Question

Please note that only the information below are available below in the questionnaire: The new machinery could also serve as collateral for the new loan.

Please note that only the information below are available below in the questionnaire:

The new machinery could also serve as collateral for the new loan. Select the statement most relevant to new machinery as collateral. (Please note: only one of the listed options is be correct.)

a. Machinery normally serve as good collateral.

b. Machinery ownership normally hard to determine.

c. Specialized machinery usually assigned low or zero collateral value.

d. The value of the machinery must be subtracted from the net asset value of the company to obtain the collateral value.

e. None of the options are correct.

READ THE CASE STUDY BELOW AND PLEASE ANSWER THE ABOVE QUESTION.

CASE STUDY:

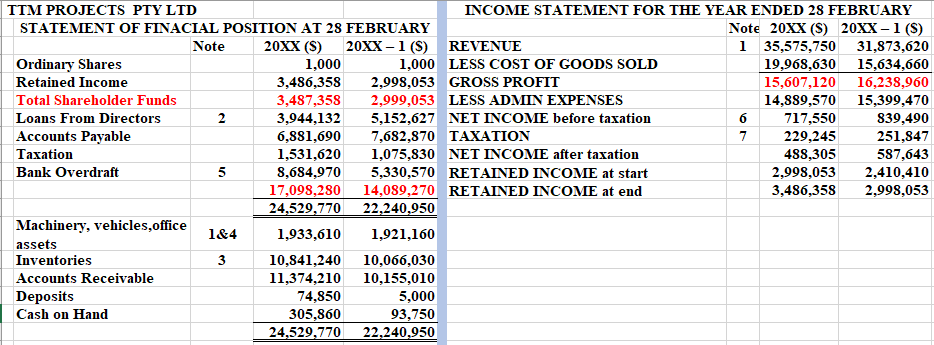

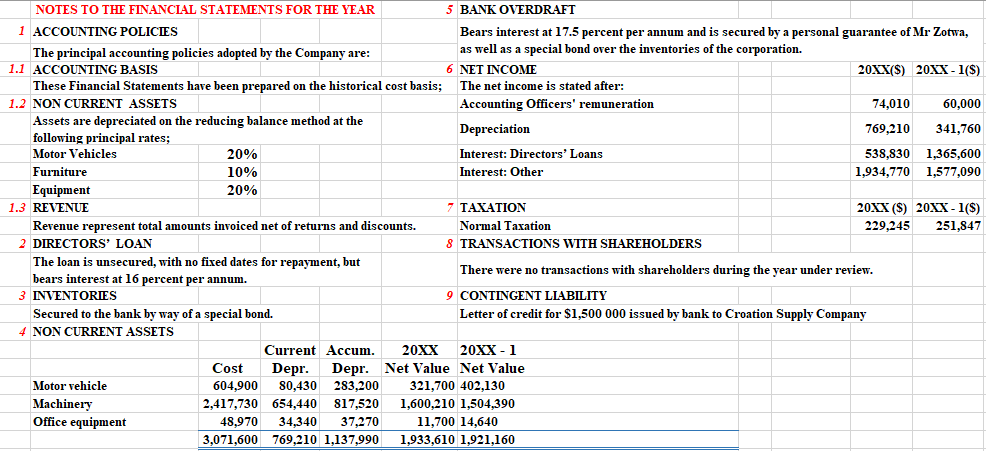

Mr Roth applies for a medium-term loan (5 years) of $4 000 000 to purchase specialised machinery which would expand the production capacity of his business substantially and $3 000 000 additional overdraft facilities to augment the working capital requirements as a result of the expansion.

The business TTM Projects Pty Ltd specialises in the manufacturing of electrical and electronic components for the automotive industry.

Mr Roth (the only shareholder of the company) offers the following collateral to the bank for the requested facilities:

- Unlimited guarantee/suretyship by himself;

- A second mortgage bond over his residential property for $2 000 000. (The realistic market value of the property is $3 250 000 according to a valuation recently done by the bank. The first bond to the value of $2,500,000 in favour of your bank secures the existing debt pertaining to the residential property.);

- A cession of debtors;

- A cession of his loan accounts in TTM Projects Pty Ltd;

- A mortgage over the machinery to be purchased; and

- A mortgage over inventory.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started