Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please make sure the full answer is visible when posted, thank you in advance Watts and Lyon are forming a partnership Watts invests $45,000 and

please make sure the full answer is visible when posted, thank you in advance

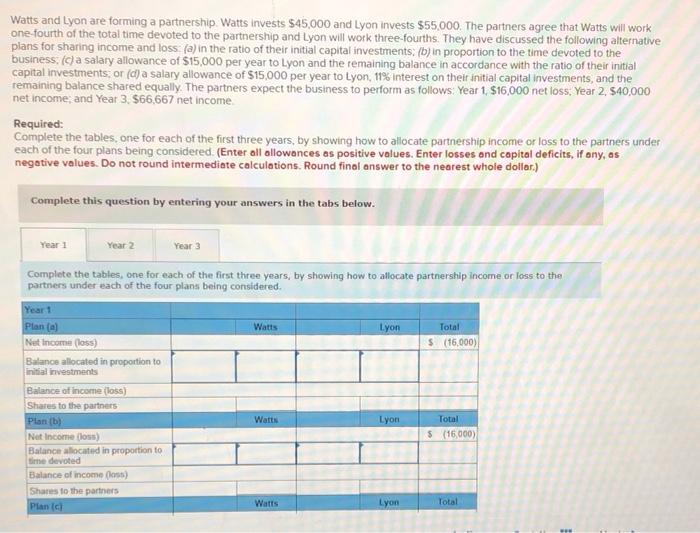

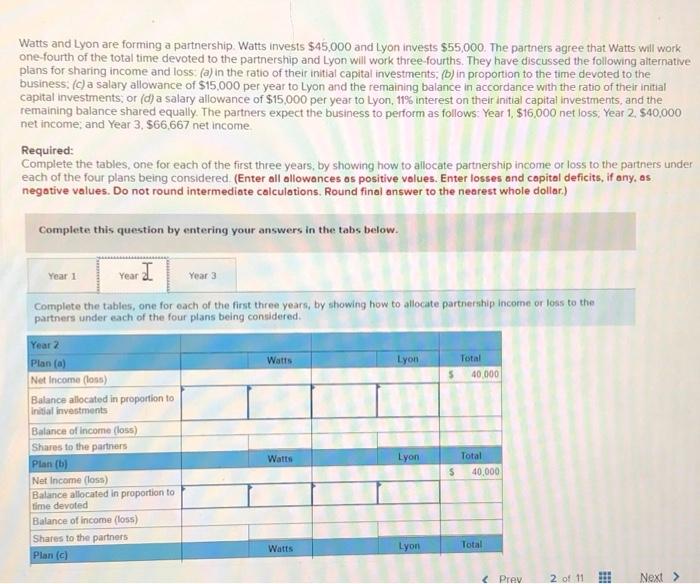

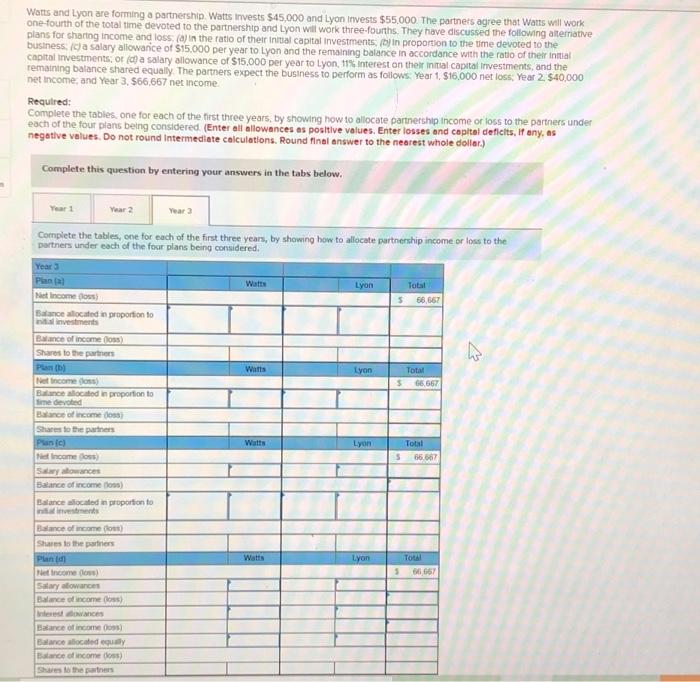

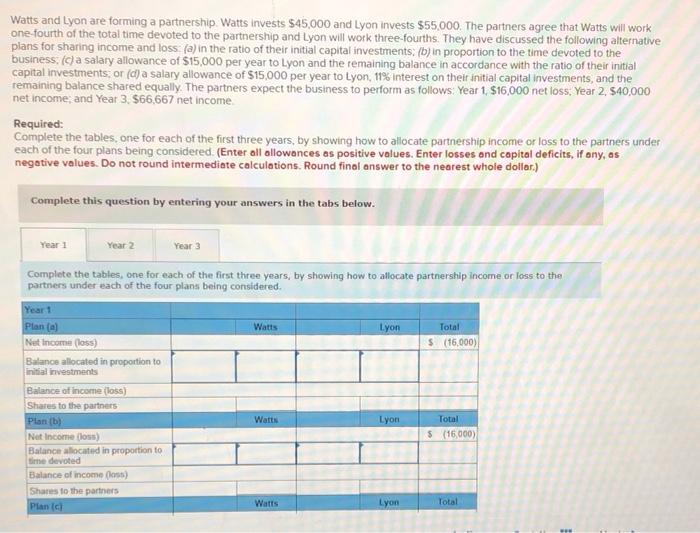

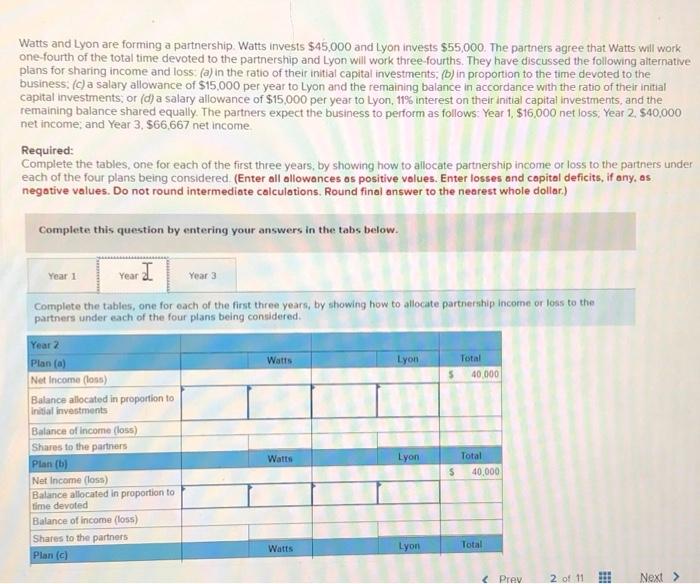

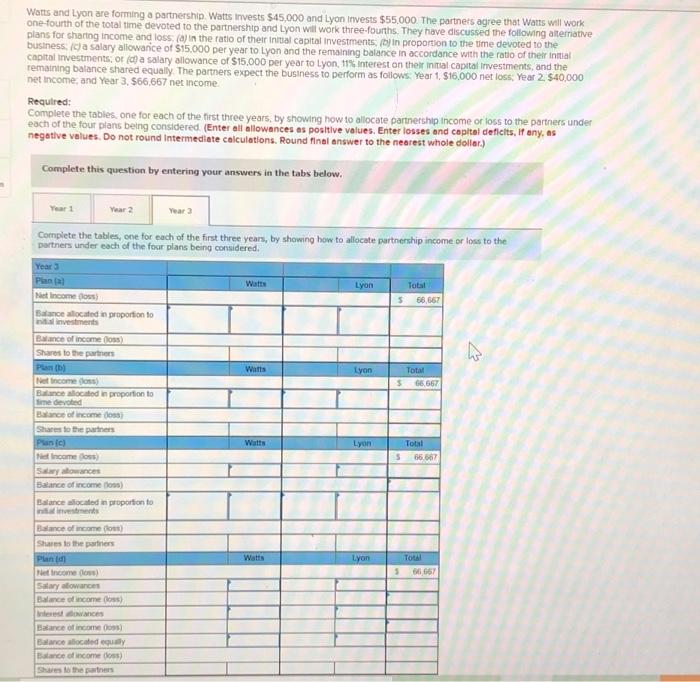

Watts and Lyon are forming a partnership Watts invests $45,000 and Lyon invests $55.000. The partners agree that Watts will work one fourth of the total time devoted to the partnership and Lyon will work three-fourths. They have discussed the following alternative plans for sharing income and loss (a) in the ratio of their initial capital investments, (b) in proportion to the time devoted to the business. (c) a salary allowance of $15,000 per year to Lyon and the remaining balance in accordance with the ratio of their initial capital investments; or (d) a salary allowance of $15,000 per year to Lyon, 11% interest on their initial capital investments, and the remaining balance shared equally. The partners expect the business to perform as follows: Year 1, $16,000 net loss, Year 2, $40,000 net income; and Year 3. $66,667 net income Required: Complete the tables, one for each of the first three years, by showing how to allocate partnership income or loss to the partners under each of the four plans being considered. (Enter all allowances as positive values. Enter losses and capital deficits, if any, as negative values. Do not round intermediate calculations. Round final answer to the nearest whole dollar) Complete this question by entering your answers in the tabs below. Year 1 Year 2 Year Complete the tables, one for each of the first three years, by showing how to allocate partnership income or loss to the partners under each of the four plans being considered. Year 1 Plan (0) Watts Lyon Total Net Income (less) $ (16,000) Balance allocated in proportion to Initial investments Balance of income Tass) Shates to the partners Plan (b) Watts Lyon Total Net Income loss) $ (16,000) Balance allocated in proportion to time devoted Balance of income (los) Share to the partners Watts Plan Lyon Total Watts and Lyon are forming a partnership. Watts invests $45,000 and Lyon invests $55,000. The partners agree that Watts will work one-fourth of the total time devoted to the partnership and Lyon will work three-fourths. They have discussed the following alternative plans for sharing income and loss (a) in the ratio of their initial capital investments. (b) in proportion to the time devoted to the business. (c) a salary allowance of $15,000 per year to Lyon and the remaining balance in accordance with the ratio of their initial capital investments, or (d) a salary allowance of $15,000 per year to Lyon, 11% interest on their initial capital investments, and the remaining balance shared equally. The partners expect the business to perform as follows: Year 1.516,000 net loss, Year 2, $40,000 net income, and Year 3, 566,667 net income Required: Complete the tables, one for each of the first three years, by showing how to allocate partnership income or loss to the partners under each of the four plans being considered (Enter all allowances os positive values. Enter losses and capital deficits, if any, as negative values. Do not round intermediate calculations. Round final answer to the nearest whole dollar) Complete this question by entering your answers in the tabs below. Year 1 year I Year 3 Complete the tables, one for each of the first three years, by showing how to allocate partnership income or loss to the partners under each of the four plans being considered year? Plan (0) Watts Lyon Total Net Income (ons) 40.000 Balance allocated in proportion to Initial Investments Balance of income floss) Shares to the partners Watts Plan (6) Lyon Total $ Net Income (los) 40,000 Balance allocated in proportion to time devoted Balance of income (loss) Shares to the partners Watts Plan (c) Lyon Total Warts and Lyon are forming a partnership Watts Invests $45,000 and Lyon invests $55.000. The partners agree that wants will work one-fourth of the total time devoted to the partnership and Lyon will work three-fourths. They have discussed the following alternative plans for sharing income and loss (a) in the ratio of their initial capital investments, (b) in proportion to the time devoted to the business. (C) a salary allowance of $15,000 per year to Lyon and the remaining balance in accordance with the ratio of their initial capital Investments of (ca salary allowance of $15,000 per year to Lyon, 11% Interest on their initial capital investments, and the remaining balance shared equally. The partners expect the business to perform as follows. Year 1, 516,000 net loss, Year 2. $40,000 net income, and Year 3. $66.667 net income Required: Complete the tables, one for each of the first three years, by showing how to allocate partnership income or loss to the partners under each of the four plans being considered. (Enter all allowances as positive values. Enter losses and capital deficits, if any, as negative values. Do not round Intermediate calculations. Round final answer to the nearest whole dollar) Complete this question by entering your answers in the tabs below. Year 3 Complete the tables, one for each of the first three years, by showing how to allocate partnership income or loss to the partners under each of the four plans being considered. Watts Lyon Total 68,667 5 w Watts Lyon Total 66,667 $ Watts Lyon Total 66667 5 Year 3 Plana Net Income.com ance allocated in proportion to investments Bance of income (0) Share to the partners Plan Net Income doss) Balance allocated in proportion to time devoted Bwance of incomess) Share to the partners Planc) Net Incomess) Sydowances Balance of income) Balance located in proportion to investments Bance of income (s) Share to the partners Planin Net Income dow) Salary allowances Balance of income (s) Interesowances Balance of income 003) Balance located Balance of income doss) Share to the partners Watts Lyon Total 66667 5 Watts and Lyon are forming a partnership Watts invests $45,000 and Lyon invests $55.000. The partners agree that Watts will work one fourth of the total time devoted to the partnership and Lyon will work three-fourths. They have discussed the following alternative plans for sharing income and loss (a) in the ratio of their initial capital investments, (b) in proportion to the time devoted to the business. (c) a salary allowance of $15,000 per year to Lyon and the remaining balance in accordance with the ratio of their initial capital investments; or (d) a salary allowance of $15,000 per year to Lyon, 11% interest on their initial capital investments, and the remaining balance shared equally. The partners expect the business to perform as follows: Year 1, $16,000 net loss, Year 2, $40,000 net income; and Year 3. $66,667 net income Required: Complete the tables, one for each of the first three years, by showing how to allocate partnership income or loss to the partners under each of the four plans being considered. (Enter all allowances as positive values. Enter losses and capital deficits, if any, as negative values. Do not round intermediate calculations. Round final answer to the nearest whole dollar) Complete this question by entering your answers in the tabs below. Year 1 Year 2 Year Complete the tables, one for each of the first three years, by showing how to allocate partnership income or loss to the partners under each of the four plans being considered. Year 1 Plan (0) Watts Lyon Total Net Income (less) $ (16,000) Balance allocated in proportion to Initial investments Balance of income Tass) Shates to the partners Plan (b) Watts Lyon Total Net Income loss) $ (16,000) Balance allocated in proportion to time devoted Balance of income (los) Share to the partners Watts Plan Lyon Total Watts and Lyon are forming a partnership. Watts invests $45,000 and Lyon invests $55,000. The partners agree that Watts will work one-fourth of the total time devoted to the partnership and Lyon will work three-fourths. They have discussed the following alternative plans for sharing income and loss (a) in the ratio of their initial capital investments. (b) in proportion to the time devoted to the business. (c) a salary allowance of $15,000 per year to Lyon and the remaining balance in accordance with the ratio of their initial capital investments, or (d) a salary allowance of $15,000 per year to Lyon, 11% interest on their initial capital investments, and the remaining balance shared equally. The partners expect the business to perform as follows: Year 1.516,000 net loss, Year 2, $40,000 net income, and Year 3, 566,667 net income Required: Complete the tables, one for each of the first three years, by showing how to allocate partnership income or loss to the partners under each of the four plans being considered (Enter all allowances os positive values. Enter losses and capital deficits, if any, as negative values. Do not round intermediate calculations. Round final answer to the nearest whole dollar) Complete this question by entering your answers in the tabs below. Year 1 year I Year 3 Complete the tables, one for each of the first three years, by showing how to allocate partnership income or loss to the partners under each of the four plans being considered year? Plan (0) Watts Lyon Total Net Income (ons) 40.000 Balance allocated in proportion to Initial Investments Balance of income floss) Shares to the partners Watts Plan (6) Lyon Total $ Net Income (los) 40,000 Balance allocated in proportion to time devoted Balance of income (loss) Shares to the partners Watts Plan (c) Lyon Total Warts and Lyon are forming a partnership Watts Invests $45,000 and Lyon invests $55.000. The partners agree that wants will work one-fourth of the total time devoted to the partnership and Lyon will work three-fourths. They have discussed the following alternative plans for sharing income and loss (a) in the ratio of their initial capital investments, (b) in proportion to the time devoted to the business. (C) a salary allowance of $15,000 per year to Lyon and the remaining balance in accordance with the ratio of their initial capital Investments of (ca salary allowance of $15,000 per year to Lyon, 11% Interest on their initial capital investments, and the remaining balance shared equally. The partners expect the business to perform as follows. Year 1, 516,000 net loss, Year 2. $40,000 net income, and Year 3. $66.667 net income Required: Complete the tables, one for each of the first three years, by showing how to allocate partnership income or loss to the partners under each of the four plans being considered. (Enter all allowances as positive values. Enter losses and capital deficits, if any, as negative values. Do not round Intermediate calculations. Round final answer to the nearest whole dollar) Complete this question by entering your answers in the tabs below. Year 3 Complete the tables, one for each of the first three years, by showing how to allocate partnership income or loss to the partners under each of the four plans being considered. Watts Lyon Total 68,667 5 w Watts Lyon Total 66,667 $ Watts Lyon Total 66667 5 Year 3 Plana Net Income.com ance allocated in proportion to investments Bance of income (0) Share to the partners Plan Net Income doss) Balance allocated in proportion to time devoted Bwance of incomess) Share to the partners Planc) Net Incomess) Sydowances Balance of income) Balance located in proportion to investments Bance of income (s) Share to the partners Planin Net Income dow) Salary allowances Balance of income (s) Interesowances Balance of income 003) Balance located Balance of income doss) Share to the partners Watts Lyon Total 66667 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started