Answered step by step

Verified Expert Solution

Question

1 Approved Answer

------------------------------------------------------------------------------ Please only answer question (d) with a step-by-step answer. Thanks! Question 2 (Total Marks: 10) Interest rates in Australia are currently at an all-time

------------------------------------------------------------------------------

Please only answer question (d) with a step-by-step answer. Thanks!

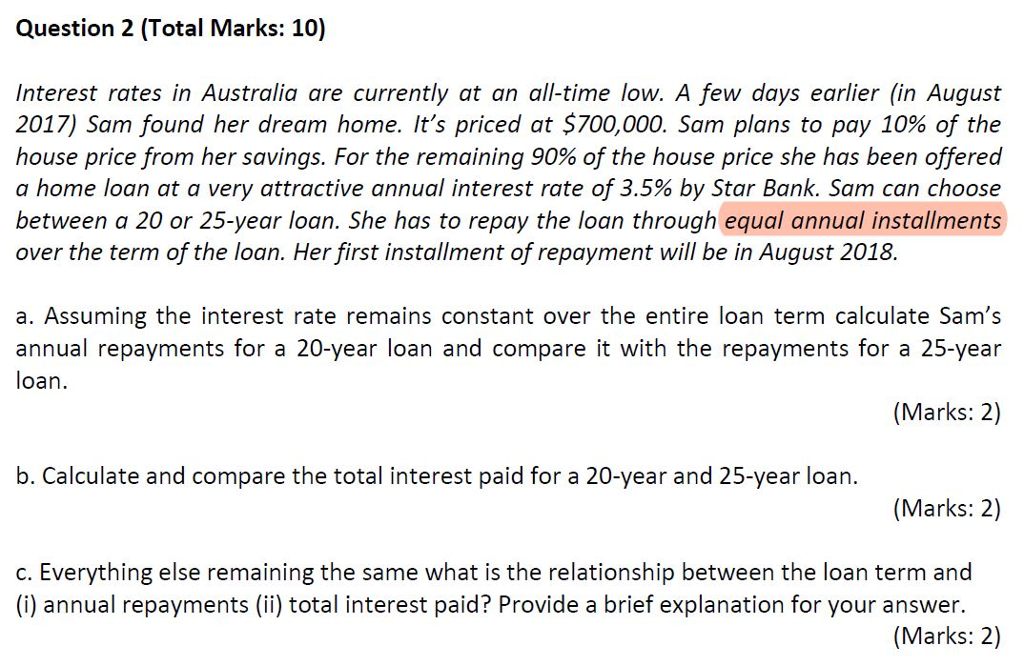

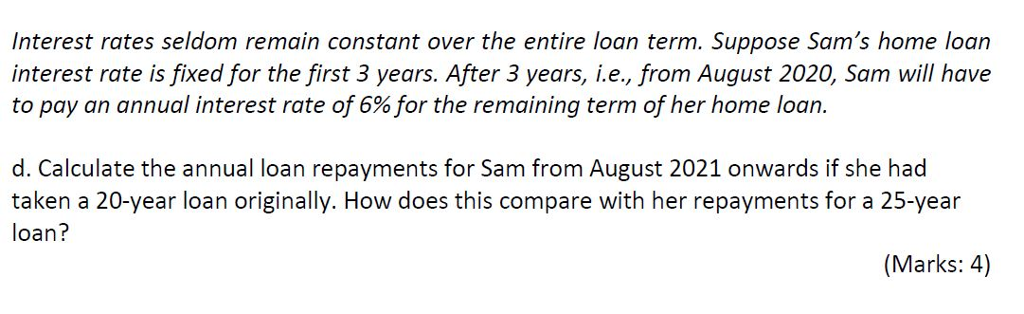

Question 2 (Total Marks: 10) Interest rates in Australia are currently at an all-time low. A few days earlier (in August 2017) Sam found her dream home. It's priced at $700,000. Sam plans to pay 10% of the house price from her savings. For the remaining 90% of the house price she has been offered a home loan at a very attractive annual interest rate of 3.5% by Star Bank. Sam can choose between a 20 or 25-year loan. She has to repay the loan through equal annual installments over the term of the loan. Her first installment of repayment will be in August 2018. a. Assuming the interest rate remains constant over the entire loan term calculate Sam's annual repayments for a 20-year loan and compare it with the repayments for a 25-year loan (Marks: 2) b. Calculate and compare the total interest paid for a 20-year and 25-year loan. (Marks: 2) c. Everything else remaining the same what is the relationship between the loan term and (i) annual repayments (ii) total interest paid? Provide a brief explanation for your answer. (Marks: 2)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started