Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please make sure the whole answer is visible when posted, thank you in advance! Kohler Corporation reports the following components of stockholders' equity at December

please make sure the whole answer is visible when posted, thank you in advance!

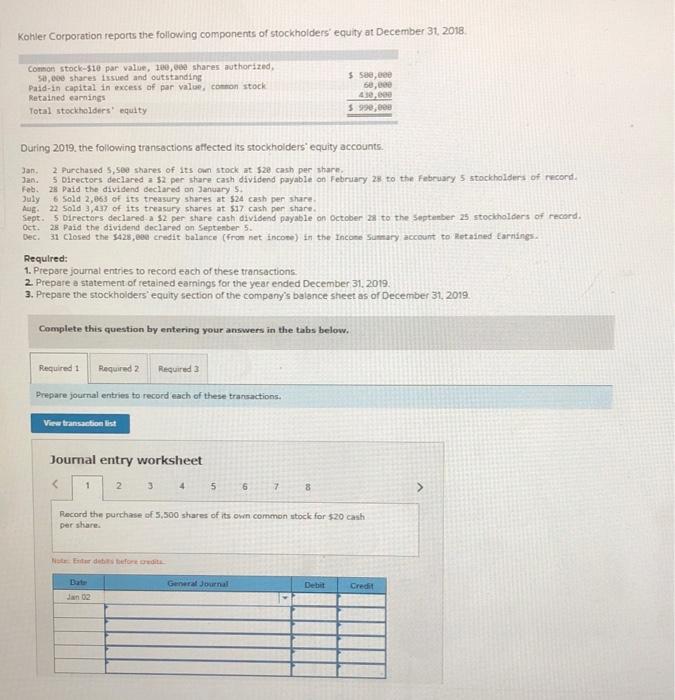

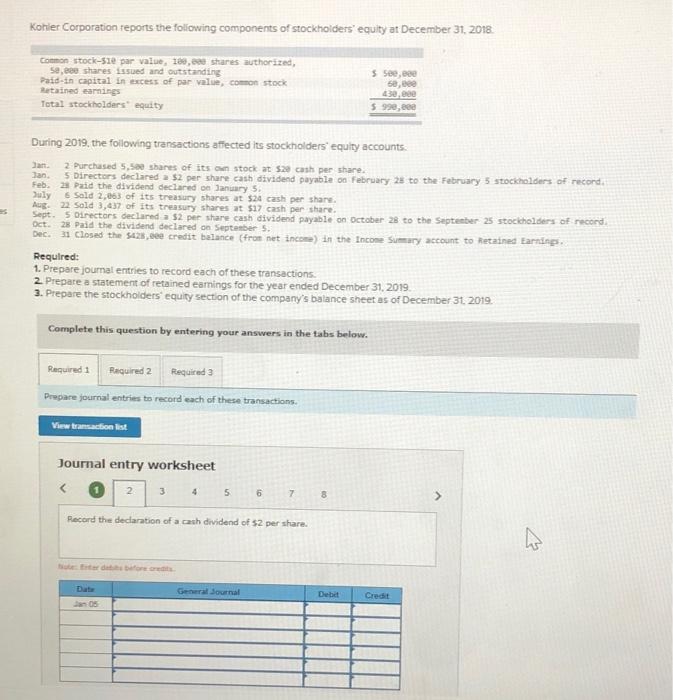

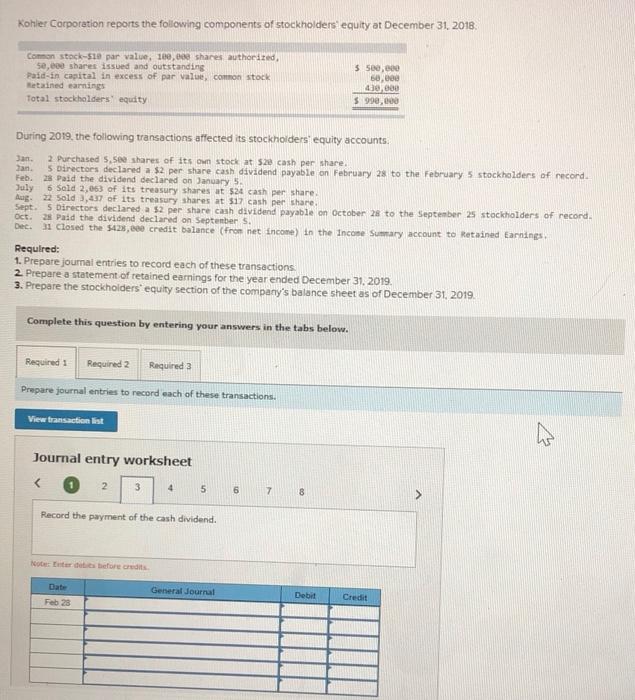

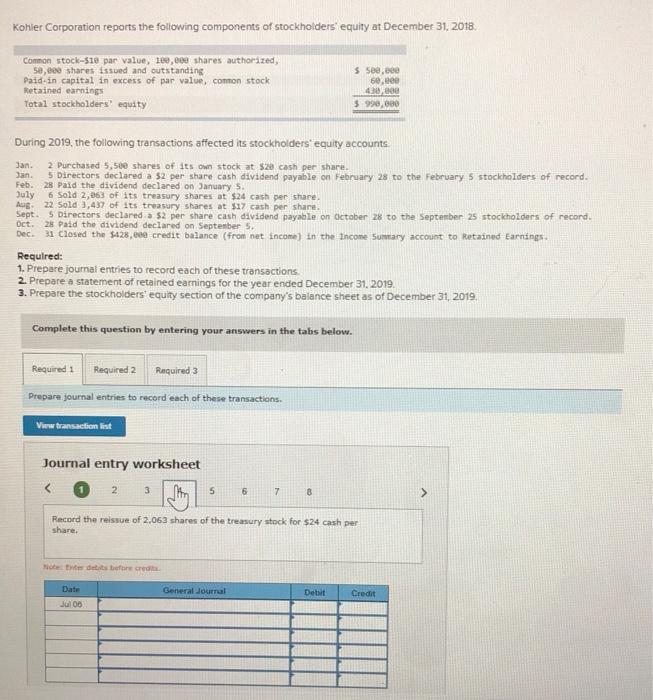

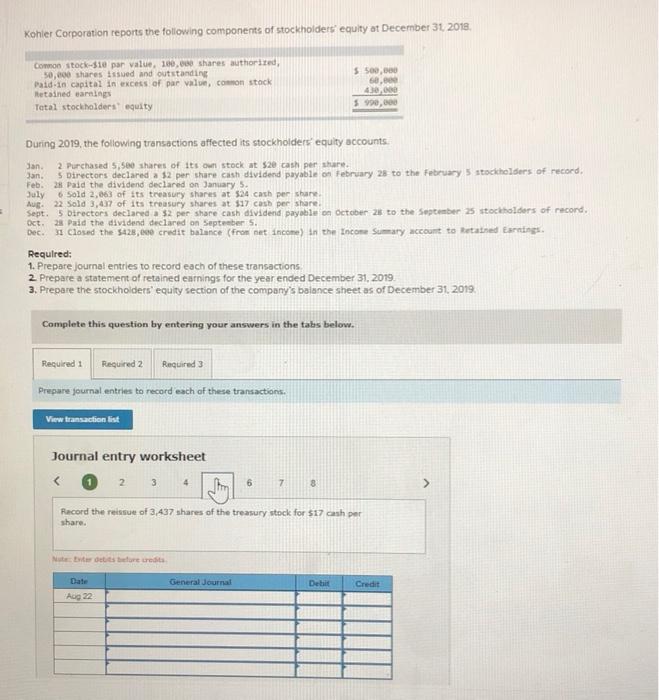

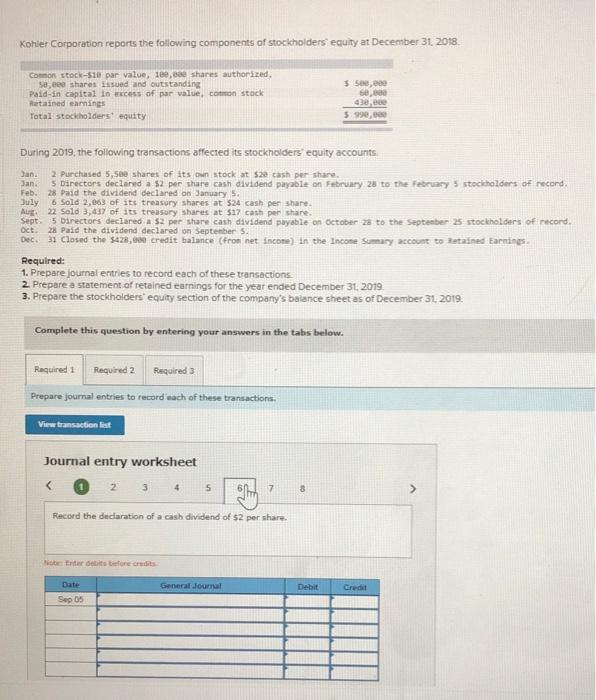

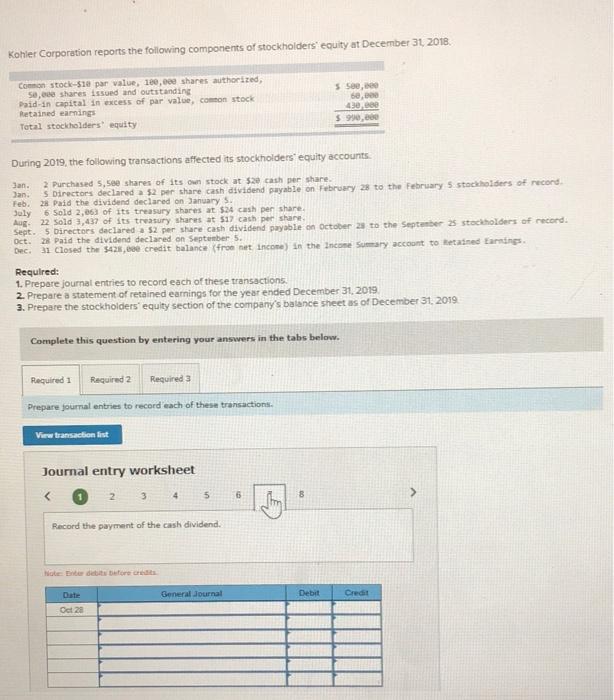

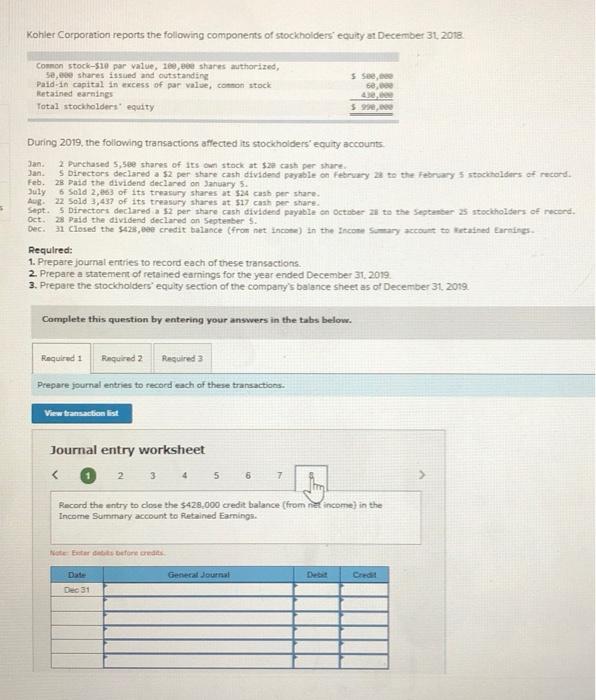

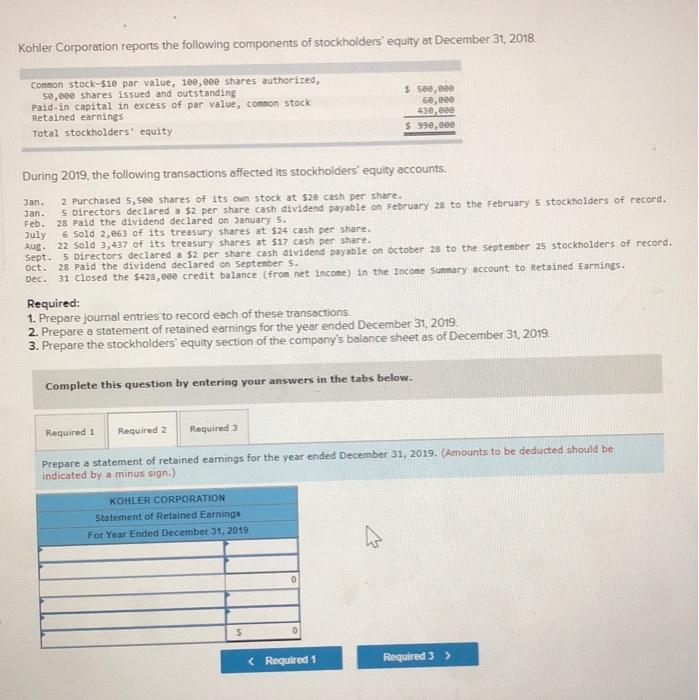

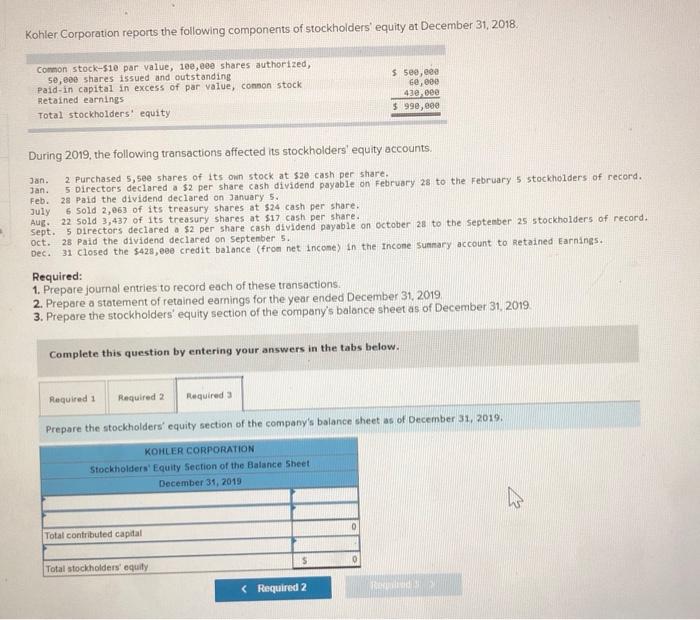

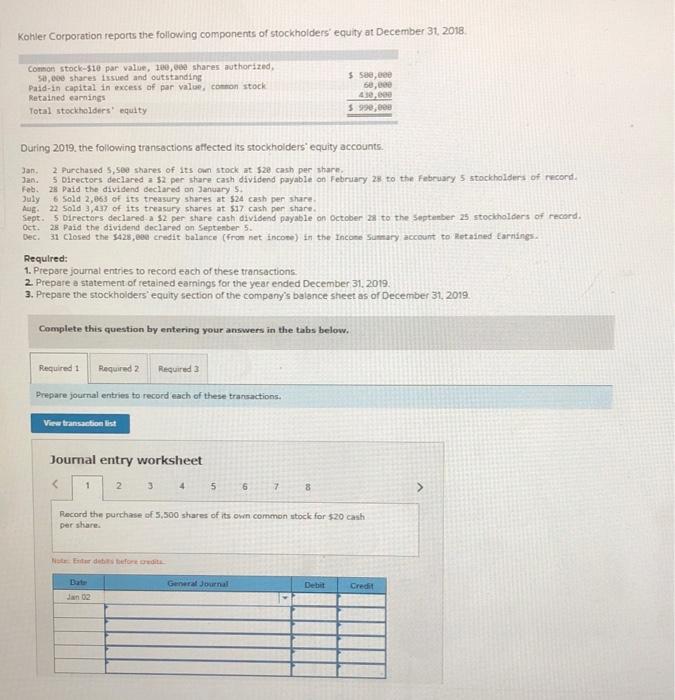

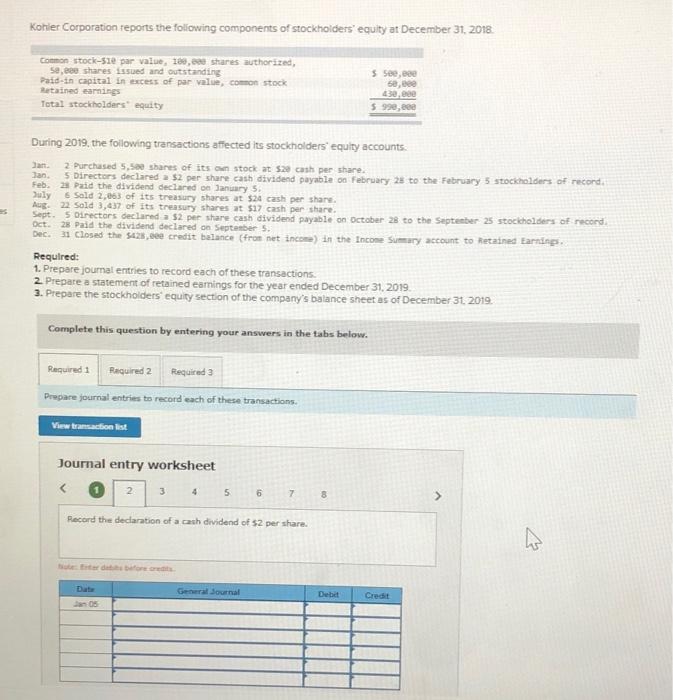

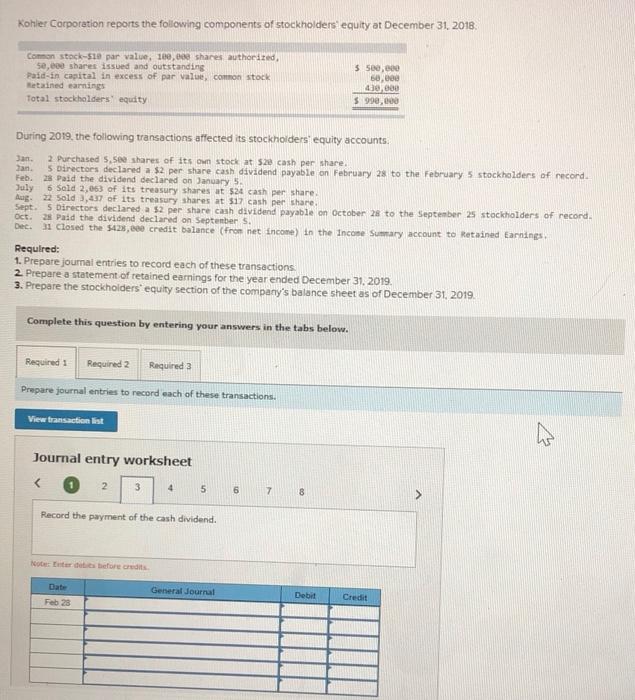

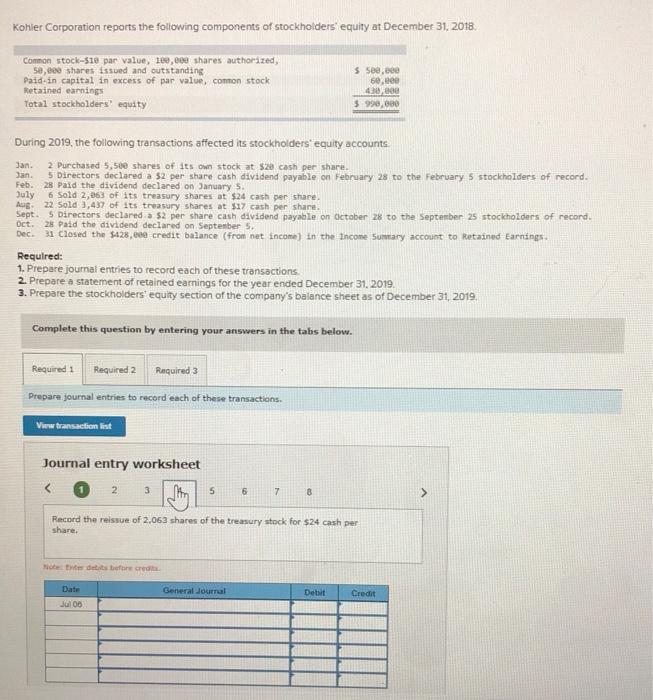

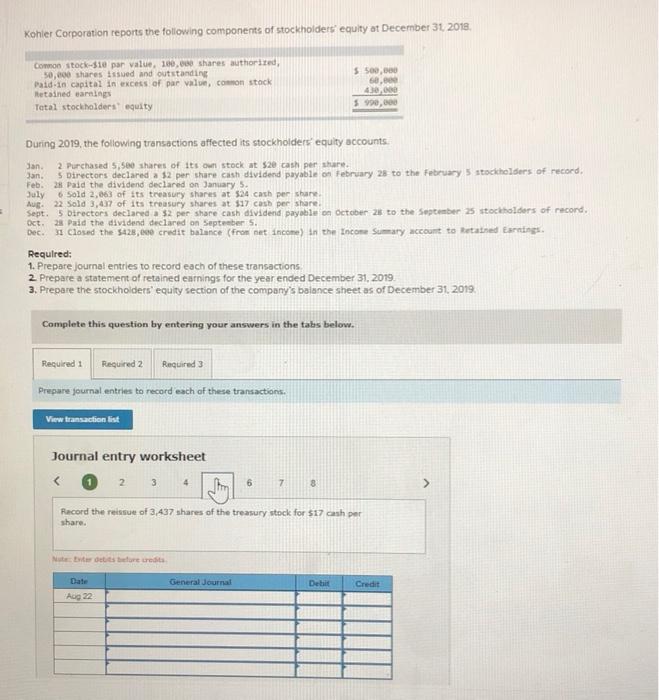

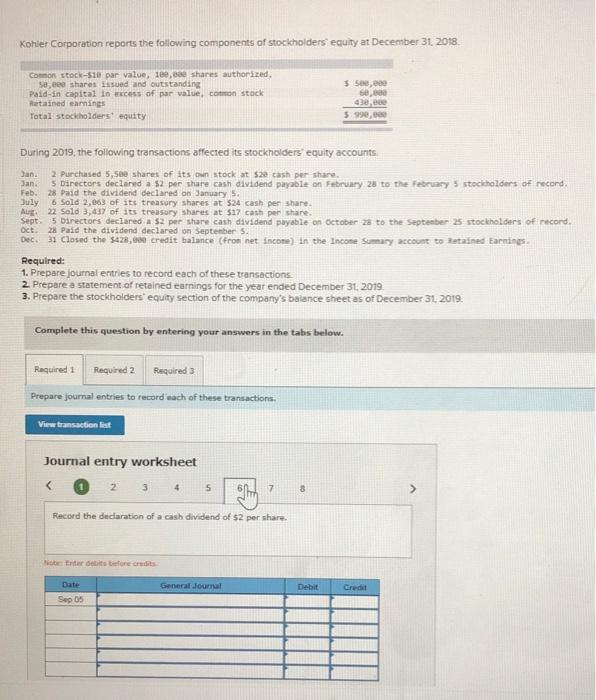

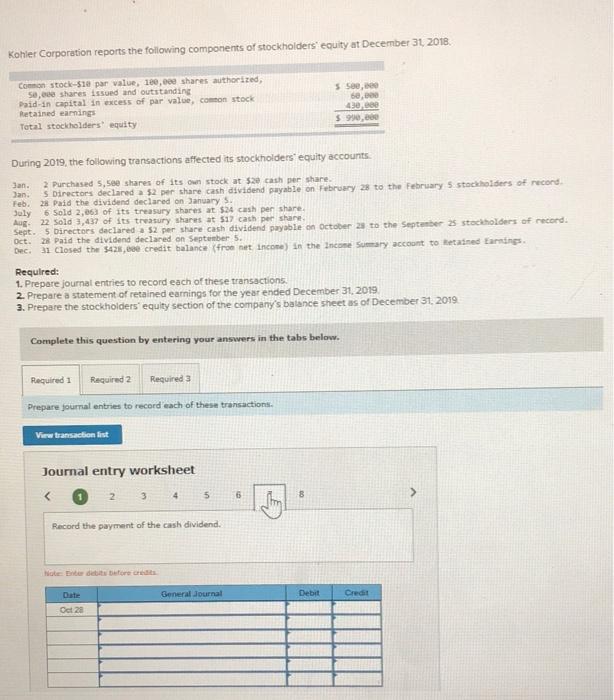

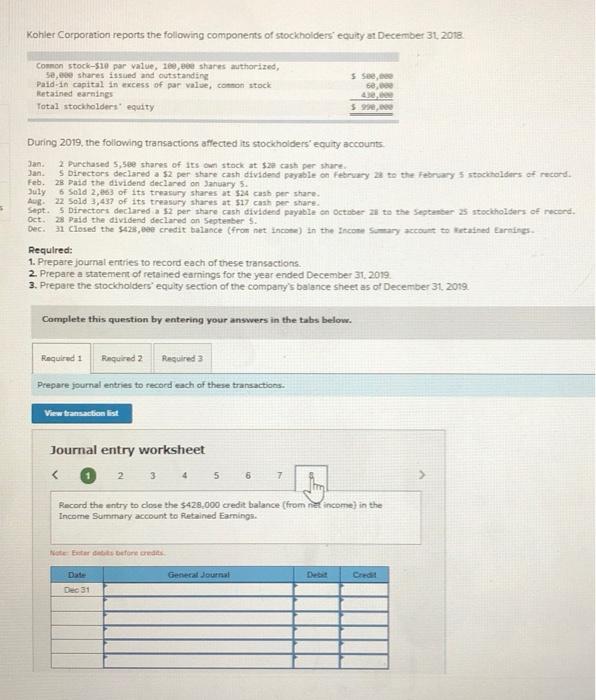

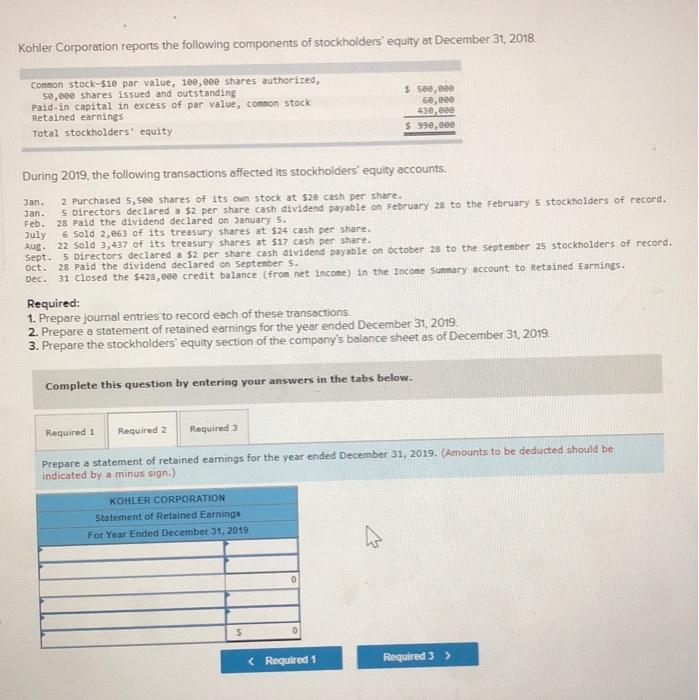

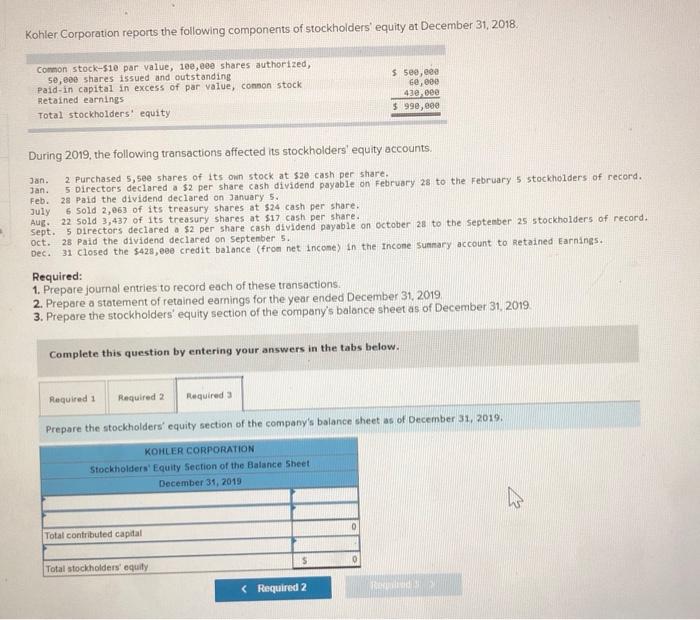

Kohler Corporation reports the following components of stockholders' equity at December 31, 2018 Comon stock-$10 par value, 100,000 shares authorized 50,000 shares issued and outstanding Paid in capital in excess of par value, common stock Retained earnings Total stockholders' equity $ sae, 60.000 430,000 $ 990,000 During 2019, the following transactions affected its stockholders' equity accounts. Jan 2 Purchased 5, see shares of its own stock at $28 cash per share. Jan. 5 Directors declared a 32 per share cash dividend payable on February 28 to the February 5 stockholders of record Feb 28 Paid the dividend declared on January 5. July 6 Sold 2,663 of its treasury shares at 524 cash per share. Aug 22 Sold 3,437 of its treasury shares at $17 cash per share Sept. 5 Directors declared a 32 per share cash dividend payable on October 23 to the September 25 stockholders of record Oct. 28 Paid the dividend declared on September 5. Dec 31 closed the s4 28, con credit balance (from net income) in the income Summary account to Retained Earnings. Required: 1. Prepare journal entries to record each of these transactions 2. Prepare a statement of retained earnings for the year ended December 31, 2019. 3. Prepare the stockholders' equity section of the company's balance sheet as of December 31, 2019. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare journal entries to record each of these transactions. View transaction list Journal entry worksheet Record the declaration of a cash dividend of $2 per share. 2 Sardor General Sournal Debet Credit 05 Kohler Corporation reports the following components of stockholders' equity at December 31, 2018 Comon stock-$10 par value, 100,000 shares authorized, 5e, share issued and outstanding Paid-in capital in excess of par value common stock Metained earnings Total stockholders' equity 5 500,000 50,00 dere $ 990,00 During 2019, the following transactions affected its stockholders equity accounts. Jan. 2. Purchased 5.500 shares of its own stock at 5.20 cash per share 5 Directors declared a $2 per share cash dividend payable on February 28 to the February 5 stockholders of record Feb. 28 Paid the dividend declared on January 5 July 6 Sold 2,063 of its treasury shares at $24 cash per share Aug. 22 Sold 3,437 of its treasury shares at 317 cash per share. Sept. 5 Directors declared a 2 per share cash dividend payable on October 28 to the September 25 stockholders of record 28 Paid the dividend declared on September 5. Dec. 1 Closed the 5428,800 credit balance (From net income in the Income Summary account to Retained Earnings Required: 1. Prepare joumai entries to record each of these transactions 2. Prepare a statement of retained earnings for the year ended December 31, 2019, 3. Prepare the stockholders' equity section of the company's balance sheet as of December 31, 2019. Oct Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required Prepare journal entries to record each of these transactions. View transaction list Journal entry worksheet Record the payment of the cash dividend. er det before credits Bate Feb 28 General Journal Debit Credit Kohler Corporation reports the following components of stockholders equity at December 31, 2018 Common stock-510 par value, 180,000 shares authorized, Se,eee shares issued and outstanding Paid in capital in excess of par value, common stock Retained earnings Total stockholders' equity s see, 60,00 430,00 $ 990,00 During 2019, the following transactions affected its stockholders' equity accounts Jan. 2 Purchased 5,500 shares of its own stock at $20 cash per share. Jan. 5 Directors declared a 52 per share cash dividend payable on February 28 to the February 5 stockholders of record Feb. 28 Paid the dividend declared on January 5. July 6 Sold 2,063 of its treasury shares at $24 cash per share Aug 22 Sold 3,437 of its treasury shares at $27 cash per share Oct. 28 Paid the dividend declared on September 5. Sept. 5 Directors declared a $2 per share cash dividend payable on October 28 to the September 25 stockholders of record. Dec. 31 closed the $428,000 credit balance (fron net income) in the Income Summary account to Retained Earnings. Required: 1. Prepare journal entries to record each of these transactions 2. Prepare a statement of retained earnings for the year ended December 31, 2019. 3. Prepare the stockholders' equity section of the company's balance sheet as of December 31, 2019, Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare journal entries to record each of these transactions. View transaction list Journal entry worksheet 2 3 Then 5 6 7 Record the reissue of 2,063 shares of the treasury stock for $24 cash per share. Note des before credit General Journal Debit Credit Jul 00 Kohler Corporation reports the following components of stockholders' equity at December 31 2018 Common stock-$10 par value. 100.000 shares authorized, 50,000 shares issued and outstanding Paid in capital in excess of par value, common stock Netined earnings Total stockholders equity $500,000 60, 436,00 5990,000 During 2019, the following transactions affected its stockholders equity accounts Jan 2. Purchased 5,500 shares of its own stock at $2e cash per shume Jan. 5 Directors declared a 12 per share cash dividend payable on February 28 to the February 5 stockholders of record Feb 28 Paid the dividend declared on January 5. July 6 Sold 2,063 of its treasury shares at $24 cash per share Aug. 22 Sold 3,437 of its treasury shares at $17 cash per share Sept. 5 Directors declared a $2 per share cash dividend payable on October 25 to the September 25 stockholders of record. Oct. 23 Paid the dividend declared on September 5. Dec. 31 Closed the 5428,000 credit balance (from net income to the Income Sumary account to retained Earnings. Required: 1. Prepare journal entries to record each of these transactions 2. Prepare a statement of retained earnings for the year ended December 31, 2019 3. Prepare the stockholders equity section of the company's balance sheet as of December 31, 2019. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare journal entries to record each of these transactions, View transaction list Journal entry worksheet 2 3 som Racord the rest of 3,437 shares of the treasury stock for $17 cash per 4. 6 7 8 > share. Nettore credit General Journal Debit Credit Aug 22 Kohler Corporation reports the following components of stockholders' equity at December 31, 2018 Common stock-510 par value, 100,000 shares authorized se, eee shares issued and outstanding Paid in capital in excess of par value, common stock Ratained earnings Total stockholders equity $500,000 60,000 438. 5990,00 Jan. Jan. Feb. 28 Paid the dividend declared on January 5. July During 2019, the following transactions affected its stockholders equity accounts 2 Purchased 5,5ee shares of its own stock at $20 cash per share Directors declared a $2 per there cash dividend payable on February 28 to the february 3 stockholders of record. 6 Sold 2,063 of its treasury shares at 524 cash per share Aug 22 Sold 3, 437 of its treasury Shares at $17 cash per share Supt. 5 Directors declared as per share cash dividend payable on October 23 to the September stockholders of record. Dec. 1 closed the sazs, credit balance (from net income) in the Income Somasy account to retained Earnings. Required: 1. Prepare journal entries to record each of these transactions 2. Prepare a statement of retained earnings for the year ended December 31, 2019. 3. Prepare the stockholders' equity section of the company's balance sheet as of December 31, 2019. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required Prepare journal entries to record each of these transaction. View transaction list Journal entry worksheet Record the entry to close the $428.000 credit balance (from income) in the Income Summary account to Retained Earnings. Note Earts forts General Journal Credit Dec 31 Kohler Corporation reports the following components of stockholders' equity at December 31, 2018 Common stock-$10 par value, 180,000 shares authorized, 50,000 shares issued and outstanding Paid in capital in excess of par value, common stock Retained earnings Total stockholders' equity $ see, mee 60,00 430, eee $ 990,00 During 2019, the following transactions affected its stockholders' equity accounts. Jan. 2 Purchased 5,500 shares of its own stock at $28 cash per share. jan. 5 Directors declared $2 per share cash dividend payable on February 28 to the February 5 stockholders of record. Feb. 28 Paid the dividend declared on January 5. July 6 Sold 2,863 of its treasury shares at $24 cash per share. Aug. 22 Sold 3,437 of its treasury shares at $17 cash per share. Sept. 5 Directors declared a $2 per share cash dividend payable on October 28 to the September 25 stockholders of record. Oct. 28 Paid the dividend declared on September 5. Dec. 31 Closed the $428,eee credit balance (fron net incone) in the Income Summary account to Retained Earnings. Required: 1. Prepare journal entries to record each of these transactions 2. Prepare a statement of retained earnings for the year ended December 31, 2019 3. Prepare the stockholders' equity section of the company's balance sheet as of December 31, 2019 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a statement of retained earnings for the year ended December 31, 2019. (Amounts to be deducted should be indicated by a minus sign.) KOHLER CORPORATION Statement of Retained Earnings For Year Ended December 31, 2019 $ Kohler Corporation reports the following components of stockholders' equity at December 31, 2018 Common stock-$10 par value, 100,000 shares authorized, 50,000 shares issued and outstanding Paid in capital in excess of par value, connon stock Retained earnings Total stockholders' equity $ 500,000 60,000 430, cee 5990, see During 2019, the following transactions affected its stockholders' equity accounts Jan. 2 Purchased 5,500 shares of its own stock at $20 cash per share. Jan. 5 Directors declared a $2 per share cash dividend payable on February 28 to the February 5 stockholders of record. Feb. 28 Paid the dividend declared on January 5. July 6 Sold 2,063 of its treasury shares at $24 cash per share. Aug. 22 Sold 3,437 of its treasury shares at $17 cash per share. Sept. 5 Directors declared a $2 per share cash dividend payable on October 28 to the September 25 stockholders of record. Oct. 28 Paid the dividend declared on September 5. Dec. 31 Closed the $428,000 credit balance (from net income) in the Incone Sunnary account to Retained Earnings. Required: 1. Prepare journal entries to record each of these transactions 2. Prepare a statement of retained earnings for the year ended December 31, 2019 3. Prepare the stockholders' equity section of the company's balance sheet as of December 31, 2019. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare the stockholders' equity section of the company's balance sheet as of December 31, 2019, KOHLER CORPORATION Stockholders' Equity Section of the Balance Sheet December 31, 2013 his 0 Total contributed capital $ 0 Total stockholders equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started