Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please only answer Question 13-2. 13-1 is included for the information needed to complete 13-2. 13-2 ONLY!!!! PLEASE ONLY DO 13-2!!!!! Remeasurement-U.S. Dollar Is the

Please only answer Question 13-2. 13-1 is included for the information needed to complete 13-2. 13-2 ONLY!!!! PLEASE ONLY DO 13-2!!!!!

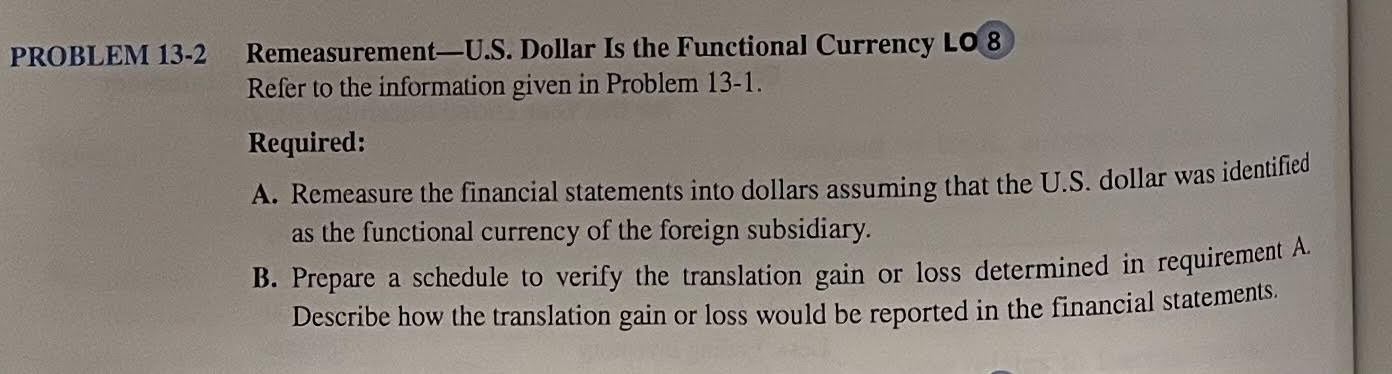

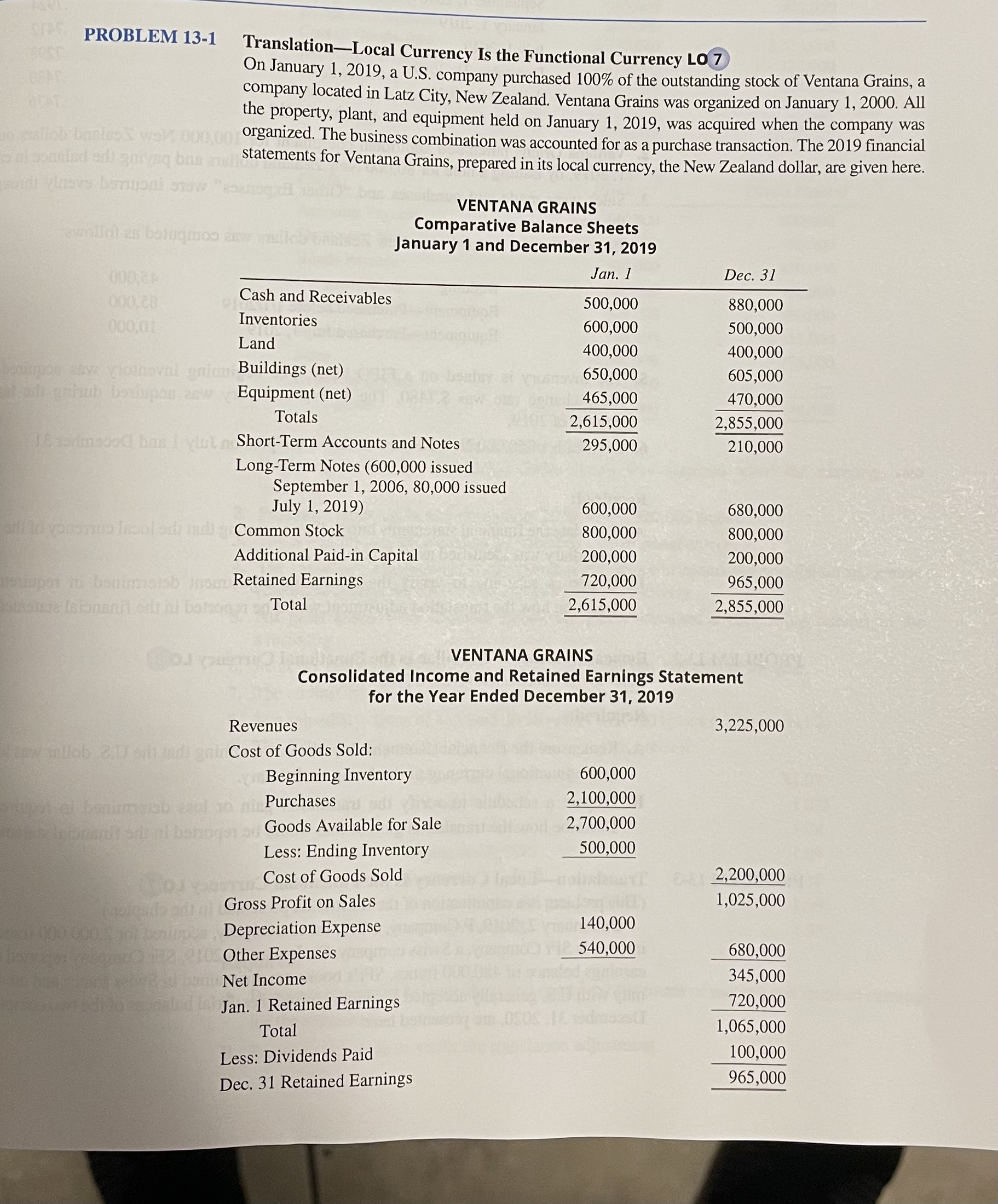

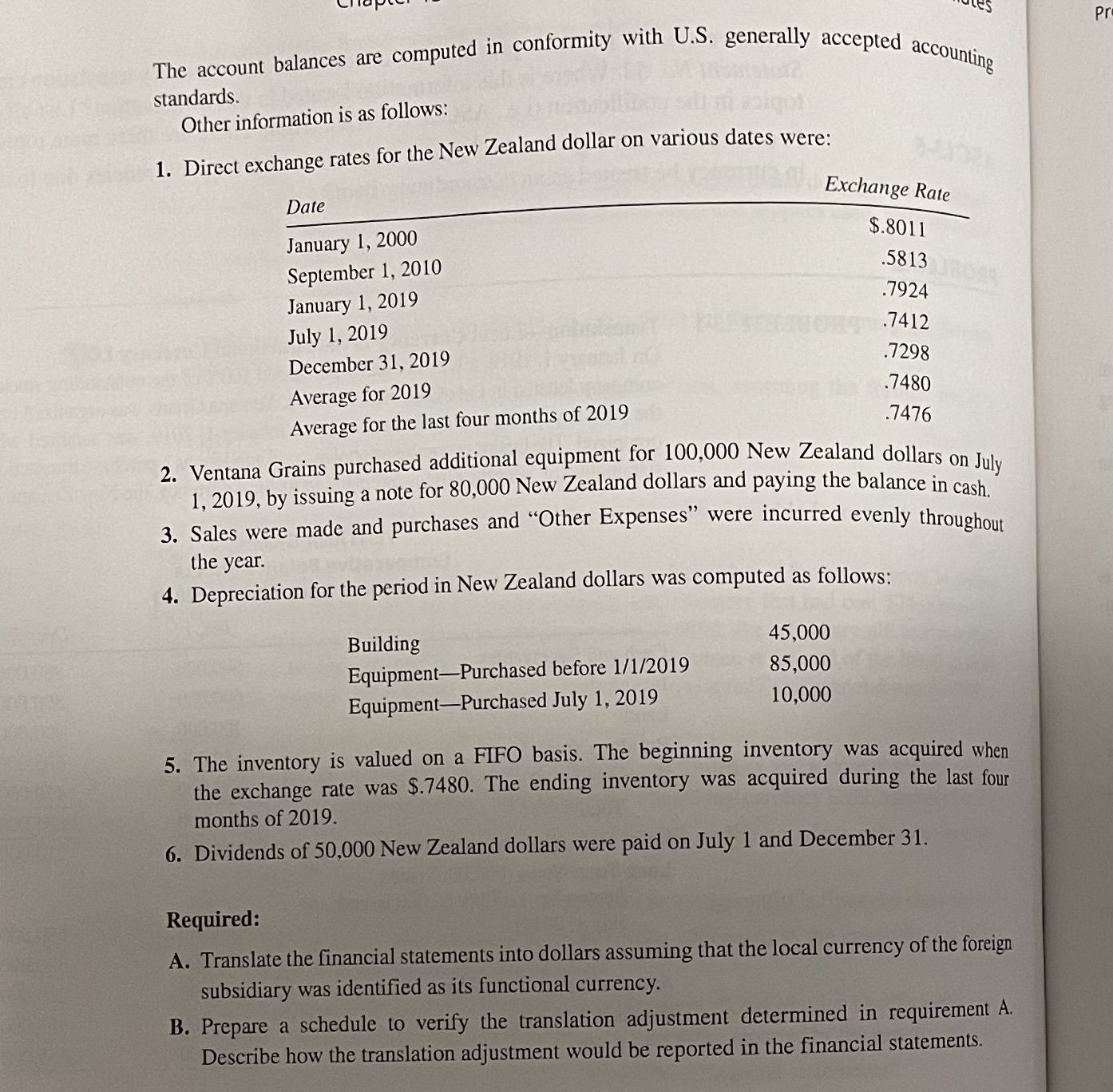

Remeasurement-U.S. Dollar Is the Functional Currency LO 8 Refer to the information given in Problem 13-1. Required: A. Remeasure the financial statements into dollars assuming that the U.S. dollar was identified as the functional currency of the foreign subsidiary. B. Prepare a schedule to verify the translation gain or loss determined in requirement A. Describe how the translation gain or loss would be reported in the financial statements. Translation-Local Currency Is the Functional Currency LO 7 On January 1, 2019, a U.S. company purchased 100% of the outstanding stock of Ventana Grains, a company located in Latz City, New Zealand. Ventana Grains was organized on January 1, 2000. All the property, plant, and equipment held on January 1, 2019, was acquired when the company was organized. The business combination was accounted for as a purchase transaction. The 2019 financial statements for Ventana Grains, prepared in its local currency, the New Zealand dollar, are given here. VENTANA GRAINS Comparative Balance Sheets January 1 and December 31, 2019 VENTANA GRAINS Consolidated Income and Retained Earnings Statement for the Year Ended December 31, 2019 The account balances are computed in conformity with U.S. generally accepted accounting standards. Other information is as follows: 1. Direct exchange rates for the New Zealand dollar on various dates were: 2. Ventana Grains purchased additional equipment for 100,000 New Zealand dollars on July 1,2019 , by issuing a note for 80,000 New Zealand dollars and paying the balance in cash. 3. Sales were made and purchases and "Other Expenses" were incurred evenly throughout the year. 4. Depreciation for the period in New Zealand dollars was computed as follows: 5. The inventory is valued on a FIFO basis. The beginning inventory was acquired when the exchange rate was $.7480. The ending inventory was acquired during the last four months of 2019. 6. Dividends of 50,000 New Zealand dollars were paid on July 1 and December 31 . Required: A. Translate the financial statements into dollars assuming that the local currency of the foreign subsidiary was identified as its functional currency. B. Prepare a schedule to verify the translation adjustment determined in requirement A. Describe how the translation adjustment would be reported in the financial statements. Remeasurement-U.S. Dollar Is the Functional Currency LO 8 Refer to the information given in Problem 13-1. Required: A. Remeasure the financial statements into dollars assuming that the U.S. dollar was identified as the functional currency of the foreign subsidiary. B. Prepare a schedule to verify the translation gain or loss determined in requirement A. Describe how the translation gain or loss would be reported in the financial statements. Translation-Local Currency Is the Functional Currency LO 7 On January 1, 2019, a U.S. company purchased 100% of the outstanding stock of Ventana Grains, a company located in Latz City, New Zealand. Ventana Grains was organized on January 1, 2000. All the property, plant, and equipment held on January 1, 2019, was acquired when the company was organized. The business combination was accounted for as a purchase transaction. The 2019 financial statements for Ventana Grains, prepared in its local currency, the New Zealand dollar, are given here. VENTANA GRAINS Comparative Balance Sheets January 1 and December 31, 2019 VENTANA GRAINS Consolidated Income and Retained Earnings Statement for the Year Ended December 31, 2019 The account balances are computed in conformity with U.S. generally accepted accounting standards. Other information is as follows: 1. Direct exchange rates for the New Zealand dollar on various dates were: 2. Ventana Grains purchased additional equipment for 100,000 New Zealand dollars on July 1,2019 , by issuing a note for 80,000 New Zealand dollars and paying the balance in cash. 3. Sales were made and purchases and "Other Expenses" were incurred evenly throughout the year. 4. Depreciation for the period in New Zealand dollars was computed as follows: 5. The inventory is valued on a FIFO basis. The beginning inventory was acquired when the exchange rate was $.7480. The ending inventory was acquired during the last four months of 2019. 6. Dividends of 50,000 New Zealand dollars were paid on July 1 and December 31 . Required: A. Translate the financial statements into dollars assuming that the local currency of the foreign subsidiary was identified as its functional currency. B. Prepare a schedule to verify the translation adjustment determined in requirement A. Describe how the translation adjustment would be reported in the financial statements

Remeasurement-U.S. Dollar Is the Functional Currency LO 8 Refer to the information given in Problem 13-1. Required: A. Remeasure the financial statements into dollars assuming that the U.S. dollar was identified as the functional currency of the foreign subsidiary. B. Prepare a schedule to verify the translation gain or loss determined in requirement A. Describe how the translation gain or loss would be reported in the financial statements. Translation-Local Currency Is the Functional Currency LO 7 On January 1, 2019, a U.S. company purchased 100% of the outstanding stock of Ventana Grains, a company located in Latz City, New Zealand. Ventana Grains was organized on January 1, 2000. All the property, plant, and equipment held on January 1, 2019, was acquired when the company was organized. The business combination was accounted for as a purchase transaction. The 2019 financial statements for Ventana Grains, prepared in its local currency, the New Zealand dollar, are given here. VENTANA GRAINS Comparative Balance Sheets January 1 and December 31, 2019 VENTANA GRAINS Consolidated Income and Retained Earnings Statement for the Year Ended December 31, 2019 The account balances are computed in conformity with U.S. generally accepted accounting standards. Other information is as follows: 1. Direct exchange rates for the New Zealand dollar on various dates were: 2. Ventana Grains purchased additional equipment for 100,000 New Zealand dollars on July 1,2019 , by issuing a note for 80,000 New Zealand dollars and paying the balance in cash. 3. Sales were made and purchases and "Other Expenses" were incurred evenly throughout the year. 4. Depreciation for the period in New Zealand dollars was computed as follows: 5. The inventory is valued on a FIFO basis. The beginning inventory was acquired when the exchange rate was $.7480. The ending inventory was acquired during the last four months of 2019. 6. Dividends of 50,000 New Zealand dollars were paid on July 1 and December 31 . Required: A. Translate the financial statements into dollars assuming that the local currency of the foreign subsidiary was identified as its functional currency. B. Prepare a schedule to verify the translation adjustment determined in requirement A. Describe how the translation adjustment would be reported in the financial statements. Remeasurement-U.S. Dollar Is the Functional Currency LO 8 Refer to the information given in Problem 13-1. Required: A. Remeasure the financial statements into dollars assuming that the U.S. dollar was identified as the functional currency of the foreign subsidiary. B. Prepare a schedule to verify the translation gain or loss determined in requirement A. Describe how the translation gain or loss would be reported in the financial statements. Translation-Local Currency Is the Functional Currency LO 7 On January 1, 2019, a U.S. company purchased 100% of the outstanding stock of Ventana Grains, a company located in Latz City, New Zealand. Ventana Grains was organized on January 1, 2000. All the property, plant, and equipment held on January 1, 2019, was acquired when the company was organized. The business combination was accounted for as a purchase transaction. The 2019 financial statements for Ventana Grains, prepared in its local currency, the New Zealand dollar, are given here. VENTANA GRAINS Comparative Balance Sheets January 1 and December 31, 2019 VENTANA GRAINS Consolidated Income and Retained Earnings Statement for the Year Ended December 31, 2019 The account balances are computed in conformity with U.S. generally accepted accounting standards. Other information is as follows: 1. Direct exchange rates for the New Zealand dollar on various dates were: 2. Ventana Grains purchased additional equipment for 100,000 New Zealand dollars on July 1,2019 , by issuing a note for 80,000 New Zealand dollars and paying the balance in cash. 3. Sales were made and purchases and "Other Expenses" were incurred evenly throughout the year. 4. Depreciation for the period in New Zealand dollars was computed as follows: 5. The inventory is valued on a FIFO basis. The beginning inventory was acquired when the exchange rate was $.7480. The ending inventory was acquired during the last four months of 2019. 6. Dividends of 50,000 New Zealand dollars were paid on July 1 and December 31 . Required: A. Translate the financial statements into dollars assuming that the local currency of the foreign subsidiary was identified as its functional currency. B. Prepare a schedule to verify the translation adjustment determined in requirement A. Describe how the translation adjustment would be reported in the financial statements Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started