Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please, only answer if you have the CORRECT ANSWER to the question. if your answer is wrong or irrelevant, I will REPORT it to Chegg

Please, only answer if you have the CORRECT ANSWER to the question. if your answer is wrong or irrelevant, I will REPORT it to Chegg and leave a thumb down. So please, check your answer before posting it!

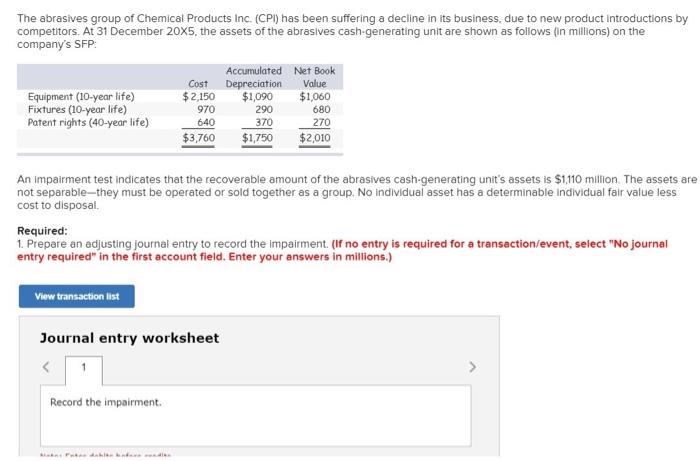

The abrasives group of Chemical Products Inc. (CPI) has been suffering a decline in its business, due to new product introductions by competitors. At 31 December 205, the assets of the abrasives cash-generating unit are shown as follows (in millions) on the company's SFP: An impairment test indicates that the recoverable amount of the abrasives cash-generating unit's assets is $1,110 million. The assets are not separable-they must be operated or sold together as a group. No individual asset has a determinable individual fair value less cost to disposal. Required: 1. Prepare an adjusting journal entry to record the impairment. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions.) Journal entry worksheet Note: Enter debits before credits. 2. What would be the net book value of the assets after one year if no impairment was recorded? Assume that straight-line depreciation is used. (Enter your answer in millions.)

I'll leave a thumb up if you have the correct answer! Thank you!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started