Answered step by step

Verified Expert Solution

Question

1 Approved Answer

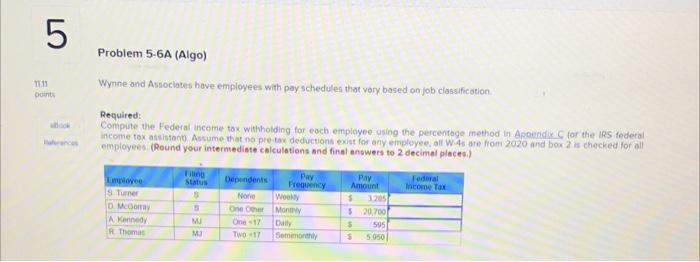

please only answer 6 not 5 5 Problem 5-6A (Algo) 11.11 Dont Wynne and Associates have employees with pay schedules that very based on job

please only answer 6 not 5

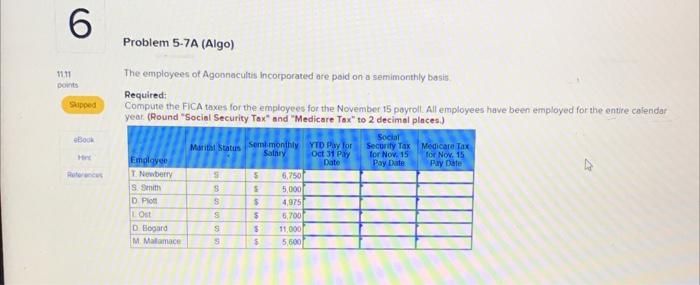

5 Problem 5-6A (Algo) 11.11 Dont Wynne and Associates have employees with pay schedules that very based on job classification, Required: Compute the Federal income tax withholding for each employee using the percentage method in Apound for the IRS federal income tax assistant Ausume that no pre tax deductions exist for any employee all w.4s are from 2020 and box 2 is checked for all employees (Round your intermediate calculations and final answers to 2 decimal places) Fing Status Federal Income Tax D MO A Kennedy Thomas E-- Dependents None One Other One-17 TWO 17 Pay Frequency Wooly Monthly Daily Seminar Pay Amount $ 205 520,700 $ 595 5.950 M 6 Problem 5-7A (Algo) 1111 points The employees of Agonnacultis Incorporated are paid on a semimonthly basis. Required: Compute the FICA taxes for the employees for the November 15 payroll. All employees have been employed for the entire calendar year. (Round "Social Security Tax" and "Medicare Tox" to 2 decimal places.) Stipped so Social Security Tax Medicare Tax for Nov. 15 for Nov. 15 Pay Date Pay Date Employee I Newberry S Smith DP Lost D Board M Malamace Marit Status Semi monthly YTD Pay for Salary Oct 31 Pay Date 5 5,750 S 5,000 S $ 4.975 S $ 5,700 S $ 11.000 S $ 5,600 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started