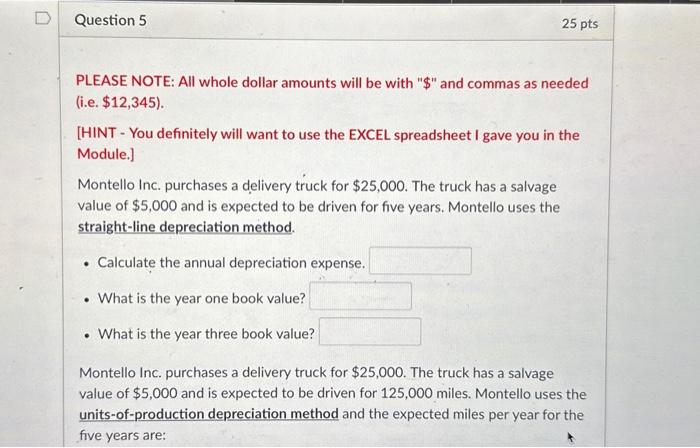

Question: PLEASE NOTE: All whole dollar amounts will be with $ and commas as needed (i.e. $12,345). [HINT - You definitely will want to use the

![use the EXCEL spreadsheet I gave you in the Module.] Montello Inc.](https://s3.amazonaws.com/si.experts.images/answers/2024/09/66da3dd8e3281_71266da3dd89054a.jpg)

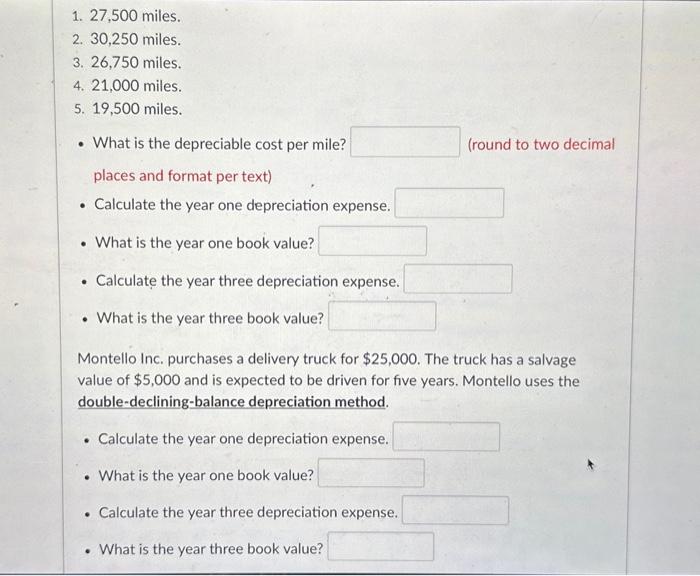

PLEASE NOTE: All whole dollar amounts will be with "\$" and commas as needed (i.e. $12,345). [HINT - You definitely will want to use the EXCEL spreadsheet I gave you in the Module.] Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $5,000 and is expected to be driven for five years. Montello uses the straight-line depreciation method. - Calculate the annual depreciation expense. - What is the year one book value? - What is the year three book value? Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $5,000 and is expected to be driven for 125,000 miles. Montello uses the units-of-production depreciation method and the expected miles per year for the five years are: 4. 21,000 miles. 5. 19,500 miles. - What is the depreciable cost per mile? (round to two decimal places and format per text) - Calculate the year one depreciation expense. - What is the year one book value? - Calculate the year three depreciation expense. - What is the year three book value? Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $5,000 and is expected to be driven for five years. Montello uses the double-declining-balance depreciation method. - Calculate the year one depreciation expense. - What is the year one book value? - Calculate the year three depreciation expense. - What is the year three book value? - In what year is a "plug" amount used instead of the formula to calculate the depreciation expense? Year (just type the number) PLEASE NOTE: All whole dollar amounts will be with "\$" and commas as needed (i.e. $12,345). [HINT - You definitely will want to use the EXCEL spreadsheet I gave you in the Module.] Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $5,000 and is expected to be driven for five years. Montello uses the straight-line depreciation method. - Calculate the annual depreciation expense. - What is the year one book value? - What is the year three book value? Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $5,000 and is expected to be driven for 125,000 miles. Montello uses the units-of-production depreciation method and the expected miles per year for the five years are: 4. 21,000 miles. 5. 19,500 miles. - What is the depreciable cost per mile? (round to two decimal places and format per text) - Calculate the year one depreciation expense. - What is the year one book value? - Calculate the year three depreciation expense. - What is the year three book value? Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $5,000 and is expected to be driven for five years. Montello uses the double-declining-balance depreciation method. - Calculate the year one depreciation expense. - What is the year one book value? - Calculate the year three depreciation expense. - What is the year three book value? - In what year is a "plug" amount used instead of the formula to calculate the depreciation expense? Year (just type the number)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts