 million for the equipment and $400,000 for the goodwill, versus (i) $750,000 for the equipment and $650,000 for the goodwill). Blaze will claim 100% bonus de- preciation for the equipment, its marginal tax rate is 21%, and it discounts cash flows at a 10% annual rate. b. Determine the effect on the tax Helen pays with allocations (i) and (ii) from part a. As sume the gain on the equipment is taxed as ordinary income, while the gain on the good will is taxed as a long-term capital gain. Helen's marginal tax rate is 37% for ordinary income and 20% for long-term capital gains. (The treatment of the equipment's gain as ordinary income is due to depreciation recapture, which is discussed in Chapter 1:13). c. Which of the two allocations is better Thanks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started