Answered step by step

Verified Expert Solution

Question

1 Approved Answer

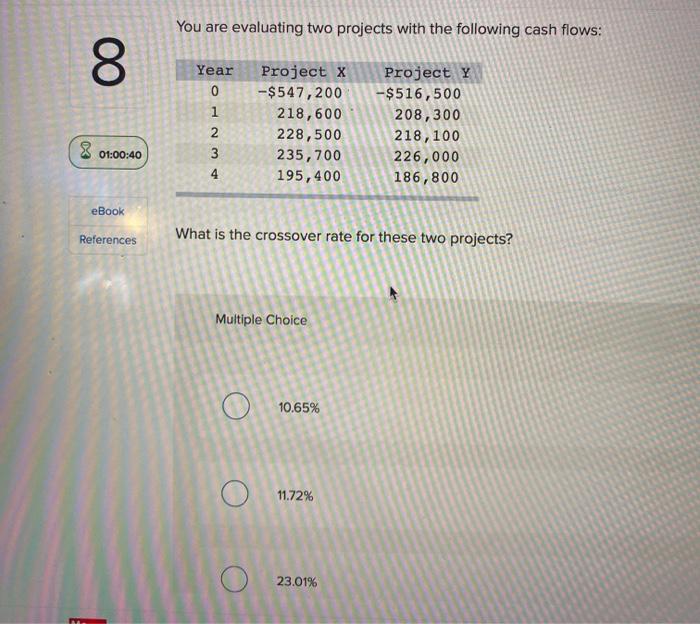

Please make the answer clear and precise. Also show workings. Need the answer ASAP. You are evaluating two projects with the following cash flows: 00

Please make the answer clear and precise. Also show workings. Need the answer ASAP.

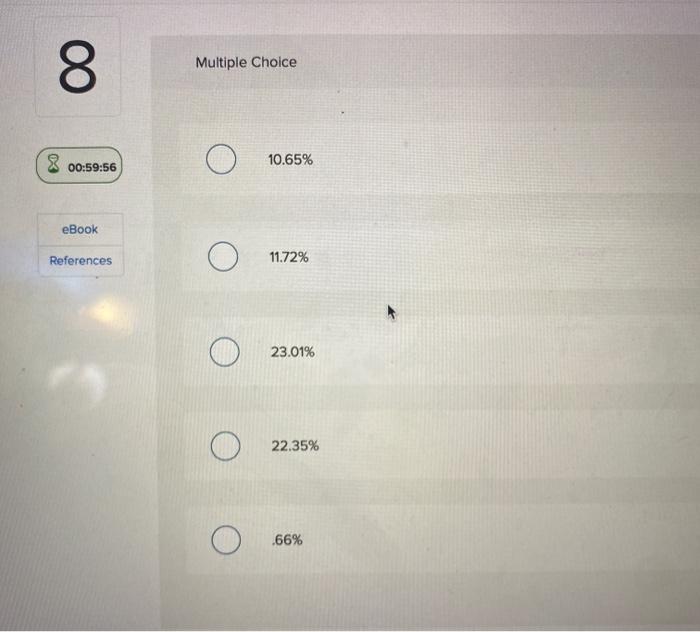

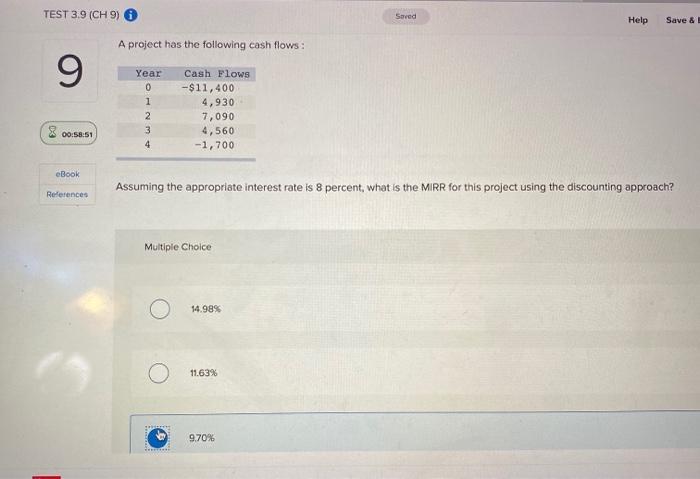

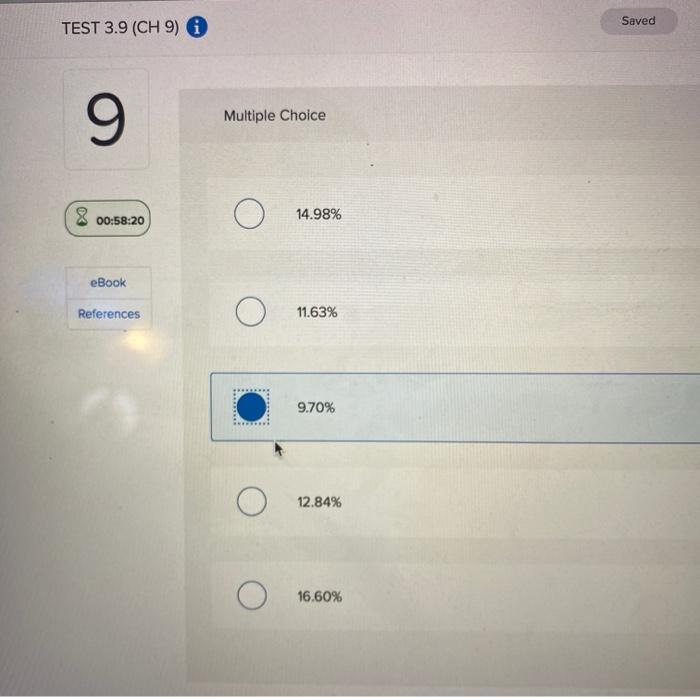

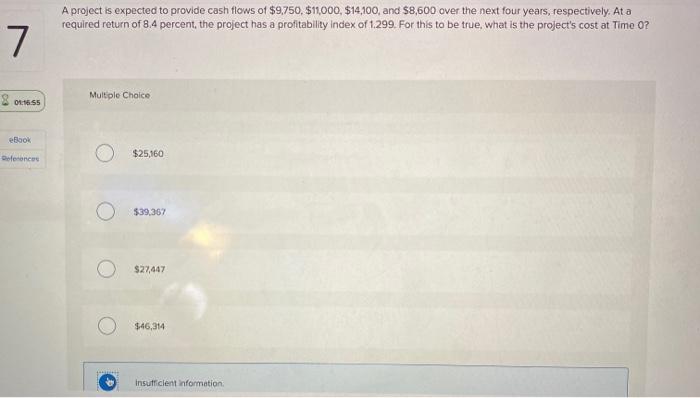

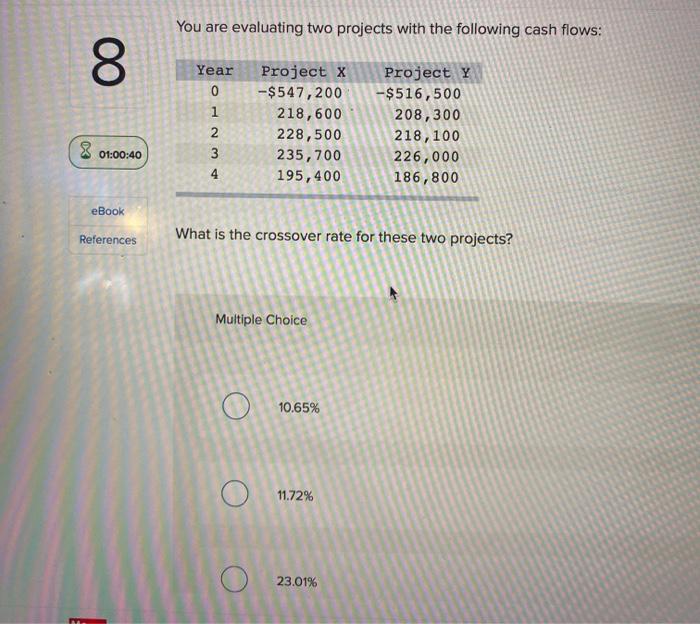

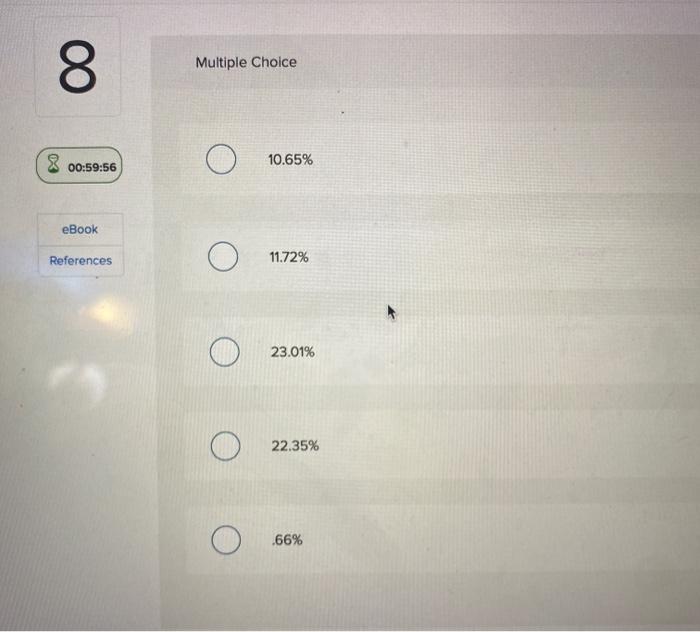

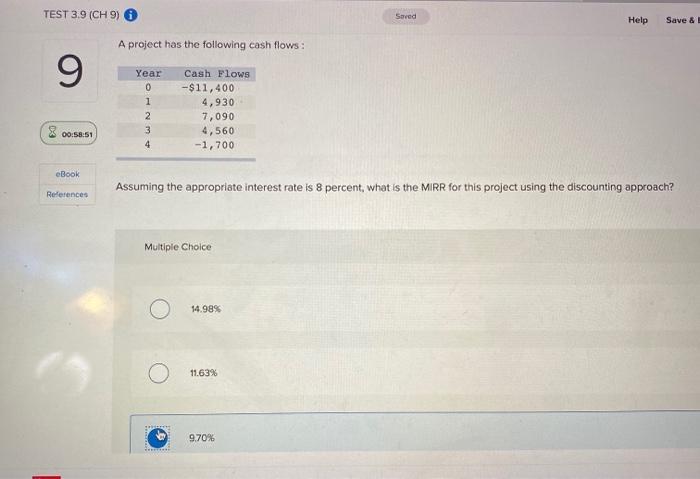

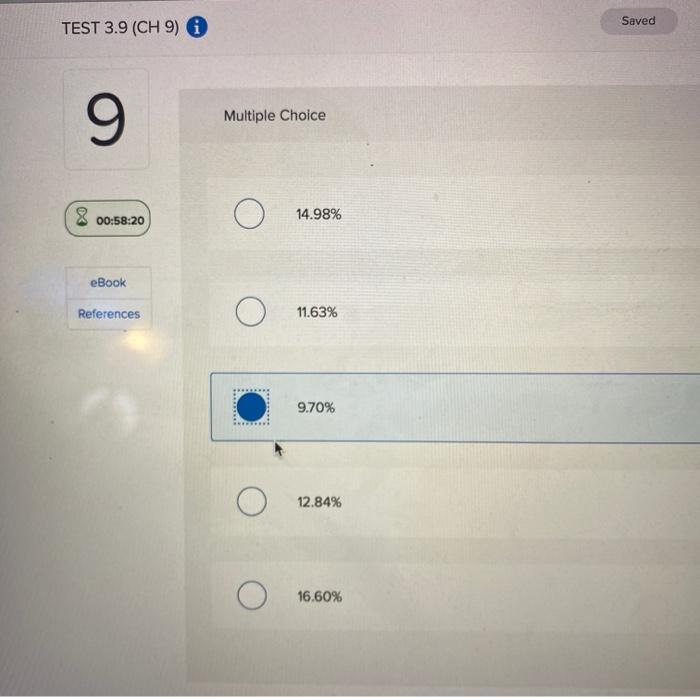

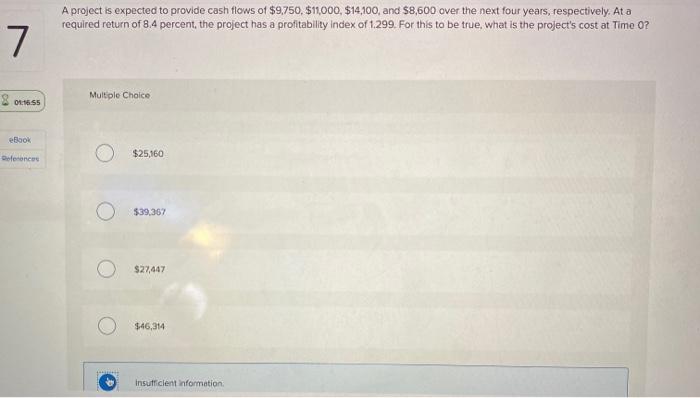

You are evaluating two projects with the following cash flows: 00 Year Project x -$547,200 218,600 228,500 235, 700 195,400 1 2 3 4 Project Y -$516,500 208,300 218,100 226,000 186,800 8 01:00:40 eBook References What is the crossover rate for these two projects? Multiple Choice 10.65% . 11.72% 23.01% 00 Multiple Choice 8 O 10.65% 00:59:56 eBook References O O 11.72% 23.01% 22.35% .66% TEST 3.9 (CH 9) Saved Help Save & A project has the following cash flows: 9 Year 0 1 2 3 4 Cash Flows -$11,400 4,930 7,090 4,560 -1,700 00:58:51 eBook Assuming the appropriate interest rate is 8 percent, what is the MIRR for this project using the discounting approach? References Multiple Choice 14.989 11.63% 9.70% Saved TEST 3.9 (CH 9) 9 Multiple Choice 8 00:58:20 O 14.98% eBook References 11.63% 9.70% 12.84% 16.60% A project is expected to provide cash flows of $9,750, $11,000, $14,100, and $8,600 over the next four years, respectively. At a required return of 8.4 percent, the project has a profitability Index of 1.299. For this to be true, what is the project's cost at Time 0? 7 80116.55 Multiple Choice eBook $25,160 Defence O $39,367 $27,447 $46,314 Insufficient information

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started