Please make sure your answer is correct. I have been wrong twice on Chegg. thanks!!!!!I appreciate it

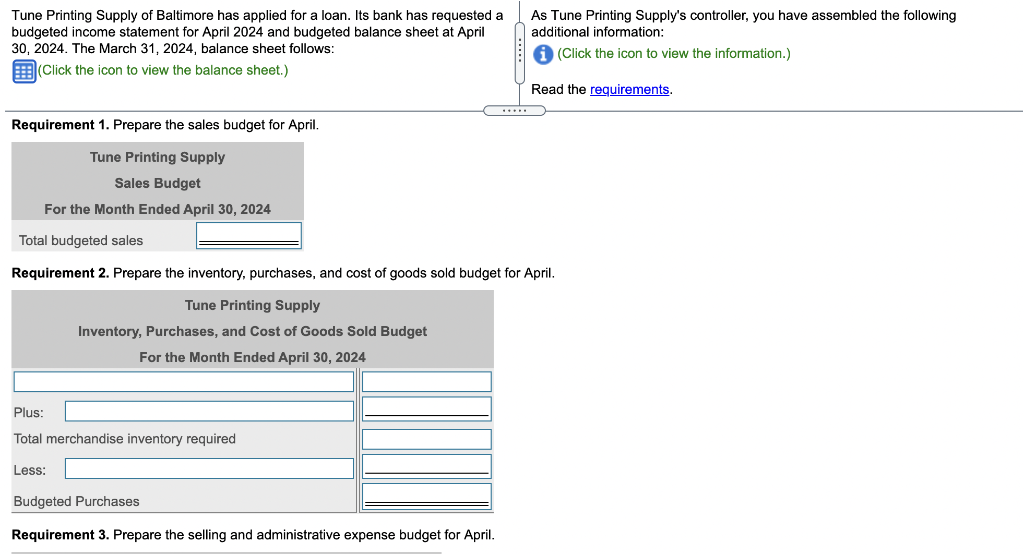

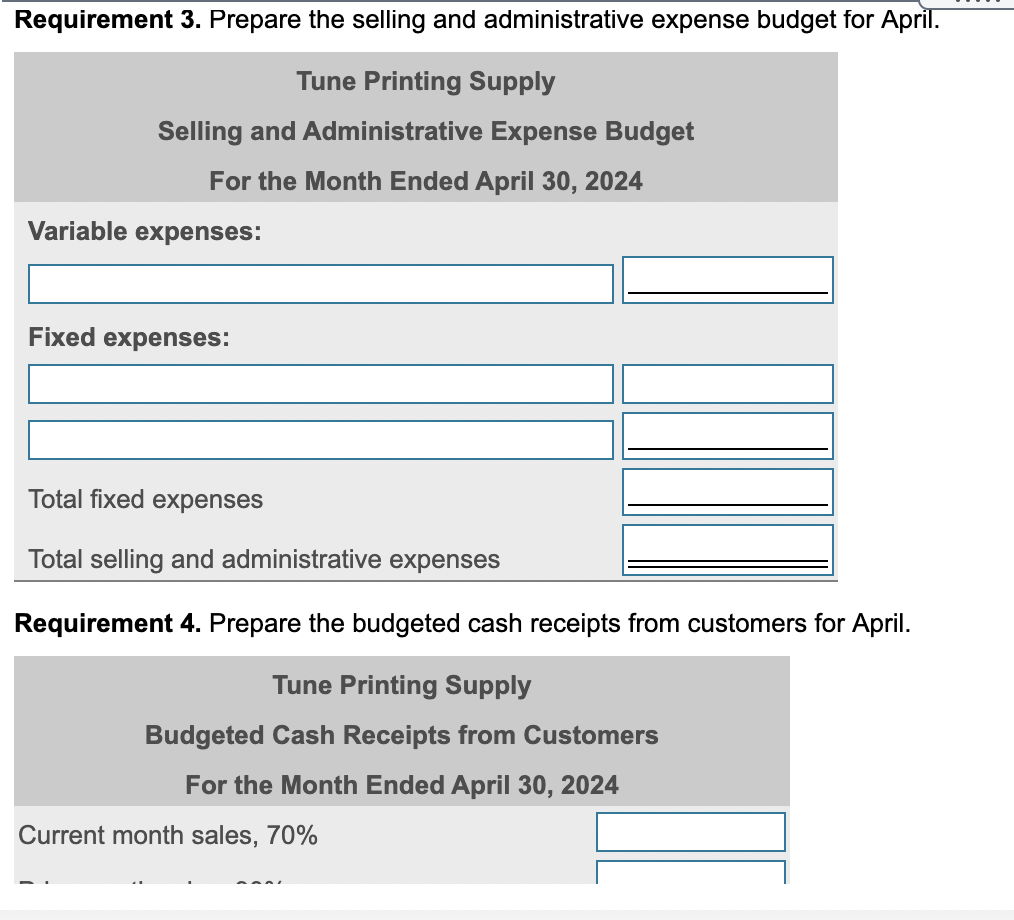

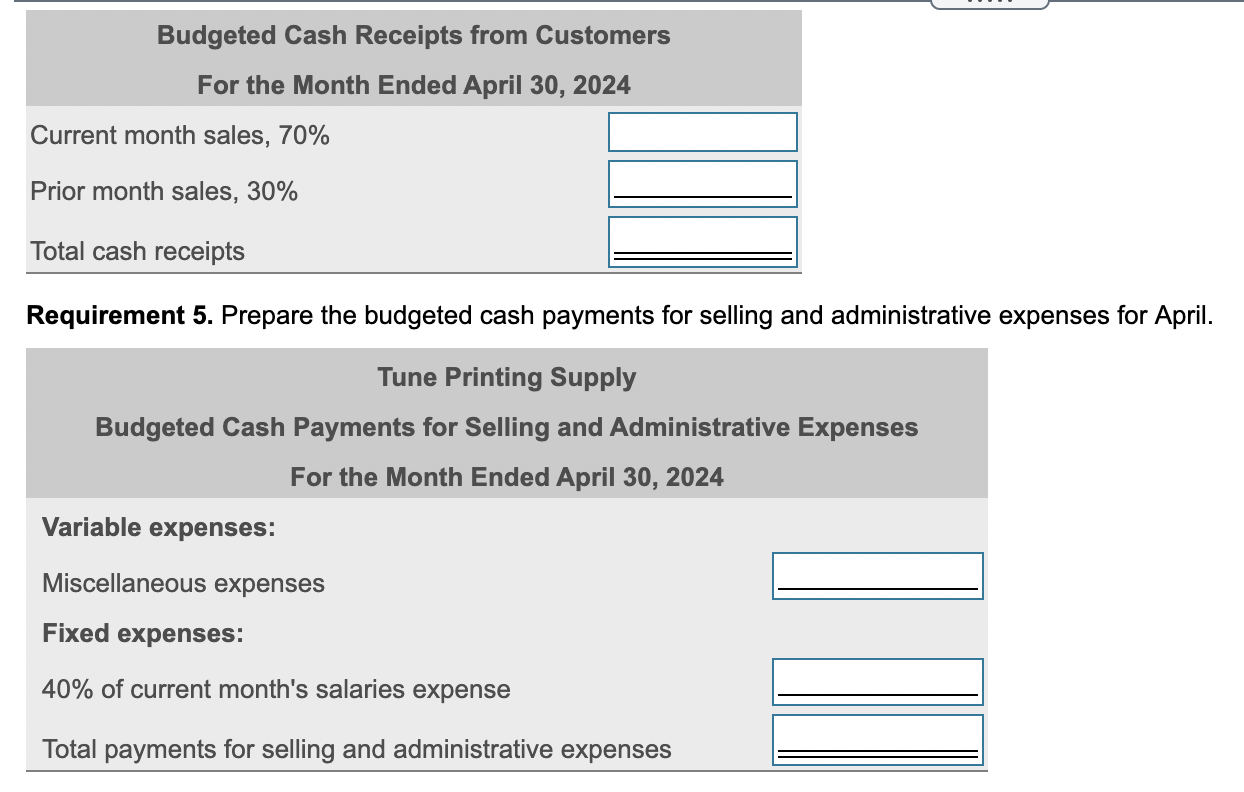

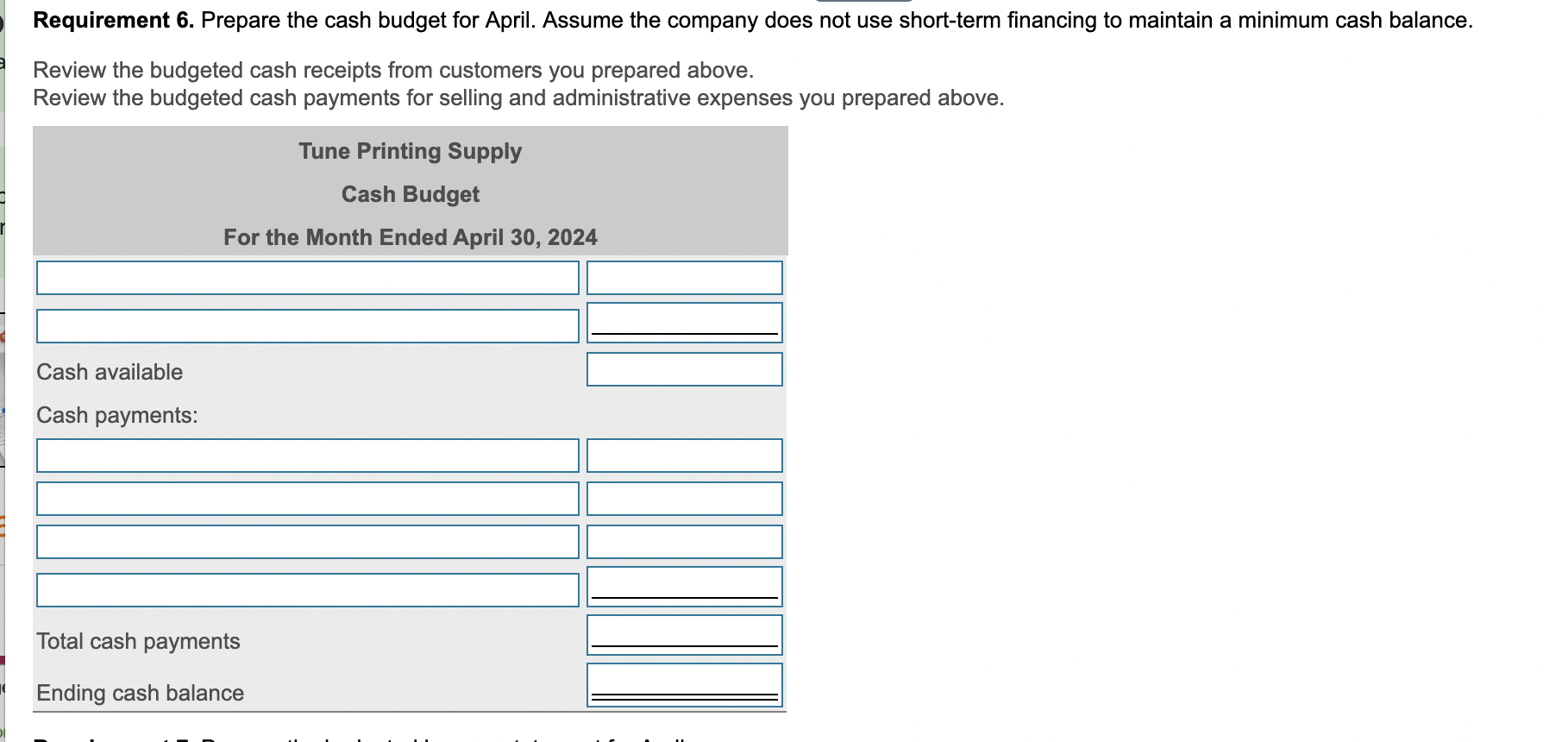

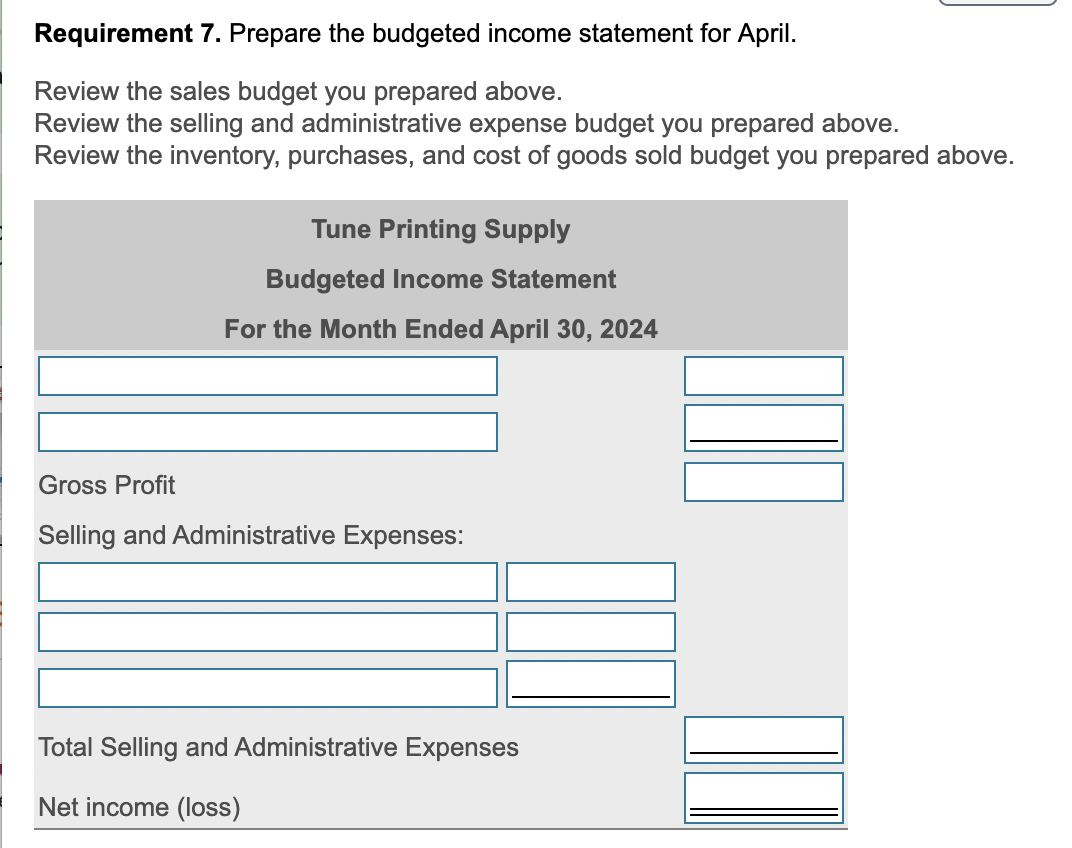

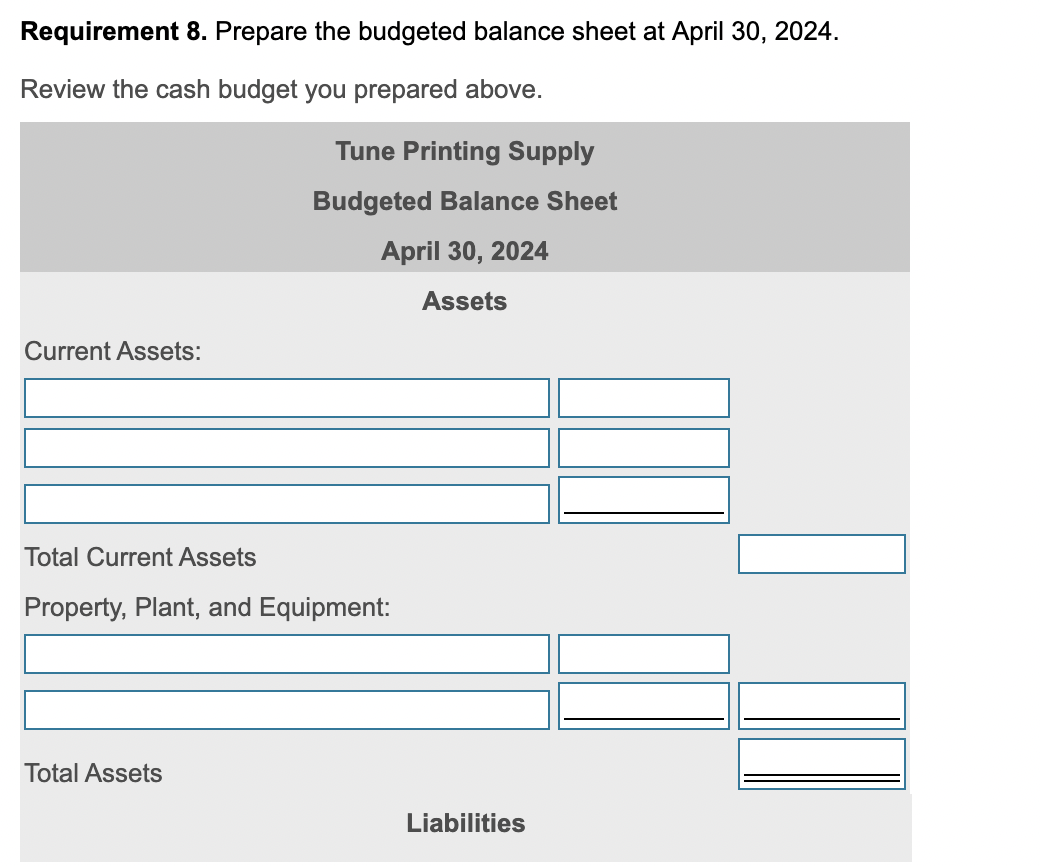

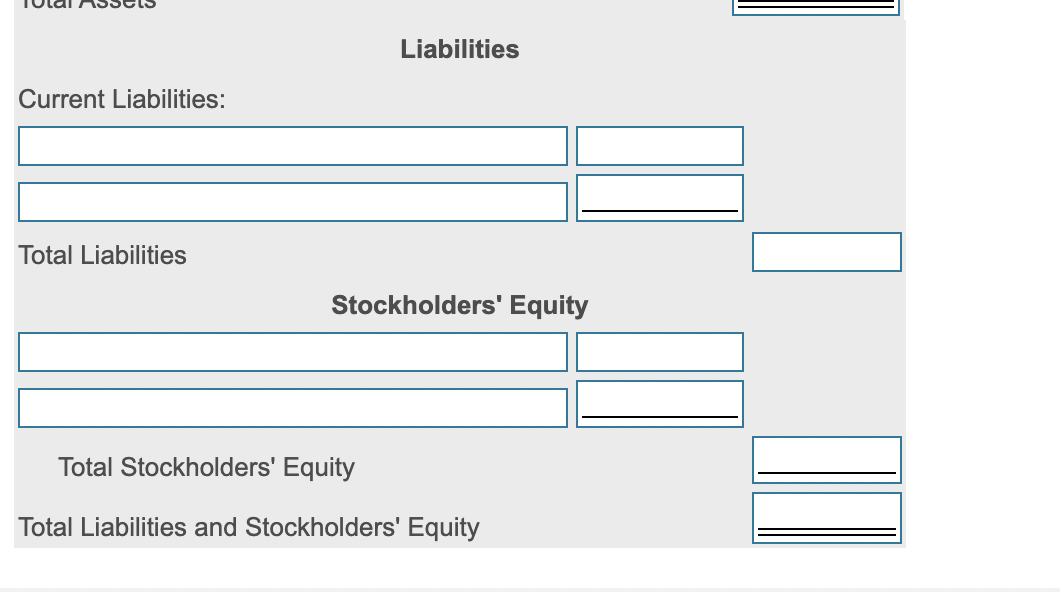

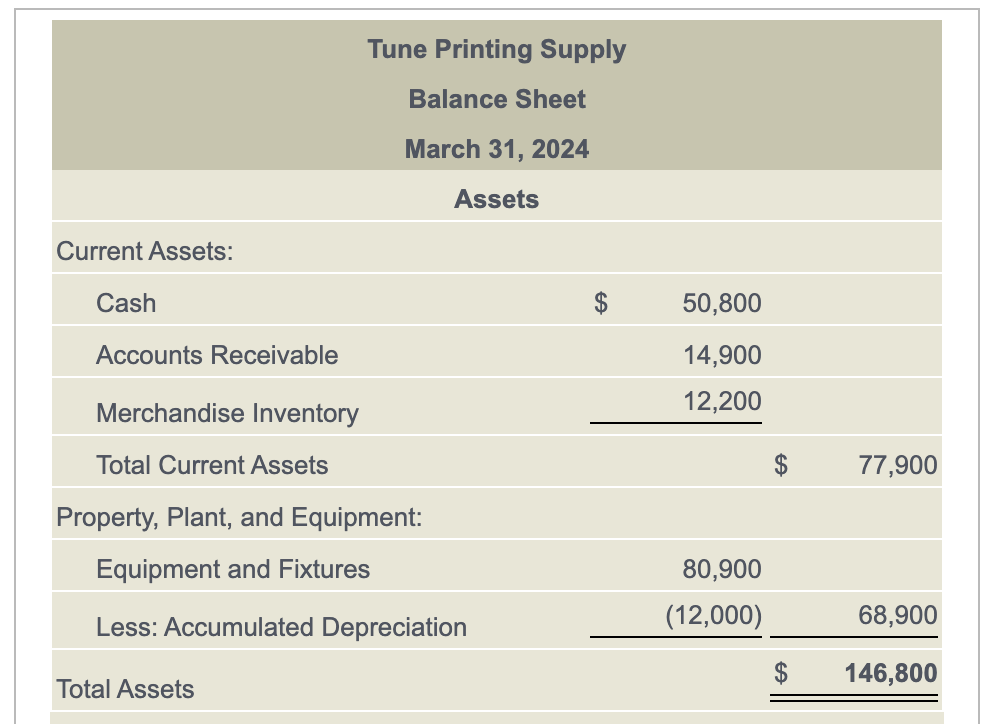

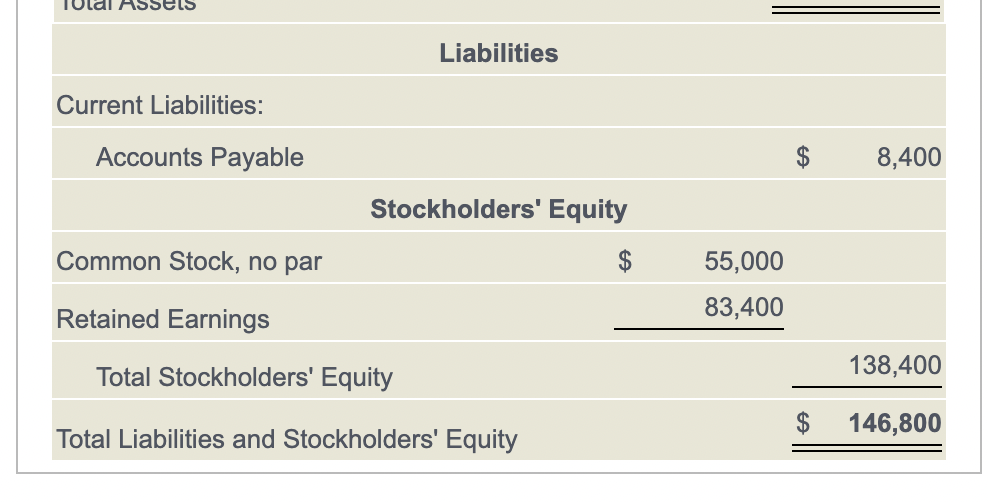

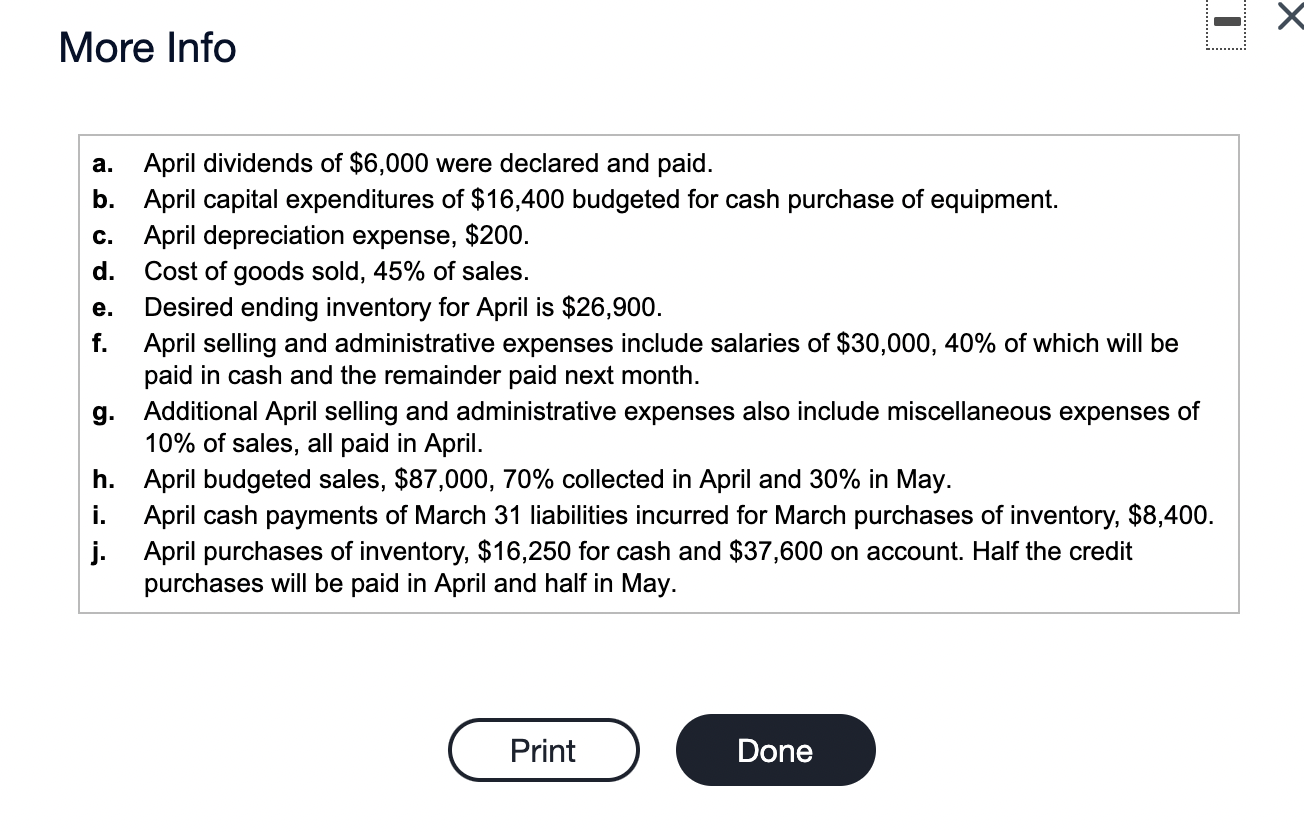

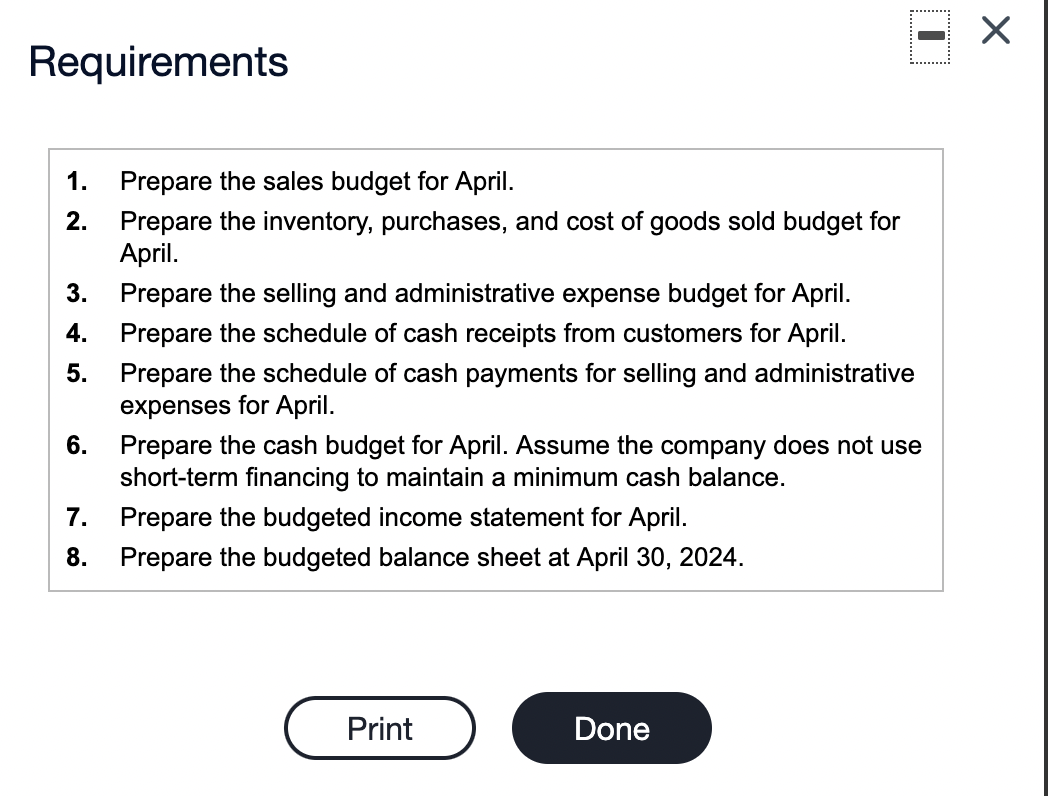

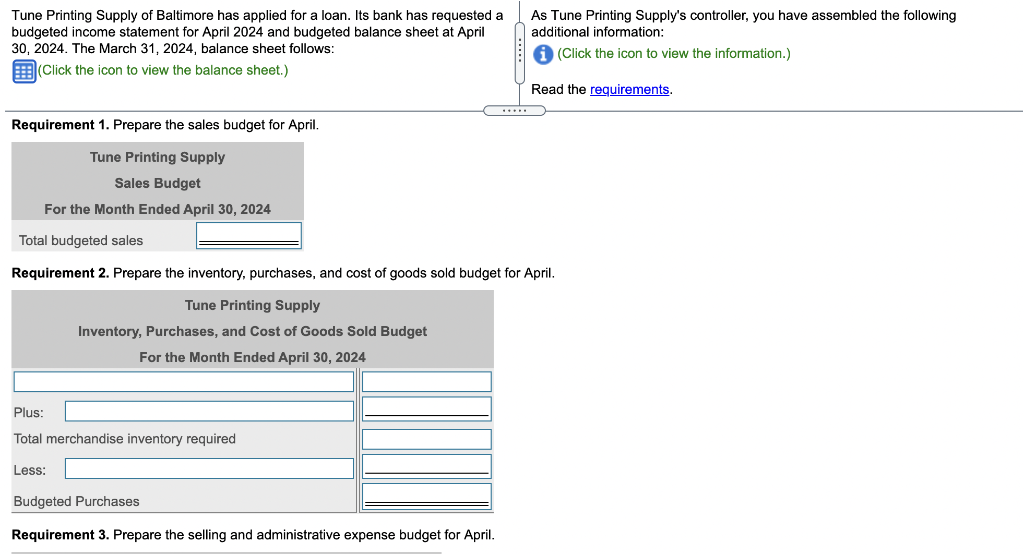

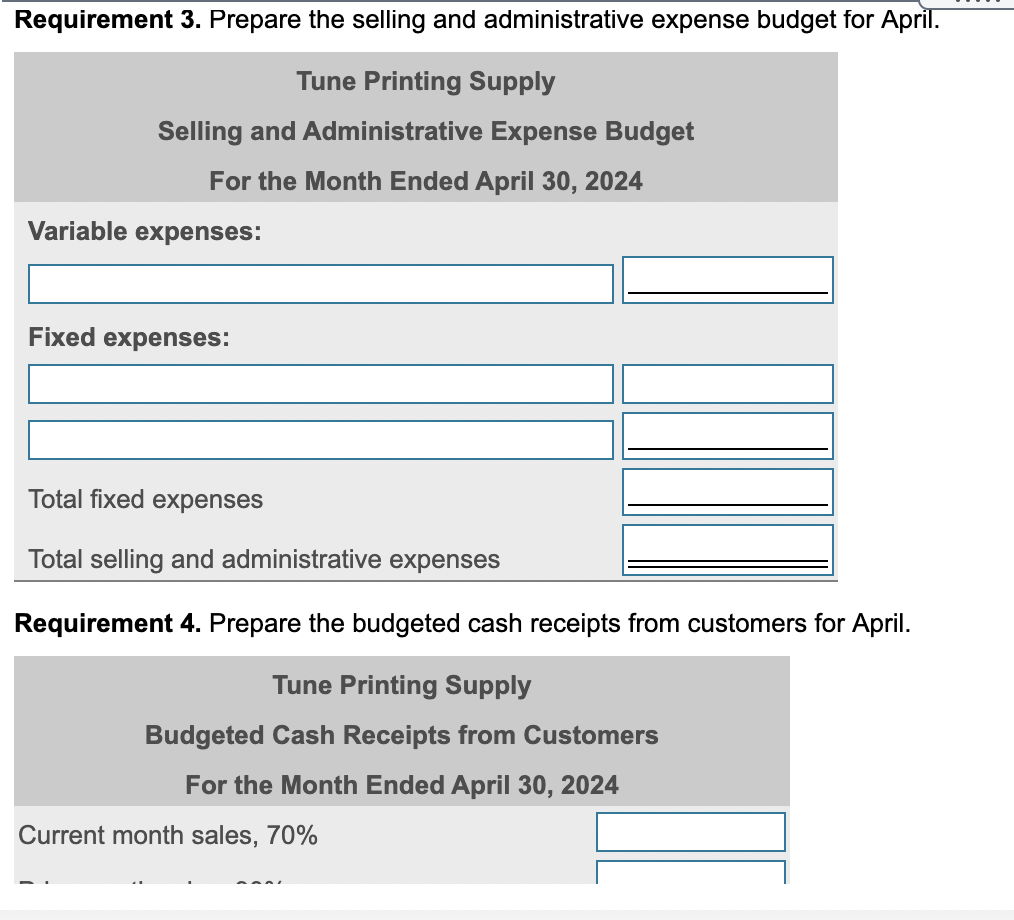

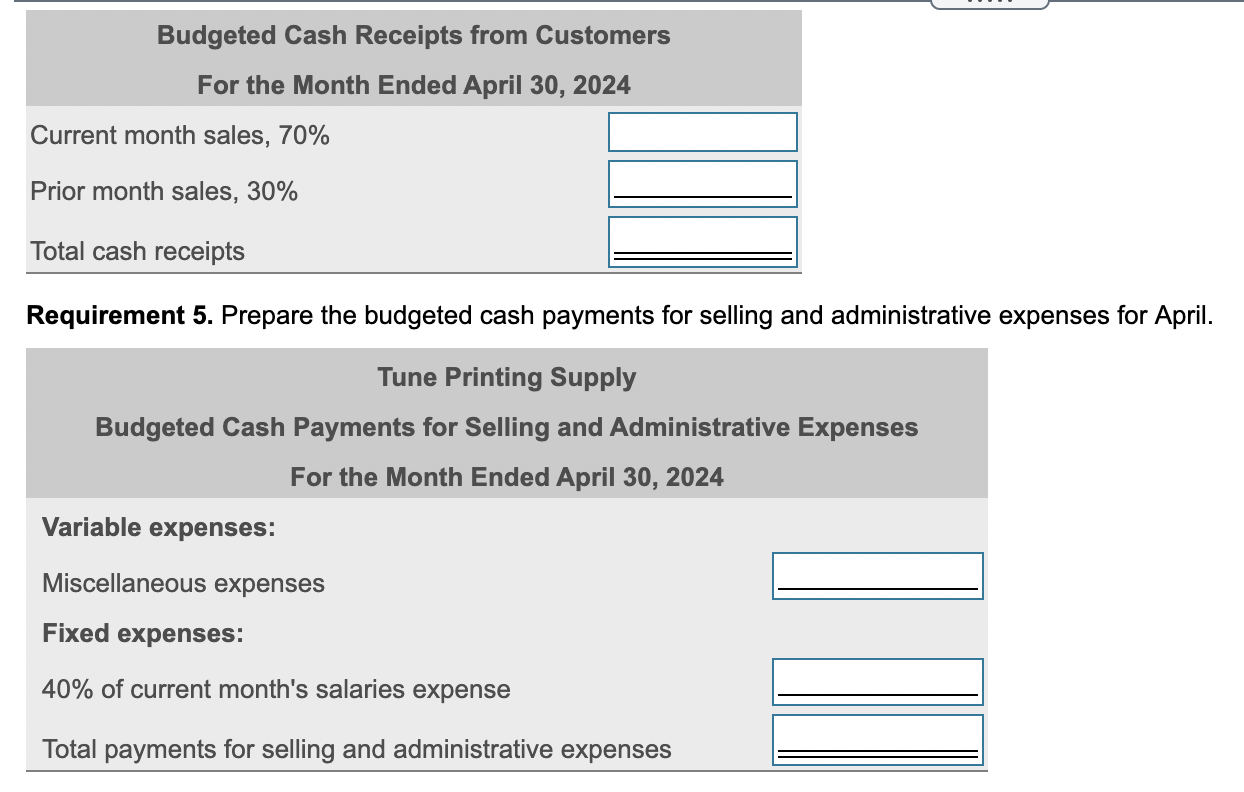

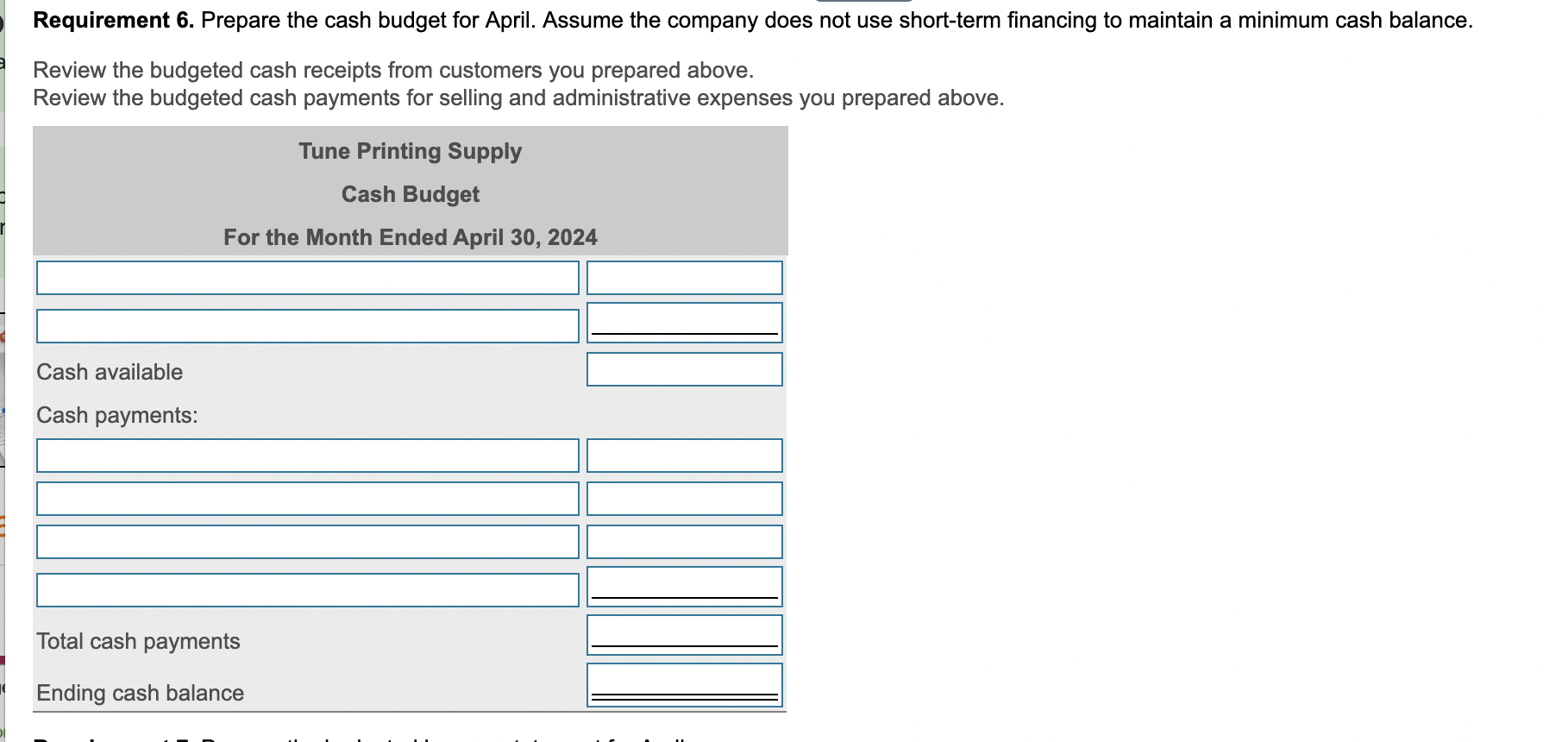

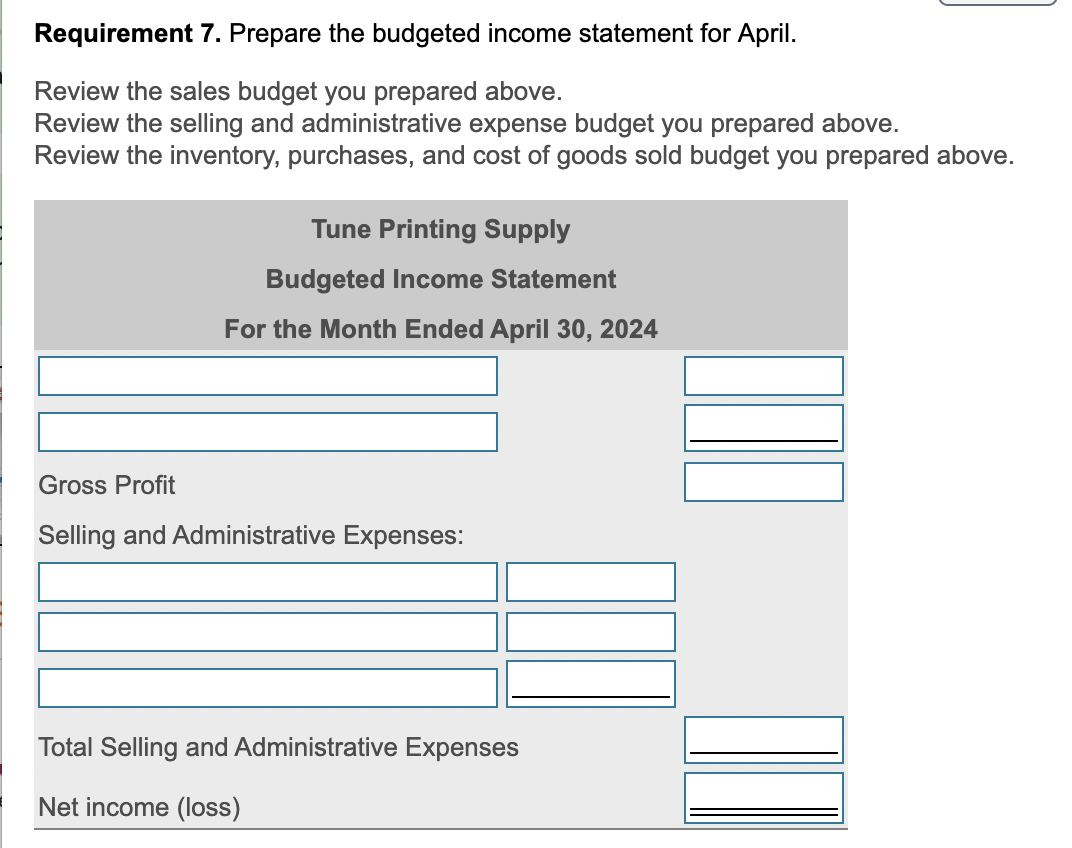

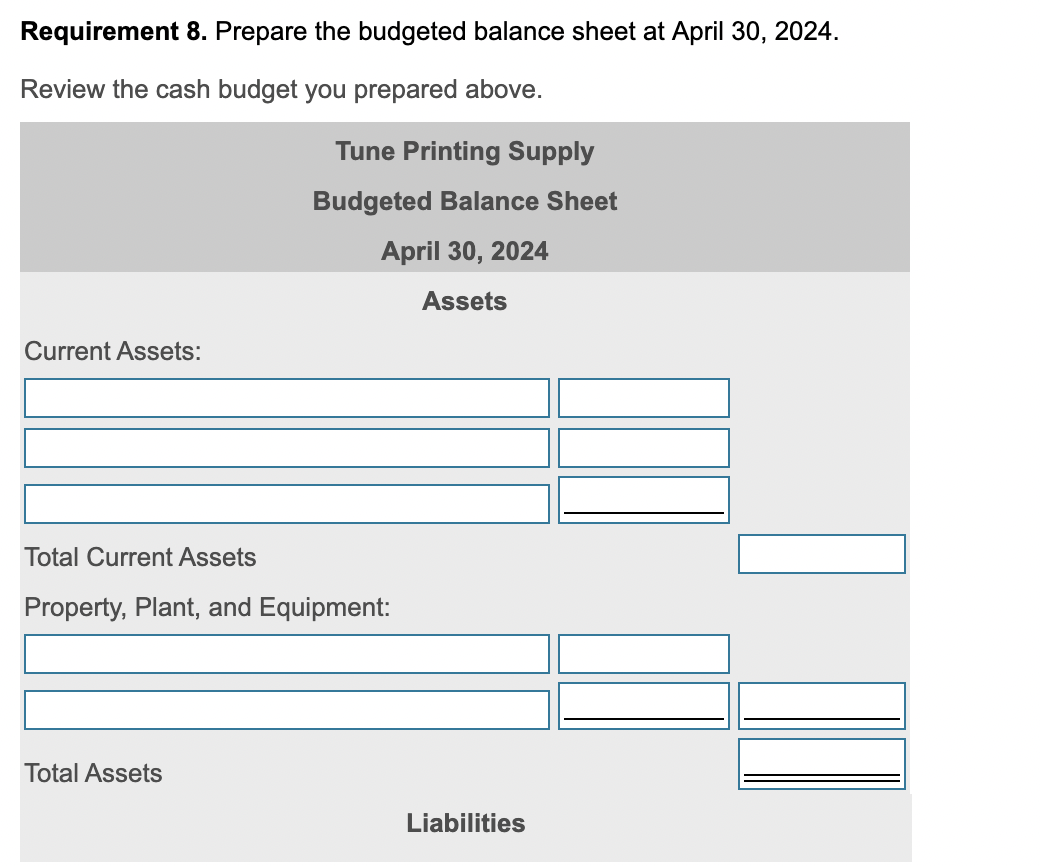

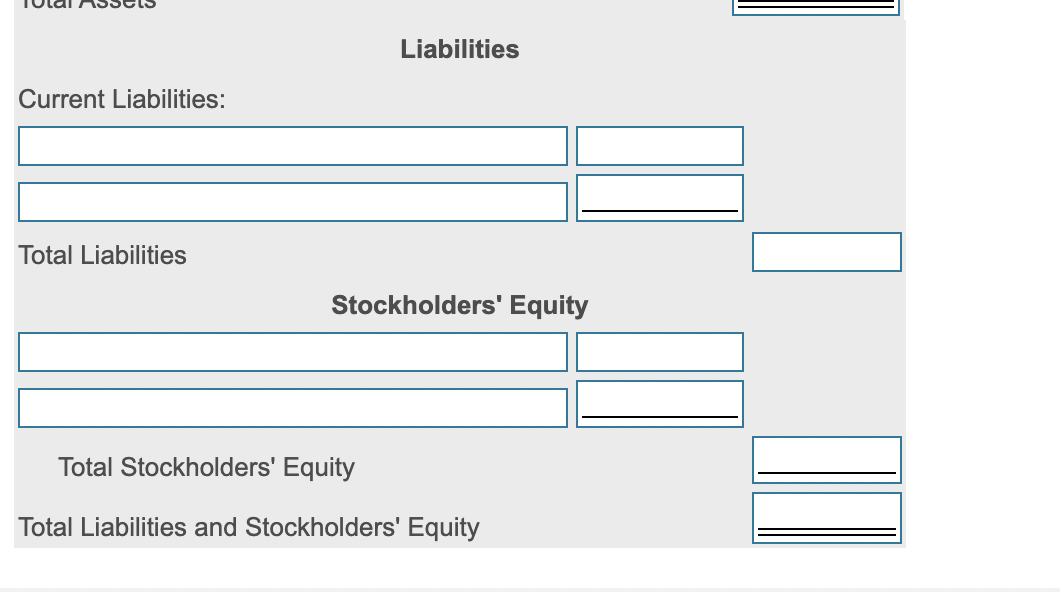

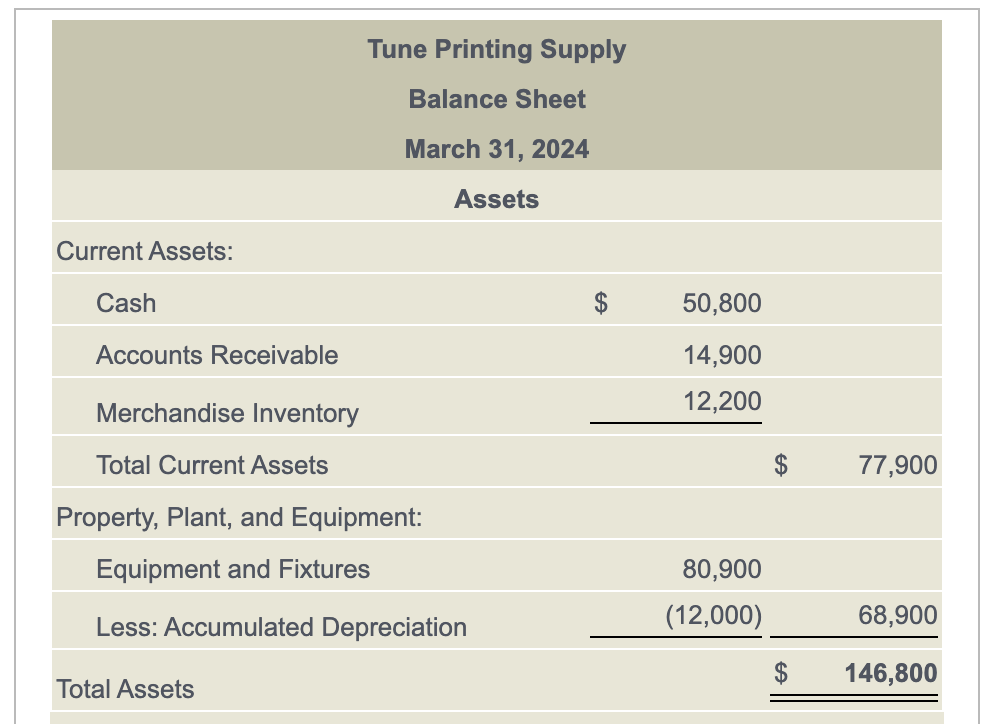

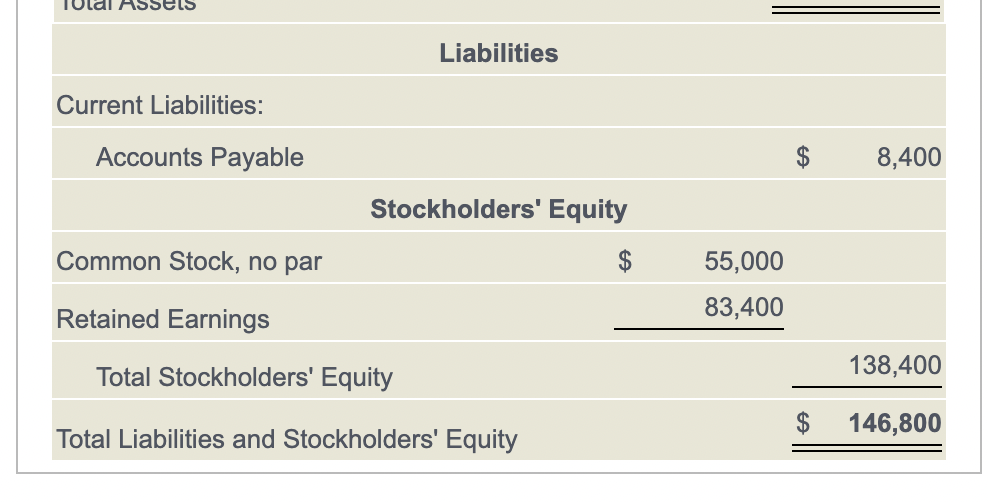

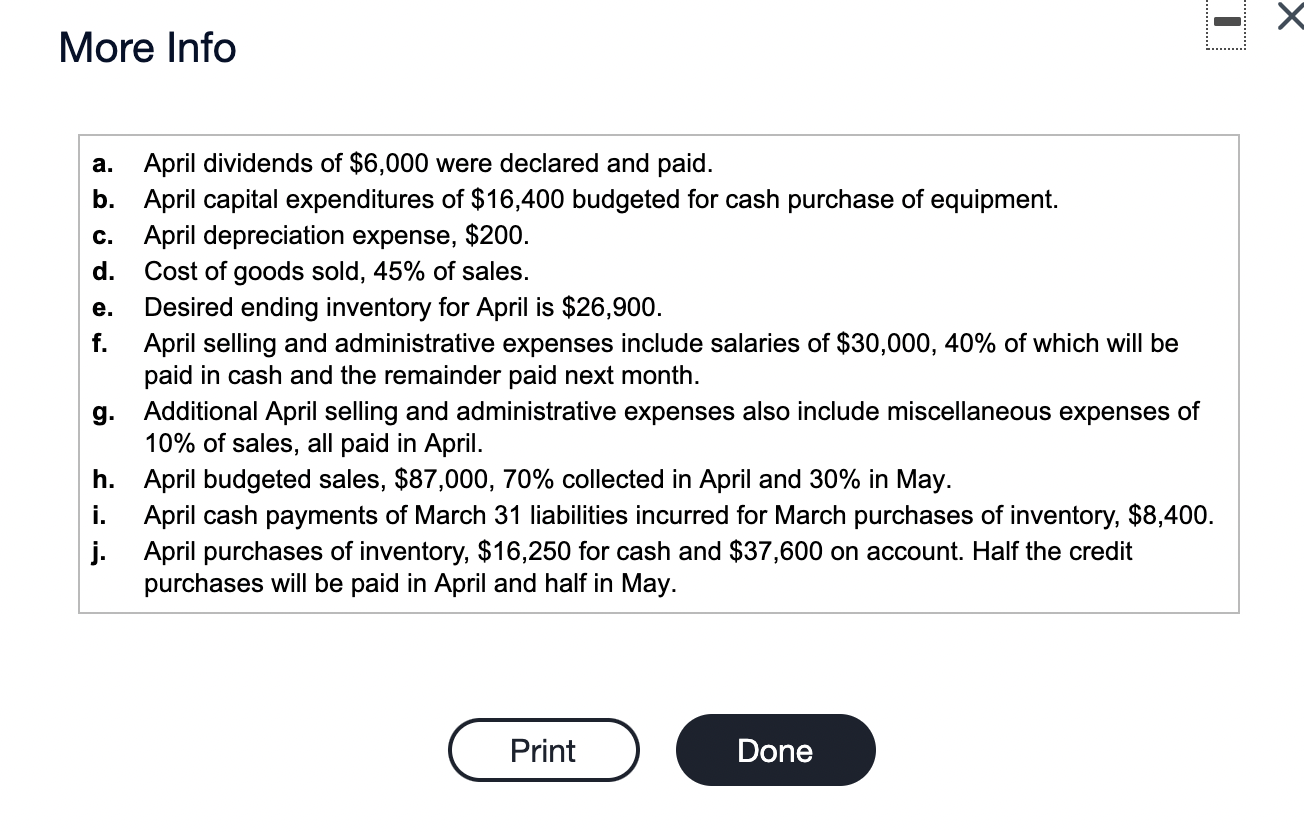

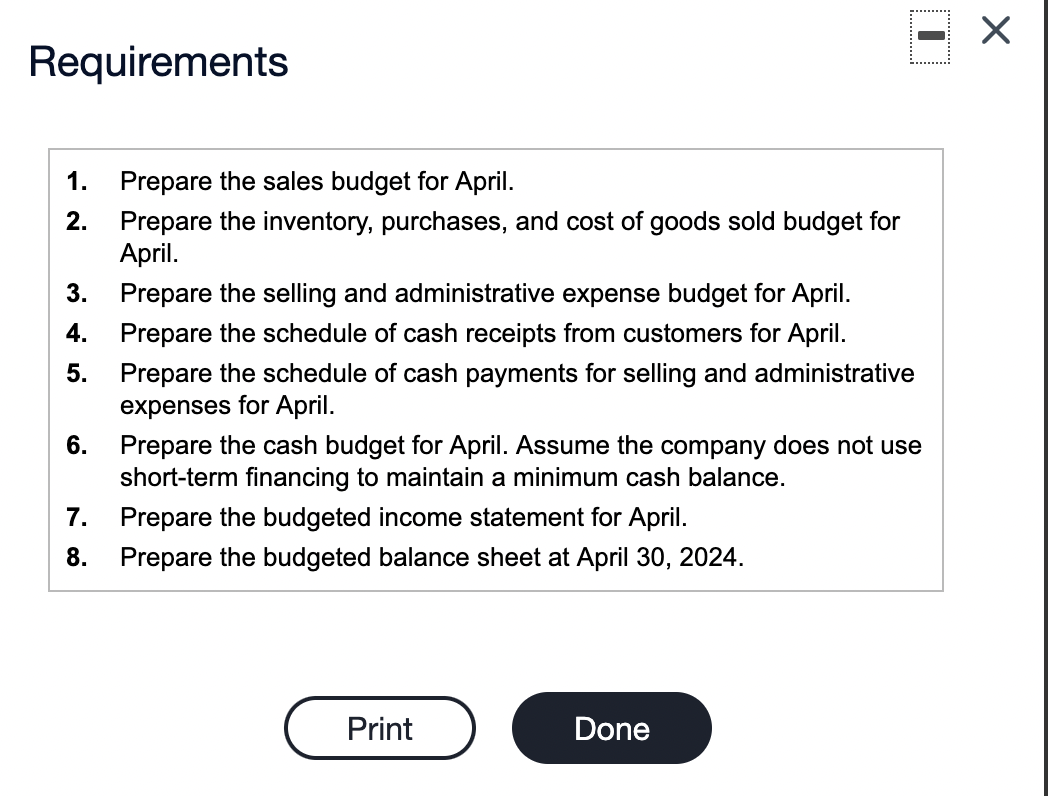

Tune Printing Supply of Baltimore has applied for a loan. Its bank has requested a budgeted income statement for April 2024 and budgeted balance sheet at April 30, 2024. The March 31, 2024, balance sheet follows: Click the icon to view the balance sheet.) As Tune Printing Supply's controller, you have assembled the following additional information: (Click the icon to view the information.) Read the requirements. ... Requirement 1. Prepare the sales budget for April. Tune Printing Supply Sales Budget For the Month Ended April 30, 2024 Total budgeted sales Requirement 2. Prepare the inventory, purchases, and cost of goods sold budget for April. Tune Printing Supply Inventory, Purchases, and Cost of Goods Sold Budget For the Month Ended April 30, 2024 Plus: Total merchandise inventory required Less: Budgeted Purchases Requirement 3. Prepare the selling and administrative expense budget for April. Requirement 3. Prepare the selling and administrative expense budget for April. Tune Printing Supply Selling and Administrative Expense Budget For the Month Ended April 30, 2024 Variable expenses: Fixed expenses: II Total fixed expenses Total selling and administrative expenses Requirement 4. Prepare the budgeted cash receipts from customers for April. Tune Printing Supply Budgeted Cash Receipts from Customers For the Month Ended April 30, 2024 Current month sales, 70% Budgeted Cash Receipts from Customers For the Month Ended April 30, 2024 Current month sales, 70% Prior month sales, 30% Total cash receipts Requirement 5. Prepare the budgeted cash payments for selling and administrative expenses for April. Tune Printing Supply Budgeted Cash Payments for Selling and Administrative Expenses For the Month Ended April 30, 2024 Variable expenses: Miscellaneous expenses Fixed expenses: 40% of current month's salaries expense IN Total payments for selling and administrative expenses Requirement 6. Prepare the cash budget for April. Assume the company does not use short-term financing to maintain a minimum cash balance. Review the budgeted cash receipts from customers you prepared above. Review the budgeted cash payments for selling and administrative expenses you prepared above. Tune Printing Supply Cash Budget For the Month Ended April 30, 2024 Cash available Cash payments: Total cash payments Ending cash balance Requirement 7. Prepare the budgeted income statement for April. Review the sales budget you prepared above. Review the selling and administrative expense budget you prepared above. Review the inventory, purchases, and cost of goods sold budget you prepared above. Tune Printing Supply Budgeted Income Statement For the Month Ended April 30, 2024 Gross Profit Selling and Administrative Expenses: Total Selling and Administrative Expenses Net income (loss) Requirement 8. Prepare the budgeted balance sheet at April 30, 2024. Review the cash budget you prepared above. Tune Printing Supply Budgeted Balance Sheet April 30, 2024 Assets Current Assets: Total Current Assets Property, Plant, and Equipment: Total Assets Liabilities Liabilities Current Liabilities: Total Liabilities Stockholders' Equity Total Stockholders' Equity Total Liabilities and Stockholders' Equity Tune Printing Supply Balance Sheet March 31, 2024 Assets Current Assets: Cash $ 50,800 Accounts Receivable 14,900 12,200 Merchandise Inventory Total Current Assets 77,900 Property, Plant, and Equipment: Equipment and Fixtures 80,900 (12,000) Less: Accumulated Depreciation 68,900 146,800 Total Assets Liabilities Current Liabilities: Accounts Payable 8,400 Stockholders' Equity Common Stock, no par $ 55,000 83,400 Retained Earnings Total Stockholders' Equity 138,400 $ Total Liabilities and Stockholders' Equity 146,800 - More Info a. e. April dividends of $6,000 were declared and paid. b. April capital expenditures of $16,400 budgeted for cash purchase of equipment. c. April depreciation expense, $200. d. Cost of goods sold, 45% of sales. Desired ending inventory for April is $26,900. f. April selling and administrative expenses include salaries of $30,000, 40% of which will be paid in cash and the remainder paid next month. g. Additional April selling and administrative expenses also include miscellaneous expenses of 10% of sales, all paid in April. h. April budgeted sales, $87,000, 70% collected in April and 30% in May. i. April cash payments of March 31 liabilities incurred for March purchases of inventory, $8,400. j. April purchases of inventory, $16,250 for cash and $37,600 on account. Half the credit purchases will be paid in April and half in May. Print Done Requirements A + 1. Prepare the sales budget for April. 2. Prepare the inventory, purchases, and cost of goods sold budget for April. 3. Prepare the selling and administrative expense budget for April. 4. Prepare the schedule of cash receipts from customers for April. 5. Prepare the schedule of cash payments for selling and administrative expenses for April. 6. Prepare the cash budget for April. Assume the company does not use short-term financing to maintain a minimum cash balance. 7. Prepare the budgeted income statement for April. 8. Prepare the budgeted balance sheet at April 30, 2024. . Print Done