Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please need help with this as it's due tomorrow. you can take all my remaining questions if needed as I never asked a question before.

please need help with this as it's due tomorrow. you can take all my remaining questions if needed as I never asked a question before.

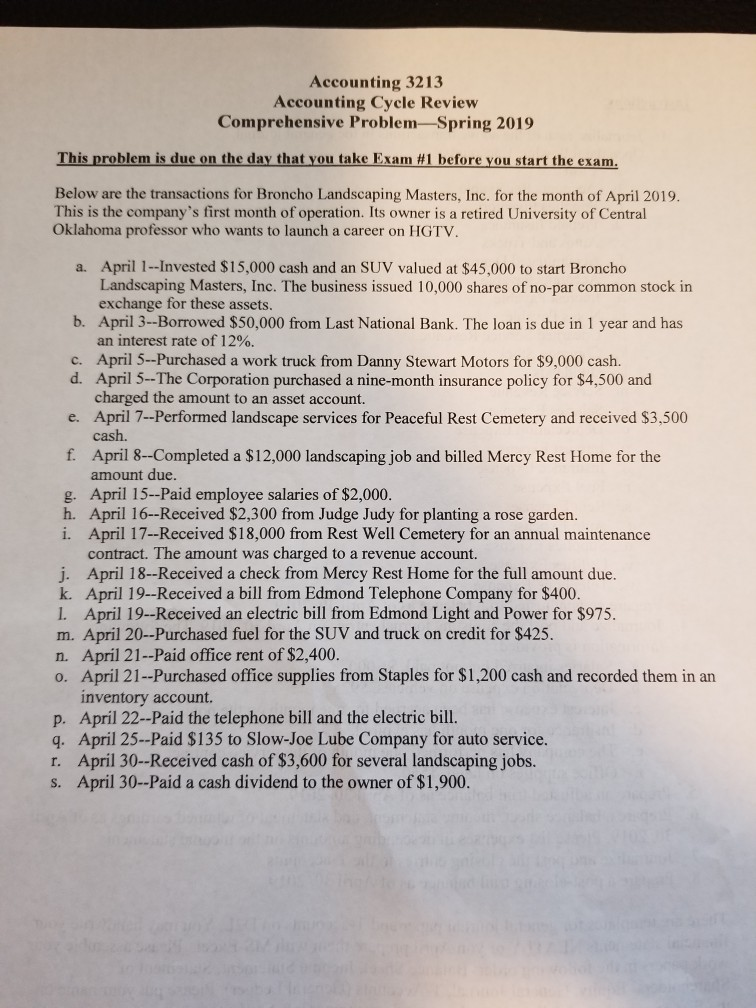

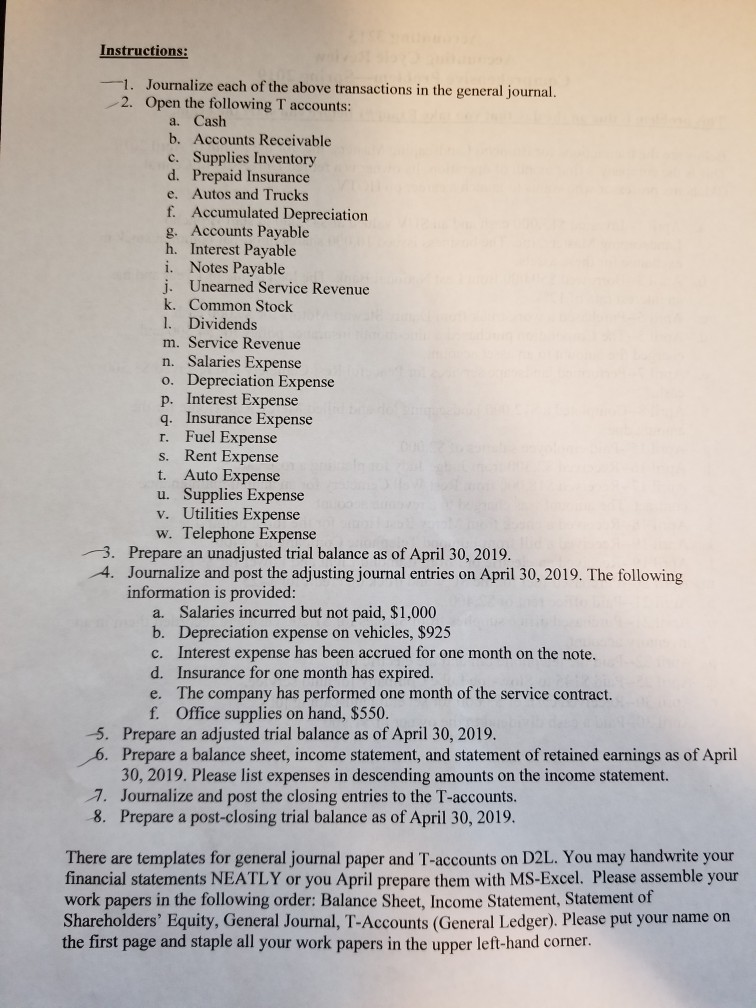

Accounting 3213 Accounting Cycle Review Comprehensive Problem-Spring 2019 This problemis due on the day thatyou take Exam #1 before you tartthe exa Below are the transactions for Broncho Landscaping Masters, Inc. for the month of April 2019. This is the company's first month of operation. Its owner is a retired University of Central Oklahoma professor who wants to launch a career on HGTV a. April 1--Invested $15,000 cash and an SUV valued at $45,000 to start Broncho Landscaping Masters, Inc. The business issued 10,000 shares of no-par common stock in exchange for these assets. b. April 3-Borrowed $50,000 from Last National Bank. The loan is due in 1 year and has an interest rate of 12%. c. April 5--Purchased a work truck from Danny Stewart Motors for $9,000 cash. d. April 5-The Corporation purchased a nine-month insurance policy for $4,500 and charged the amount to an asset account. e. April 7--Performed landscape services for Peaceful Rest Cemetery and received $3,500 cash. f. April 8-Completed a $12,000 landscaping job and billed Mercy Rest Home for the amount due. g. April 15--Paid employee salaries of $2,000. h. April 16--Received $2,300 from Judge Judy for planting a rose garden. i. April 17--Received $18,000 from Rest Well Cemetery for an annual maintenance contract. The amount was charged to a revenue account. j. April 18--Received a check from Mercy Rest Home for the full amount due. k. April 19--Received a bill from Edmond Telephone Company for $400 l April 19--Received an electric bill from Edmond Light and Power for $975. m. April 20--Purchased fuel for the SUV and truck on credit for $425. n. April 21--Paid office rent of $2,400. o. April 21--Purchased office supplies from Staples for $1,200 cash and recorded them in an inventory account. p. April 22--Paid the telephone bill and the electric bill. q. April 25-Paid $135 to Slow-Joe Lube Company for auto service. r. April 30-Received cash of $3,600 for several landscaping jobs. s. April 30-Paid a cash dividend to the owner of $1,900. Instructions: 1. Journalize each of the above transactions in the general journal. 2. Open the following T accounts: a. Cash b. Accounts Receivable c. Supplies Inventory d. Prepaid Insurance e. Autos and Trucks f. Accumulated Depreciation g. Accounts Payable h. Interest Payable i. Notes Payable j. Unearned Service Revenue k. Common Stock 1. Dividends m. Service Revenue n. Salaries Expense o. Depreciation Expense p. Interest Expense q. Insurance Expense r. Fuel Expense s. Rent Expense t. Auto Expense u. Supplies Expense v. Utilities Expense w. Telephone Expense 3. Prepare an unadjusted trial balance as of April 30, 2019. 4. Journalize and post the adjusting journal entries on April 30, 2019. The following information is provided: a. Salaries incurred but not paid, $1,000 b. Depreciation expense on vehicles, $925 c. Interest expense has been accrued for one month on the note. d. Insurance for one month has expired. e. The company has performed one month of the service contract. f. Office supplies on hand, $550. -5. Prepare an adjusted trial balance as of April 30, 2019. 6. Prepare a balance sheet, income statement, and statement of retained earnings as of April 30, 2019. Please list expenses in descending amounts on the income statement. 7. Journalize and post the closing entries to the T-accounts. 8. Prepare a post-closing trial balance as of April 30, 2019. There are templates for general journal paper and T-accounts on D2L. You may handwrite your financial statements NEATLY or you April prepare them with MS-Excel. Please assemble your work papers in the following order: Balance Sheet, Income Statement, Statement of Shareholders' Equity, General Journal, T-Accounts (General Ledger). Please put your name on the first page and staple all your work papers in the upper left-hand corner. Accounting 3213 Accounting Cycle Review Comprehensive Problem-Spring 2019 This problemis due on the day thatyou take Exam #1 before you tartthe exa Below are the transactions for Broncho Landscaping Masters, Inc. for the month of April 2019. This is the company's first month of operation. Its owner is a retired University of Central Oklahoma professor who wants to launch a career on HGTV a. April 1--Invested $15,000 cash and an SUV valued at $45,000 to start Broncho Landscaping Masters, Inc. The business issued 10,000 shares of no-par common stock in exchange for these assets. b. April 3-Borrowed $50,000 from Last National Bank. The loan is due in 1 year and has an interest rate of 12%. c. April 5--Purchased a work truck from Danny Stewart Motors for $9,000 cash. d. April 5-The Corporation purchased a nine-month insurance policy for $4,500 and charged the amount to an asset account. e. April 7--Performed landscape services for Peaceful Rest Cemetery and received $3,500 cash. f. April 8-Completed a $12,000 landscaping job and billed Mercy Rest Home for the amount due. g. April 15--Paid employee salaries of $2,000. h. April 16--Received $2,300 from Judge Judy for planting a rose garden. i. April 17--Received $18,000 from Rest Well Cemetery for an annual maintenance contract. The amount was charged to a revenue account. j. April 18--Received a check from Mercy Rest Home for the full amount due. k. April 19--Received a bill from Edmond Telephone Company for $400 l April 19--Received an electric bill from Edmond Light and Power for $975. m. April 20--Purchased fuel for the SUV and truck on credit for $425. n. April 21--Paid office rent of $2,400. o. April 21--Purchased office supplies from Staples for $1,200 cash and recorded them in an inventory account. p. April 22--Paid the telephone bill and the electric bill. q. April 25-Paid $135 to Slow-Joe Lube Company for auto service. r. April 30-Received cash of $3,600 for several landscaping jobs. s. April 30-Paid a cash dividend to the owner of $1,900. Instructions: 1. Journalize each of the above transactions in the general journal. 2. Open the following T accounts: a. Cash b. Accounts Receivable c. Supplies Inventory d. Prepaid Insurance e. Autos and Trucks f. Accumulated Depreciation g. Accounts Payable h. Interest Payable i. Notes Payable j. Unearned Service Revenue k. Common Stock 1. Dividends m. Service Revenue n. Salaries Expense o. Depreciation Expense p. Interest Expense q. Insurance Expense r. Fuel Expense s. Rent Expense t. Auto Expense u. Supplies Expense v. Utilities Expense w. Telephone Expense 3. Prepare an unadjusted trial balance as of April 30, 2019. 4. Journalize and post the adjusting journal entries on April 30, 2019. The following information is provided: a. Salaries incurred but not paid, $1,000 b. Depreciation expense on vehicles, $925 c. Interest expense has been accrued for one month on the note. d. Insurance for one month has expired. e. The company has performed one month of the service contract. f. Office supplies on hand, $550. -5. Prepare an adjusted trial balance as of April 30, 2019. 6. Prepare a balance sheet, income statement, and statement of retained earnings as of April 30, 2019. Please list expenses in descending amounts on the income statement. 7. Journalize and post the closing entries to the T-accounts. 8. Prepare a post-closing trial balance as of April 30, 2019. There are templates for general journal paper and T-accounts on D2L. You may handwrite your financial statements NEATLY or you April prepare them with MS-Excel. Please assemble your work papers in the following order: Balance Sheet, Income Statement, Statement of Shareholders' Equity, General Journal, T-Accounts (General Ledger). Please put your name on the first page and staple all your work papers in the upper left-hand cornerStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started