PLEASE MAKE SURE TO COMPLETE ALL REQUIREMENTS. THIS IS ONE QUESTION AND ALL PARTS OF QUESTION ARE HERE.

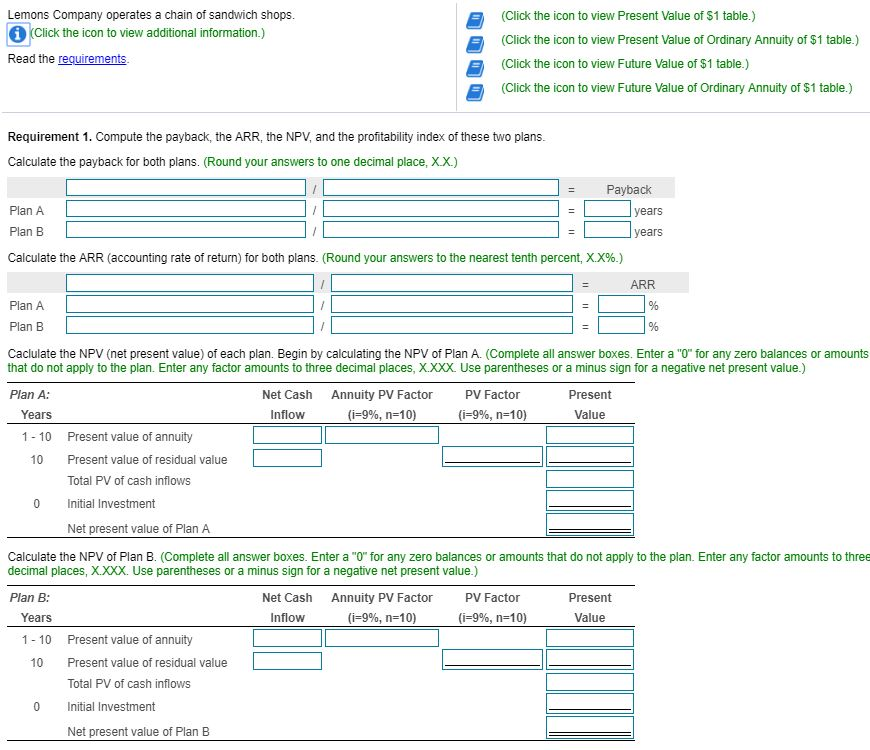

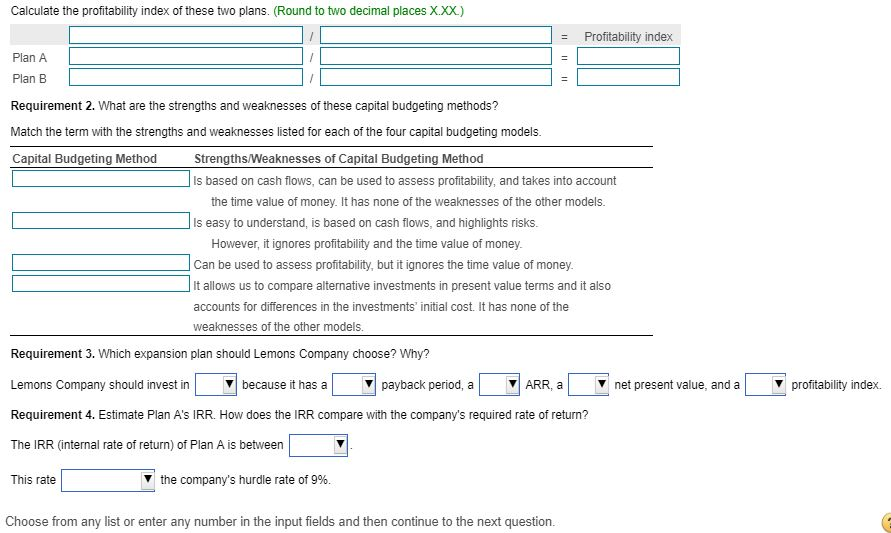

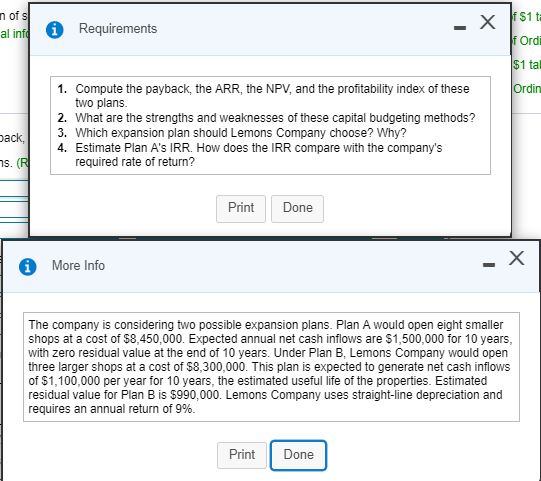

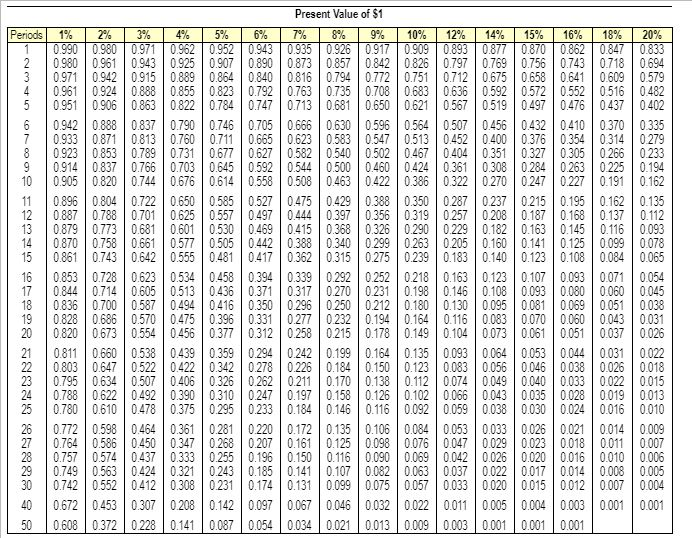

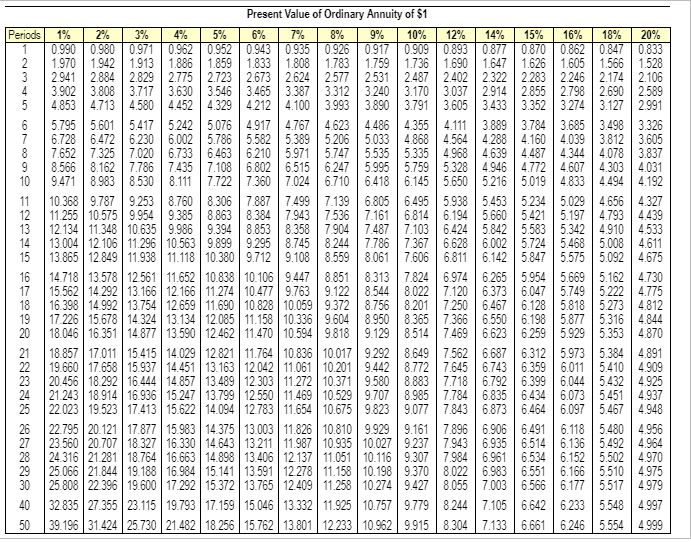

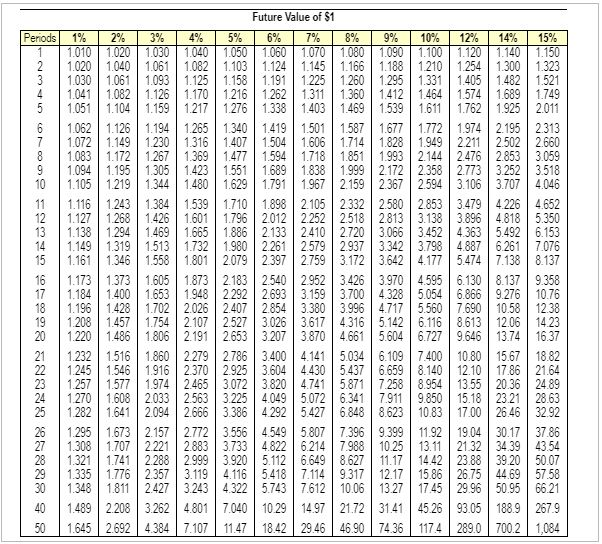

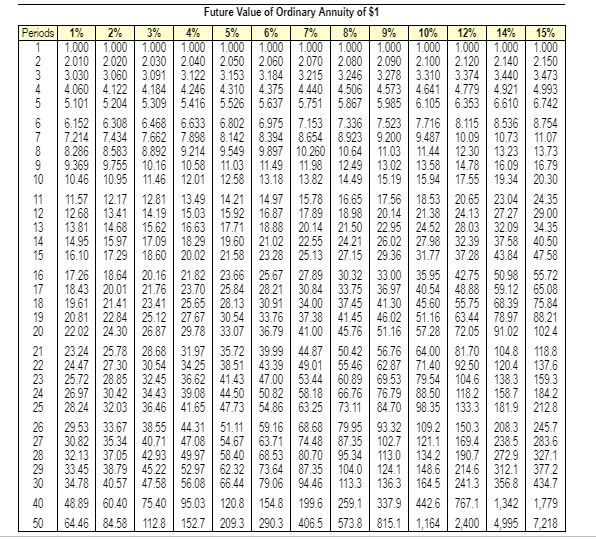

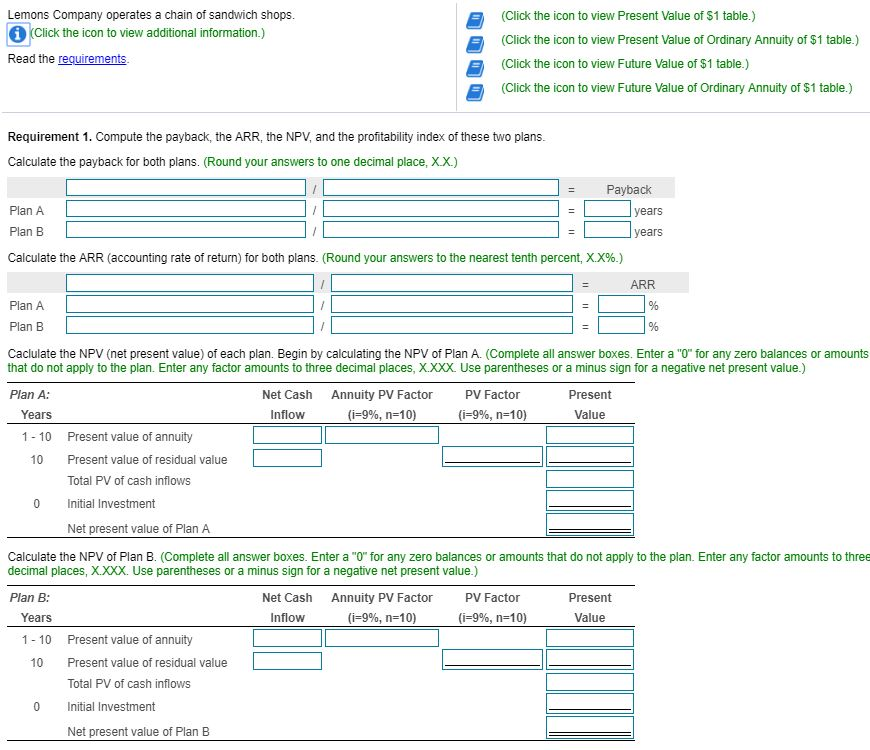

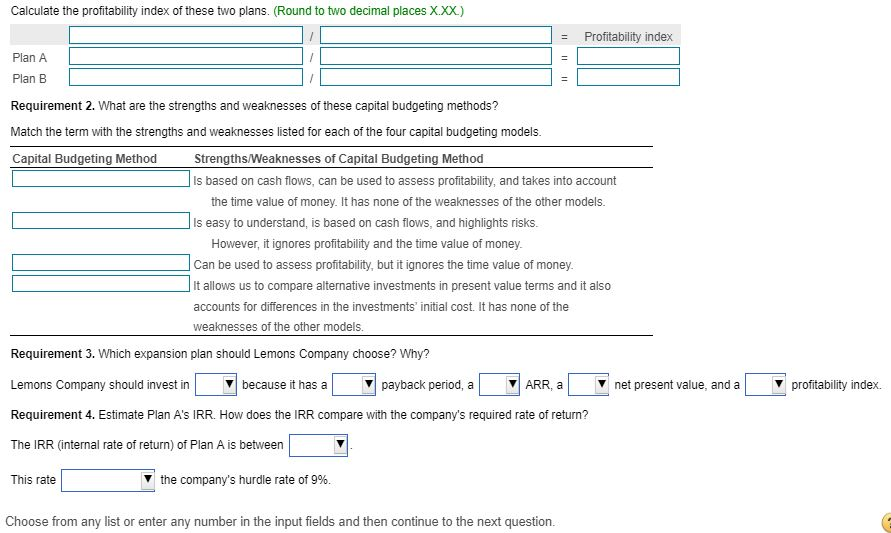

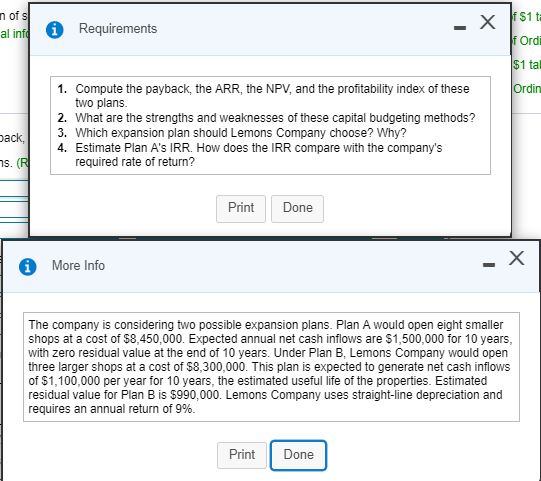

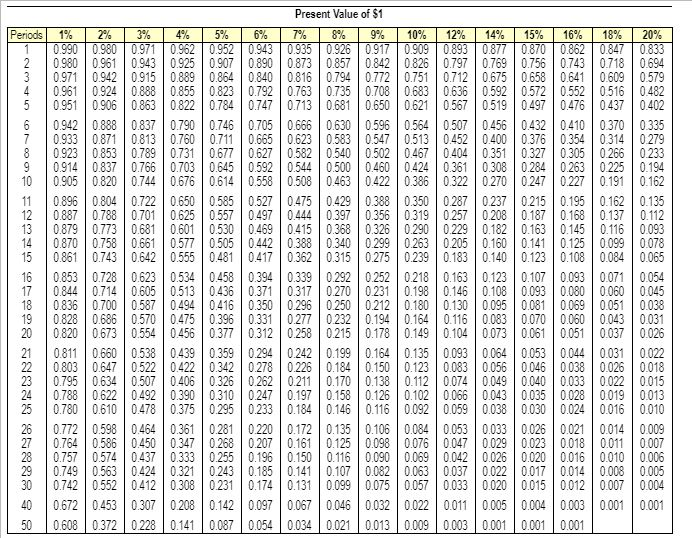

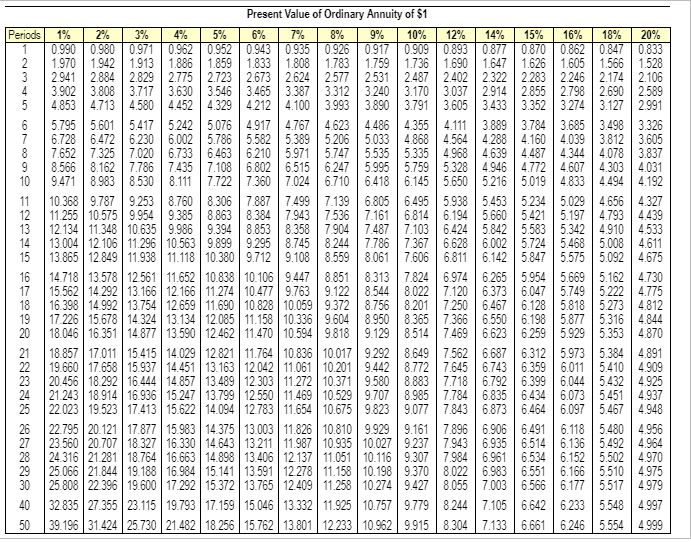

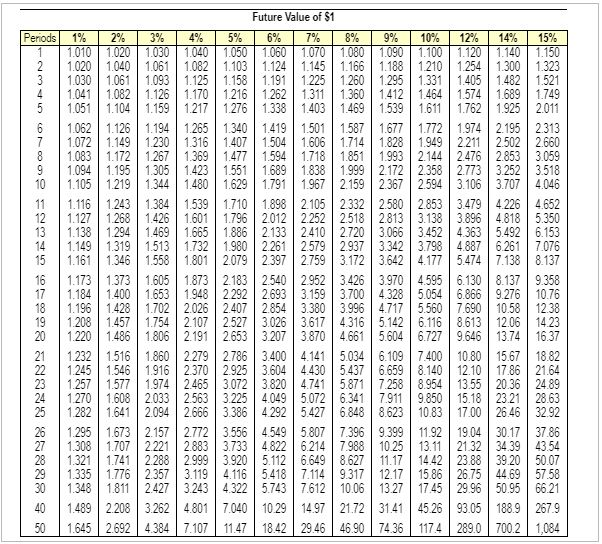

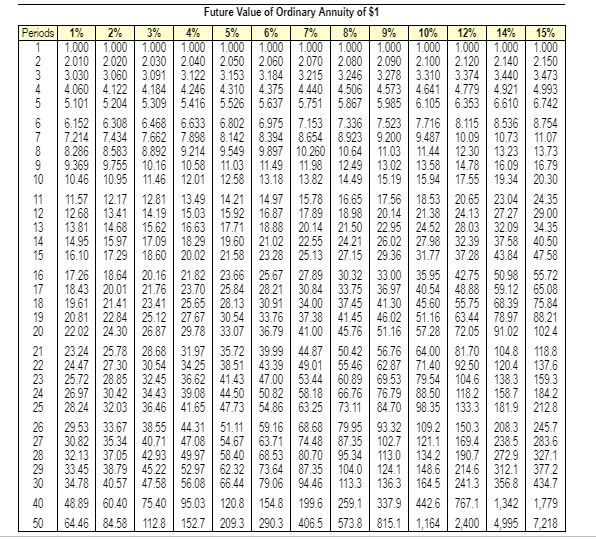

Lemons Company operates a chain of sandwich shops. (Click the icon to view additional information.) Read the requirements (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Future Value of $1 table.) (Click the icon to view Future Value of Ordinary Annuity of $1 table.) Requirement 1. Compute the payback, the ARR, the NPV, and the profitability index of these two plans. Calculate the payback for both plans. (Round your answers to one decimal place, X.X.) = Payback years L Plan A Plan B years Calculate the ARR (accounting rate of return) for both plans. (Round your answers to the nearest tenth percent, X.X%.) ARR Plan A Plan B Caciulate the NPV (net present value) of each plan. Begin by calculating the NPV of Plan A. (Complete all answer boxes. Enter a "0" for any zero balances or amounts that do not apply to the plan. Enter any factor amounts to three decimal places, X.XXX Use parentheses or a minus sign for a negative net present value.) Plan A: Years 1-10 Net Cash Inflow Annuity PV Factor (i=9%, n=10) PV Factor (i=9%, n=10) Present Value Present value of annuity Present value of residual value Total PV of cash inflows Initial Investment 0 Net present value of Plan A Calculate the NPV of Plan B. (Complete all answer boxes. Enter a "0" for any zero balances or amounts that do not apply to the plan. Enter any factor amounts to three decimal places, X.XXX. Use parentheses or a minus sign for a negative net present value.) Net Cash Inflow Annuity PV Factor (i=9%, n=10) PV Factor (i=9%, n=10) Present Value Plan B: Years 1 - 10 10 Present value of annuity Present value of residual value Total PV of cash inflows Initial Investment Net present value of Plan B Calculate the profitability index of these two plans. (Round to two decimal places X.XX.) = Profitability index Plan A Plan B Requirement 2. What are the strengths and weaknesses of these capital budgeting methods? Match the term with the strengths and weaknesses listed for each of the four capital budgeting models. Capital Budgeting Method Strengths/Weaknesses of Capital Budgeting Method is based on cash flows, can be used to assess profitability, and takes into account the time value of money. It has none of the weaknesses of the other models. is easy to understand, is based on cash flows, and highlights risks. However, it ignores profitability and the time value of money Can be used to assess profitability, but it ignores the time value of money. It allows us to compare alternative investments in present value terms and it also accounts for differences in the investments initial cost. It has none of the weaknesses of the other models. Requirement 3. Which expansion plan should Lemons Company choose? Why? Lemons Company should invest in because it has a payback period, a VARR, a n et present value, and a profitability index. Requirement 4. Estimate Plan A's IRR. How does the IRR compare with the company's required rate of return? The IRR (internal rate of return) of Plan A is between This rate the company's hurdle rate of 9%. Choose from any list or enter any number in the input fields and then continue to the next question. nofs al info S1t: Requirements X - fordi $1 tal Ordin 1. Compute the payback, the ARR, the NPV, and the profitability index of these two plans. 2. What are the strengths and weaknesses of these capital budgeting methods? 3. Which expansion plan should Lemons Company choose? Why? 4. Estimate Plan A's IRR. How does the IRR compare with the company's required rate of return? Dack, 7. (R Print Done More Info - X The company is considering two possible expansion plans. Plan A would open eight smaller shops at a cost of $8,450,000. Expected annual net cash inflows are $1,500,000 for 10 years, with zero residual value at the end of 10 years. Under Plan B, Lemons Company would open three larger shops at a cost of $8,300,000. This plan is expected to generate net cash inflows of $1,100,000 per year for 10 years, the estimated useful life of the properties. Estimated residual value for Plan B is $990,000. Lemons Company uses straight-line depreciation and requires an annual return of 9%. Print Done Periods 18% 20% 0.833 0.694 0.579 0.572 | 0.497 OOOOOOO OOOOOOO 0.327 0 247 Present Value of $1 2% | 3% 14% 15% 16% 17% 18% 19% 10% 12% 14% 15% 16% 0.980 10.971 10.962 0.952 T0.943 To935 To925 | 0917 0.909 0.893 0877 0.370 0.852 0.943 | 0.925 | 0.907 | 0.890 | 0.873 | 0.857 | 0.842 | 0.826 | 0.797 | 0.769 | 0.756 0.743 0.915 | 0.889 | 0.854 | 0.840 | 0.816 | 0.794 | 0772 | 0.751 | 0.712 | 0.675 0.658 0.924 | 0.888 | 0855 | 0.823 | 0.792 | 0.763 | 0.735 | 0.708 | 0.683 | 0.636 | 0.592 0.906 | 0.863 | 0.822 | 0.784 | 0.747 | 0.713 | 0.681 | 0.650 | 0.621 | 0.567 | 0.519 0.888 0.837 | 0.790 | 0746 0.705 | 0.666 | 0.630 | 0.596 0.564 | 0.507 0456 0432 0.871 0.813 0760 | 0711 0.665 | 0.623 | 0.583 | 0.547 0.513 | 0452 0 400 0.853 0.789 | 0.731 | 0.677 0.627 | 0.582 | 0.540 | 0.502 | 0467 | 0404 0.351 0.837 0.766 | 0.703 | 0.645 0.592 | 0.544 | 0.500 0450 | 0.424 | 0.361 0.308 0.284 0.820 0.744 | 0.676 0.614 0.558 | 0.508 | 0.463 0.422 | 0.386 | 0.322 0.270 0896 0.804 | 0.722 | 0.650 | 0.585 | 0.527 | 0.475 | 0.429 | 0.388 | 0.350 | 0.287 | 0.237 | 0215 0.887 0.788 0.701 | 0.625 | 0.557 | 0497 0.444 | 0.397 | 0.356 0.319 | 0.257 0.208 | 0.187 0.879 0.773 0.681 0.601 0.530 | 0 459 0415 | 0.358 0.326 0.290 | 0.229 0.182 0.163 0.870 0.758 0.661 0.577 0.505 | 0.442 | 0.388 | 0.340 0 299 0.263 | 0,205 | 0.160 | 0.141 0.861 0.743 0.642 0.555 | 0481 0417 0.352 | 0.315 0.275 0.239 | 0.183 | 0.140 | 0.123 0.853 0.728 0.623 | 0.534 | 0 458 | 0 394 | 0.339 0.292 | 0 252 | 0218 | 0.163 | 0.123 | 0.107 0.844 0.605 0.513 0436 | 0.371 0.317 0.270 0.198 | 0.146 | 0.108 0.093 0.587 0.494 | 0.416 0.350 | 0 296 | 0 250 | 0212 | 0 180 | 0.130 | 0.095 0.081 0.686 0.570 | 0.475 o 396 0.331 ) 0277 0 232 | 0.194 0.164 | 0.116 | 0.083 | 0.070 0.673 0.554 | 0456 0.377 0.312 0215 10178 | 0.149 | 0.104 | | 0.073 | 0.051 | 0.051 0.538 | 0439 | 0.359 | 0.294 | 0.242 | 0 199 | 0.164 | 0 135 | .093 | 0.064 0.053 0.522 | 0422 0.342 0278 0.226 | 0.184 | 0.150 | 0 123 | 0.083 | 0.056 0.046 0.507 | 0406 | 0.326 0 262 | 0.211 | 0.170 | 0.138 | 0.112 | 0.074 | 0.049 0.492 | 0.390 | 0.310 | 0.247 | 0.197 | 0.158 | 0.126 | 0.102 | .066 | 0.043 0.035 0.478 | 0.375 | 0 295 | 0.233 | 0.184 | 0.146 | 0.116 | 0.092 | 0.059 0.038 0.030 0.598 0454 | 0.351 0.281 0220 | 0.172 | 0.135 | 0.106 | 0.084 | 0.053 | 0.033 0.026 0.021 0 450 | 0.347 | 0.258 0.207 | 0.161 | 0.125 | 0.098 | | 0.076 | 0.047 | 0.029 | 0.023 0.018 0.574 | 0437 | 0.333 | 0.255 | 0.196 | 0.150 | 0.116 | 0.090 | 0.059 | 0.042 | 0.026 | 0.020 0.016 | 0.243 | 0.185 | 0.141 | 0.107 | 0.082 | 0.053 | 0.037 | 0.022 | 0.017 0.014 0.552 | 0.412 | 0.308 | | 0 231 | 0.174 | 0.131 | 0.099 | 0.075 | 0.057 | 0.033 | 0.020 | 0.015 0.453 0.307 | 0 208 0.142 0.097 | 0.067 | 0.046 | 0032 | 0.022 0.011 | 0.005 | 0.004 | 0.003 0.608 | 0.372 | 0228 | 0.141 | .087 | .054 | 0.034 | .021 | 2013 | 009 | 0.003 | .001 | 0.001 | 0.001 1 0 231 0.135 0.112 0.093 0.078 0.065 0.054 0.045 0.033 0 031 0.026 0.022 0.2018 0.015 0.013 07 0 258 | 0.037 0.031 0040 0.010 0.016 0.014 0.011 0.010 0.009 0.007 0.006 0 005 0 012 0 004 Periods 16% 14% 0.877 1.647 15% 0.870 18% 0.847 20% 0.833 1.528 - M 2.775 MON wWN 4580 4.212 4.917 5.242 n ON000 7325 TOLON 5.995 5.759 ) O 7.360 CONTOON Present Value of Ordinary Annuity of $1 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 0.990 0.980 0.971 | 0.962 1 0.952 0.943 0.935 0.926 0.917 0.909 0.893 1942 1.913 1.886 1859 1.833 1.808 1.783 1.759 1.736 1.690 2.884 2.829 2.723 2.673 2577 2.531 2.487 2.402 3.717 3.630 3.546 3.465 3240 3.170 3.037 4.452 3.890 3.791 3.605 4.486 4.355 4.111 6.230 6.002 5.033 4.868 4564 7.020 6.733 6.463 6.210 5.535 5.335 4968 8.162 7.786 7.435 7.108 6.802 5328 8.983 8.530 8.1117.722 6.418 6.145 5.650 9.787 9.2538.760 8.306 7.887 6.805 6.495 5.938 9.954 9.3858.863 8.384 7.161 6.814 6.194 10.6359.986 9.3948.853 7.487 7.103 6.424 11.296 10.563 9.899 9.295 7.786 7.367 | 6.628 11.118 10.380 9.712 8.061 7.606 6.811 12.561 11.652 10.838 10.106 7.824 6.974 12.166 | 11.274 10.477 8544 8.022 7.120 12.659 11.690 10.828 8.756 8.201 13.134 12.085 | 11.158 10.336 8.950 8.365 12.462 11.470 10.594 8.514 7.469 14.029 12.821 11.764 10.836 10.017 9292 8.649 7.562 13.163 12.042 11.061 10.201 8.772 7.645 11.272 10.371 9.580 8.883 7.718 13.79912550 11.469 10.529 9.707 7.784 11.654 9.823 9.077 7.843 11.826 10.810 9.929 7.896 11.987 10.935 10.027 9 237 7.943 13.406 12 137 11.051 10.116 9.307 7.984 12 278 11.158 10.1989.370 8.022 22 396 19.600 17.292 15.372 12.409 11.258 10.2749.427 32.835 | 27.355 | 23.115 19.793 17.159 15.046 13.332 11.925 10.757 9.779 8 244 39.196 31.424 25.730 21.482 18.256 15.762 13.801 12.233 10.9629.915 8.304 NDAN DwwwNNN ESC 00 00 09 00 8.313 COOCOCO OO 7250 7.366 4.844 9.129 4.870 4.891 . LLLLLLLLLL LOCOCO COLO COLO COCO COGUN 9.442 &&8888888898 8983 10.675 9.167 Gwa COCO 8.055 7.105 7.133 6.661 6246 4.997 5.5544999 Periods Future Value of $1 5% 6% 7% 1.050 1.060 1.070 1.103 1.1241.145 1.158 1.191 1.225 1.216 1.262 8% 1080 1.166 1.260 1.360 1.469 587 9% 1090 1.188 1.295 1.412 10% 1.100 1.210 1.331 1.464 12% 1.120 1.254 1.405 14% 1.140 1.300 1.482 15% 1.150 1.323 1.521 1.749 4% 1.040 1.082 1.125 1.170 1.217 1.265 1316 1.369 1.423 1276 1539 1.611 1.340 1.677 1.772 714 851 im 3% 1.030 1061 1.093 1.126 1.159 1.194 1.230 1.267 1.305 1.344 1.384 1.426 1.469 1.513 1.558 1.605 1.653 1.702 999 1% 2% 1.010 1.020 1.020 | 1.040 1.030 1.061 1.041 1.082 1.051 1.104 1.062 1.126 1.149 1.172 1.195 1219 1.243 1.268 1.294 1.319 1.161 1.346 1.173 1373 1.400 1.428 1.457 { 1480 159 332 ) ) 518 ) 1.138 W NNNNN 2.720 ON )