Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please only answer 2. The answer to 2 is 15,217,391,30. This 100% correct. What i need is the steps to get to that answer. Thank

Please only answer 2. The answer to 2 is 15,217,391,30. This 100% correct. What i need is the steps to get to that answer. Thank you.

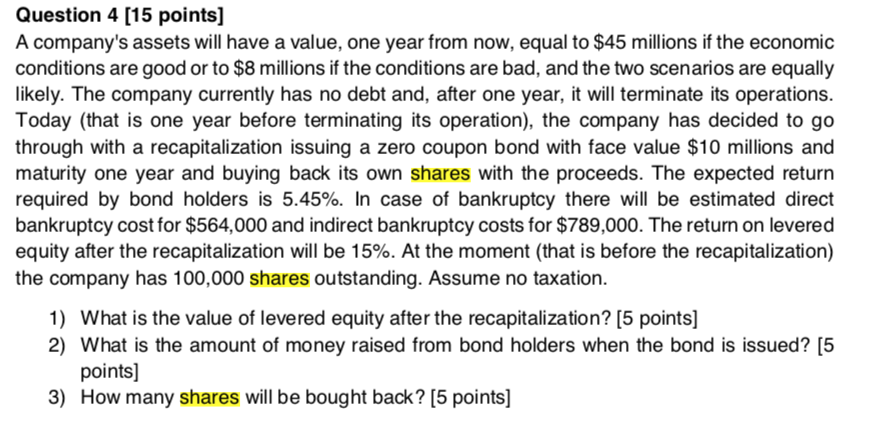

Question 4 [15 points] A company's assets will have a value, one year from now, equal to $45 millions if the economic conditions are good or to $8 millions if the conditions are bad, and the two scenarios are equally likely. The company currently has no debt and, after one year, it will terminate its operations. Today (that is one year before terminating its operation), the company has decided to go through with a recapitalization issuing a zero coupon bond with face value $10 millions and maturity one year and buying back its own shares with the proceeds. The expected return required by bond holders is 5.45%. In case of bankruptcy there will be estimated direct bankruptcy cost for $564,000 and indirect bankruptcy costs for $789,000. The return on levered equity after the recapitalization will be 15%. At the moment that is before the recapitalization) the company has 100,000 shares outstanding. Assume no taxation. 1) What is the value of levered equity after the recapitalization? [5 points) 2) What is the amount of money raised from bond holders when the bond is issued? [5 points] 3) How many shares will be bought back? (5 points) Question 4 [15 points] A company's assets will have a value, one year from now, equal to $45 millions if the economic conditions are good or to $8 millions if the conditions are bad, and the two scenarios are equally likely. The company currently has no debt and, after one year, it will terminate its operations. Today (that is one year before terminating its operation), the company has decided to go through with a recapitalization issuing a zero coupon bond with face value $10 millions and maturity one year and buying back its own shares with the proceeds. The expected return required by bond holders is 5.45%. In case of bankruptcy there will be estimated direct bankruptcy cost for $564,000 and indirect bankruptcy costs for $789,000. The return on levered equity after the recapitalization will be 15%. At the moment that is before the recapitalization) the company has 100,000 shares outstanding. Assume no taxation. 1) What is the value of levered equity after the recapitalization? [5 points) 2) What is the amount of money raised from bond holders when the bond is issued? [5 points] 3) How many shares will be bought back? (5 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started