Answered step by step

Verified Expert Solution

Question

1 Approved Answer

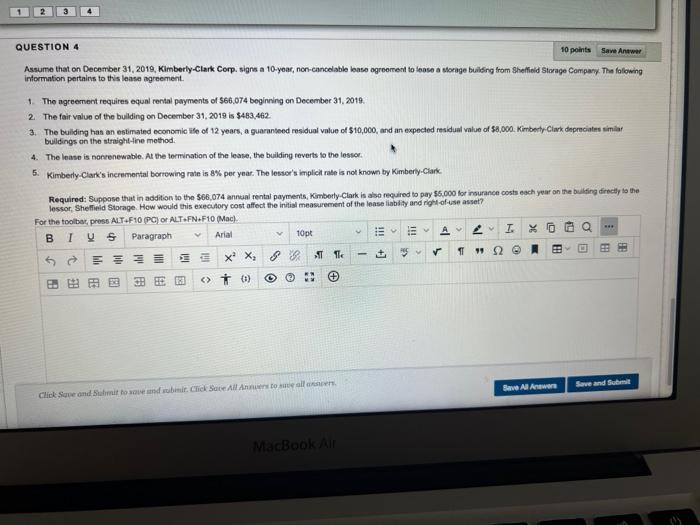

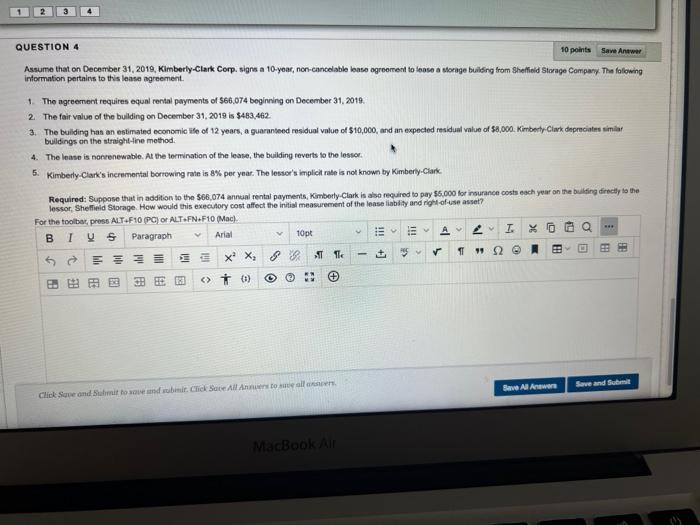

please need help asap a QUESTION 4 10 points Save Anew Assume that on December 31, 2019, Kimberly-Clark Corp. signs a 10-year, non-cancelable lease agreement

please need help asap

a QUESTION 4 10 points Save Anew Assume that on December 31, 2019, Kimberly-Clark Corp. signs a 10-year, non-cancelable lease agreement to loose a Morage building from Sheffield Storage Company. The following information pertains to this lease agreement. The agreement requires equal rental payments of $66.074 beginning on December 31, 2019, 2 The fair value of the building on December 31, 2019 is $483,462. 3. The building hon an estimated economic tile of 12 years, a guaranteed residual value of $10,000, and an expected residual value of 58,000. Kimberly Clark deprecintes similar buildings on the straight line method 4. The lease is no renewable. At the termination of the lease, the building reverts to the lontor 5. Kimberly Clark's incremental borrowing rate is 8% per year. The lessor's implicitrate is not known by Kimberly-Clark Required: Suppose that in addition to the $66,074 annual rental payments, Kimberly-Clark is also required to pay $6.000 for insurance costs each year on the building directly to the lessor Sheffield Storage. How would this executory cost affect the initial measurement of the lease liability and right-of-use asset? For the toolbar, press ALT-F10 POO ALTOFN F10 (Mac) B I VS Paragraph Arial 10pt I OdQ op 1 * 2 A . XX, T1 B. BE ( * ) ** + 3: BCH Save Al Answer Save and Summit Click Save and Shamit to save and submit. Click Save All Antonellen MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started