Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please make sure Part B is done, I need that table. = A (35 points) 1. Your client wants to purchase a new home and

Please make sure Part B is done, I need that table.

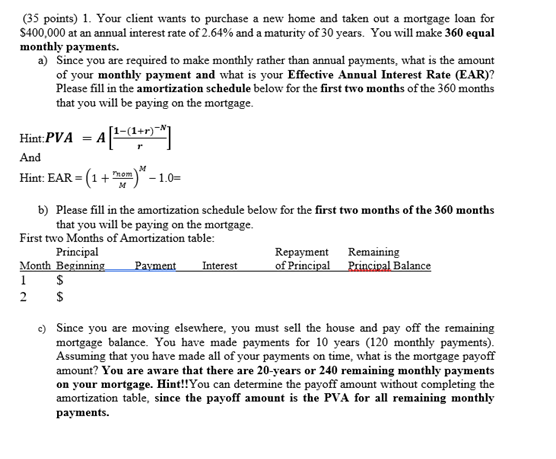

= A (35 points) 1. Your client wants to purchase a new home and taken out a mortgage loan for $400,000 at an annual interest rate of 2.64% and a maturity of 30 years. You will make 360 equal monthly payments. a) Since you are required to make monthly rather than annual payments, what is the amount of your monthly payment and what is your Effective Annual Interest Rate (EAR)? Please fill in the amortization schedule below for the first two months of the 360 months that you will be paying on the mortgage. Hint:PVA [1-(1+r)**] And Hint: EAR = (1+ -1.0= b) Please fill in the amortization schedule below for the first two months of the 360 months that you will be paying on the mortgage. First two Months of Amortization table: Principal Repayment Remaining Month Beginning Payment Interest of Principal Principal Balance 1 $ 2 $ M c) Since you are moving elsewhere, you must sell the house and pay off the remaining mortgage balance. You have made payments for 10 years (120 monthly payments). Assuming that you have made all of your payments on time, what is the mortgage payoff amount? You are aware that there are 20-years or 240 remaining monthly payments on your mortgage. Hint!!You can determine the payoff amount without completing the amortization table, since the payoff amount is the PVA for all remaining monthly paymentsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started