Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ONLY ANSWER IF YOU KNOW THE CORRECT ANSWER TO THE QUESTION! IF YOUR ANSWER IS IRRELEVANT OR INCORRECT, I WILL LEAVE A THUMB DOWN

PLEASE ONLY ANSWER IF YOU KNOW THE CORRECT ANSWER TO THE QUESTION! IF YOUR ANSWER IS IRRELEVANT OR INCORRECT, I WILL LEAVE A THUMB DOWN AND REPORT TO CHEGG!

IF YOU HAVE A CORRECT ANSWER, I WILL LEAVE A THUMB UP!

THANK YOU SO MUCH FOR YOUR HELP!

PLEASE ONLY ANSWER IF YOU KNOW THE CORRECT ANSWER TO THE QUESTION. IF YOUR ANSWER IS IRRELEVANT OR INCORRECT, I WILL REPORT IT TO CHEGG AND LEAVE A THUMB DOWN.

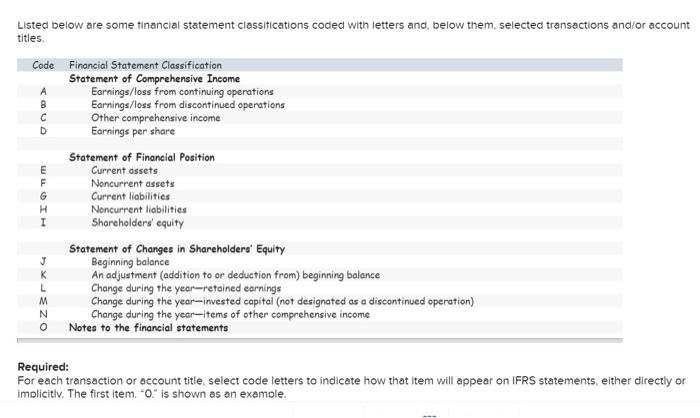

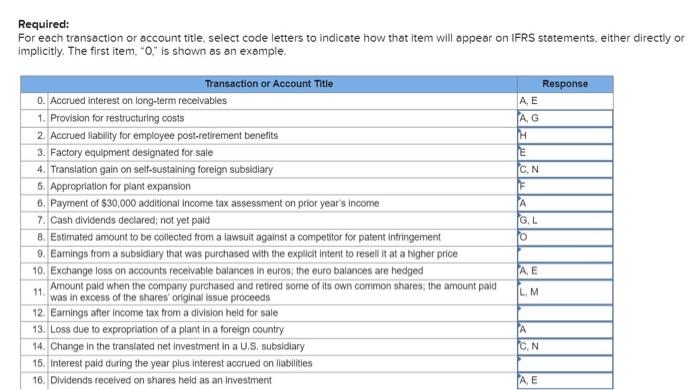

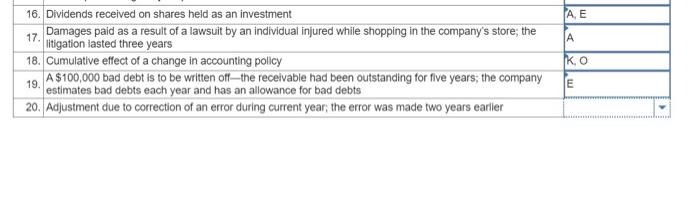

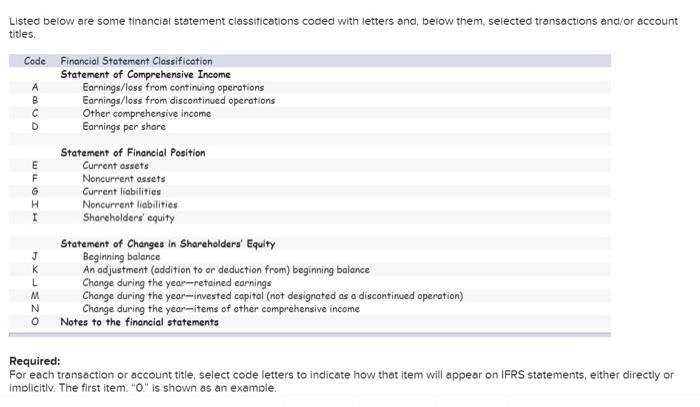

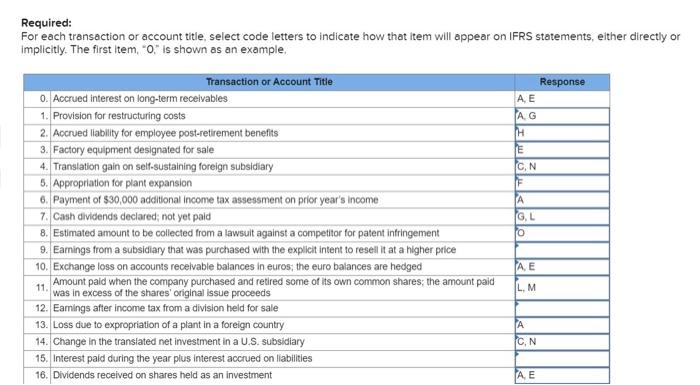

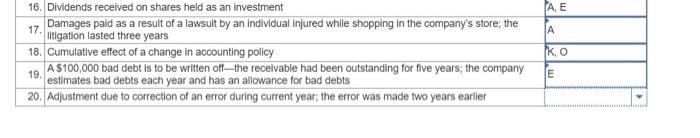

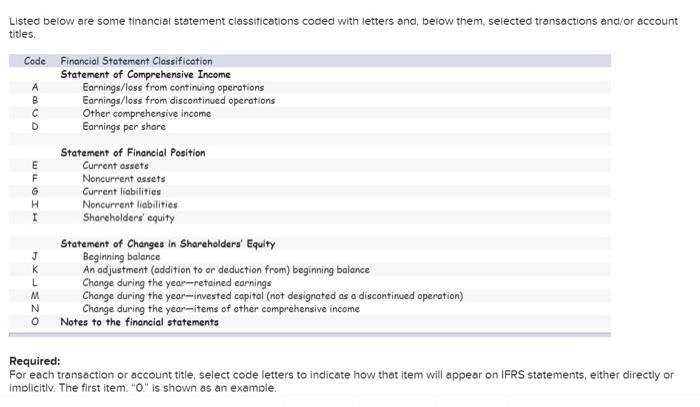

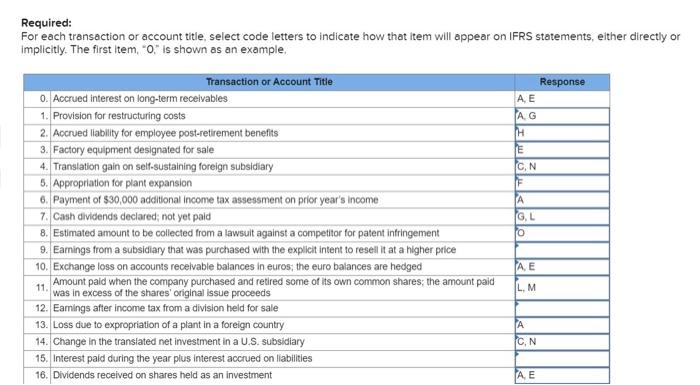

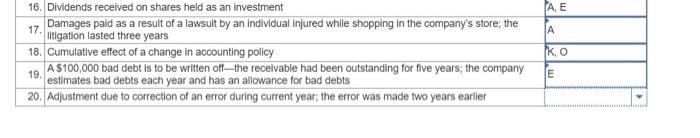

Listed below are some tinancial statement classitications coded with letters and, below them, selected transactions andior account titles. Required: For each transaction or account title, select code letters to indicate how that item will appear on IFRS statements, either directly or implicitlv. The first item. " 0 ." is shown as an example. Required: For each transaction or account title, select code letters to indicate how that item will appear on IFRS statements, either directly or implicitly. The first item, "0," is shown as an example. Listed below are some tinancial statement classitications coded with letters and, below them, selected transactions and/or account titles. Required: For each transaction or account title, select code letters to indicate how that item will appear on IFRS statements, either directly or imolicitlv. The first item. " 0 ." is shown as an examole. Required: For each transaction or account title, select code letters to indicate how that item will appear on IFRS statements, either directly or implicitly. The first item, "0," is shown as an example. 16. Dividends received on shares held as an investment 17. Damages paid as a result of a lawsult by an individual injured while shopping in the company's store; the litigation lasted three years 18. Cumulative effect of a change in accounting policy 19. A $100,000 bad debt is to be written off-the receivable had been outstanding for five years; the company estimates bad debts each year and has an allowance for bad debts 20. Adjustment due to correction of an error during current year; the error was made two years earlier \begin{tabular}{|l|} \hlineA,E \\ \hlineK,O \\ \hlineE \\ \hline \end{tabular} Listed below are some tinancial statement classitications coded with letters and, below them, selected transactions andior account titles. Required: For each transaction or account title, select code letters to indicate how that item will appear on IFRS statements, either directly or implicitlv. The first item. " 0 ." is shown as an example. Required: For each transaction or account title, select code letters to indicate how that item will appear on IFRS statements, either directly or implicitly. The first item, "0," is shown as an example. Listed below are some tinancial statement classitications coded with letters and, below them, selected transactions and/or account titles. Required: For each transaction or account title, select code letters to indicate how that item will appear on IFRS statements, either directly or imolicitlv. The first item. " 0 ." is shown as an examole. Required: For each transaction or account title, select code letters to indicate how that item will appear on IFRS statements, either directly or implicitly. The first item, "0," is shown as an example. 16. Dividends received on shares held as an investment 17. Damages paid as a result of a lawsult by an individual injured while shopping in the company's store; the litigation lasted three years 18. Cumulative effect of a change in accounting policy 19. A $100,000 bad debt is to be written off-the receivable had been outstanding for five years; the company estimates bad debts each year and has an allowance for bad debts 20. Adjustment due to correction of an error during current year; the error was made two years earlier \begin{tabular}{|l|} \hlineA,E \\ \hlineK,O \\ \hlineE \\ \hline \end{tabular} I WILL LEAVE A THUMB UP IF YOU HAVE A CORRECT ANSWER!

THANK YOU SO MUCH FOR YOUR HELP!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started