Please note that IGM's share price is $43.60 and Saxon's current publicly traded share price is $12.70. Please assume that Saxon earns 0% interest

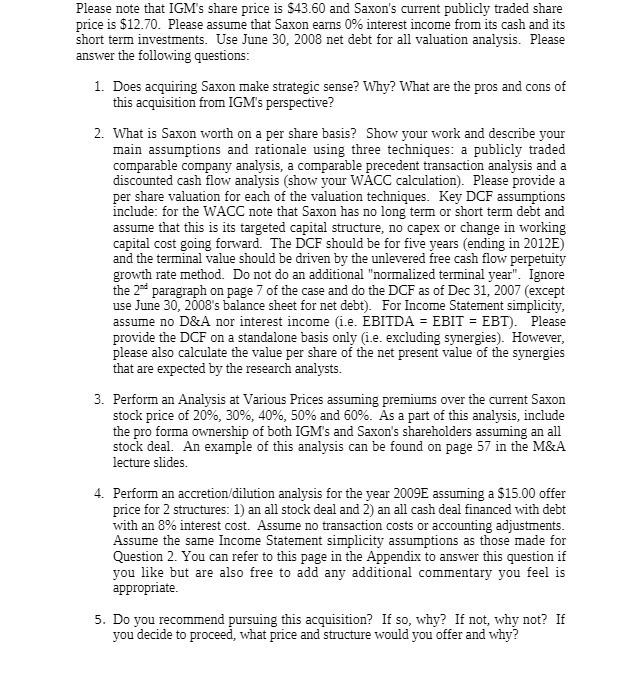

Please note that IGM's share price is $43.60 and Saxon's current publicly traded share price is $12.70. Please assume that Saxon earns 0% interest income from its cash and its short term investments. Use June 30, 2008 net debt for all valuation analysis. Please answer the following questions: 1. Does acquiring Saxon make strategic sense? Why? What are the pros and cons of this acquisition from IGM's perspective? 2. What is Saxon worth on a per share basis? Show your work and describe your main assumptions and rationale using three techniques: a publicly traded comparable company analysis, a comparable precedent transaction analysis and a discounted cash flow analysis (show your WACC calculation). Please provide a per share valuation for each of the valuation techniques. Key DCF assumptions include: for the WACC note that Saxon has no long term or short term debt and assume that this is its targeted capital structure, no capex or change in working capital cost going forward. The DCF should be for five years (ending in 2012E) and the terminal value should be driven by the unlevered free cash flow perpetuity growth rate method. Do not do an additional "normalized terminal year". Ignore the 2nd paragraph on page 7 of the case and do the DCF as of Dec 31, 2007 (except use June 30, 2008's balance sheet for net debt). For Income Statement simplicity, assume no D&A nor interest income (i.e. EBITDA = EBIT = EBT). Please provide the DCF on a standalone basis only (i.e. excluding synergies). However, please also calculate the value per share of the net present value of the synergies that are expected by the research analysts. 3. Perform an Analysis at Various Prices assuming premiums over the current Saxon stock price of 20%, 30%, 40%, 50% and 60%. As a part of this analysis, include the pro forma ownership of both IGM's and Saxon's shareholders assuming an all stock deal. An example of this analysis can be found on page 57 in the M&A lecture slides. 4. Perform an accretion/dilution analysis for the year 2009E assuming a $15.00 offer price for 2 structures: 1) an all stock deal and 2) an all cash deal financed with debt with an 8% interest cost. Assume no transaction costs or accounting adjustments. Assume the same Income Statement simplicity assumptions as those made for Question 2. You can refer to this page in the Appendix to answer this question if you like but are also free to add any additional commentary you feel is appropriate. 5. Do you recommend pursuing this acquisition? If so, why? If not, why not? If you decide to proceed, what price and structure would you offer and why?

Step by Step Solution

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1Acquiring Saxon makes strategic sense for IGM Saxons core competency in providing retail financial advisory services aligns with IGMs goal to expand its retail distribution network The acquisition al...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started