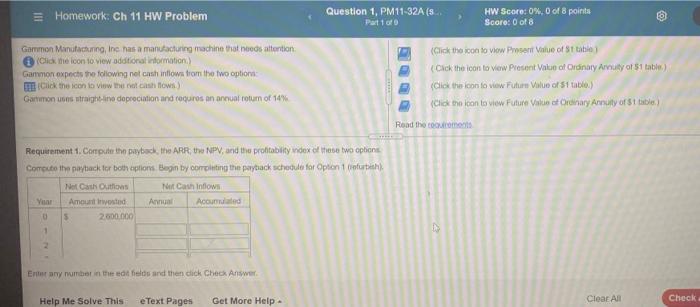

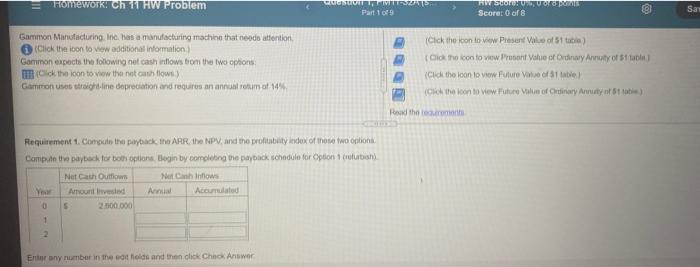

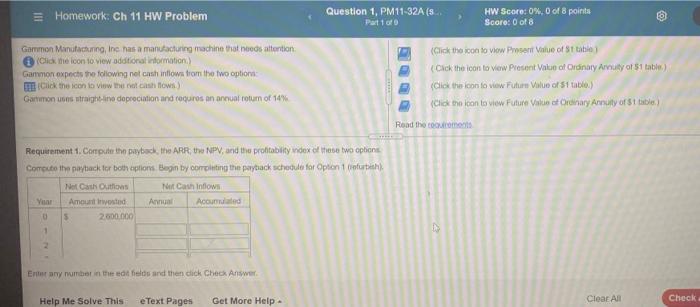

please need help sloving this , going all the way to year 8 on the table for requirement 1

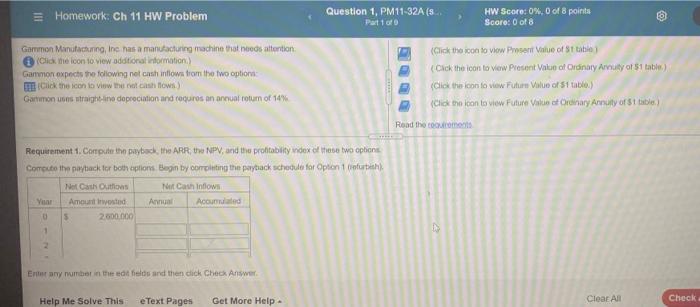

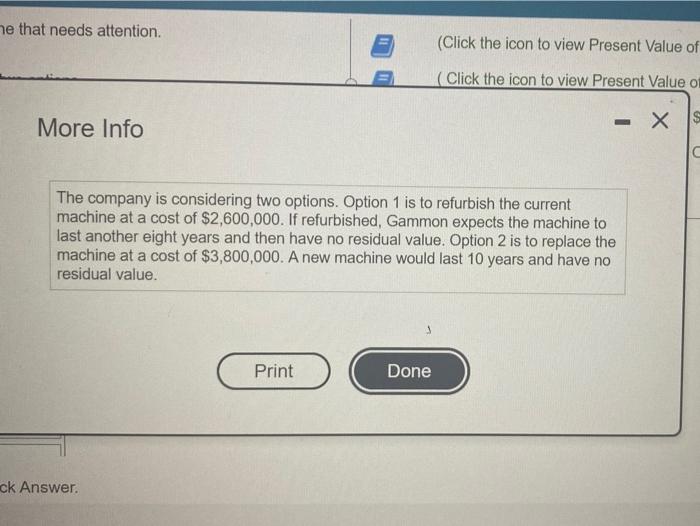

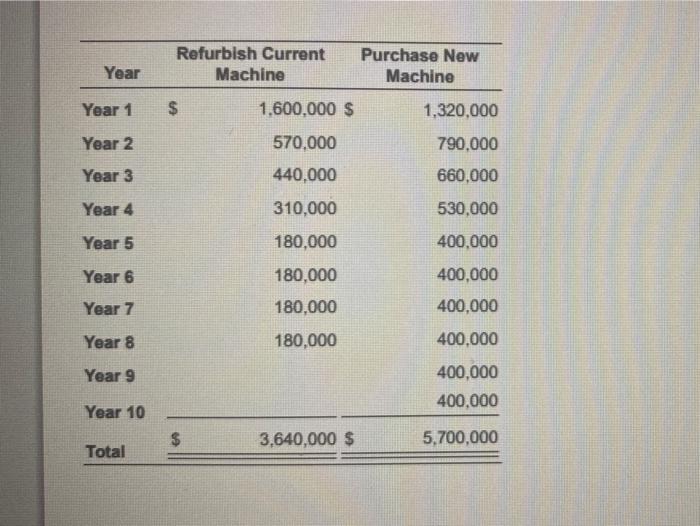

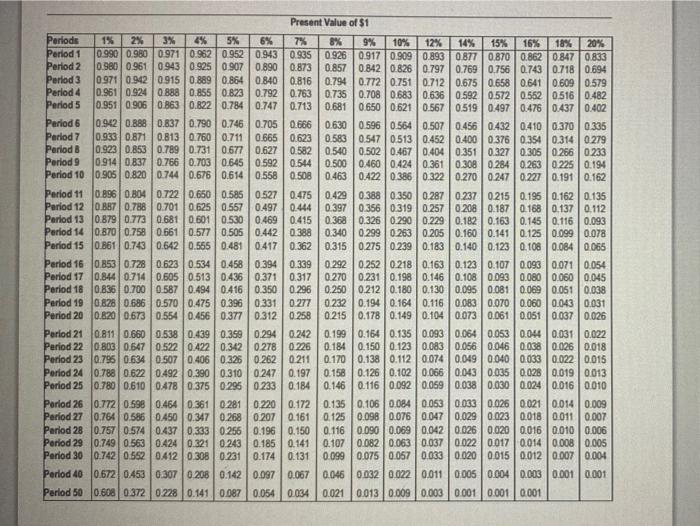

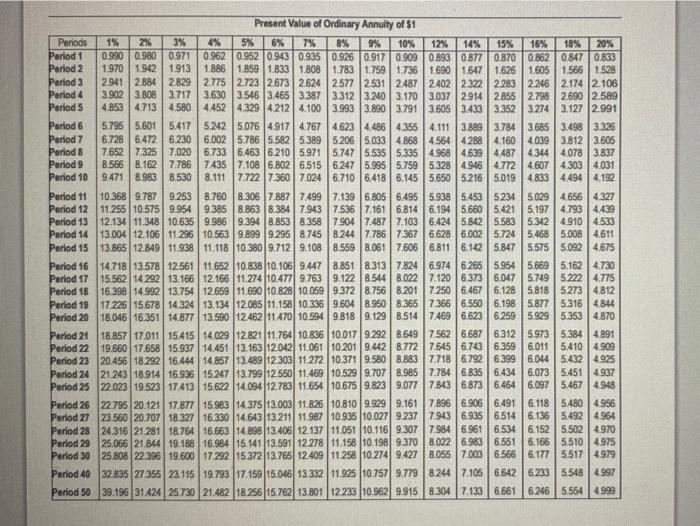

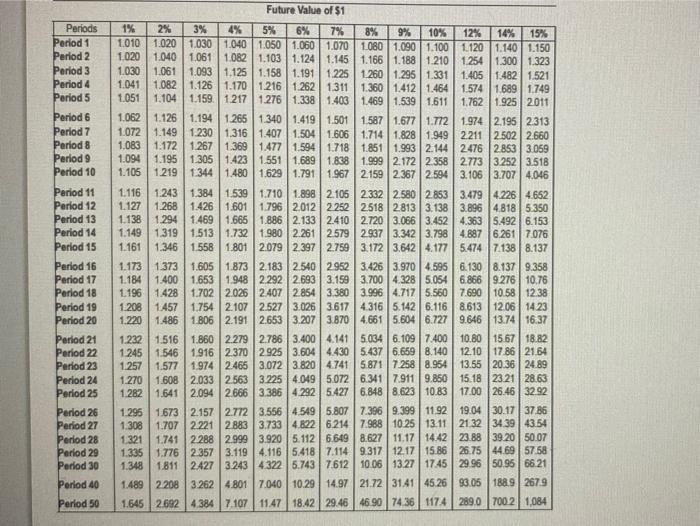

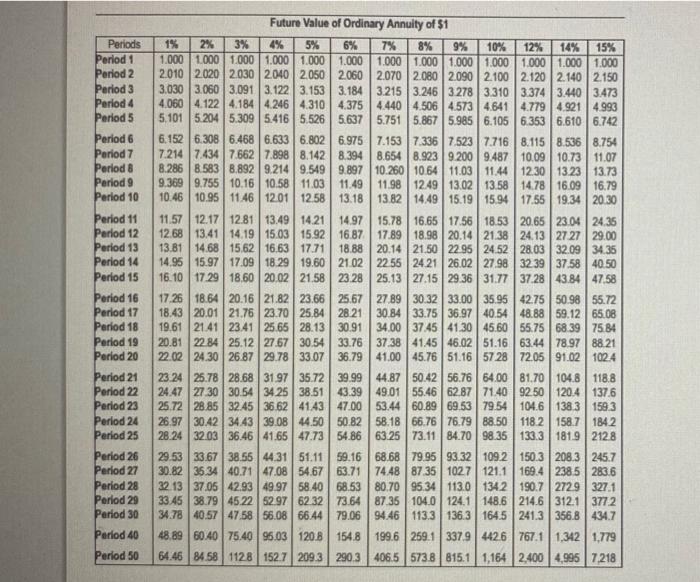

= Homework Ch 11 HW Problem Question 1, PM11-32A (8. Part 10 HW Score: 0% 0 of 8 points Score: 0 of 8 Garmon Manufacturing, Inc. has a manufacturing machine that needs attention (Click the icon to view additional information) Gammon expects the following not cash inflows from the two option: Click the icon to view the cash flow Garmon ons straight-line depreciation and requires an annual rotum of 14% (Click the icon to view Present Value of State Click the icon to view Present Value of Ordinary Arvuty of 51 table) (Click the icon to view Future Value of 51 table) (Click the icon to view Future Value of Ordinary Annuity of 1 table) Read the outcomes Requirement 1. Computer the payback, the ARR, the NPV, and the profitability index of these two options Correcto the pay track tor both eptions. Begin by correlating the parytack schedule for Optor volutath) Net Carth Outlios Mt Cash inflows Yur Amountriested Annual Accumulated 2.600.000 U 5 1 Enter any number in the fields and then click Check Answer Help Me Solve This e Text Pages Get More Help Check Clear All me that needs attention. (Click the icon to view Present Value of Click the icon to view Present Value o - More Info X s 10 The company is considering two options. Option 1 is to refurbish the current machine at a cost of $2,600,000. If refurbished, Gammon expects the machine to last another eight years and then have no residual value. Option 2 is to replace the machine at a cost of $3,800,000. A new machine would last 10 years and have no residual value. Print Done ck Answer. Refurbish Current Machine Year Purchase New Machine Year 1 $ 1,600,000 $ 1,320,000 Year 2 570,000 790,000 660,000 Year 3 440,000 310,000 Year 4 530,000 Year 5 180,000 400,000 Year 6 180,000 400,000 400,000 Year 7 180,000 Year 8 180,000 400.000 Year 9 400,000 400,000 Year 10 3,640,000 $ 5,700,000 Total Part 1 of 9 Score: 0 of 8 needs attention. (Click the icon to view Present Value of $1 cions: (Click the icon to view Present Value of Om $11 Requirements Ordi 1. Compute the payback, the ARR, the NPV, and the profitability index of these two options. 2. Which option should Gammon choose? Why? Print Done Present Value of $1 Periods 15 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20% Period 1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.9090.893 0.8770.870 0.862 0.847 0.833 Period 2 0.980 0.961 0943 0.925 0.907 0.890 0.873 0.8570.84208260.797 0.769 0.756 0.743 0.7180.694 Period 3 0.9710.942 0915 0.8890.864 0.840 0.816 0.7940.772 0.751 0.712 0.675 0.658 0.641 0.609 0.579 Period 4 0.961 0.9240888 0.8550.8230.792 0.763 0.735 0.708 0.683 0.636 0.592 0.5720552 0.516 0.482 Period 5 0.951 0.9060863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.567 0.519 0.497 0.4760437 0.402 Period 6 0.942 0.888 0.837 0.790 0.746 0.705 0.6660.630 0.596 0.564 0.5070.456 0.432 0.410 0.370 0.335 Period 7 0.933 0.871 0.813 0.750 0.7110.665 0.623 0.5830.5470513 0.452 0.400 0.376 0.354 0.314 0279 Period 0.923 0.853 0.789 0.731 0.677 0.627 0.5820.540 0.502 0.467 0.4040.351 0.327 0.305 0.266 0233 Period 9 0.914 0.837 0.766 0.70306450.5920.544 0.500 0.460 0.424 0.361 0.308 0.284 0.263 0225 0.194 Period 10 10.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.322 0.270 0.247 0.227 0.19 0.162 Period 11 0.8960 B040.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.287 0.237 0.215 0.196 0.162 0.135 Period 12 0.587 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.257 0208 0.187 0.168 0.1370.112 Period 13 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.229 0.182 0.163 0.145 0.116 0.093 Period 14 0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.205 0.160 0.141 0.125 0.099 0.078 Period 15 0.861 0.743 0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.183 0.1400.123 0.108 0.084 0.065 Period 16 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0218 0.163 0.123 0.1070093 0.071 0.054 Period 17 0.844 0.714 0.505 0.513 0.436 0.371 0.317 0.270 0.231 0.198 0.146 0.108 0.093 0.080 0.060 0.045 Period 18 0.836 0.7000.587 0.494 0.416 0.350 0.296 0.250 0.212 0.1800.130 0.095 0.081 0.069 0.051 0.038 Period 19 0.828 0.686 0.570 0.475 0.3960.331 0.277 0232 0.1940.164 0.116 0.083 0.070 0.060 0.043 0.031 Period 20 0.820 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.104 0.073 0.061 0.051 0.037 0.026 Period 21 0.811 0.660 0.538 0.439 0.359 0.294 0.2420.1990.1640.135 0.093 0.064 0.053 0.044 0.031 0.022 Period 22 0.803 0.647 0.522 0.422 0.342 0278 0226 0.184 0.150 0.123 0.083 0.056 0.046 0.038 0.026 0.018 Period 23 0.795 0.634 0.507 0.4060.326 0.262 0.211 0.170 0.138 0.112 0.074 0.049 0.040 0.033 0.022 0.015 Period 24 0.788 0.622 0.492 0.390 0.310 0.247 0.197 0.158 0.126 0.1020.066 0.043 0.035 0.028 0.019 0.013 Period 25 0.780 0.6100478 0.375 0.295 0.233 0.184 0.146 0.116 0.092 0.0590.038 0.030 0.024 0.0160.010 Perlod 26 0.772 0.598 0.464 0.361 0.281 0.220 0.172 0.135 0.106 0.084 0.053 0.033 0.026 0.021 0.014 0.009 Period 27 0.764 0.586 0.450 0.347 0.268 0.207 0.161 0.125 0.098 0.076 0.047 0.0290.023 0.0180.0110.007 Period 28 0.757 0.574 0.437 0.333 0256 0.1960.150 0.116 0.090 0.069 0.042 0.026 0.0200.016 0.010 0.006 Period 29 0.7490.563 0.424 0.321 0243 0.185 0.141 0.107 0.082 0.063 0.037 0.022 0.0170.014 0.008 0.005 Period 30 0.742 0.5520412 0.308 0231 0.1740.131 0.099 0.075 0.057 0.033 0.0200.015 0.012 0.007 0.004 Period 40 0.672 0453 0.3070208 0.142 0.097 0.067 0.046 0.032 0.022 0.0110.005 0.0040.003 0.001 0.001 Perlod 50 0.608 0.372 0228 0.141 0.087 0.054 0.034 0.021 0.013 0.0090.003 0.001 0.001 0.001 Present Value of Ordinary Annuity of 51 Periods 1% 2% 3% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20% Period 1 0.990 09800.971 0.962 09520.943 0.935 0.926 0.917 0.9090893 0.877 0.870 0.86208470.833 Period 2 1.970 1.942 1.913 1.886 1.859 1833 1.808 1.783 1.759 1.736 1690 1647 1.626 1.605 1.566 1.528 Parlod 3 2941 288428292775 2.723 2.673 2624 2577 2531 2.487240223222.283 2.246 2174 2.106 Period 4 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 29142855 2798 2690 2.589 Period 5 4.8534.713 4.580 4.452 4.3294212 4.100 3.9933.890 3.791 3.605 3.43333523274 3.127 2.991 Period 6 5.795 5.601 5417 5242 5.076 4.917 4.767 4623 4.4864 355 4.111 3.8893.784 3.685 3.498 3.325 Period 7 6.728 6.472 6.230 6.002 5.786 5582 5.389 5.206 5.093 4.86845644288 4.160 4.0393.812 3.605 Period 8 7.65273257.020 6.733 6.463 6210 5971 5.747 5535 5335 4.968 46394.487 4344 4.078 3.837 Period 9 8.566 8.162 7.786 7435 7.108 6.802 6.515 6247 5.995 5.750 5.32849464.7724.607 4.303 4031 Period 10 9.471 8.983 8.530 8.111 7.722 7.360 7.024 | 6.710 6.418 6.145 5.65052165.019 4833 4.494 4.192 Period 11 10.368 9.7879.253 8.760 8.306 7.887 7.499 7.139 6.8056.495 5.938 5.4535234 5.0294656 4.327 Period 12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 75367.1616.814 6.1945.660 5.421 5.197 4.793 4.439 Period 13 12.134 11.348 10.6359.986. 9.394 8.8538.3587.9047.487 7.103 6.424 5.8425583 5.3424910 4.533 Period 14 13.00412106 11.296 10.563 9.899 9.295 8.74582447.786 7.367 6,628 6.002 5.724 5.468 5.000 4.611 Period 15 13,86512849 11.938 11.118 10.380 9.712 9.108 8.559 8.0617.606 6,811 6.142 5.8475575 5.092 4.675 Period 16 14.718 | 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824 6.9746.26559545.669 5.1624.730 Period 17 15.562 14292 13.166 12.166 11.274 10.477 9763 9.122 8.5448.022 7.1206373 6.047 5.749 5222 4.775 Period 18 16.398 14.992 13.754 12.659 11.690 10.828 10.0699.372 8.7568.2017.250 6.4676.128 58185273 4.812 Period 19 17 225 15,678 14.32413.134 12.085 11.158 10.336 9.604 8.950 8.3657366 6.550 6.1985.87753164844 Period 20 18.046 16.351 14.877 13.590 1246211.470 10.5949.818 9.129 8.5147.469 6.623 6.259 5.929 5.353 4.870 Period 21 18.857 17.011 15.415 14.029 12821|11.764 10.836 10.017 9.292 8.6497562 | 6.687 6.3125.973 5.3844891 Period 22 19.660 17.658 15.93714451 13.163 12042 11.061 10.2019.442 8.7727.645 6.7436.3596.0115.410 4.909 Period 23 20456 18 292 16.444 14.857 13.48912303 11.272 10.371 9.5808.8837.718 6.792 6.399 6.044 5432 4925 Period 24 21.243 18.914 16.936 15.247 13.799 12.550 11.469 10.529 9.7078.9857.7846.835 6.434 6.073 5.451 4.937 Period 25 22.023 19.5231741315.622 14.094 12783 11.654 10.675 9.8239.077 7.8436.8736.464 6.097 5.467 4948 Period 26 22.795 20.12117 87715.983 14.375 13.003 11.826 10.8109.929 9.1617.896 6.906 6.491 6.118 5.480 4956 Period 27 23.560 20.707 18.327 16.330 14.643/13 211 11.987 10.935 10.027 923779436.935 6.514 6.1365492 4.964 Period 28 24.3162128118.764 16.663 14.898 13.406 12.137 11.051 10.116 9.3077.984 6.9616.534 6.152 5.5024970 Period 29 25.066 21.844 19.188 16.984 15.141 13.591) 12 278 11.158 10.1989 370 8.022 6 983 6.551 6.166 5510 4.975 Period 30 25.80822396 19.600 17.292 15.372 13.765 12409 11 258 10 274 9.4278.0567.003 6.566 6.1775.517 4979 Period 40 32835 27355 23.115 19.793 17.159 15.046 1333211.925 10.757 9.7798244 7.1066.642 6.233 5.548 | 4997 Period 50 39.196 3142425 730 21.482 18.25615.762 13.801 12233 10.962 9.915 8.304 7.133 6.6616.246 55544999 10% Periods Period 1 Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period 8 Period 9 Period 10 Period 11 Period 12 Period 13 Period 14 Period 15 Period 16 Period 17 Period 18 Period 19 Period 20 Period 21 Period 22 Period 23 Period 24 Period 25 Period 26 Period 27 Period 28 Period 29 Period 30 Period 40 Period 50 Future Value of $1 1% 2% 3% 4% 5% 6% 7% 8% 9% 12% 14% 15% 1.010 1.020 1030 1.040 1.050 1.060 1.070 1080 1.090 1.100 1.120 1.140 1.150 1 020 1.040 1.061 1.0821.103 1.1241.145 1.166 1.1881.210 1.254 1.300 1.323 1.030 1.061 1.093 1.125 1.158 1.191 1.225 1.260 1.295 1.331 1.405 1.482 1.521 1.041 1.0821.126 1.1701216 1 262 1311 1.360 1.4121.464 1.574 1689 1.749 1.051 1.104 1.159 1.217 1.2761.338 1.403 1.469 1.539 1.611 1.762 1.925 | 2011 1.052 1.126 1.1941.265 1.340 1.419 1.501 1587 1.6771.772 1.9742.1952.313 1.072 1.149 1.230 1.316 1.407 1.5041.606 1.7141.8281.949 2211 2502 2.660 1.083 1.1721.267 1369 1.477 1.594 1.7181.851 1.993 2.144 2476 2853 3.059 1.094 1.195 1.305 1.423 1.551 1.689 1.838 1.999 2.172 2.358277332523518 1.105 1.219 1.344 1.480 1.6291.791 1.967 2.159 2.367 2.594 3.106 3.707 4.046 1.116 1.243 1.384 1.539 1.710 1.898 2.105 23322.580 2.853 3.479 4.226 4652 1.127 1.268 1.426 1.601 1.796 2.0122252 2518 2813 3.138 3.896 4.818 5.350 1138 1.294 1.469 1.665 1.886 2.133 2.410 2.720 3.066 3.452 4.363 5.492 6.153 1.149 1.319 1.513 1.732 1.980 2.261 2.579 2.937 3.342 3.798 4.887 6.261 7076 1.161 1.346 1.558 1.801 2.079 2 397 2.759 3.172 3.642 4.177 5.47471388.137 1.173 1.3731.605 1.873 2.183 2.5402952 3.426 3.970 4.595 6.130 8.137 9.358 1.184 1.400 1.653 1.948 2.2922693 3.1593.700 4.3285.0546.866 9.276 10.76 1.196 1428 1.702 2.026 2407 285 3.380 3.996 4.717 5.560 7.690 10.58 12.38 1.208 1.4571754 2.107 2.527 3.026 3.6174.316 5.142 6.116 8.613 12.06 1423 1.220 1.486 1.806 2.191 2.653 3.207 3.870 4,661 5.6046.727 9.646 13.74 16:37 1.232 1.516 1.860 2.279 2.786 3.400 4.141 5034 6.1097.400 10.80 15.67 1.82 1.245 1.546 1916 2370 2 925 3.604 4.430 5.4376.659 8.140 12.10 17.86 21.64 1.257 1.5771.9742.465 3.072 3.820 4741 587172588.954 13.55 20.36 24.89 1.270 1.608 2.033 2,563 3.225 4.049 5.072 6.3417.911 9.850 15.18 23 21 28.63 1.282 1.641 2.094 2.666 3.386 4 292 5.427 6.848 8 623 10.83 17.00 26.46 3292 1.295 1.673 2.157 2.772 3.556 4.549 5.8077.3969.399 11.92 19.04 30.1737.86 1.308 1.707 2 221 2 883 3.733 4.822 6.214 7.988 10 25 13.11 21 32 34 39 | 43.54 1321 1.741 2288 2.999 3.920 5.112 6.649 8.627 11.17 14:42 23.88 39 50 1.335 1776 2357 3.119 4.116 5.418 7.1149.317 121715.86 26.75 44.69 57.58 1.348 1.811 2.427 3.243 43225.743 7.612 10.06 13.27 17.45 | 29.96 50.956621 1.48922083 262 4.801 7.040 10.29 14.9721.72 31.41 | 45.26 93.05 188.92679 1.64526924.384 7.107 11.47 18.42 29.46 46.90 74.36 1174 289.0 700 2 1,084 Periods Period 1 Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period 8 Period 9 Period 10 Period 11 Period 12 Period 13 Period 14 Period 15 Period 16 Period 17 Period 18 Period 19 Period 20 Future Value of Ordinary Annuity of 51 15 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 2010 2020 2030 2040 2050 2060 2.070 2.080 2.090 2.100 2.120 2.140 2.150 3.030 3.060 3.091 3.122 3.153 3.1843.215 3.246 3278 3.310 3.374 3.440 3.473 4.0604.122 4.1844.246 4.310 4.375 4.440 4.5064.573 4.641 4.779 4.921 4.993 5.101 5.204 5.309 5.416 5.526 5.637 5.751 5.8675.985 6.105 6.353 6.610 6.742 6.152 6.308 6.468 6.633 6.802 6.975 7.1537.336 7523 7.7168.115 8.536 8.754 7.214 7.4347.6627.898 8.142 8.3948.6548.9239.2009.487 10.09 10.73 11.07 8.286 8.5838.8929.2149.549 9.897 10.260 10.64 11.03 11.44 1230 13.23 13.73 9.369 9.755 10.16 10.58 | 11.03 11.49 11.98 12.49 13.02 13.58 14.78 16.09 16.79 10.46 10.95 11.46 12.01 12:58 13.18 1382 14 49 15.1915.94 17.55 19.34 20.30 11.57 12.17 12.81 13.49 1421 14.97 15.78 16.65 17.56 18.53 20.65 23.0424.35 12.68 13.41 14.19 15.03 15.92 16.87 17.8918.98 20.14 21.38 24.13 27.2729.00 13.81 14.68 15,62 16.63 17.71 18.88 20.14 21.50 22.95 24.52 28.03 32.09 34 35 14,95 15.97 17.09 18.29 19.60 21.022255 24.21 26.02 27.98 3239 37.58 40.50 16.10 17.29 18.60 20.02 21.58 23.28 25.13 27.15 29.3631.77 37.28 43.84 | 47,58 17.26 18.64 20.16 21.82 23.66 25.67 27 89 30.32 | 33.00 35.95 42.75 50.98 55.72 18.43 20.01 21.7623.70 25.84 28. 21 30.84 33.75 36.97 40.54 48.8859.12 65.08 19.61 21.41 23.41 25.65 28.13 30.91 34.00 37.45 41.30 45.60 55.75 68 39 75.84 20.81 2284 25.12 27.67 30.54 33.76 37 38 41.45 46.02 51.1663.44 78.9788.21 22.02 24.30 26.87 29.7833.07 36.79 41.00 45.76 51.165728 72.05 91.02 1024 23 24 25.7828.68 3197 35.72 39.99 44.87 50.4256.76 64.00 81.70 104.8 118.8 24.47 27 30 30.543425 38.51 43.39 49.01 55.46 628771.40 92 50 120.4 137.6 25.72 28.85 3245 36 62 41.4347.00 53.44 60.89 69.5379.54 104.6 138 31593 26.97 30.42 34 43 39.08 44.50 50.82 58.18 66.76 76.79 88.50 118.2 158.71842 28.24 32.03 36.46 41.65 47.73 54.86 63.25 73.1184.70 98.35 133.3 181.92128 29.53 33.67 38.55 44.3151.11 59.16 68.68 79.95 93.32 1092 150.3 208.3 245.7 30.82 35.3440.71 47.08 54.6763.717448 87 35 1027 121.1 169.4 238.5 283.6 32.13 37.05 42.93 49.97 58.40 68.53 80.70 95.34 113.0 1342 190.7 2729327.1 33.45 38.79 45.22 52.97 6232 73.6487.35 104.0 | 124.1148.6 214.6 312.1 3772 34.78 40.57 47.58 56.08 66.44 79.06 94.46 113.3136.3164.5 241.3356.8 434.7 48.89 60.40 75.40 96.03 120.8154.8 199.6 259.1 337.94426767.1 1,342 1.779 64.46 84.58 1128 152.7209.3 290.3 406.5 573.8815,1 1,164 2,400 4,9957.218 Period 21 Period 22 Period 23 Period 24 Period 25 Period 26 Period 27 Period 28 Period 29 Period 30 Perlod 40 Period 50 HOMEWOTKI Ch 11 HW Problem CULO COLOHUO Scorer of San Part 10 Gammon Manufacturing, Inc. han a manufacturing machine that needs attention (Click the icon to view additional information Gammon expects the following net cash inflows from the two ophions Ick the icon to view the net cathows Gamton uses tight-line depreciation and requires an annual resume 14% Click the coon to view Present of 51 ) Click the icon to www Present Value of Odray Arruty of talu (Cid the icon to view Future Value of State Click the loan to view Future Value of Ordinary Annual State) Read the remote Requirement 1. Comptes the payback the ARR the NPV and the profitabity index of those two option Compute the payback for both options begin by completing the playback schedule for Option 1 rulubishi Net Cath Outfi Nut Chinos You Alvested Annual Accumulated 0 5 2.000.000 1 En any number in the world and then click Chick